Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Material Shift: Growing adoption of composite and concrete poles due to superior durability and lower lifecycle costs compared to wood.

-

Advanced Conductors: Development of high‑temperature low‑sag (HTLS) and ACCC conductors to increase capacity without new rights‑of‑way.

-

Digitalization: Sensors and IoT-enabled pole‑top devices for real‑time condition monitoring and predictive maintenance.

-

Localized Manufacturing: Establishment of production facilities closer to end markets to reduce logistics costs and lead times.

-

Regulatory Support: Incentives and funding for grid resilience projects in North America and Europe.

Market Drivers

-

Rising Electricity Demand: Urbanization and electrification spur new distribution network build‑out.

-

Grid Reliability Concerns: Increasing extreme weather events drive replacement of aging infrastructure.

-

Renewable Energy Integration: Distributed generation requires network upgrades and new feeder lines.

-

Government Programs: Subsidies and financing for rural electrification in Africa, Asia, and Latin America.

-

Smart Grid Rollout: Investments in advanced metering and distribution automation propel equipment upgrades.

Market Restraints

-

High CAPEX Costs: Significant investment required for poles, conductors, and construction.

-

Land Acquisition Challenges: Securing rights‑of‑way for overhead lines faces legal and environmental hurdles.

-

Supply Chain Disruptions: Fluctuations in steel, aluminum, and composite raw material prices impact project budgets.

-

Regulatory Complexity: Varied standards and permitting processes across regions can delay deployments.

-

Skilled Labor Shortage: Construction and maintenance require specialized workforce, limited in some markets.

Market Opportunities

-

Composite Pole Adoption: Rising interest in fiberglass and polymer poles for corrosion resistance and long life.

-

HTLS Conductor Deployment: Utilities seeking to boost capacity on existing rights‑of‑way.

-

Rural Electrification Projects: Large-scale initiatives in India, Africa, and Southeast Asia.

-

Substation Extensions: Off‑grid and microgrid projects require new distribution lines and poles.

-

EPC Service Expansion: Integrated project delivery models offering end‑to‑end solutions.

Market Dynamics

-

Supply Side: Innovations in material science (composites, low‑weight steel alloys); localizing manufacturing to reduce lead times.

-

Demand Side: Utility focus on loss reduction and reliability; commercial developers requiring dedicated feeders for solar parks.

-

Economic Factors: Infrastructure stimulus packages, fluctuating commodity prices, and interest rates shaping CAPEX cycles.

Regional Analysis

-

North America: Strong replacement market for aging wood poles; significant smart grid and storm‑hardening investments.

-

Europe: Emphasis on underground cabling in urban areas, but rural overhead networks still expand in Eastern Europe.

-

Asia‑Pacific: Rapid urbanization and rural electrification in China, India, and ASEAN drive high-volume demand.

-

Latin America: Government‑backed rural electrification and grid upgrades in Brazil, Mexico, and Andean states.

-

Middle East & Africa: Large‑scale new build projects in GCC; electrification push in Sub‑Saharan Africa.

Competitive Landscape

Leading companies in the Distribution Lines and Poles Market:

- General Cable Corporation

- Nexans S.A.

- Southwire Company, LLC

- Prysmian Group

- Valmont Industries, Inc.

- Hubbell Incorporated

- KEC International Limited

- Lamifil NV

- Stella-Jones Inc.

- Skipper Limited

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

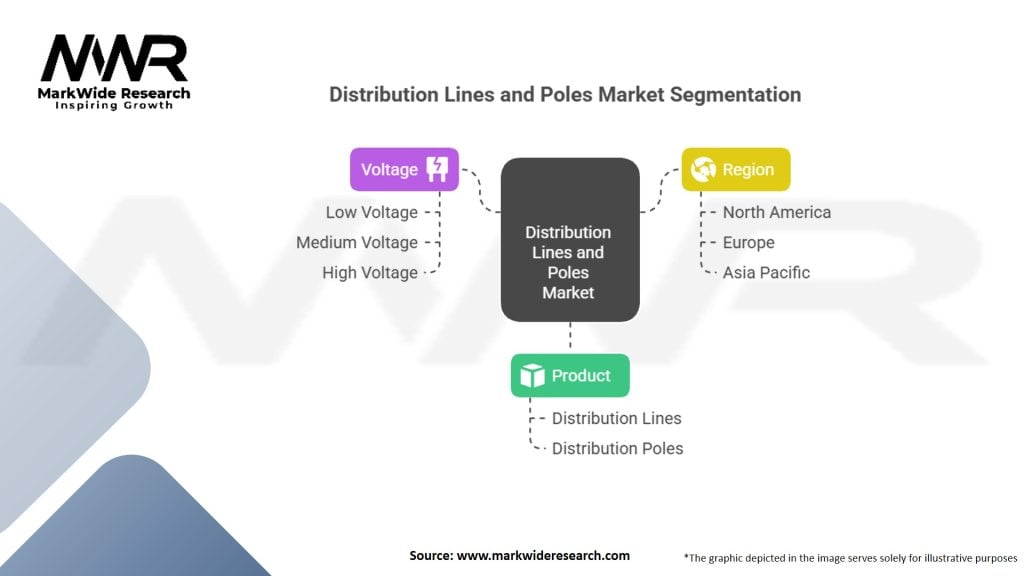

Segmentation

-

By Pole Material:

-

Wood

-

Steel

-

Concrete

-

Composite (Fiberglass, Polymer)

-

-

By Conductor Type:

-

ACSR (Aluminum Conductor Steel‑Reinforced)

-

AAAC (All‑Aluminum Alloy Conductor)

-

HTLS (High‑Temperature Low‑Sag)

-

ACCC (Aluminum Conductor Composite Core)

-

-

By Installation Type:

-

Overhead

-

Underground

-

-

By End‑User:

-

Utilities

-

Industrial & Commercial

-

Renewable Energy Developers

-

-

By Region:

-

North America

-

Europe

-

Asia‑Pacific

-

Latin America

-

Middle East & Africa

-

Category-wise Insights

-

Wood Poles: Still prevalent in low‑voltage, rural distribution due to low CAPEX, but lifecycle costs and replacement cycles drive shift to steel and composites.

-

Steel & Concrete Poles: Favored for higher voltages and urban environments; scalability and resistance to termites and rot.

-

Composite Poles: Premium segment, lower maintenance and lightweight handling reduce installation time on challenging terrains.

Key Benefits for Industry Participants and Stakeholders

-

Revenue Growth: Utility modernization and renewables integration create sustained equipment and services revenue.

-

Cost Savings: Advanced conductors and composite poles reduce losses and maintenance over asset lifecycles.

-

Sustainability: Eco‑friendly materials and reduced land usage support ESG objectives.

-

Operational Efficiency: Smart grid sensors and predictive maintenance lower downtime and improve reliability.

-

Market Diversification: EPC and after‑sales services broaden service portfolios for equipment manufacturers.

SWOT Analysis

-

Strengths: Established global supply chains; continuous R&D in materials and conductors; critical infrastructure status.

-

Weaknesses: High upfront costs; fragmented regional regulations; reliance on commodity prices.

-

Opportunities: Composite pole growth; rural electrification in emerging economies; HTLS conductor retrofits.

-

Threats: Economic downturns reducing CAPEX; competition from underground cables; regulatory delays.

Market Key Trends

-

Digital Grid Solutions: Sensors on poles for real‑time health monitoring and fault detection.

-

Modular Pole Systems: Pre‑engineered kits for rapid deployment in remote and disaster‑affected regions.

-

Green Poles: Use of recycled materials and carbon footprint labeling.

-

Hybrid Overhead‑Underground Solutions: Strategic undergrounding in urban cores coupled with overhead lines in suburbs.

-

Microgrid & DER Integration: Poles and lines adapted for bidirectional power flows and islanding capabilities.

Covid-19 Impact

-

Delayed Projects: Lockdowns and supply chain disruptions temporarily slowed installations.

-

Resilience Investments: Post‑pandemic stimulus prioritized infrastructure improvements, accelerating orders.

-

Safety Protocols: Remote monitoring and automation reduced on‑site staffing requirements.

-

Supply Chain Realignments: Manufacturers diversified sourcing and increased local inventories to mitigate future risks.

Key Industry Developments

-

Valmont’s Composite Pole Launch (2023): Lighter poles with 50‑year design life entering North American market.

-

Nexans HTLS Conductor Expansion (2024): New production lines in Europe to meet utility retrofits.

-

ABB’s Smart Pole Sensor Platform (2023): SaaS‑based analytics for fault detection and predictive maintenance.

-

PLP‑LS Joint Venture (2024): Local manufacturing of poles and hardware in India for rural electrification.

-

Trelleborg EPC Contracts: Large‑scale distribution network upgrades in Latin America under public‑private partnership.

Analyst Suggestions

-

Invest in Composite R&D: Focus on cost‑reduction and recyclability to broaden adoption.

-

Expand EPC Services: Offer turnkey solutions combining equipment, installation, and maintenance.

-

Leverage Digital Platforms: Develop SaaS tools for real‑time network analytics and SLA‑based service models.

-

Localize Supply Chains: Establish regional manufacturing to reduce lead times and currency risk.

-

Engage in Standardization Efforts: Participate in consortia to harmonize technical and safety standards globally.

Future Outlook

The Distribution Lines and Poles Market is poised for steady growth, underpinned by:

-

Sustained Utility CAPEX: Continued investments in grid modernization and resilience.

-

Renewable Integration: Ongoing build‑out of solar, wind, and storage requiring robust distribution networks.

-

Rural Electrification: Expanding energy access in Africa, Asia, and Latin America.

-

Smart Grid Evolution: Increasing deployment of IoT‑enabled pole‑top devices and automated feeders.

-

Material Innovation: Adoption of advanced composites and high‑performance conductors will reshape asset lifecycles and project economics.

Conclusion

The Distribution Lines and Poles Market is integral to the global energy transition, enabling reliable, flexible, and sustainable electricity delivery. With rising demand for grid upgrades, renewable integration, and smart grid capabilities, stakeholders across utilities, equipment manufacturers, and EPC providers have significant opportunities to innovate and capture value. By investing in advanced materials, digital solutions, and turnkey service models, market participants can address challenges of cost, reliability, and environmental impact—ensuring that distribution networks meet the evolving needs of a decarbonized, electrified economy.