444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Battery leasing service refers to the practice of leasing batteries for various applications instead of purchasing them outright. This model offers flexibility, cost savings, and reduced environmental impact, making it an attractive option for businesses and individuals alike. In this market analysis, we will delve into the key insights, trends, and dynamics shaping the battery leasing service market.

Meaning

Battery leasing service is a business model where customers lease batteries for a specific period, paying a rental fee instead of buying the batteries outright. This approach allows businesses and individuals to access the benefits of batteries without the upfront costs and long-term ownership responsibilities.

Executive Summary

The battery leasing service market has witnessed significant growth in recent years, driven by the increasing demand for energy storage solutions and the growing adoption of electric vehicles. This analysis provides an in-depth understanding of the market’s key drivers, restraints, opportunities, and market dynamics, along with regional analysis, competitive landscape, and segmentation.

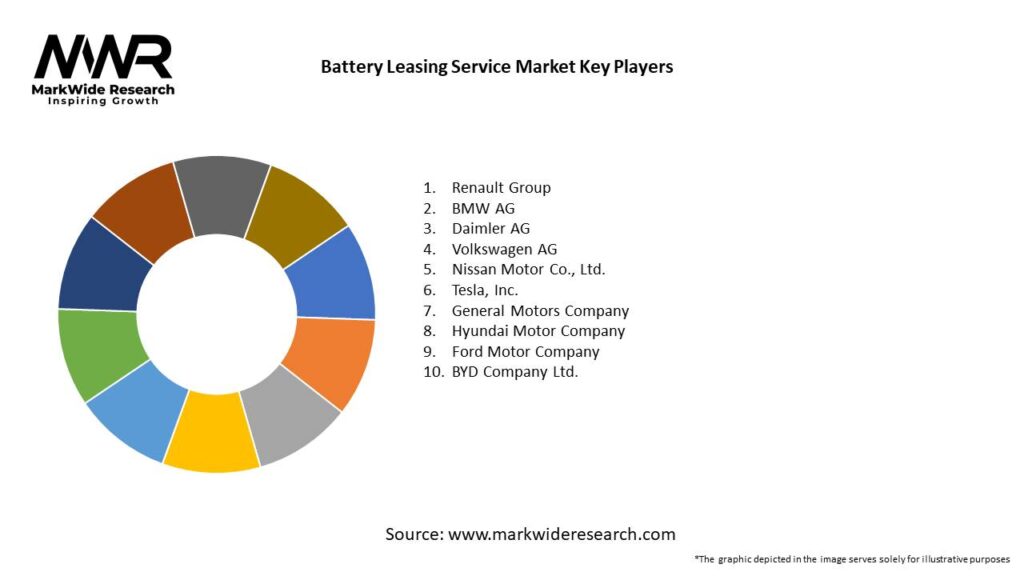

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The battery leasing service market is influenced by various factors, including technological advancements, government regulations, consumer preferences, and environmental concerns. These dynamics shape the market landscape and present both challenges and opportunities for industry participants.

Regional Analysis

The battery leasing service market is segmented into key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has unique market dynamics, customer preferences, and regulatory frameworks that impact the adoption of battery leasing services.

Competitive Landscape

Leading companies in the Battery Leasing Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

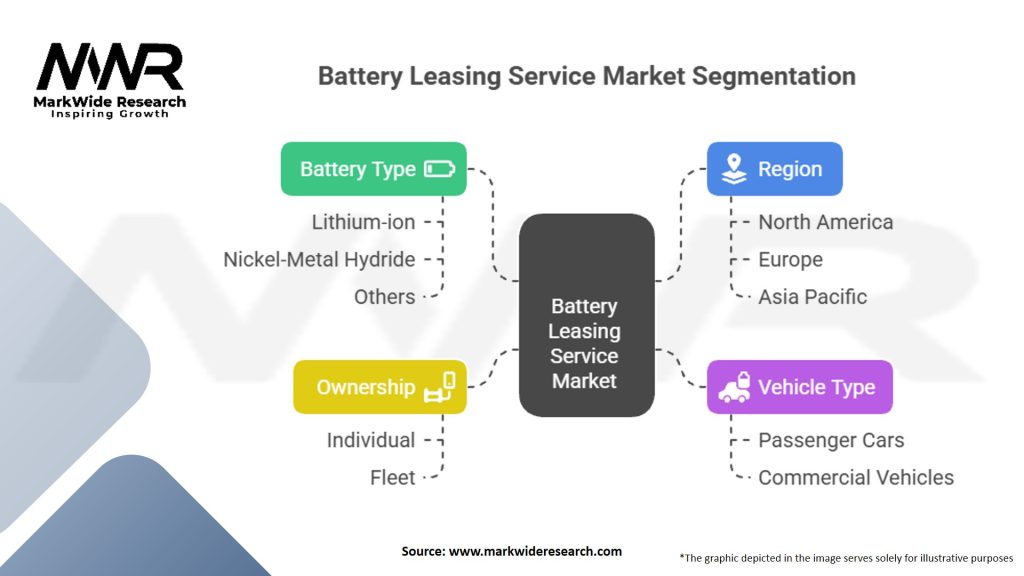

Segmentation

The battery leasing service market can be segmented based on battery type, application, end-user, and region. This segmentation provides a deeper understanding of market dynamics and customer preferences, enabling companies to tailor their offerings accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the battery leasing service market. While there was a temporary slowdown in the market due to supply chain disruptions and reduced consumer spending, the long-term outlook remains positive. The pandemic has highlighted the need for sustainable transportation and energy storage solutions, driving the demand for battery leasing services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The battery leasing service market is expected to witness significant growth in the coming years, driven by the increasing adoption of electric vehicles, renewable energy projects, and the need for sustainable energy storage solutions. Technological advancements, strategic partnerships, and evolving consumer preferences will shape the future landscape of the battery leasing service market.

Conclusion

The battery leasing service market offers a compelling alternative to traditional battery ownership, providing cost savings, flexibility, and environmental benefits. With the increasing demand for electric vehicles and renewable energy systems, battery leasing services are poised for substantial growth. Industry participants should capitalize on market opportunities, address challenges, and adopt sustainable practices to stay competitive in this evolving market.

What is Battery Leasing Service?

Battery leasing service refers to a model where consumers can rent batteries for electric vehicles or other applications instead of purchasing them outright. This service often includes maintenance and replacement, making it a flexible option for users who want to avoid the high upfront costs of battery ownership.

What are the key players in the Battery Leasing Service Market?

Key players in the Battery Leasing Service Market include companies like NIO, Ample, and Gogoro, which provide innovative battery leasing solutions for electric vehicles and scooters. These companies focus on enhancing user convenience and reducing the financial burden of battery ownership, among others.

What are the growth factors driving the Battery Leasing Service Market?

The growth of the Battery Leasing Service Market is driven by the increasing adoption of electric vehicles, the rising demand for sustainable transportation solutions, and advancements in battery technology. Additionally, the need for cost-effective energy storage solutions in various sectors is contributing to market expansion.

What challenges does the Battery Leasing Service Market face?

The Battery Leasing Service Market faces challenges such as regulatory hurdles, the need for standardization in battery technology, and concerns over battery recycling and sustainability. These factors can impact the scalability and acceptance of battery leasing models in different regions.

What opportunities exist in the Battery Leasing Service Market?

Opportunities in the Battery Leasing Service Market include the potential for partnerships with automotive manufacturers, the expansion of battery swapping stations, and the growing interest in renewable energy integration. These factors can enhance service offerings and attract a broader customer base.

What trends are shaping the Battery Leasing Service Market?

Trends shaping the Battery Leasing Service Market include the rise of subscription-based models, advancements in battery technology, and increased focus on sustainability. Additionally, the integration of smart technology for battery management is becoming more prevalent, enhancing user experience.

Battery Leasing Service Market

| Segmentation | Details |

|---|---|

| Battery Type | Lithium-ion, Nickel-Metal Hydride, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Ownership | Individual, Fleet |

| Region | North America, Europe, Asia Pacific, etc. |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Battery Leasing Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at