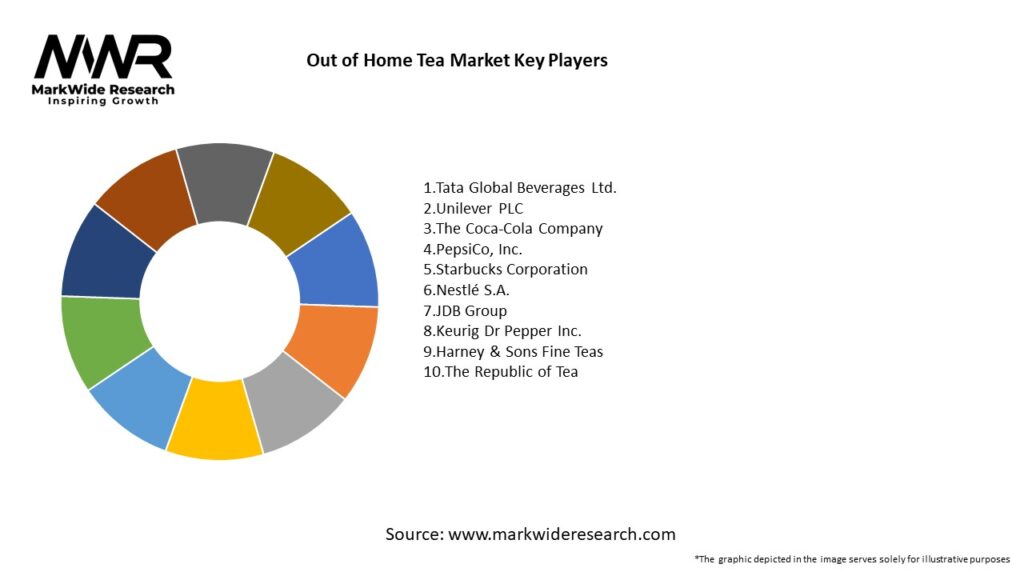

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Café Culture Expansion: The proliferation of specialty cafés and tea bars offering curated tea experiences boosts on‑premise consumption.

-

RTD Growth: Cold-brew and bottled teas continue to attract busy consumers seeking healthier alternatives to carbonated soft drinks.

-

Premiumization Trend: Consumers are willing to pay a premium for single-origin, organic, and artisanal tea offerings.

-

Health and Wellness Focus: Functional teas—such as adaptogen‑infused, detox, and immunity-boosting formulations—are rapidly gaining traction.

-

Sustainability and Ethics: Demand for ethically sourced, fair-trade tea and eco‑friendly packaging is shaping brand strategies.

Market Drivers

-

Urbanization & On-the-Go Lifestyles: Increasing urban populations and longer working hours fuel demand for convenient beverage options.

-

Health Consciousness: Awareness of the antioxidant and wellness benefits of tea drives consumers away from sugary soft drinks.

-

Café and Specialty Retail Growth: Expansion of global café chains and indie tea boutiques enhances market reach.

-

Product Innovation: New formats—bubble tea, kombucha, tea‑infused sparkling waters—attract younger demographics.

-

Digital Ordering & Delivery: Mobile apps and third-party delivery services make OOH tea more accessible.

-

Premium Offering Premium Pricing: Consumers showing willingness to spend on high-quality, artisan teas.

Market Restraints

-

Price Sensitivity: High-end tea products can be cost-prohibitive in price-sensitive markets.

-

Competition from Coffee & Alternative Beverages: Coffee and energy drinks dominate the OOH beverage space in many regions.

-

Supply Chain Volatility: Climate change and geopolitical factors can disrupt tea leaf supply and pricing.

-

Regulatory Constraints on Sugar and Labeling: Stricter regulations on added sugars and labeling requirements may limit product formulations.

-

Consumer Fatigue: Over-saturation of new flavors and formats can lead to declining novelty appeal.

Market Opportunities

-

Functional & Medicinal Teas: Growth in teas targeting specific health concerns (sleep, stress, digestion).

-

Experiential Tea Services: Tea‑tasting events, tea flights, and immersive tea-room concepts create differentiated experiences.

-

Sustainable Packaging Solutions: Biodegradable, compostable cups and bottles align with eco‑friendly consumer values.

-

Emerging Markets Penetration: Rising middle class in Africa, Latin America, and Southeast Asia offers new growth frontiers.

-

Technology Integration: Smart vending machines, automated pour-over kiosks, and AI‑driven personalization.

-

Collaborations & Co-Branding: Partnerships between tea brands and fashion, hospitality, or wellness influencers.

Market Dynamics

-

Supply Side Factors: Innovations in cold-brew extraction, spray‑drying, and aseptic bottling enhance product stability. Improved traceability and blockchain in the supply chain build consumer trust.

-

Demand Side Factors: Millennials and Gen Z prioritize health, ethics, and social media–worthy experiences, influencing product development and marketing.

-

Economic Influences: Disposable income levels directly affect premium segment growth; global recessions can shift demand toward value offerings.

-

Policy Influences: Import tariffs, food and safety regulations, and sustainability mandates shape market entry and product compliance.

Regional Analysis

-

North America (30% market share): Driven by U.S. specialty cafés, RTD innovation, and health‑oriented functional teas.

-

Asia-Pacific (40%): Largest consumer base led by China’s tea culture, Taiwan’s bubble tea craze, and Japan’s matcha resurgence.

-

Europe (15%): Strong in premium loose-leaf tea bars and growing RTD niche; UK and Germany lead.

-

Latin America (8%): Emerging café culture in Brazil and Mexico; yerba mate blends gaining popularity.

-

Middle East & Africa (7%): Rapid expansion in Gulf countries’ café scenes; sachet‑style teas common in Africa with growth in RTD.

Competitive Landscape

Leading Companies in the Out of Home Tea Market:

- Tata Global Beverages Ltd.

- Unilever PLC

- The Coca-Cola Company

- PepsiCo, Inc.

- Starbucks Corporation

- Nestlé S.A.

- JDB Group

- Keurig Dr Pepper Inc.

- Harney & Sons Fine Teas

- The Republic of Tea

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

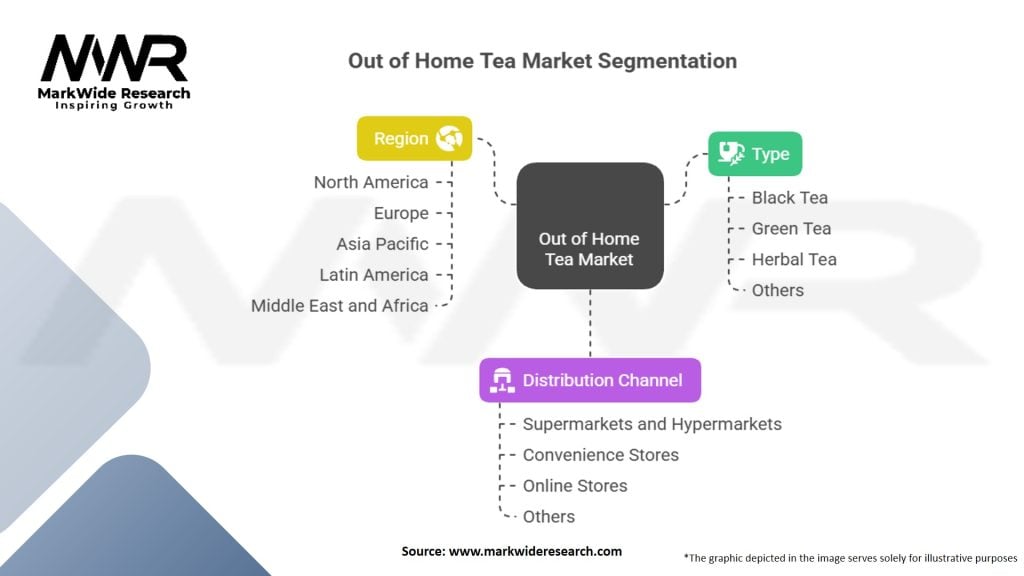

Segmentation

-

By Product Format:

-

Hot Tea

-

Iced Tea

-

RTD Bottled/Canned Tea

-

Specialty Formats (bubble tea, kombucha)

-

-

By Distribution Channel:

-

Cafés & Tea Bars

-

Restaurants & Hotels

-

Convenience & Retail Outlets (vending)

-

Delivery & Digital Platforms

-

-

By Type:

-

Black Tea

-

Green Tea

-

Oolong & White Tea

-

Herbal & Functional Infusions

-

-

By Geography: North America, Europe, Asia-Pacific, Latin America, MEA

Category-wise Insights

-

RTD Iced Teas: Rapid growth due to convenience; sugar‑reduced and natural-flavor variants leading.

-

Bubble Tea & Specialty: Strong youth appeal; premium pricing and experiential consumption drive profit margins.

-

Functional Teas: Immunity‑boosting and adaptogen blends command higher price points and loyal followings.

-

On-Premise Loose‑Leaf & Artisanal: Premium segment growth in urban centers; high-margin but slower volume.

Key Benefits for Industry Participants and Stakeholders

-

Revenue Diversification: Expanding beyond in‑home consumption to high-margin OOH channels.

-

Customer Engagement: Enhanced brand loyalty via experiential tea services and digital loyalty programs.

-

Health Positioning: Aligning with wellness trends builds brand equity.

-

Cross‑Selling Opportunities: Bundling teas with food items increases average transaction value.

-

Data & Insights: Digital ordering platforms generate consumer behavior data for targeted marketing.

SWOT Analysis

-

Strengths:

-

Diverse product formats for multiple consumption occasions.

-

Strong health and wellness narrative.

-

Ability to command premium pricing in café venues.

-

-

Weaknesses:

-

Dependence on high‑cost real estate for on-premise outlets.

-

Susceptibility to supply chain disruptions (tea leaf harvests).

-

Intense competition with coffee and alternative beverages.

-

-

Opportunities:

-

Growth in emerging markets with rising disposable incomes.

-

Innovation in sustainable packaging and refill stations.

-

Integration of AR/VR for immersive tea education experiences.

-

-

Threats:

-

Regulatory scrutiny over added sugars and labeling.

-

Economic downturns reducing discretionary café visits.

-

Climate change impacting tea crop yields and quality.

-

Market Key Trends

-

Zero‑Sugar & Natural Ingredients: Reformulation of RTD teas with natural sweeteners and clean labels.

-

Cold‑Brew Popularity: Growing consumer preference for smoother, less acidic cold‑brew teas.

-

Plant‑Based & Vegan Blends: Incorporation of superfood ingredients like turmeric, ginger, and CBD.

-

Digital & Contactless Ordering: Widespread adoption of mobile apps, QR‑code menus, and automated tea kiosks.

-

Tea Tourism & Experiences: Tea plantation tours and in‑café workshops drive brand awareness and premium pricing.

Covid-19 Impact

-

Short-Term Decline in On‑Premise Sales: Lockdowns forced café closures, shifting some demand to RTD and home delivery.

-

Surge in RTD & Delivery: Consumers sought safe, convenient RTD options and home‑delivery services.

-

Digital Acceleration: Tea brands rapidly adopted e‑commerce, contactless pick‑up, and subscription models.

-

Long-Term Focus on Safety & Hygiene: Enhanced in‑store protocols and packaging hygiene standards became permanent.

Key Industry Developments

-

Sustainable Sourcing Commitments: Major brands pledging 100% ethically sourced tea by 2030.

-

Innovation in Packaging: Launch of carton-based RTD teas with plant-based, recyclable materials.

-

Partnerships & Co‑Branding: Collaborations between tea brands and wellness influencers or local artisans.

-

Automated Tea Bars: Introduction of robotic tea dispensers in shopping malls and airports.

-

Acquisitions & M&A: Consolidation among specialty tea chains to expand geographic reach and menu offerings.

Analyst Suggestions

-

Leverage Digital Platforms: Invest in mobile ordering, loyalty apps, and direct‑to‑consumer e‑commerce to build consumer relationships.

-

Focus on Health & Transparency: Highlight clean‑label ingredients, functional benefits, and sustainability credentials in marketing.

-

Diversify Formats: Expand into new RTD formats—tea‑coffee hybrids, sparkling teas—to attract crossover consumers.

-

Optimize Supply Chains: Develop local sourcing partnerships and invest in inventory analytics to mitigate disruptions.

-

Enhance In‑Store Experience: Create interactive tea‑tasting events, tea ceremonies, and education workshops to boost foot traffic and spend.

Future Outlook

The Out of Home Tea Market is poised for sustained growth as consumer preferences evolve toward healthier, more experiential beverage options. Key projections:

-

CAGR of ~6% through 2030, driven by RTD expansion and specialty tea formats.

-

Asia-Pacific to remain fastest‑growing region, with emerging café scenes in India, Southeast Asia, and China.

-

Premiumization to drive higher per‑unit revenues in on‑premise segments.

-

Digital integration and subscription models will deepen brand loyalty and recurring revenue streams.

-

Sustainability innovations in sourcing and packaging to become critical differentiators.

Conclusion

The global Out of Home Tea Market represents a vibrant and rapidly evolving sector where health trends, convenience, and experiential consumption converge. As consumers seek premium, functional, and sustainable beverage options, tea brands and operators have the opportunity to capture new audiences through innovation in product formats, digital engagement, and immersive tea experiences. By addressing challenges such as supply chain resilience, regulatory compliance, and competitive pressures—and by capitalizing on the rising popularity of functional and specialty teas—stakeholders can secure long-term growth and profitability in this dynamic market.