444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The super heat resistant polyimide film market is witnessing strong growth driven by the expanding demand for high-performance materials in electronics, aerospace, automotive, and renewable energy industries. These films, known for their exceptional thermal stability, chemical resistance, and mechanical strength, are crucial for use in extreme environments where conventional polymers fail. The market is growing at a CAGR of over 7.6%, supported by advancements in flexible electronics, electric vehicles, and high-temperature insulation applications.

Globally, over 65% of polyimide film usage is concentrated in electronics manufacturing, particularly in flexible printed circuits, display panels, and semiconductor packaging. The growing adoption of lightweight and durable materials in next-generation electronics and aerospace applications continues to drive demand. According to MarkWide Research, the shift toward electrification and miniaturization in modern industries is accelerating market expansion, with Asia-Pacific emerging as the key manufacturing hub for polyimide films.

The super heat resistant polyimide film market refers to the global industry focused on the production and utilization of polyimide-based films engineered to withstand extreme temperatures above 400°C while maintaining structural integrity. These films are synthesized from aromatic dianhydrides and diamines, offering exceptional thermal endurance, dielectric strength, and dimensional stability. Their superior performance in high-temperature and chemically aggressive environments makes them ideal for electronics, aerospace, and energy applications.

MWR emphasizes that super heat resistant polyimide films represent a specialized subset of advanced polymer materials designed to meet the rising performance standards of modern high-reliability systems. Their ability to function under prolonged heat exposure without deformation or degradation differentiates them from conventional polymer films, making them vital for industries transitioning toward energy efficiency and performance durability.

The global super heat resistant polyimide film market is projected to grow at a 7.6% CAGR between 2024 and 2032, driven by robust demand in electronics, aerospace, and automotive sectors. Increasing miniaturization of components and rising adoption of electric vehicles have heightened the need for materials capable of enduring extreme heat while maintaining dielectric stability. These films are commonly used in flexible printed circuits, high-temperature insulation, and advanced composites.

According to MarkWide Research, Asia-Pacific dominates the global market due to the concentration of electronics and semiconductor manufacturing facilities in countries such as China, Japan, and South Korea. Meanwhile, Europe and North America are witnessing rising demand from aerospace and defense sectors that prioritize lightweight materials with high-temperature resistance and chemical durability.

Increasing demand for flexible electronics and high-reliability components is the primary driver of the market. As devices become smaller and more powerful, materials capable of enduring high heat while retaining mechanical strength are essential. Growth in electric vehicles and hybrid systems is boosting the use of polyimide films in battery insulation, motor windings, and circuit protection.

Furthermore, advances in aerospace materials and the need for lightweight, high-strength films to replace metals and ceramics in extreme conditions are stimulating demand. The rising adoption of renewable energy systems—especially solar modules and wind turbines—also contributes to market growth, as these applications require durable, heat-tolerant insulation materials.

High production costs associated with polymer synthesis and processing remain a challenge, particularly for small manufacturers. Complex manufacturing procedures involving polycondensation and imidization processes increase energy consumption and raw material costs. Limited availability of raw materials such as aromatic dianhydrides also constrains production scalability.

Moreover, environmental regulations regarding solvent usage and emissions during polymerization have added compliance costs. Competition from other high-temperature materials like PEEK and PTFE may further limit short-term market penetration in cost-sensitive sectors.

Emerging flexible and wearable electronics create significant opportunities for polyimide film adoption. The expansion of 5G networks and foldable devices requires high-performance dielectric films for antennas, circuits, and sensors. Next-generation electric vehicles and aerospace components are opening new frontiers for lightweight and thermally stable films.

In addition, the development of eco-friendly and recyclable polyimide films presents opportunities aligned with global sustainability trends. Manufacturers focusing on low-emission synthesis processes and bio-based polymers can gain a competitive advantage in the coming decade.

Market dynamics reflect a strong correlation between technological progress and industrial modernization. With electronics manufacturing growing 9% annually, demand for thermal-stable substrates continues to escalate. The rise in EV production and the shift to high-power batteries have increased the use of insulating films by 10% year-on-year. Meanwhile, aerospace and defense sectors are adopting advanced polymer films to replace traditional metal insulation systems.

Manufacturers are focusing on innovation, developing polyimide films with improved surface smoothness, higher dielectric strength, and superior thermal conductivity to meet evolving industrial requirements.

The analysis of the super heat resistant polyimide film market is based on a combination of primary and secondary research. Primary data includes interviews with polymer scientists, engineers, and industrial manufacturers, while secondary sources consist of technical publications, government reports, and trade data. Quantitative forecasts incorporate production capacities, material costs, and end-user consumption rates.

MarkWide Research employs proprietary modeling techniques to assess market performance, integrating demand indicators from electronics, automotive, and aerospace industries, along with global economic variables influencing material supply and trade flows.

Asia-Pacific leads the global market with 48% share, supported by extensive electronics manufacturing in China, Japan, South Korea, and Taiwan. The region’s dominance is reinforced by high investment in semiconductors and flexible circuit production. North America holds 25% market share, driven by aerospace innovation and the growing electric vehicle sector.

Europe follows with 20% share, propelled by demand from renewable energy and industrial automation. Latin America and Middle East & Africa are emerging markets, where growing industrialization and infrastructure development are fostering gradual adoption of heat-resistant polymers for insulation and electronic applications.

By Application:

By Type:

Super heat resistant films are increasingly preferred in critical applications where standard films fail to withstand high thermal stress. These include aerospace engines, high-density semiconductor circuits, and EV battery insulation. Electronics manufacturing remains the largest category, with steady growth driven by increased demand for miniaturized devices. Automotive applications are emerging rapidly due to the need for lightweight, durable, and heat-tolerant insulation materials in EV powertrains.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization in electronics is driving innovation in ultra-thin polyimide films with enhanced dielectric performance. Energy-efficient and recyclable materials are becoming a major trend, with manufacturers shifting toward solvent-free production. 3D printing of polyimide composites is gaining traction for customized high-temperature components. Additionally, hybrid multilayer films combining polyimide with other polymers are being developed for multifunctional performance.

The super heat resistant polyimide film market is expected to sustain strong growth through the next decade as industries move toward higher efficiency, miniaturization, and sustainability. Increasing demand from electronics, aerospace, and automotive sectors will continue to shape production strategies. Innovations in eco-friendly synthesis, multilayer composite films, and advanced coating technologies will broaden the material’s application scope. Asia-Pacific will remain the global manufacturing hub, while North America and Europe focus on high-value aerospace and defense segments.

The super heat resistant polyimide film market stands at the forefront of advanced materials innovation, empowering industries to meet growing demands for performance, durability, and sustainability. With exceptional thermal and electrical properties, these films are essential in modern electronics, EVs, and aerospace systems. Despite cost challenges, technological advancements and green manufacturing practices are enhancing scalability and affordability. As noted by MarkWide Research, the future of this market lies in continuous innovation, global collaboration, and integration with sustainable technologies—ensuring that polyimide films remain indispensable in next-generation engineering and electronic applications.

What is Super Heat Resistant Polyimide Film?

Super Heat Resistant Polyimide Film is a high-performance polymer film known for its exceptional thermal stability, chemical resistance, and electrical insulation properties. It is widely used in applications such as aerospace, electronics, and automotive industries.

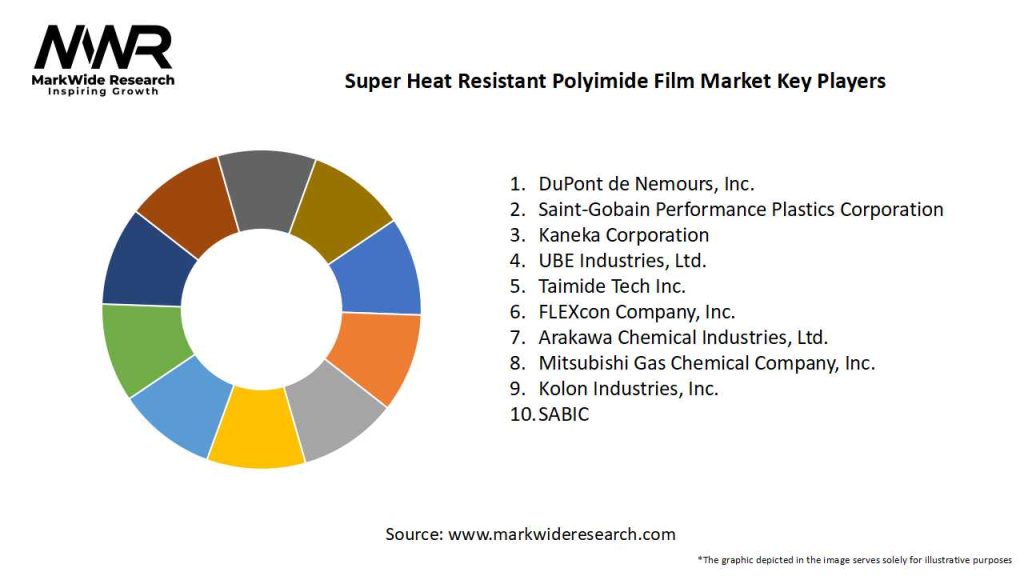

What are the key players in the Super Heat Resistant Polyimide Film Market?

Key players in the Super Heat Resistant Polyimide Film Market include DuPont, Kaneka Corporation, and Mitsubishi Gas Chemical Company, among others. These companies are known for their innovative products and extensive research in high-performance materials.

What are the growth factors driving the Super Heat Resistant Polyimide Film Market?

The growth of the Super Heat Resistant Polyimide Film Market is driven by the increasing demand for lightweight and heat-resistant materials in the aerospace and electronics sectors. Additionally, advancements in manufacturing technologies are enhancing the performance and applications of these films.

What challenges does the Super Heat Resistant Polyimide Film Market face?

The Super Heat Resistant Polyimide Film Market faces challenges such as high production costs and the availability of alternative materials. These factors can limit market growth and affect the adoption of polyimide films in certain applications.

What opportunities exist in the Super Heat Resistant Polyimide Film Market?

Opportunities in the Super Heat Resistant Polyimide Film Market include the growing demand for electric vehicles and renewable energy technologies. These sectors require advanced materials that can withstand extreme conditions, presenting a significant growth potential for polyimide films.

What trends are shaping the Super Heat Resistant Polyimide Film Market?

Trends in the Super Heat Resistant Polyimide Film Market include the development of thinner and more flexible films, as well as the integration of smart technologies. These innovations are expanding the applications of polyimide films in various industries, including consumer electronics and telecommunications.

Super Heat Resistant Polyimide Film Market

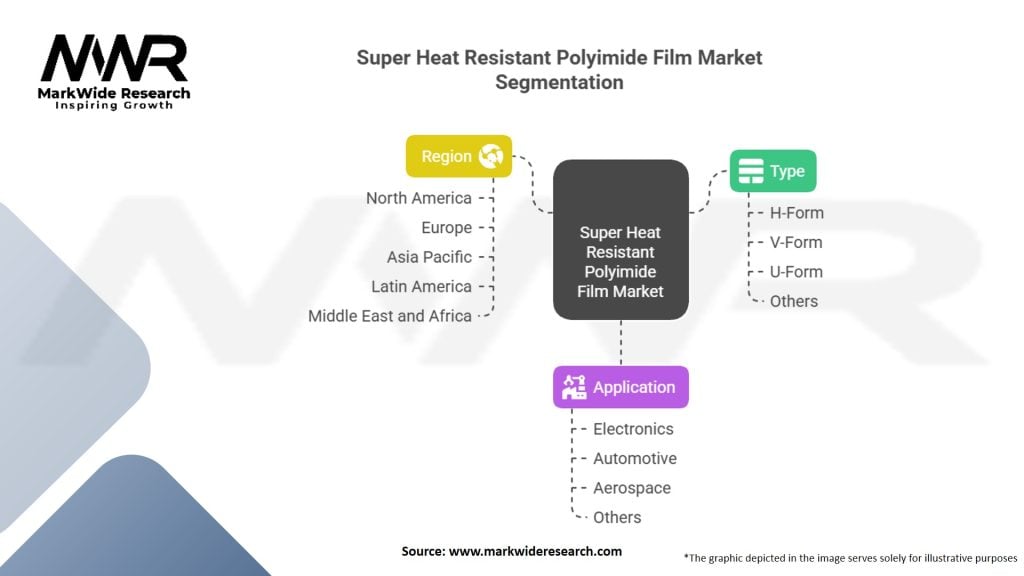

| Segmentation Details | Description |

|---|---|

| Type | H-Form, V-Form, U-Form, Others |

| Application | Electronics, Automotive, Aerospace, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Super Heat Resistant Polyimide Film Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at