444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The oil refining market plays a crucial role in the global energy sector, serving as a key link between crude oil production and the supply of various refined petroleum products. Oil refining involves the conversion of crude oil into valuable products such as gasoline, diesel, jet fuel, and petrochemicals. The market for oil refining is driven by the growing demand for energy and transportation fuels across the globe. This analysis will provide insights into the current state of the oil refining market, its key drivers, restraints, opportunities, and future outlook.

Meaning

Oil refining refers to the complex process of converting crude oil into refined products that are suitable for use. Crude oil is a mixture of hydrocarbons with varying molecular weights and properties. The refining process involves separating and purifying these hydrocarbons through various physical and chemical processes. The goal is to produce high-quality fuels and petrochemicals that meet specific market requirements. The refining industry plays a crucial role in ensuring the availability of energy and transportation fuels, powering economies worldwide.

Executive Summary

The oil refining market has witnessed significant growth in recent years, driven by the increasing demand for energy and refined petroleum products. The market is characterized by intense competition, stringent environmental regulations, and the need for continuous technological advancements. This analysis provides a comprehensive overview of the oil refining market, highlighting key market insights, drivers, restraints, opportunities, and trends. It also discusses the regional analysis, competitive landscape, segmentation, and the impact of COVID-19 on the market. Additionally, this report presents key industry developments, analyst suggestions, and a future outlook for the oil refining market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The oil refining market is influenced by a variety of factors that impact its growth and profitability. These dynamics include fluctuating crude oil prices, changing geopolitical landscape, regulatory policies, technological advancements, and shifting consumer preferences. Adapting to these dynamics requires refiners to continuously innovate, optimize operations, and invest in sustainable practices. The ability to navigate these dynamics effectively determines the success and competitiveness of players in the market.

Regional Analysis

The oil refining market is geographically diverse, with key players operating across different regions. The regional analysis provides insights into the market dynamics, demand-supply scenario, regulatory environment, and competitive landscape in each region. Key regions in the oil refining market include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region has its unique characteristics, challenges, and growth opportunities, influencing the overall market dynamics.

Competitive Landscape

Leading Companies in the Oil Refining Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

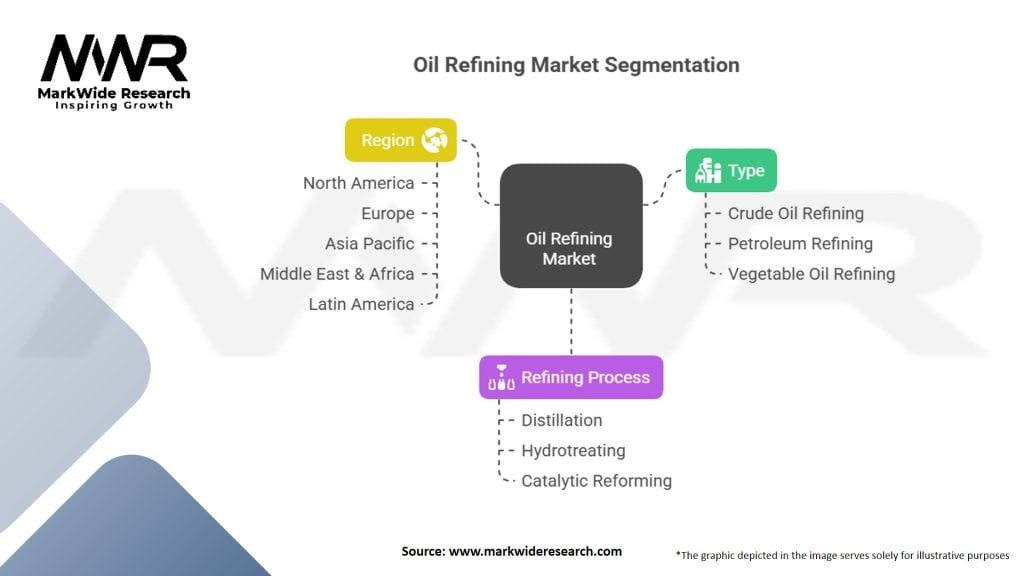

Segmentation

The oil refining market can be segmented based on various factors such as type of refining process, refined products, end-use industries, and geographical regions. Segmenting the market allows for a better understanding of specific market segments and their respective growth prospects. It enables companies to tailor their strategies and offerings to cater to the unique needs of different segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Essential Infrastructure: Critical role in supplying fuels, lubricants, and petrochemicals.

Economies of Scale: Large integrated refineries benefit from high throughput and cost advantages.

Technological Advances: Upgrades like hydrocracking and desulfurization improve efficiency and compliance.

Weaknesses:

High Capital Intensity: Major investments required for construction, maintenance, and environmental controls.

Margins Volatility: Refining crack spreads fluctuate with crude and product price dynamics.

Environmental Footprint: Significant GHG emissions and waste streams attract regulatory scrutiny.

Opportunities:

Renewable Feedstocks: Co‑processing bio‑oils and renewable diesel/hydrogen integration.

Upgrading Facilities: Retrofitting existing plants to produce higher‑value, low‑sulfur products.

Circular Economy: Development of petrochemical recycling and waste‑to‑fuel technologies.

Threats:

Energy Transition: Shift toward electrification and renewables may reduce long‑term fuel demand.

Strict Emissions Regulations: Tightening rules on CO₂ and sulfur emissions can raise operating costs.

Geopolitical Risks: Supply disruptions and trade barriers impacting crude availability.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the oil refining market. The global lockdowns, travel restrictions, and economic slowdown resulted in a decline in energy demand, leading to reduced refining activities. Refiners faced challenges such as storage constraints, declining margins, and disrupted supply chains. However, the market has shown resilience and adaptability, with refiners implementing cost-cutting measures, diversifying their product portfolios, and focusing on sustainability to navigate the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the oil refining market looks promising, driven by the increasing demand for energy and the transition towards cleaner and sustainable energy sources. Refiners will continue to face challenges such as volatility in crude oil prices, environmental regulations, and geopolitical factors. However, by embracing technological advancements, focusing on sustainability, and catering to evolving market needs, players in the oil refining industry can seize opportunities and thrive in the dynamic market landscape.

Conclusion

The oil refining market plays a vital role in meeting the global demand for energy and transportation fuels. This analysis has provided a comprehensive overview of the market, highlighting its meaning, key insights, drivers, restraints, opportunities, and future outlook. The analysis emphasized the importance of SEO optimization and human-friendly content creation to ensure maximum visibility and engagement. With the right strategies, innovations, and adaptability, participants in the oil refining market can navigate the challenges and capitalize on the opportunities presented by evolving industry dynamics.

Oil Refining Market

| Segmentation Details | Description |

|---|---|

| Type | Crude Oil Refining, Petroleum Refining, Vegetable Oil Refining, Others |

| Refining Process | Distillation, Hydrotreating, Catalytic Reforming, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Oil Refining Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at