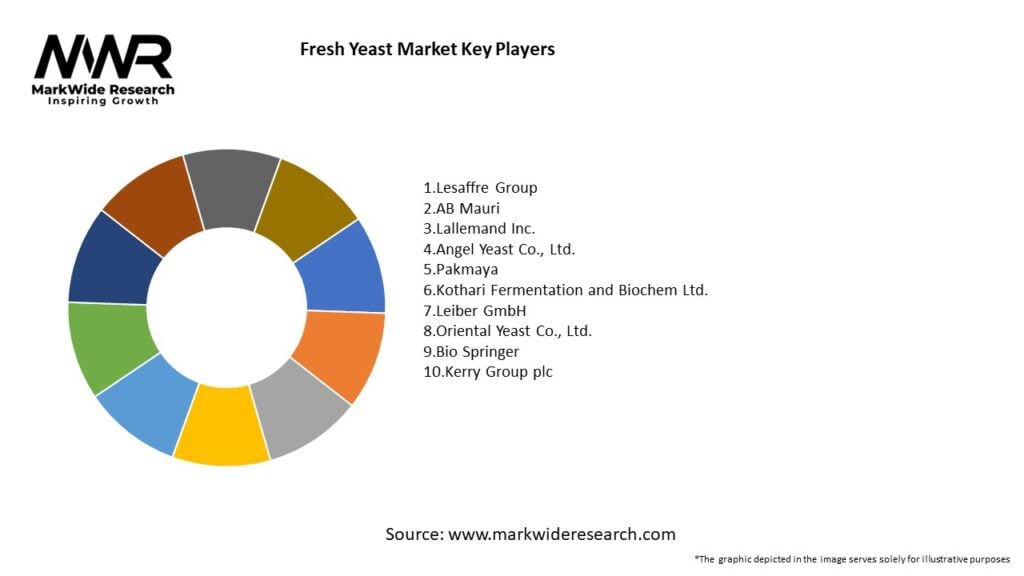

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Artisanal and Premium Baking Surge: Consumer preference for freshly baked, authentic breads and pastries continues to rise, bolstering demand for fresh yeast with superior flavor and handling properties.

-

Cold Chain Investments: Enhanced refrigerated storage and transport capabilities are enabling market expansion into previously underserved regions, reducing product spoilage and extending shelf life.

-

Strain Innovation: Advances in microbial genetics are delivering yeast strains with improved fermentation kinetics, stress tolerance, and flavor compound profiles tailored to specific bakery applications.

-

Competition from Dry Yeast: Dry and instant yeast products offer logistical advantages and longer shelf life, placing pressure on fresh yeast producers to optimize cost, convenience, and performance.

-

Regulatory and Safety Standards: Rigorous food safety regulations (e.g., HACCP, ISO 22000) drive producers to implement advanced quality control and traceability systems, enhancing consumer confidence.

These insights underscore the importance of innovation, infrastructure, and quality assurance in maintaining fresh yeast’s competitive edge.

Market Drivers

-

Rising Global Bread Consumption: Bread remains a dietary staple worldwide; increased per capita consumption in emerging economies is directly boosting fresh yeast demand.

-

Expansion of Organized Retail and Foodservice: Growth in supermarkets, hypermarkets, cafés, and quick-service restaurants requires reliable, large-scale procurement of fresh yeast.

-

Artisanal and Craft Bakery Trend: The premiumization of bakery goods, driven by health-conscious and gourmet consumer segments, favors fresh yeast for its superior sensory characteristics.

-

Technological Advancements in Production: Automated fermentation control, improved harvesting techniques, and novel packaging (e.g., vacuum-sealed, modified atmosphere) are extending shelf life and reducing costs.

-

Cold Chain Infrastructure Development: Investments in refrigerated warehousing and distribution networks enable fresh yeast availability in distant markets, reducing spoilage and waste.

-

Clean-Label and Natural Ingredient Movement: Consumer demand for minimally processed, natural ingredients supports fresh yeast over chemical leavening agents or preservatives.

Market Restraints

-

Perishability and Shelf Life Constraints: Fresh yeast’s limited shelf life (typically 10–14 days) and strict temperature requirements create logistical challenges and potential waste.

-

High Transportation Costs: Maintaining a continuous cold chain from production to end-use adds complexity and cost, particularly for long-distance distribution.

-

Competition from Dry and Instant Yeast: Dry yeast formats, with up to two-year shelf life and room-temperature stability, offer operational convenience that can displace fresh yeast.

-

Quality Consistency Issues: Variations in cell viability and moisture content across manufacturing batches can impact fermentation performance and end-product quality.

-

Regulatory Compliance Costs: Food safety and quality assurance requirements necessitate significant investment in monitoring, testing, and certification.

Market Opportunities

-

Emerging Market Penetration: Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and Africa create new growth corridors for fresh yeast consumption.

-

Specialty Strain Development: R&D into sourdough, high‐temperature‐tolerant, low‐FODMAP, and gluten-reduced yeast strains can unlock niche bakery segments.

-

E‑commerce and Direct‑to‑Baker Models: Online channels enable small bakeries and home bakers to access fresh yeast directly from producers, bypassing traditional distribution.

-

Collaborations with Equipment Manufacturers: Integrating yeast monitoring sensors into bakery equipment can optimize fermentation and dough handling, enhancing product consistency.

-

Sustainability Initiatives: Process innovations that reduce water usage, energy consumption, and packaging waste can improve environmental footprint and appeal to eco‐conscious customers.

-

Co‑manufacturing and Toll‑Processing: Smaller yeast producers can partner with large fermenters to scale production without investing in full facility builds, improving flexibility and capacity.

Market Dynamics

-

Supply Side: Major producers operate large‐scale fermenters, employing continuous and batch fermentation to maximize yield and consistency. Investments in high‐efficiency aerobic and anaerobic reactors, nutrient optimization, and downstream processing (centrifugation, washing, compression) drive cost efficiencies. Strategic acquisitions and capacity expansions help meet growing demand.

-

Demand Side: End‐users range from artisanal bakeries seeking premium performance to industrial bread lines prioritizing cost effectiveness. Seasonal peaks (e.g., holidays) and cultural baking traditions influence consumption patterns. Value‐added products (e.g., pre‐ferments, frozen dough systems) represent adjacent opportunities.

-

Economic & Policy Influences: Favorable agricultural policies and subsidies for cereal production indirectly support yeast demand. Trade agreements affecting raw material (sugar, corn steep liquor) imports and cold storage incentivize local production. Food safety regulations drive consolidation around certified, traceable providers.

Regional Analysis

-

North America: Mature market with high per‐capita bread consumption; strong cold chain infrastructure; ongoing innovation in specialty and clean‐label yeast products.

-

Europe: Traditional heartland of baking; emphasis on artisan and organic breads; regulatory rigor around GMO and allergen labeling influences yeast selection.

-

Asia‐Pacific: Fastest‐growing region; rising wheat consumption; emergence of Western‐style bakeries in urban centers; infrastructure investments improving fresh yeast access.

-

Latin America: Growing bakery sector in Brazil, Mexico, Argentina; logistical challenges in cold chain but significant opportunity in emerging urban markets.

-

Middle East & Africa: Nascent fresh yeast market constrained by infrastructure; growth potential tied to urbanization and retail modernization.

Competitive Landscape

Leading Companies in the Fresh Yeast Market:

- Lesaffre Group

- AB Mauri

- Lallemand Inc.

- Angel Yeast Co., Ltd.

- Pakmaya

- Kothari Fermentation and Biochem Ltd.

- Leiber GmbH

- Oriental Yeast Co., Ltd.

- Bio Springer

- Kerry Group plc

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

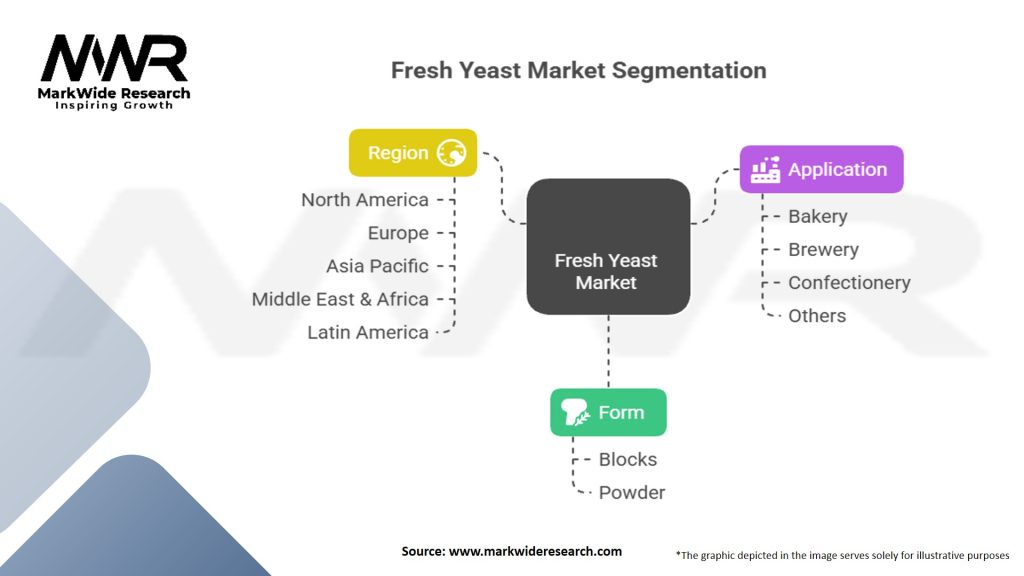

Segmentation

-

By Type:

-

Cake Yeast (Compressed): Standard form for artisanal and industrial bakeries.

-

Liquid Fresh Yeast: Pre‐suspended formulations for direct use in certain automated systems.

-

-

By Application:

-

Bread & Rolls

-

Pastries & Croissants

-

Pizza Dough

-

Specialty & Artisan Breads

-

Other (e.g., pretzels, bagels)

-

-

By End‐User:

-

Industrial Bakeries

-

Artisanal Bakeries & Cafés

-

Foodservice & HORECA

-

Retail (home baker segment)

-

-

By Distribution Channel:

-

Direct Sales

-

Distributors & Wholesalers

-

Online/E‐commerce

-

-

By Region:

-

North America

-

Europe

-

Asia‐Pacific

-

Latin America

-

Middle East & Africa

-

Category‐wise Insights

-

Cake Yeast: Dominates due to widespread adoption and ease of use; primary form for bulk and artisanal baking.

-

Liquid Fresh Yeast: Niche segment, often used in mechanized systems requiring pre‐mixed yeast slurries.

-

Artisan vs. Industrial: Artisan bakeries prioritize flavor and handling, favoring premium strains; industrial players focus on cost and consistency.

-

Retail/Home Use: Growing segment driven by home baking trends, though logistical challenges limit availability.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Product Quality: Fresh yeast delivers superior flavor, aroma, and texture, differentiating bakery offerings.

-

Operational Efficiency: Rapid fermentation and easy dough handling reduce production time and energy costs.

-

Cost Management: While pricier than dry yeast, fresh yeast’s performance can reduce overall ingredient and production costs through optimized recipes and shorter proof times.

-

Market Differentiation: Specialty strains and clean‐label credentials enable bakeries to command premium pricing.

-

Supply Chain Resilience: Localized production and expanded cold storage networks build redundancy against disruptions.

-

Sustainability: Innovations in packaging (biodegradable films, modified‐atmosphere wraps) and process efficiencies improve environmental impact.

SWOT Analysis

-

Strengths: Superior sensory performance; established fermentation technology; strong brand reputations among leading producers.

-

Weaknesses: Perishable nature; high logistics and cold chain costs; limited shelf life.

-

Opportunities: Emerging market expansion; specialty strain development; e‐commerce direct delivery; sustainability innovations.

-

Threats: Competition from dry/instant yeast; raw material price volatility; regulatory changes in food safety and cold storage standards.

Market Key Trends

-

Specialty Strains & Clean‐Label: Demand for non‐GMO, organic, and heritage yeast strains is rising.

-

Functional Yeasts: Development of strains with probiotic potential, gluten‐free attributes, or enhanced nutritional profiles.

-

Digital Baking Solutions: Integration of IoT sensors for fermentation monitoring and automated yeast dosing.

-

Sustainable Packaging: Adoption of recyclable films and carbon‐neutral logistics.

-

Home Baking Surge: Spurred by at‐home trends, some producers offer consumer‐sized fresh yeast packages via grocery and online channels.

Covid‑19 Impact

-

Home Baking Boom: Lockdowns triggered unprecedented home baking, temporarily boosting retail fresh yeast demand.

-

Supply Chain Disruptions: Short‐term cold chain and production interruptions highlighted the need for robust logistics.

-

Foodservice Slowdown: Closure of cafés and restaurants reduced industrial volumes, accelerating diversification into retail and e‑commerce channels.

-

Safety Protocols: Enhanced sanitation and traceability measures increased operational costs but improved consumer trust.

Key Industry Developments

-

Capacity Expansions: Major players have invested in new fermenters and cold storage facilities to support growth.

-

M&A Activity: Consolidation among regional producers to achieve scale and distribution efficiency.

-

Innovation Hubs: Partnerships with academic and research institutions to develop next‑gen yeast strains and applications.

-

Sustainability Initiatives: Rollout of eco‑friendly packaging and renewable energy integration in production sites.

-

Digital Platforms: Launch of direct‑to‑consumer online platforms and subscription models for home bakers.

Analyst Suggestions

-

Invest in Cold Chain Infrastructure: Strengthen refrigerated warehousing and transport to minimize waste and expand geographic reach.

-

Develop Specialty Strains: Focus R&D on targeted strain attributes (e.g., rapid proof, high osmotic tolerance) for differentiated market segments.

-

Expand Retail Footprint: Leverage e‑commerce and grocery partnerships to capture the home baking audience.

-

Enhance Traceability: Implement blockchain or digital labeling to assure quality and origin, meeting consumer transparency demands.

-

Optimize Costs: Pursue process improvements and renewable energy use to reduce production and logistics expenses.

-

Forge Strategic Alliances: Collaborate with bakery equipment manufacturers and foodservice groups to integrate yeast solutions into broader offerings.

Future Outlook

The fresh yeast market is expected to grow at a CAGR of ~4.5% from 2025 to 2030, driven by continued expansion of the global bakery sector, rising demand for premium and artisanal baked goods, and infrastructure investments in cold chain logistics. Innovation in specialty strains, sustainable practices, and digital fermentation technologies will shape the competitive landscape. While dry yeast alternatives will continue to exert pressure, fresh yeast’s sensory advantages and premium positioning secure its role among quality-focused bakeries. Emerging market entry, home baking channels, and functional yeast applications offer new growth avenues. Overall, stakeholders who invest in infrastructure, R&D, and digital integration will be best positioned to capitalize on the evolving fresh yeast market.

Conclusion

The Fresh Yeast Market remains a cornerstone of the global baking industry, offering unmatched performance in fermentation speed, flavor development, and dough handling. As consumer preferences evolve toward premium, artisan, and clean‑label products, fresh yeast producers must innovate in strain development, sustainability, and supply chain resilience. By addressing the challenges of perishability and logistics through advanced cold chain solutions and packaging, and by expanding into emerging and retail segments, the market can sustain robust growth. Partnerships across R&D, equipment, and digital ecosystems will accelerate next‑generation applications—ranging from functional foods to probiotic breads—cementing fresh yeast’s role in the future of baking and beyond.