Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Urbanization & Digital Adoption: With 67% of the global population projected to live in cities by 2050, demand for last-mile mobility solutions continues to surge. Smartphone penetration (80%+ in many urban markets) underpins app usage.

-

Service Diversification: Platforms increasingly offer multimodal integrations—e‑scooters, bike‑sharing, public transit ticketing—positioning themselves as “mobility as a service” (MaaS) providers.

-

Sustainability Focus: Green initiatives (EV subsidies, carbon‐neutral operations) are attracting eco‐conscious riders and aligning with emission reduction mandates.

-

Driver Ecosystem: Flexible gig‑economy work appeals to many drivers, but retention and satisfaction hinge on earnings stability, insurance coverage, and benefits.

-

Data & AI Leverage: Advanced analytics improve predictive demand modeling, dynamic pricing, and personalized marketing, enhancing both operational efficiency and user loyalty.

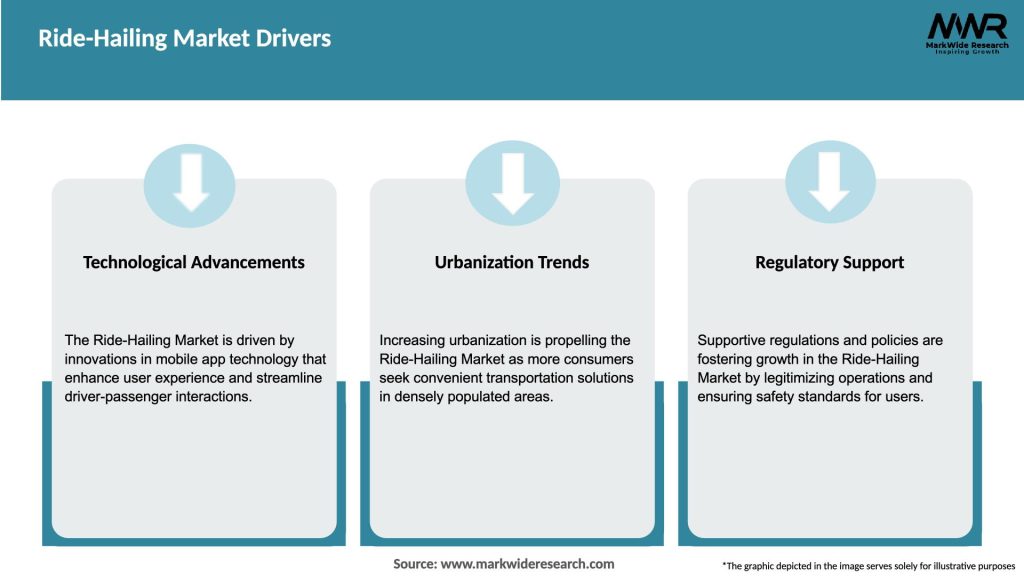

Market Drivers

-

Convenience & Reliability: On‐demand service, real‐time tracking, and upfront pricing deliver superior user experience versus traditional taxis.

-

Cost‐Effectiveness: Competitive fares—especially in shared‐ride options—and promotional discounts incentivize adoption.

-

Technology Penetration: Widespread smartphone ownership, mobile internet availability, and app‐based payments drive usage.

-

Urban Traffic Challenges: Congestion and parking shortages push consumers toward ride‐hailing as a stress‐free alternative.

-

Public Health & Safety: Contactless transactions and driver‐screening features (ratings, background checks) enhance rider confidence, especially post‑pandemic.

-

Government Collaboration: In some regions, ride‐hailing partnerships with transit agencies optimize first‐ and last‐mile connectivity, expanding service reach.

Market Restraints

-

Regulatory Hurdles: Divergent local regulations on licensing, surge pricing, and driver classification (employee vs. contractor) can limit expansion or result in operational bans.

-

Driver Retention Issues: Income volatility and lack of traditional employment benefits lead to driver churn, requiring continual recruitment and incentives.

-

Profitability Pressures: Heavy subsidies and promotional spending to gain market share strain margins; profitability remains elusive for many operators.

-

Infrastructure Limitations: In regions with poor road networks or intermittent connectivity, app performance and service quality suffer.

-

Data Privacy & Security: Handling sensitive user data demands robust cybersecurity measures; breaches can damage reputation and attract fines.

Market Opportunities

-

Emerging Markets: Rapid urbanization in Asia‑Pacific, Africa, and Latin America presents substantial untapped demand for reliable, app‑based mobility.

-

Electric & Autonomous Vehicles: Partnerships with EV manufacturers and investments in autonomous fleets promise cost savings (fuel, labor) and regulatory goodwill.

-

Corporate & Health Mobility Services: Customized B2B offerings for employee transport and non‑emergency medical transport open new revenue streams.

-

Subscription Models: Monthly or annual membership plans offering discounted rates and priority booking enhance customer stickiness.

-

Integrated MaaS Platforms: Aggregating ride‑hailing with public transit, shared micromobility, and carpooling under unified payment systems increases user engagement and ecosystem reliance.

Market Dynamics

-

Supply Side: Software innovation (AI routing, fraud detection), partnerships with auto and fintech firms, and expanding driver networks fuel service rollouts. Cost efficiencies through fleet electrification and dynamic pricing algorithms are critical.

-

Demand Side: Consumers expect seamless, multi‐modal mobility options, personalized offers, and strong safety protocols. Economic conditions (fuel prices, disposable income) influence ride demand.

-

Economic & Regulatory: Trade policies, local tax regimes, and mobility regulations shape market entry strategies. Public incentives for EVs and green transport support sustainable fleet transitions.

Regional Analysis

-

North America: Uber and Lyft dominate, with rising interest in EV fleets. Regulatory tussles over gig‑worker classification persist, but tech‐savvy consumers drive high per‑capita usage.

-

Europe: Fragmented by local players (Bolt, Free Now), with strong regulatory oversight on emissions and labor rights. Integration with public transit and micromobility is advanced.

-

Asia‑Pacific: DiDi leads in China, Grab in Southeast Asia, Ola in India. Rapid urban growth, high smartphone usage, and relatively lax early regulations spurred explosive adoption. Profitability varies by region.

-

Latin America: Uber, Cabify, and regional apps compete amid regulatory uncertainty. Safety concerns and cash‑based economies require localized payment and security features.

-

Middle East & Africa: Market share is split between global players and nimble local startups. Growth driven by tourism, expat populations, and smart city initiatives; however, coverage gaps and cash preferences remain challenges.

Competitive Landscape

Leading Companies in the Ride-Hailing Market:

- Uber Technologies Inc.

- Didi Chuxing Technology Co., Ltd.

- Lyft, Inc.

- Grab Holdings Inc.

- Ola Cabs (ANI Technologies Pvt. Ltd.)

- Gojek Tech

- Yandex N.V.

- Bolt Technology OU (formerly Taxify)

- Careem Networks FZ-LLC

- Gett, Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

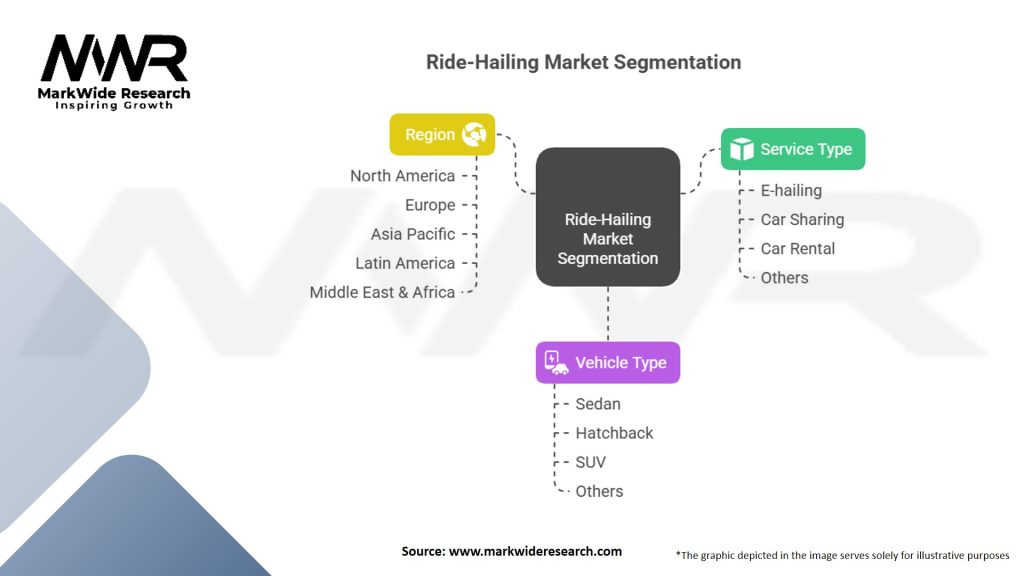

Segmentation

-

By Service Type: Private on‐demand, shared rides, premium/luxury, carpooling, micromobility integration.

-

By User Type: Individual riders, corporate accounts, tourism services.

-

By Vehicle Type: Standard cars, luxury vehicles, two‐wheelers (motorcycle hailing), electric vehicles.

-

By Region: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa.

Category‑wise Insights

-

Shared Rides: Cost‑effective and environmentally friendly; crucial for reducing congestion but complex to route and price.

-

Premium Services: Higher margins but limited to urban centers with affluent user bases.

-

Electric Fleets: Offer regulatory incentives and brand goodwill; infrastructure (charging) is essential.

-

Micromobility: Scooters and bikes fill first/last‑mile gaps but require robust maintenance and parking solutions.

Key Benefits for Industry Participants and Stakeholders

-

Riders: Convenience, safety, transparent pricing, and multi‑modal options.

-

Drivers: Flexible income opportunities, though earnings stability depends on incentives and utilization rates.

-

Cities: Reduced private car usage, improved traffic flow (with carpooling), potential collaboration on data‑driven urban planning.

-

Investors: Long‑term potential as mobility shifts from ownership to service models, with opportunities in adjacent services (delivery, logistics).

SWOT Analysis

-

Strengths: High user convenience; scalable technology platforms; flexible business models.

-

Weaknesses: Profitability challenges; regulatory pushback on gig‑worker models; reliance on subsidies for market share.

-

Opportunities: EV and autonomous vehicle integration; expansion into underserved regions; corporate mobility and healthcare transport.

-

Threats: Regulatory constraints; intensifying competition; cybersecurity risks; macroeconomic downturns affecting discretionary spending.

Market Key Trends

-

EV Adoption: Transitioning driver fleets to electric vehicles for sustainability and cost savings.

-

Autonomous Rides: Pilot projects for self‑driving cars aiming to reduce labor costs, though widespread rollout remains years away.

-

Subscription Mobility: Flat‑fee plans attracting frequent users and generating predictable revenue.

-

MaaS Platforms: Integrating multiple transport modes (public transit, ride‑hail, bikes) under unified apps.

-

Safety & Hygiene: Post‑pandemic focus on contactless pickups, rider/driver health verifications, and vehicle cleaning standards.

Covid‑19 Impact

-

Demand Shock: Initial lockdowns caused ride volumes to plunge by up to 80%, pivoting many platforms toward delivery services.

-

Hygiene Protocols: Introduction of mask mandates, sanitization requirements, and partition installations in vehicles.

-

Accelerated Contactless Payments: Surge in digital wallet and in‑app payment adoption to minimize physical contact.

-

Flexible Driver Policies: Insurance and financial assistance programs to support driver retention during downturns.

Key Industry Developments

-

Uber‑Toyota Partnership: Joint development of autonomous ride‑hailing vehicles.

-

DiDi’s EV Deals: Collaborations with automakers to supply electric cars to drivers at subsidized rates.

-

Grab’s Super App: Expansion into payments, food delivery, and financial services alongside ride‑hailing.

-

Lyft’s Healthcare Transport: Dedicated non‑emergency medical transport partnerships with healthcare providers.

Analyst Suggestions

-

Diversify Services: Strengthen non‑ride verticals (delivery, freight, corporate mobility) to smooth revenue streams.

-

Focus on Profitability: Gradually shift from subsidy‑driven growth to sustainable fare structures and cost controls.

-

Partner with Cities: Offer data and shared‑mobility solutions to alleviate urban congestion and improve public transit integration.

-

Expand EV Infrastructure: Work with governments and energy providers to roll out charging networks for drivers.

-

Enhance Driver Support: Introduce benefits, training, and earnings guarantees to reduce churn and ensure service quality.

Future Outlook

The ride‑hailing market is set to mature, with growth driven by continued urbanization, technology evolution, and shifts toward MaaS ecosystems. Key expectations include:

-

Profitability Turnaround: As operators scale and trim incentives, EBITDA positivity may emerge in core markets by mid‑2020s.

-

EV & AV Integration: Electric vehicles will constitute a significant fleet share; autonomous pilots will expand from controlled zones to open roads.

-

Regulatory Harmonization: Collaboration with policymakers on fair labor rules, safety standards, and data governance will stabilize the competitive landscape.

-

Global Expansion: Focus on Southeast Asia, Latin America, and Africa where urban populations and smartphone usage are rapidly growing.

-

Consumer Loyalty: Subscription plans and integrated mobility wallets will drive recurring revenue and strengthen brand loyalty.

Conclusion

The Global Ride‑Hailing Market has revolutionized urban mobility, offering unparalleled convenience and flexibility. While growth has been rapid—fueled by smartphone ubiquity and evolving consumer preferences—the path to sustainable profitability requires a balanced approach to driver welfare, regulatory compliance, and technological investment. Platforms that successfully integrate electric and autonomous vehicles, partner with public transit, and expand into adjacent services will emerge as true “mobility super apps.” As cities worldwide grapple with congestion, emission reduction targets, and the need for resilient transportation networks, ride‑hailing services stand poised to play an integral role in shaping the future of urban mobility.