444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aerospace and defense industry has witnessed significant advancements in technology, and one such innovation that has revolutionized the manufacturing process is additive manufacturing, also known as 3D printing. Additive manufacturing enables the production of complex components with reduced weight, enhanced performance, and improved cost-efficiency. This market analysis delves into the aerospace and defense additive manufacturing sector, examining its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants, SWOT analysis, key trends, Covid-19 impact, industry developments, analyst suggestions, future outlook, and a conclusive summary.

Meaning

Aerospace and defense additive manufacturing refers to the utilization of 3D printing technologies in the production of aerospace and defense components. It involves the layer-by-layer deposition of materials to create intricate designs, allowing manufacturers to produce complex geometries that were previously challenging or impossible to manufacture using traditional methods. Additive manufacturing offers advantages such as faster production cycles, cost savings, design flexibility, and improved material utilization, making it a game-changer in the aerospace and defense industry.

Executive Summary

The aerospace and defense additive manufacturing market has experienced substantial growth in recent years, driven by the increasing demand for lightweight and fuel-efficient aircraft and advanced defense systems. With additive manufacturing technologies maturing and gaining wider acceptance, the market is expected to witness a surge in adoption. However, challenges such as high initial costs, regulatory constraints, and the need for skilled labor pose barriers to market growth. Nonetheless, the aerospace and defense additive manufacturing market presents lucrative opportunities for industry players to innovate, collaborate, and capitalize on the potential benefits it offers.

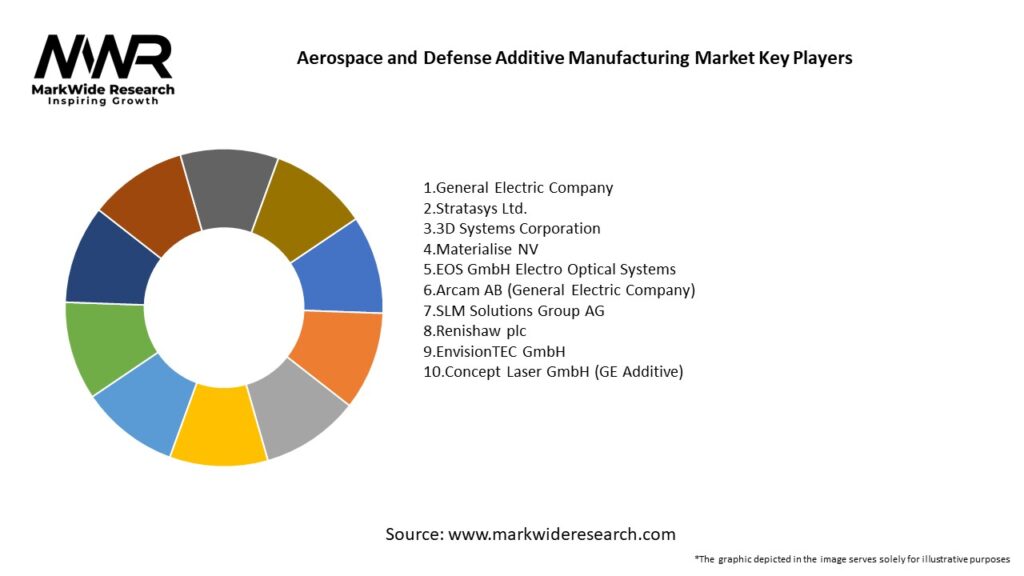

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The aerospace and defense additive manufacturing market is influenced by various factors, including technological advancements, industry collaborations, government regulations, market competition, and customer demands. Rapid advancements in additive manufacturing technologies, coupled with increasing industry awareness, are driving market growth. Industry players are focusing on expanding their additive manufacturing capabilities, developing new materials, and establishing strategic partnerships to gain a competitive edge. Government initiatives to promote advanced manufacturing, research and development funding, and supportive policies also play a vital role in shaping the market dynamics.

Regional Analysis

Competitive Landscape

Leading Companies in the Aerospace and Defense Additive Manufacturing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

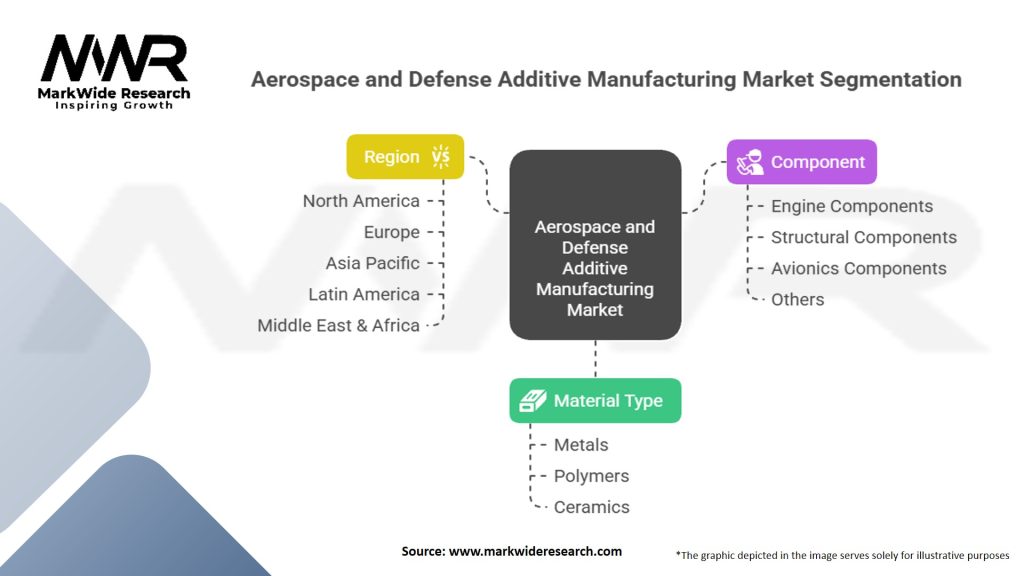

Segmentation

The aerospace and defense additive manufacturing market can be segmented based on technology, material, application, and end-user. Common technologies include powder bed fusion, directed energy deposition, material extrusion, and vat photopolymerization. Materials used in additive manufacturing encompass metals, polymers, ceramics, and composites. Applications of additive manufacturing in the aerospace and defense sector include prototyping, tooling, engine components, airframe structures, and space systems. The end-users include aircraft manufacturers, defense organizations, and additive manufacturing service providers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the aerospace and defense additive manufacturing market. While the overall industry faced challenges due to disruptions in the supply chain, reduced demand for air travel, and budget constraints, the pandemic also highlighted the importance of agility, resilience, and localized production. Additive manufacturing’s ability to produce critical components on-demand and its potential for distributed manufacturing became evident during the crisis. The pandemic accelerated the adoption of additive manufacturing in certain areas, such as the production of medical equipment and spare parts for critical systems.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the aerospace and defense additive manufacturing market looks promising. The technology is expected to continue advancing, enabling the production of larger, more complex components with improved material properties. Increasing industry awareness and acceptance, coupled with supportive government initiatives, will drive market growth. As the cost of additive manufacturing technologies decreases and the range of materials expands, smaller aerospace manufacturers and defense organizations will have increased access to these capabilities. The market will witness collaborations, partnerships, and investments in research and development, fueling innovation and driving the adoption of additive manufacturing across the aerospace and defense sector.

Conclusion

The aerospace and defense additive manufacturing market is undergoing rapid transformation, fueled by advancements in technology, materials, and industry collaborations. Additive manufacturing offers numerous benefits, including design flexibility, cost savings, lightweight components, and supply chain optimization.

While challenges such as high initial costs and regulatory constraints exist, the market presents significant opportunities for industry participants to innovate, collaborate, and capitalize on the potential advantages offered by additive manufacturing. With continued research and development, supportive policies, and a skilled workforce, the aerospace and defense additive manufacturing market is poised for substantial growth and transformation in the coming years.

What is Aerospace and Defense Additive Manufacturing?

Aerospace and Defense Additive Manufacturing refers to the use of 3D printing technologies to produce components and parts for the aerospace and defense sectors. This process allows for complex geometries, lightweight structures, and rapid prototyping, enhancing design flexibility and reducing material waste.

What are the key companies in the Aerospace and Defense Additive Manufacturing market?

Key companies in the Aerospace and Defense Additive Manufacturing market include Boeing, Lockheed Martin, and Northrop Grumman, among others.

What are the growth factors driving the Aerospace and Defense Additive Manufacturing market?

The growth of the Aerospace and Defense Additive Manufacturing market is driven by the increasing demand for lightweight components, the need for rapid prototyping, and advancements in 3D printing technologies. Additionally, the push for cost reduction in manufacturing processes is a significant factor.

What challenges does the Aerospace and Defense Additive Manufacturing market face?

Challenges in the Aerospace and Defense Additive Manufacturing market include regulatory compliance, material limitations, and the need for skilled workforce. These factors can hinder the widespread adoption of additive manufacturing technologies in critical applications.

What opportunities exist in the Aerospace and Defense Additive Manufacturing market?

Opportunities in the Aerospace and Defense Additive Manufacturing market include the development of new materials, expansion into unmanned aerial vehicles, and the potential for on-demand manufacturing. These advancements can lead to more efficient supply chains and innovative designs.

What trends are shaping the Aerospace and Defense Additive Manufacturing market?

Trends in the Aerospace and Defense Additive Manufacturing market include the integration of artificial intelligence in design processes, increased collaboration between companies, and the focus on sustainability through reduced waste. These trends are influencing how manufacturers approach production and innovation.

Aerospace and Defense Additive Manufacturing Market

| Segmentation | Details |

|---|---|

| Material Type | Metals, Polymers, Ceramics |

| Component | Engine Components, Structural Components, Avionics Components, Others |

| Region | Global (including regions such as North America, Europe, Asia Pacific, Latin America, Middle East & Africa) |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aerospace and Defense Additive Manufacturing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at