Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Bio‑Based Polyamide Demand:

Adoption of nylon 1012 in automotive fuel lines, oil seals, and electrical connectors is driving brassylic acid consumption. -

Green Lubricants & Plasticizers:

Regulatory pressure on phthalates and mineral oil-based additives boosts interest in bio-based, biodegradable alternatives derived from brassylic acid. -

Feedstock Volatility:

Erucic acid availability from rapeseed/mustard oil fluctuates seasonally and geographically, impacting brassylic acid supply and pricing. -

Process Innovation:

Advances in white biotechnology—whole‑cell catalysis and enzyme-mediated oxidation—promise lower‑cost, circular production routes. -

Regional Growth Rates:

Asia‑Pacific’s brassylic acid market is expected to grow at ~8% CAGR due to rapid polymerization capacity additions, while North America and Europe grow at ~5–6% CAGR.

Market Drivers

-

Automotive Lightweighting Initiatives:

Bio‑based nylons (1012) improve fuel efficiency and emissions compliance. -

Regulatory Bans on Hazardous Additives:

Phthalate restrictions accelerate adoption of brassylic acid‑based plasticizers in consumer and medical PVC. -

Sustainability Mandates:

Corporate commitments to reduce carbon footprints favor bio‑derived monomers. -

Performance Requirements:

High chemical and thermal stability of brassylic acid polymers meet demands in electronics and industrial machinery. -

Expanding Personal Care Sector:

Natural, biodegradable ingredients like brassylic acid esters gain traction in premium cosmetics.

Market Restraints

-

High Production Costs:

Ozonolysis and peroxide oxidation routes are energy‑intensive, leading to higher costs versus petrochemical analogues. -

Feedstock Constraints:

Dependence on erucic acid from limited rapeseed/mustard cultivars poses supply risk. -

Competition from Adipic Acid:

Established C6 dicarboxylic acid dominates lower‑cost polymer markets. -

Technical Barriers:

Scaling biotechnological processes from lab to commercial scale remains challenging. -

Market Awareness:

Limited awareness among end users about benefits of long‑chain dicarboxylic acids restricts adoption in some regions.

Market Opportunities

-

Biotechnological Production Routes:

Enzyme‑catalyzed conversion of long‑chain fatty acids or microbial fermentation can reduce costs and environmental impact. -

High‑Value Niche Polymers:

Developing specialty copolymers for medical devices and advanced electronics. -

Co‑Products Valorization:

Capturing and selling glycerol, erucamide, and residual fatty acids improves overall process economics. -

Emerging Markets Penetration:

Targeting India, Southeast Asia, and Latin America for bio‑based PVC and lubricant applications. -

Strategic Collaborations:

Partnerships between specialty chemical producers and major OEMs to co‑develop tailored brassylic acid‑based materials.

Market Dynamics

-

Supply Side:

Tight supply of erucic acid and fluctuations in rapeseed oil prices; investments in biorefineries and feedstock diversification are critical. -

Demand Side:

Demand driven by polymer makers needing high‑performance, eco‑friendly monomers; price sensitivity is higher in commodity applications. -

Economic Factors:

Capital intensity of new production facilities requires long‑term offtake agreements; stable policy incentives for bio‑based chemicals can accelerate investment.

Regional Analysis

-

North America:

Largest consumer of brassylic acid for bio‑nylon 1012 in automotive; growing interest in green lubricants. -

Europe:

Driven by strict REACH regulations and HI‑TECH polymer R&D in Germany, France, and Italy; biogenic content mandates bolster bio‑acid uptake. -

Asia‑Pacific:

Fastest growth; China and India expanding polymer, personal care, and lubricant markets; government support for bio‑refinery projects. -

Latin America:

Emerging interest, particularly in Brazil, leveraging domestic rapeseed production; small capacity but high growth potential in PVC plasticizers. -

Middle East & Africa:

Limited current consumption but significant potential as strategic bio‑refinery sites owing to agricultural feedstocks and growing polymer demands.

Competitive Landscape

Leading Companies in the Brassylic Acid Market:

- Vertellus Holdings LLC

- BASF SE

- Finetech Industry Limited

- Tokyo Chemical Industry Co., Ltd.

- Penta Manufacturing Company

- Sigma-Aldrich Corporation

- AK Scientific, Inc.

- Santa Cruz Biotechnology, Inc.

- TCI America

- Alfa Aesar

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

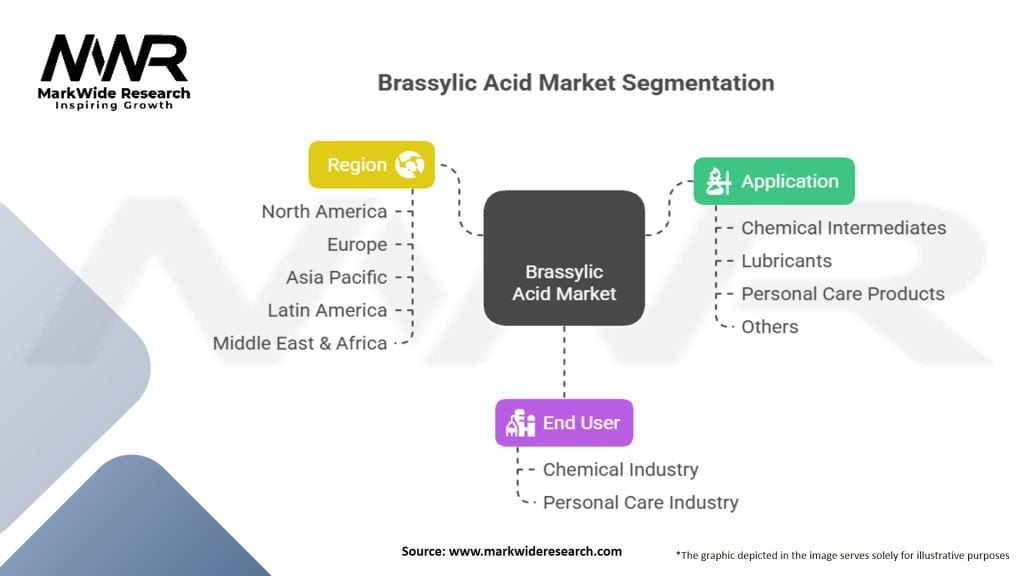

Segmentation

-

By Production Process:

-

Chemical oxidation (ozonolysis, peroxide)

-

Biotechnological routes (enzymatic, microbial fermentation)

-

-

By Application:

-

Polyamides & Copolymers: Bio‑nylon 1012, specialty polyesters

-

Lubricants & Greases: Thickening agents, viscosity modifiers

-

Plasticizers & Coatings: Bio‑based plasticizers, UV‑curable formulations

-

Personal Care & Cosmetics: Emollients, viscosity modifiers

-

Others: Adhesives, sealants, chemical intermediates

-

-

By Form:

-

Monomeric acid powder

-

Dilute (>85%) aqueous solution

-

Derivatives (esters, salts)

-

-

By End‑Use Industry:

-

Automotive & Transportation

-

Electrical & Electronics

-

PVC & Plasticizers

-

Lubricants & Metalworking Fluids

-

Personal Care & Cosmetics

-

Textiles & Fibers

-

Others

-

-

By Region:

-

North America

-

Europe

-

Asia‑Pacific

-

Latin America

-

Middle East & Africa

-

Category‑wise Insights

-

Bio‑Nylon 1012: Fastest‑growing segment; expected to reach 30% of total brassylic acid demand by 2030.

-

Green Lubricants: Premium pricing allows healthy margins; significant R&D collaboration between acid producers and lubricant formulators.

-

Personal Care: Emerging niche; consumer preference for “naturally derived” ingredients drives small‑scale specialty demand.

Key Benefits for Industry Participants and Stakeholders

-

Sustainability & Branding:

Bio‑based origin enhances product differentiation and meets ESG targets. -

Performance Enhancement:

Long‑chain diacid imparts superior mechanical and thermal properties to polymers. -

Regulatory Advantage:

Helps formulators comply with REACH, EPA, and other chemical regulations. -

Market Differentiation:

Enables development of high‑value specialty polymers and formulations. -

Value Chain Integration:

Producers can capture more margin by integrating upstream feedstock (erucic acid) and downstream polymer partnerships.

SWOT Analysis

Strengths:

-

Bio‑based, sustainable monomer aligned with green chemistry.

-

Unique long‑chain structure offers superior polymer performance.

-

Diverse applications across multiple high‑value industries.

Weaknesses:

-

Higher production cost versus C6 dicarboxylic acids (adipic).

-

Feedstock (erucic acid) availability limited to specialty rapeseed cultivars.

-

Technical complexity in bioprocess scale‑up.

Opportunities:

-

Emerging bio‑refinery projects in Asia‑Pacific and Latin America.

-

New biotechnological routes lowering CAPEX and OPEX.

-

High‑growth segments such as automotive bio‑nylons and green lubricants.

Threats:

-

Volatile rapeseed oil and erucic acid prices.

-

Competition from well‑established petrochemical monomers.

-

Shifting regulatory frameworks impacting chemical production.

Market Key Trends

-

Shift to Biotech Routes:

Pilot facilities demonstrating enzyme‑catalyzed oxidation with 20–30% lower energy consumption. -

Strategic Polymer Alliances:

Acid producers co‑developing specialty nylon lines with tier‑1 automotive OEMs. -

Downstream Product Innovation:

New brassylic acid‑based copolyesters offering 40% lower Tg for flexible films. -

Premium Bio‑Lubricants:

Increasing trials of brassylic acid thickeners in compressor and hydraulic fluids. -

Digital Supply‑Chain Integration:

Using blockchain to authenticate bio‑origin feedstock and ensure traceability.

Covid‑19 Impact

-

Supply Disruptions: Temporary rapeseed harvest fluctuations and logistics slowdowns affected erucic acid availability.

-

Demand Shifts: Automotive production downturn in 2020 led to reduced nylon 1012 consumption, partially offset by stable personal care demand.

-

Accelerated Sustainability: Post‑pandemic focus on resilience spurred new bio‑refinery investments in 2021–22.

-

Cost Pressures: COVID‑driven feedstock price spikes prompted short‑term margin compression.

-

Innovation Funding: Public stimulus towards green chemicals accelerated bioprocess scale‑up projects.

Key Industry Developments

-

Biotech Pilot Plants:

Launch of a 5,000 tpa microbial brassylic acid facility in Europe (Q4 2023). -

Automotive Partnerships:

Arkema and Renault announced bio‑nylon 1012 joint development in late 2023, targeting EV components. -

Green Lubricant Product Lines:

Croda expanded brassylic acid ester derivatives for industrial lubricants in mid‑2024. -

New PVC Plasticizers:

BASF launched a brassylic acid‑based plasticizer for medical PVC in 2024. -

Sustainability Certifications:

Producers obtaining ISCC+ and RSB certification for bio‑origin feedstock in 2023–24.

Analyst Suggestions

-

De‑risk Feedstock:

Secure multi‑origin erucic acid sourcing or invest in on‑farm rapeseed contracts. -

Scale Biotech Routes:

Accelerate enzyme/fermentation pathways to reduce production costs < 20% above petrochemical routes. -

Forge Downstream Alliances:

Partner with nylon, lubricant, and plasticizer producers for co‑development and long‑term offtake. -

Invest in Premium Markets:

Focus on high‑value segments (automotive bio‑nylon, green lubricants, medical PVC). -

Market Education:

Drive technical outreach and case‑histories to expand awareness of brassylic acid benefits versus adipic acid.

Future Outlook

By 2030, the brassylic acid market is projected to exceed USD 110 million, driven by:

-

Biotech Commercialization:

At-scale enzymatic processes cutting production cost gaps. -

Regulatory Incentives:

Bio‑content mandates in EU and ASTM bio‑lubricant standards boosting demand. -

Automotive Bio‑Nylon Growth: 15% CAGR in nylon 1012 usage for EVs and lightweight components.

-

Global Expansion:

New refineries in India, Brazil, and Southeast Asia capturing regional polymer demand. -

Circular Economy Integration:

Waste‑oil upcycling into brassylic acid via green oxidation pathways.

Conclusion

The Brassylic Acid Market stands at an inflection point, with sustainability imperatives, high‑performance polymer demand, and green lubricant regulations driving accelerated adoption. While feedstock volatility and production cost remain challenges, technological breakthroughs—particularly in biotechnology—promise to make brassylic acid increasingly cost‑competitive with traditional petrochemical diacids. Stakeholders that secure robust feedstock, invest in next‑generation production routes, and align strategically with downstream polymer and lubricant innovators will be best positioned to capitalize on the market’s robust long‑term growth prospects.