444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The military aviation MRO (Maintenance, Repair, and Overhaul) market is a crucial component of the aerospace and defense industry. It encompasses the activities and processes involved in maintaining and sustaining military aircraft and their components, ensuring their operational readiness and extending their service life. Military aviation MRO plays a vital role in enhancing the safety, performance, and efficiency of military aircraft, while also reducing the overall operational costs.

Meaning

Military aviation MRO refers to the maintenance, repair, and overhaul activities conducted on military aircraft and related systems. It involves inspections, repairs, replacements, and modifications to ensure the airworthiness and mission readiness of military aircraft. The MRO process includes routine maintenance, scheduled inspections, unscheduled repairs, component overhauls, and technological upgrades. It encompasses a wide range of activities, from minor repairs to major structural modifications and engine overhauls.

Executive Summary

The military aviation MRO market is experiencing significant growth due to the increasing demand for military aircraft, technological advancements, and the need for cost-effective maintenance solutions. The market is highly competitive, with numerous players offering a wide range of MRO services. The market is driven by factors such as the increasing defense budgets of various countries, the aging fleet of military aircraft, the rising focus on aircraft lifecycle management, and the need for efficient and reliable maintenance solutions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The military aviation MRO market is driven by a combination of factors, including defense budgets, technological advancements, fleet modernization initiatives, and regulatory compliance requirements. These dynamics influence the demand for MRO services and shape the competitive landscape of the market.

Defense Budgets and Modernization Initiatives: The defense budgets of various countries play a pivotal role in shaping the military aviation MRO market. Governments allocate funds for the maintenance and modernization of their military aircraft fleets to enhance operational readiness and maintain strategic capabilities. Increasing defense budgets and modernization initiatives create opportunities for MRO service providers to secure contracts for maintenance activities.

Technological Advancements and Digitalization: The integration of advanced technologies such as predictive maintenance, data analytics, and digitalization has revolutionized the MRO landscape. These technologies enable proactive maintenance planning, enhance efficiency, and reduce downtime. MRO providers that embrace technological innovations can gain a competitive advantage by offering state-of-the-art solutions to their customers.

Lifecycle Management and Sustainment: The emphasis on lifecycle management and sustainment has gained significance in military aviation. Defense organizations aim to maximize the operational lifespan of their aircraft through regular maintenance, upgrades, and structural modifications. MRO providers that offer comprehensive lifecycle management solutions are well-positioned to meet the evolving needs of defense customers.

Regulatory Compliance and Safety: The military aviation MRO market is subject to stringent regulatory requirements and safety standards. Compliance with these regulations is essential to ensure the airworthiness and safety of military aircraft. MRO service providers must invest in maintaining the necessary certifications and adhering to regulatory guidelines to operate in the market.

Regional Analysis

The military aviation MRO market exhibits regional variations influenced by defense budgets, geopolitical factors, fleet modernization plans, and the presence of MRO service providers. Major regions contributing to the market include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America: North America dominates the military aviation MRO market, driven by the presence of major defense contractors, a significant fleet of military aircraft, and robust defense spending. The United States has the largest defense budget globally, supporting extensive MRO activities and technological advancements in the region.

Europe: Europe has a well-established military aviation MRO market, supported by defense collaborations, modernization programs, and a substantial fleet of military aircraft. Countries like the United Kingdom, France, and Germany have significant defense budgets and strong aerospace industries, fostering the demand for MRO services.

Asia Pacific: The Asia Pacific region is witnessing significant growth in the military aviation MRO market, driven by increasing defense budgets, modernization initiatives, and the procurement of advanced military aircraft. Countries such as China, India, Japan, and South Korea are investing in MRO capabilities to maintain their expanding military fleets.

Latin America: Latin America is an emerging market for military aviation MRO, with countries like Brazil, Mexico, and Chile investing in defense modernization. The growing fleet of military aircraft in the region, coupled with the need for maintenance and sustainment, presents opportunities for MRO service providers.

Middle East and Africa: The Middle East and Africa region are characterized by defense modernization efforts, geopolitical tensions, and a focus on maintaining military readiness. Countries like Saudi Arabia, the United Arab Emirates, and Israel are significant contributors to the MRO market in this region.

Competitive Landscape

Leading companies in the Military Aviation MRO Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

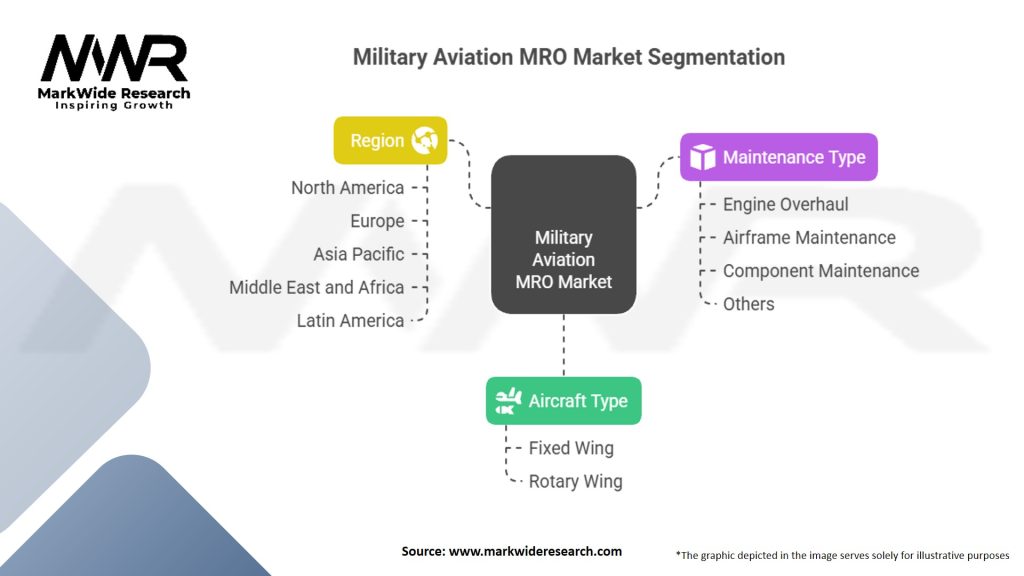

Segmentation

The military aviation MRO market can be segmented based on various factors, including aircraft type, MRO type, and end-user. Segmentation provides a structured framework for understanding market dynamics and catering to specific customer requirements.

Aircraft Type:

MRO Type:

End-User:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the military aviation MRO market. Some of the key effects include:

Despite the challenges, the military aviation MRO market showed resilience, and the recovery is expected as the pandemic subsides and defense budgets stabilize.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the military aviation MRO market is positive, driven by factors such as defense modernization efforts, the need for lifecycle management, technological advancements, and the increasing demand for MRO services. Some key trends and developments to watch for include:

Conclusion

The military aviation MRO market plays a critical role in ensuring the safety, performance, and operational readiness of military aircraft. It encompasses a wide range of activities, from routine maintenance to major repairs, component overhauls, and technological upgrades. The market is driven by factors such as defense budgets, aging aircraft fleets, technological advancements, and the need for efficient and reliable maintenance solutions.

Despite challenges such as high maintenance costs, regulatory compliance, and skilled workforce shortages, the market offers significant opportunities. Outsourcing of MRO services, emphasis on predictive maintenance, technological innovations, and the growing demand for UAV MRO are among the key opportunities for industry participants.

What is Military Aviation MRO?

Military Aviation MRO refers to the maintenance, repair, and overhaul services specifically designed for military aircraft. This includes routine maintenance, major repairs, and upgrades to ensure operational readiness and safety of military fleets.

What are the key companies in the Military Aviation MRO Market?

Key companies in the Military Aviation MRO Market include Boeing, Lockheed Martin, Northrop Grumman, and Raytheon, among others.

What are the main drivers of growth in the Military Aviation MRO Market?

The main drivers of growth in the Military Aviation MRO Market include increasing defense budgets, the need for modernization of aging aircraft, and the rising demand for advanced technologies in military operations.

What challenges does the Military Aviation MRO Market face?

Challenges in the Military Aviation MRO Market include budget constraints, regulatory compliance issues, and the complexity of maintaining advanced military aircraft systems.

What opportunities exist in the Military Aviation MRO Market?

Opportunities in the Military Aviation MRO Market include the integration of new technologies such as predictive maintenance and automation, as well as the potential for partnerships with private sector companies for enhanced service delivery.

What trends are shaping the Military Aviation MRO Market?

Trends shaping the Military Aviation MRO Market include the increasing use of digital tools for maintenance management, a focus on sustainability practices, and the shift towards more flexible and responsive MRO solutions.

Military Aviation MRO Market

| Segmentation | Details |

|---|---|

| Aircraft Type | Fixed Wing, Rotary Wing |

| Maintenance Type | Engine Overhaul, Airframe Maintenance, Component Maintenance, Others |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Military Aviation MRO Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at