444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The insurance brokerage market plays a crucial role in connecting individuals and businesses with insurance providers. Insurance brokers act as intermediaries between clients and insurance companies, offering valuable guidance and expertise to help clients navigate the complex world of insurance. These professionals assist in assessing risks, selecting appropriate insurance policies, and managing claims processes.

Meaning

Insurance brokerage refers to the process of providing insurance-related services as a broker. Brokers in this market operate independently, representing multiple insurance providers. They offer personalized advice and solutions to clients based on their unique insurance needs. Insurance brokerage services encompass a wide range of insurance types, including life insurance, property insurance, health insurance, and automobile insurance.

Executive Summary

The insurance brokerage market has experienced significant growth in recent years, driven by several factors such as increasing awareness about the importance of insurance, the complexity of insurance products, and the need for professional advice. The market is highly competitive, with numerous brokerage firms vying for clients’ attention. To succeed in this market, brokers must differentiate themselves by offering exceptional customer service, deep industry knowledge, and tailored insurance solutions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

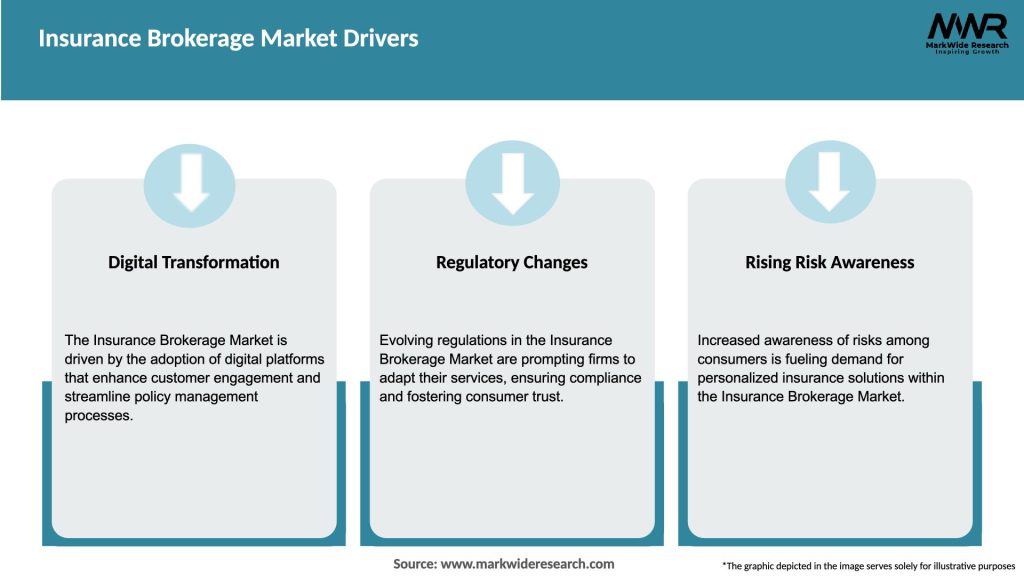

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The insurance brokerage market is characterized by dynamic and evolving trends, driven by various factors such as changing customer preferences, technological advancements, and regulatory developments. Brokers need to adapt to these market dynamics to stay competitive and seize opportunities for growth.

One of the significant dynamics in the market is the shift towards digitalization. Technological advancements have transformed how insurance brokers operate, enabling them to provide more efficient services, enhance customer experiences, and streamline back-end processes. Brokers are adopting online platforms, mobile apps, and digital tools to connect with clients, provide real-time quotes, and manage insurance policies.

Another important dynamic is the increasing focus on customer-centric approaches. Clients today expect personalized, tailored insurance solutions that address their unique needs. Successful insurance brokers prioritize understanding their clients’ businesses or individual circumstances, providing customized advice, and building long-term relationships based on trust.

Regulatory changes also impact the market dynamics, as insurance brokers need to stay updated with evolving regulations and compliance requirements. Regulatory developments can influence the types of insurance products available, distribution channels, and the overall operating environment for brokers.

Additionally, market dynamics are influenced by economic conditions, industry trends, and consumer behaviors. Brokers must monitor these dynamics and adapt their strategies to remain relevant and responsive to changing market demands.

Regional Analysis

The insurance brokerage market exhibits regional variations based on factors such as economic development, insurance penetration rates, regulatory environments, and cultural norms. Different regions present unique opportunities and challenges for insurance brokers.

North America is a mature market for insurance brokerage, characterized by a high level of insurance awareness and a robust regulatory framework. The region’s large and diverse economy creates demand for a wide range of insurance products, including property and casualty insurance, health insurance, and life insurance. Insurance brokers in North America focus on providing comprehensive risk management solutions and specialized insurance products.

In Europe, insurance brokerage markets vary across countries due to differing regulatory frameworks and cultural preferences. Some countries have a long-standing tradition of using insurance brokers, while others have a more direct distribution model. Brokers in Europe often serve as trusted advisors, particularly in complex areas such as commercial insurance and international insurance.

Asia Pacific is a region of significant growth potential for insurance brokerage. Rapid economic development, increasing disposable incomes, and a growing middle class are driving demand for insurance products in countries such as China, India, and Southeast Asian nations. Insurance brokers in this region play a vital role in educating clients about insurance and providing personalized solutions to meet the diverse needs of individuals and businesses.

Latin America and the Middle East/Africa present both opportunities and challenges for insurance brokers. These regions have lower insurance penetration rates compared to more developed markets, but they also have untapped potential. Insurance brokers in these regions face the task of raising insurance awareness, building trust, and adapting their services to cater to the unique cultural and regulatory landscapes.

Competitive Landscape

Leading companies in the Insurance Brokerage Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

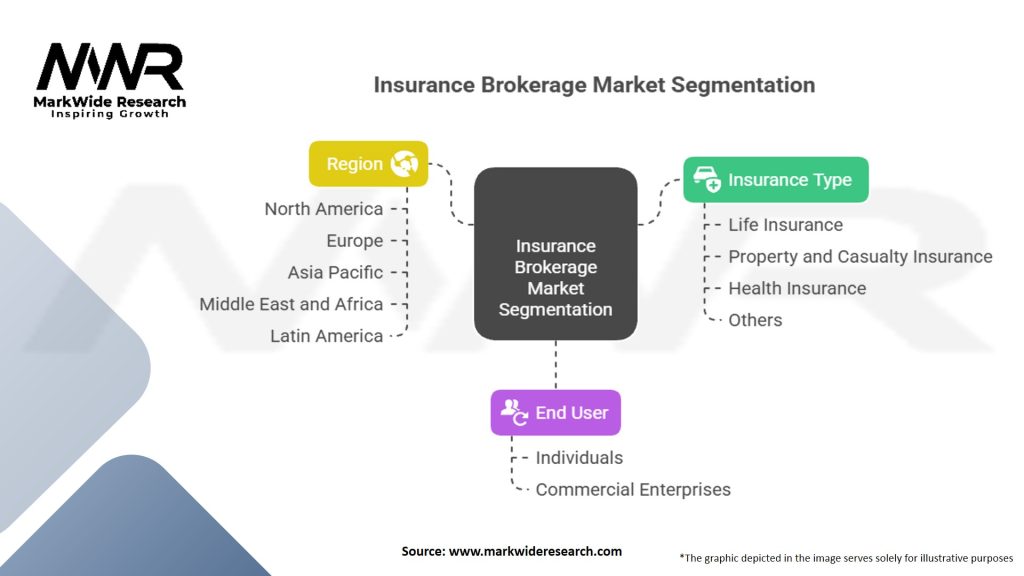

Segmentation

The insurance brokerage market can be segmented based on various factors, including insurance types, client types, and geographic regions.

Based on insurance types, the market can be segmented into:

Each segment has unique characteristics, regulatory considerations, and client needs. Insurance brokers often specialize in one or more insurance types to provide targeted expertise and solutions.

Client types form another segmentation approach in the insurance brokerage market:

Geographically, the market can be segmented into various regions, as discussed in the regional analysis section.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) provides insights into the internal and external factors that can impact the insurance brokerage market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the insurance brokerage market. The pandemic brought about various challenges and opportunities for brokers.

Challenges:

Opportunities:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the insurance brokerage market is promising, with several key trends shaping the industry. Digital transformation will continue to play a crucial role, with brokers leveraging technology to enhance operational efficiency, improve customer experiences, and access new markets.

There will be a growing emphasis on specialized expertise and niche markets as brokers seek to differentiate themselves and cater to unique client needs. Brokers will continue to expand their product offerings, addressing emerging risks such as cyber threats, climate-related risks, and evolving regulatory requirements.

The Covid-19 pandemic has accelerated the adoption of digital technologies and highlighted the importance of insurance coverage. Brokers will continue to navigate the challenges and opportunities arising from the pandemic, ensuring clients are adequately protected against future risks.

Conclusion

The insurance brokerage market is a dynamic and competitive industry that serves as a crucial link between insurance providers and clients. Insurance brokers play a vital role in educating clients, assessing risks, and providing tailored insurance solutions. The market is driven by factors such as increasing awareness about the importance of insurance, the complexity of insurance products, and the need for expert advice.

The market presents both opportunities and challenges for insurance brokers. Technological advancements, such as digital platforms and automation, offer opportunities to enhance customer experiences and operational efficiency. Specialization in niche markets and strategic partnerships can also drive growth. However, brokers need to navigate intense competition, regulatory changes, and the threat of online aggregators.

What is the Insurance Brokerage?

Insurance brokerage refers to the business of helping clients find and purchase insurance policies that best suit their needs. Brokers act as intermediaries between clients and insurance companies, providing advice and facilitating the purchase process.

Who are the key players in the Insurance Brokerage Market?

Key players in the Insurance Brokerage Market include companies like Marsh & McLennan, Aon, Willis Towers Watson, and Brown & Brown, among others. These firms offer a range of services including risk management, employee benefits, and commercial insurance solutions.

What are the main drivers of growth in the Insurance Brokerage Market?

The growth of the Insurance Brokerage Market is driven by increasing demand for customized insurance solutions, the rise in awareness of risk management, and the expansion of digital platforms that facilitate insurance transactions. Additionally, regulatory changes are prompting businesses to seek expert brokerage services.

What challenges does the Insurance Brokerage Market face?

The Insurance Brokerage Market faces challenges such as intense competition among brokers, regulatory compliance issues, and the need to adapt to rapidly changing technology. These factors can impact profitability and operational efficiency.

What opportunities exist in the Insurance Brokerage Market?

Opportunities in the Insurance Brokerage Market include the growing demand for cyber insurance, the expansion of insurance products tailored for emerging industries, and the potential for leveraging technology to enhance customer service and operational processes.

What trends are shaping the Insurance Brokerage Market?

Trends shaping the Insurance Brokerage Market include the increasing use of artificial intelligence for risk assessment, the rise of insurtech startups offering innovative solutions, and a greater focus on sustainability in insurance offerings. These trends are influencing how brokers operate and engage with clients.

Insurance Brokerage Market

| Segmentation | Details |

|---|---|

| Insurance Type | Life Insurance, Property and Casualty Insurance, Health Insurance, Others |

| End User | Individuals, Commercial Enterprises |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Insurance Brokerage Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at