444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The 12-Inch Wafer Dicing Machine market comprises advanced semiconductor manufacturing equipment designed specifically to cut large 12-inch silicon wafers into individual semiconductor chips. These machines play a critical role in the semiconductor fabrication process by enabling precise dicing and separation of wafers into smaller components, which are essential for the production of integrated circuits (ICs) used in various electronic devices.

Meaning

12-Inch Wafer Dicing Machines are sophisticated machines used to dice 12-inch silicon wafers into smaller chips with high precision. The dicing process involves cutting through the wafer material using specialized blades or lasers, ensuring that each chip meets stringent size and quality standards required for semiconductor manufacturing.

Executive Summary

The 12-Inch Wafer Dicing Machine market is driven by the increasing demand for advanced semiconductor devices across multiple industries, including consumer electronics, automotive, telecommunications, and healthcare. Key market players focus on enhancing machine efficiency, improving cutting accuracy, and expanding applications to meet the evolving needs of semiconductor manufacturers worldwide.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The 12-Inch Wafer Dicing Machine market is characterized by dynamic trends driven by technological advancements, evolving industry standards, and global demand for high-performance semiconductor devices. Market participants are focusing on R&D investments, strategic partnerships, and market expansion initiatives to capitalize on emerging opportunities and sustain competitive advantage.

Regional Analysis

Competitive Landscape

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the 12-Inch Wafer Dicing Machine market is optimistic, driven by ongoing advancements in semiconductor technologies, increasing penetration of AI and IoT applications, and expanding automotive electronics sector. Market participants leveraging innovation, strategic partnerships, and market expansion initiatives are well-positioned to capitalize on emerging opportunities and sustain growth in the global semiconductor industry.

Conclusion

In conclusion, the 12-Inch Wafer Dicing Machine market presents significant growth prospects fueled by technological innovation, rising demand for advanced semiconductor solutions, and expanding applications across key industries. Despite challenges such as high initial costs and market volatility, industry stakeholders focusing on innovation and strategic investments are poised to thrive in the dynamic semiconductor manufacturing landscape.

12-Inch Wafer Dicing Machine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blade Dicing, Laser Dicing, Plasma Dicing, Water Jet Dicing |

| Technology | Mechanical, Thermal, Chemical, Hybrid |

| End User | Semiconductor Manufacturers, Electronics Companies, Research Institutions, Automotive Suppliers |

| Application | Integrated Circuits, MEMS, LED, Solar Cells |

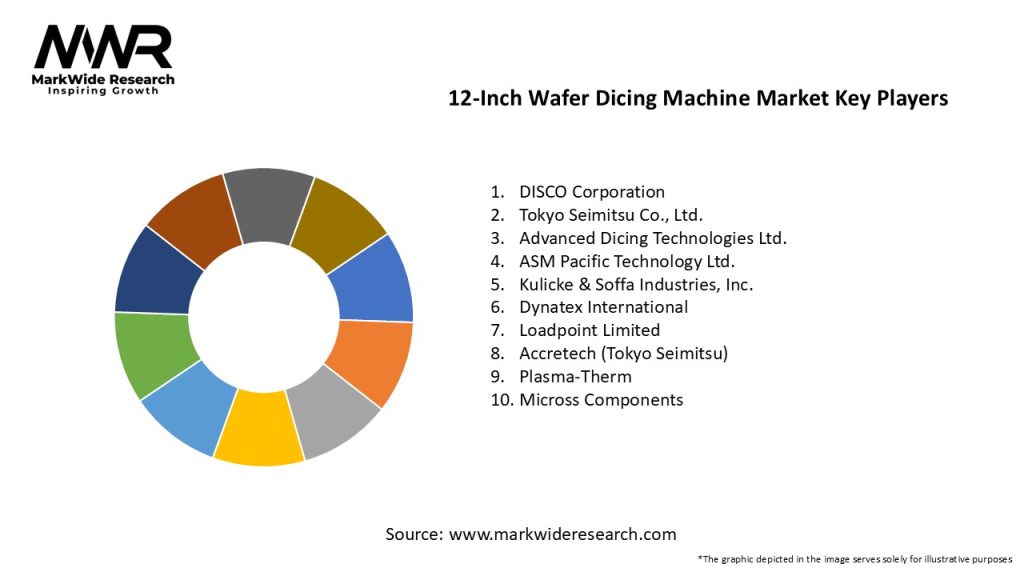

Leading Companies in 12-Inch Wafer Dicing Machine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at