444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Strong Customer Authentication (SCA) market is a critical component of the broader financial and digital security landscape. SCA is a regulatory requirement aimed at reducing fraud and enhancing the security of electronic payments. It mandates the use of multi-factor authentication (MFA) to verify the identity of users engaging in online transactions. This market encompasses a variety of authentication methods and technologies, including biometrics, one-time passwords (OTPs), and behavioral analytics. As digital transactions proliferate globally, the SCA market is poised for significant growth, driven by regulatory mandates and the increasing need for robust security measures.

Meaning

Strong Customer Authentication (SCA) refers to a set of regulatory standards designed to enhance the security of online payments and reduce fraud. It requires the implementation of multi-factor authentication (MFA), which typically involves two or more independent authentication factors: something the user knows (password or PIN), something the user has (smartphone or hardware token), and something the user is (biometric verification like fingerprint or facial recognition). SCA is a crucial aspect of the Revised Payment Services Directive (PSD2) in the European Union, which aims to make online payments more secure and trustworthy.

Executive Summary

The Strong Customer Authentication market is experiencing rapid growth, driven by increasing digital transactions, regulatory requirements, and the escalating threat of cyber fraud. The implementation of PSD2 in Europe has been a significant catalyst for the adoption of SCA solutions. Market players are innovating continuously to provide seamless and secure authentication methods that balance security with user convenience. Key market insights indicate a trend towards biometric solutions and advanced behavioral analytics. However, challenges such as user friction and the complexity of integrating SCA into existing systems persist. The future of the SCA market lies in striking a balance between stringent security measures and a smooth user experience.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Strong Customer Authentication market is characterized by dynamic interactions between regulatory requirements, technological advancements, and evolving consumer expectations. Regulatory bodies worldwide are enforcing stringent security measures to protect against increasing cyber threats, driving the adoption of SCA solutions. Technological advancements in biometrics, AI, and machine learning are enabling the development of more secure and user-friendly authentication methods. Meanwhile, consumers’ growing awareness of security issues and demand for seamless digital experiences influence the market dynamics, prompting continuous innovation and adaptation by market players.

Regional Analysis

Competitive Landscape

Leading Companies in the Strong Customer Authentication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

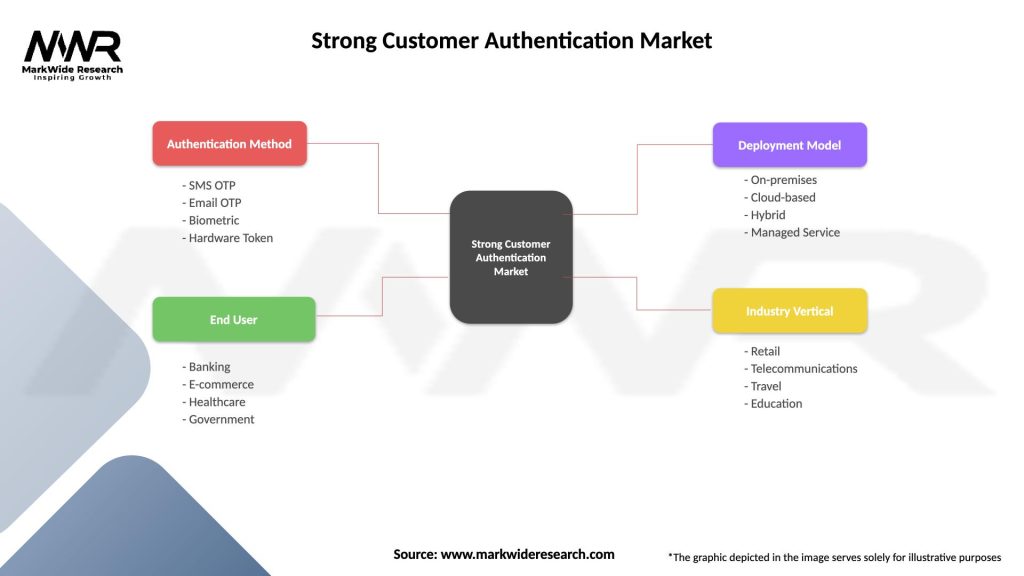

Segmentation

Segmentation provides a detailed understanding of the market dynamics and allows businesses to tailor their strategies to specific customer needs and preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

The Strong Customer Authentication market is witnessing key trends such as the rapid adoption of biometric authentication technologies, including facial recognition and fingerprint scanning, and the increasing integration of AI and machine learning for continuous authentication. There is a growing focus on reducing user friction by developing seamless and user-friendly authentication methods. Additionally, the proliferation of digital transactions and evolving regulatory landscapes, especially in Europe with PSD2, are driving continuous innovation and adoption of SCA solutions across various sectors, including banking, e-commerce, and healthcare.

Covid-19 Impact

The Covid-19 pandemic accelerated the shift towards digital transactions as more people and businesses moved online. This surge in digital activity heightened the need for robust authentication mechanisms to combat rising cyber threats and fraud. Consequently, the demand for Strong Customer Authentication solutions increased significantly. Remote work and online banking became prevalent, further emphasizing the need for secure, multi-factor authentication. Companies responded by investing in advanced SCA technologies to ensure secure access and transactions, making SCA a critical component of the digital transformation catalyzed by the pandemic.

Key Industry Developments

Recent key developments in the Strong Customer Authentication market include the implementation of the PSD2 directive in Europe, which has significantly boosted the adoption of SCA solutions. Companies are increasingly leveraging biometric technologies and behavioral analytics to enhance security and user experience. Strategic partnerships and acquisitions are also prevalent, with firms collaborating to integrate advanced SCA technologies into their offerings. Innovations such as password-less authentication and adaptive authentication methods are gaining traction, indicating a shift towards more sophisticated and user-friendly security solutions.

Analyst Suggestions

Analysts suggest that companies in the SCA market focus on balancing security with user convenience to minimize friction in the authentication process. Investing in advanced technologies like biometrics, AI, and machine learning will be crucial for staying competitive. Collaboration with regulatory bodies to ensure compliance and anticipate future regulations can provide a strategic advantage. Additionally, expanding into emerging markets with tailored SCA solutions can tap into the growing demand for digital security. Continuous innovation and user education on the importance of robust authentication will be key to long-term success in this dynamic market.

Future Outlook

The Strong Customer Authentication market is poised for continued growth, driven by regulatory mandates, technological advancements, and increasing awareness of cybersecurity. The future of the market will likely see greater adoption of biometric and AI-driven solutions, providing more secure and seamless authentication experiences. As digital transactions continue to rise, the demand for robust SCA solutions will remain strong. Companies that can innovate and address the challenges of user friction and privacy concerns will be well-positioned to capitalize on the growing market opportunities.

Conclusion

The Strong Customer Authentication market is a vital component of the global digital economy, ensuring the security and integrity of online transactions. Driven by regulatory requirements, technological advancements, and the growing need for cybersecurity, the market offers significant opportunities for growth and innovation. By balancing security with user convenience, industry participants can enhance consumer trust and achieve long-term success in the evolving digital landscape.

What is Strong Customer Authentication?

Strong Customer Authentication (SCA) refers to a regulatory requirement aimed at enhancing the security of online payments. It mandates the use of two or more independent factors for verifying a customer’s identity during transactions.

What are the key players in the Strong Customer Authentication Market?

Key players in the Strong Customer Authentication Market include companies like Thales Group, Gemalto, and Mastercard, which provide various authentication solutions and technologies to enhance payment security, among others.

What are the main drivers of the Strong Customer Authentication Market?

The main drivers of the Strong Customer Authentication Market include the increasing incidence of online fraud, the growing demand for secure payment methods, and regulatory requirements aimed at protecting consumer data.

What challenges does the Strong Customer Authentication Market face?

Challenges in the Strong Customer Authentication Market include the complexity of implementing multi-factor authentication systems, potential customer resistance to additional verification steps, and the need for seamless user experiences.

What opportunities exist in the Strong Customer Authentication Market?

Opportunities in the Strong Customer Authentication Market include the integration of biometric authentication technologies, the rise of e-commerce, and the increasing focus on enhancing customer trust in digital transactions.

What trends are shaping the Strong Customer Authentication Market?

Trends shaping the Strong Customer Authentication Market include the adoption of artificial intelligence for fraud detection, the use of mobile authentication solutions, and the growing emphasis on regulatory compliance in financial services.

Strong Customer Authentication Market

| Segmentation Details | Description |

|---|---|

| Authentication Method | SMS OTP, Email OTP, Biometric, Hardware Token |

| End User | Banking, E-commerce, Healthcare, Government |

| Deployment Model | On-premises, Cloud-based, Hybrid, Managed Service |

| Industry Vertical | Retail, Telecommunications, Travel, Education |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Strong Customer Authentication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at