444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The IC Card Smart Meter Market represents a significant advancement in the utilities sector, offering enhanced efficiency, accuracy, and convenience in measuring and managing utility consumption. IC card smart meters utilize integrated circuit (IC) technology to facilitate the automatic and precise recording of electricity, gas, and water usage. These meters are equipped with a prepaid mechanism, allowing consumers to control their consumption by purchasing utility credits in advance. The growing emphasis on smart infrastructure and the need for efficient energy management systems are driving the adoption of IC card smart meters globally.

Meaning

IC card smart meters refer to advanced metering devices that incorporate integrated circuit technology to measure and record utility consumption. These meters are equipped with an IC card interface, enabling consumers to use prepaid cards for recharging their utility accounts. The IC card smart meter system allows for automatic meter reading, real-time monitoring, and remote data transmission, thereby eliminating the need for manual meter readings and reducing the risk of billing errors. This technology enhances the efficiency of utility management and provides consumers with greater control over their utility usage.

Executive Summary

The IC card smart meter market has witnessed substantial growth in recent years, driven by the increasing demand for smart metering solutions and the need for efficient utility management. This market offers numerous opportunities for industry participants and stakeholders, including utility companies, meter manufacturers, and technology providers. However, it also faces challenges such as high initial installation costs and concerns regarding data security. Understanding the key market insights, drivers, restraints, and dynamics is crucial for businesses operating in this sector to make informed decisions and stay competitive.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The IC card smart meter market operates in a dynamic environment influenced by various factors, including technological advancements, regulatory changes, consumer preferences, and market competition. Understanding the market dynamics is essential for companies to identify opportunities, mitigate risks, and make strategic decisions.

Regional Analysis

Competitive Landscape

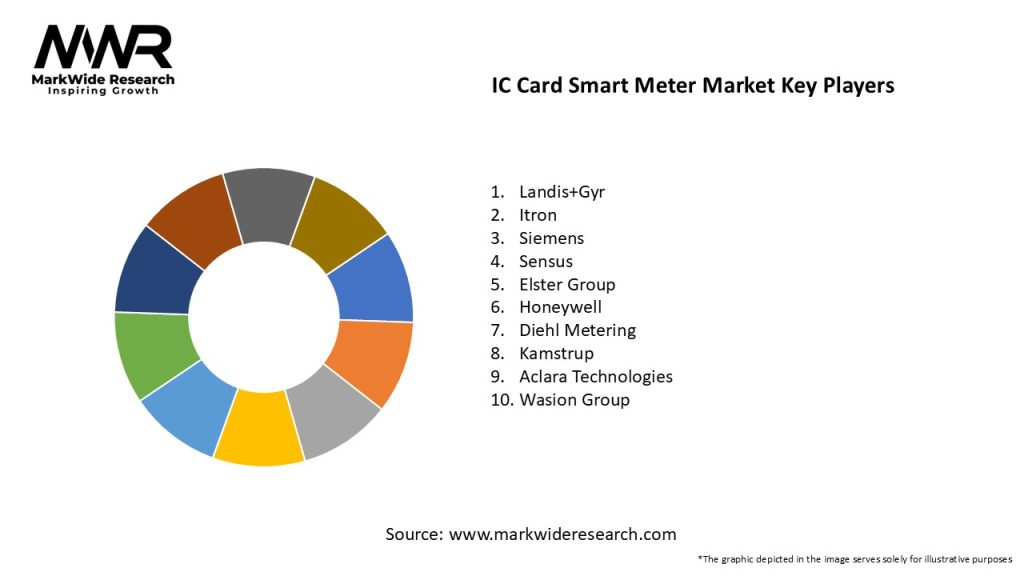

The IC card smart meter market is highly competitive, with numerous players ranging from meter manufacturers to technology providers and utility companies. The competitive landscape is influenced by factors such as technological advancements, product innovation, service offerings, and geographic reach. Some key players in the IC card smart meter market include:

These companies compete based on factors like product quality, technological innovation, pricing, and customer service. Continuous research and development, strategic partnerships, and expansion into emerging markets are essential strategies to maintain a competitive edge in the market.

Segmentation

The IC card smart meter market can be segmented based on various factors such as:

Segmentation provides a more detailed understanding of the market dynamics and allows businesses to tailor their strategies to specific customer needs and preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the IC card smart meter market benefit from enhanced operational efficiency through accurate billing and consumption monitoring. These meters enable real-time data collection and remote management, reducing operational costs and enhancing customer service. Stakeholders gain from improved revenue management and regulatory compliance, while consumers benefit from transparent billing and energy-saving insights, fostering sustainable energy practices.

SWOT Analysis

Market Key Trends

Key trends in the IC card smart meter market include the adoption of advanced metering infrastructure (AMI), integration with smart grid technologies, and the rise of energy management solutions. There’s also a growing emphasis on data analytics for predictive maintenance and consumer behavior insights, enhancing operational efficiency and customer satisfaction.

Covid-19 Impact

The Covid-19 pandemic accelerated the adoption of IC card smart meters due to their role in contactless billing and remote monitoring capabilities, ensuring operational continuity amidst lockdowns. Demand surged as utilities sought reliable energy management solutions and consumers prioritized digital payment options, reinforcing the market’s resilience and growth trajectory.

Key Industry Developments

Recent developments include innovations in metering technology, such as enhanced data encryption for cybersecurity, and partnerships between meter manufacturers and software providers to develop integrated solutions. Regulatory advancements promoting smart meter deployments and investments in AMI infrastructure have also shaped industry dynamics, driving market expansion and innovation.

Analyst Suggestions

Industry analysts recommend continued investment in cybersecurity measures to mitigate data breach risks associated with smart meter deployments. They advocate for strategic collaborations to enhance interoperability and scalability of smart metering solutions, catering to diverse market needs. Moreover, leveraging data analytics for predictive maintenance and consumer engagement can unlock new revenue streams and foster market differentiation amidst competitive pressures.

Future Outlook

Conclusion

The IC card smart meter market is poised for significant growth, driven by the increasing demand for efficient utility management solutions, technological advancements, and government support. The market offers numerous opportunities for industry participants, including utility companies, meter manufacturers, and technology providers. However, challenges such as high initial installation costs, data security concerns, and regulatory compliance need to be addressed. Understanding the key market insights, drivers, restraints, and dynamics is essential for businesses operating in this sector to make informed decisions and stay competitive. The future of the IC card smart meter market looks promising, with trends such as integration with smart home systems, development of advanced analytics, focus on cybersecurity, and expansion of the IoT ecosystem shaping its growth trajectory.

IC Card Smart Meter Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single-phase, Three-phase, Prepaid, Postpaid |

| Technology | RFID, NFC, Zigbee, PLC |

| End User | Residential, Commercial, Industrial, Utilities |

| Installation | On-grid, Off-grid, Smart Grid, Retrofit |

Leading Companies in the IC Card Smart Meter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at