444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The agricultural production equipment market encompasses a wide range of machinery and tools designed to enhance farming efficiency and productivity. This includes equipment used for planting, harvesting, irrigation, soil preparation, and livestock management. As agriculture plays a critical role in global food supply and economic stability, the demand for advanced agricultural equipment continues to grow, driven by technological advancements and the need to meet increasing food demands worldwide.

Meaning

Agricultural production equipment refers to machinery, implements, and devices specifically designed for use in agricultural activities. These tools are essential for modern farming practices, enabling farmers to maximize crop yields, optimize resource use, and improve overall farm management. The market includes a diverse array of equipment types, from tractors and combines to precision agriculture technologies and autonomous farming systems.

Executive Summary

The agricultural production equipment market is experiencing robust growth, driven by factors such as mechanization of agriculture, adoption of precision farming techniques, and increasing farm sizes. However, challenges such as fluctuating commodity prices, regulatory pressures, and environmental concerns pose significant considerations for industry participants. Understanding key market insights, technological trends, and consumer preferences is essential for stakeholders aiming to capitalize on growth opportunities and navigate market complexities.

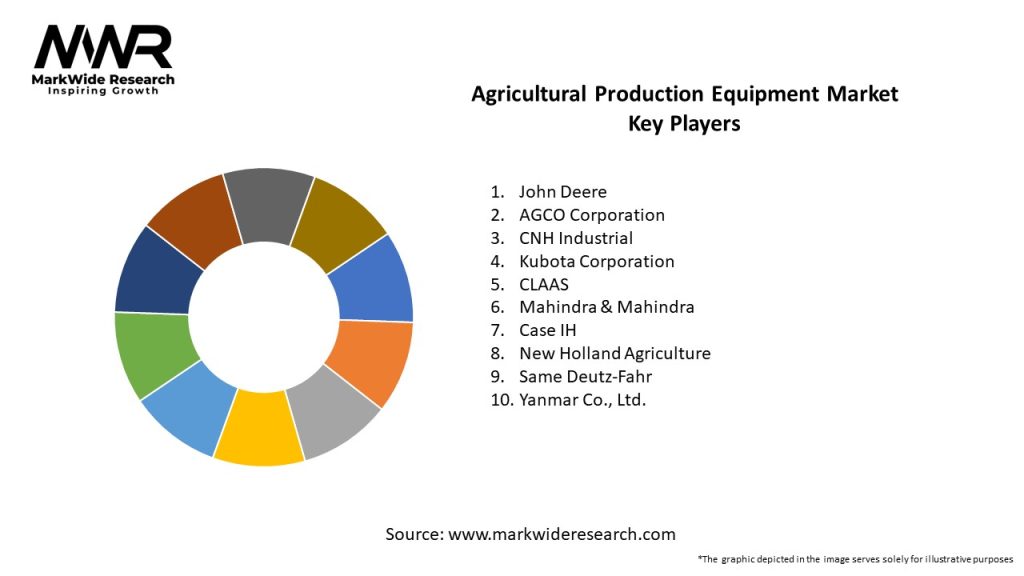

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The agricultural production equipment market operates within a dynamic ecosystem influenced by technological innovations, regulatory frameworks, economic conditions, and shifting consumer preferences. Adapting to these dynamics requires agility, innovation, and strategic partnerships to capitalize on emerging opportunities and mitigate potential risks.

Regional Analysis

Competitive Landscape

Leading Companies in the Agricultural Production Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

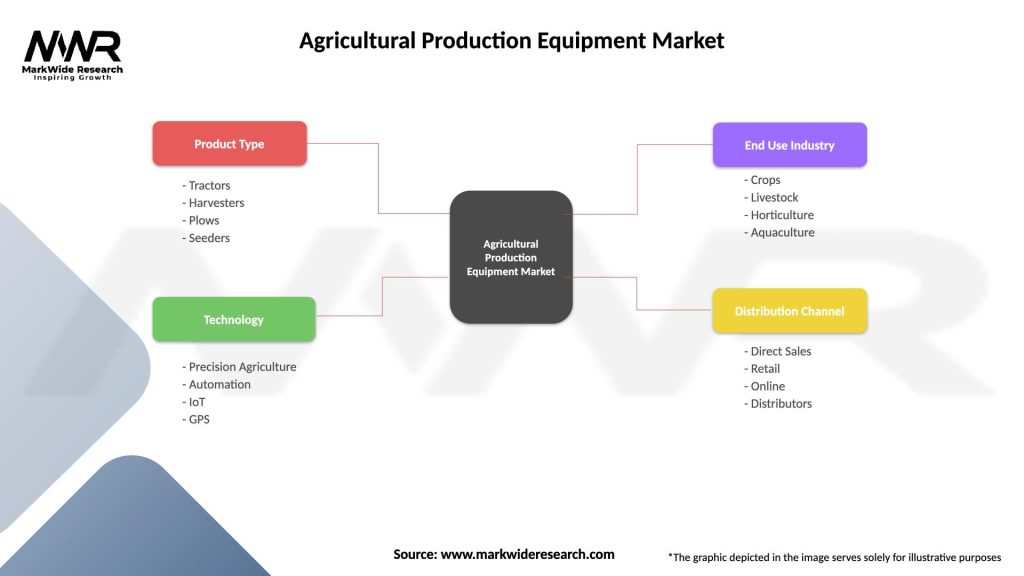

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic underscored the critical role of agricultural production equipment in ensuring global food security and supply chain resilience. While initial disruptions affected manufacturing and distribution, the crisis accelerated digital transformation, remote monitoring solutions, and e-commerce adoption in agriculture.

Key Industry Developments

Analyst Suggestions

Future Outlook

The agricultural production equipment market is poised for robust growth driven by technological advancements, precision farming adoption, and global agricultural modernization efforts. However, challenges related to economic uncertainties, regulatory complexities, and competitive pressures necessitate proactive strategies and agile adaptation to sustain market leadership and capitalize on emerging opportunities.

Conclusion

The agricultural production equipment sector plays a pivotal role in supporting global food security, farm productivity, and sustainable agriculture practices. By leveraging innovation, digitalization, and sustainability initiatives, industry stakeholders can navigate evolving market dynamics, drive operational efficiencies, and contribute to a resilient and productive agricultural ecosystem on a global scale. Strategic investments in technology, market expansion, and stakeholder collaboration will be instrumental in shaping the future landscape of the agricultural production equipment market.

What is Agricultural Production Equipment?

Agricultural Production Equipment refers to the machinery and tools used in farming and agriculture to enhance productivity and efficiency. This includes tractors, plows, harvesters, and irrigation systems, among others.

What are the key players in the Agricultural Production Equipment Market?

Key players in the Agricultural Production Equipment Market include John Deere, AGCO Corporation, CNH Industrial, and Kubota Corporation, among others. These companies are known for their innovative technologies and extensive product lines.

What are the main drivers of growth in the Agricultural Production Equipment Market?

The main drivers of growth in the Agricultural Production Equipment Market include the increasing demand for food production, advancements in agricultural technology, and the need for efficient farming practices. Additionally, government initiatives promoting modern farming techniques contribute to market expansion.

What challenges does the Agricultural Production Equipment Market face?

The Agricultural Production Equipment Market faces challenges such as high initial investment costs, fluctuating raw material prices, and the need for skilled labor to operate advanced machinery. These factors can hinder market growth and adoption.

What opportunities exist in the Agricultural Production Equipment Market?

Opportunities in the Agricultural Production Equipment Market include the development of smart farming technologies, increasing adoption of precision agriculture, and the growing trend towards sustainable farming practices. These trends are expected to drive innovation and investment in the sector.

What trends are shaping the Agricultural Production Equipment Market?

Trends shaping the Agricultural Production Equipment Market include the integration of IoT and AI technologies, the rise of autonomous farming equipment, and a focus on sustainability. These innovations are transforming traditional farming methods and improving efficiency.

Agricultural Production Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tractors, Harvesters, Plows, Seeders |

| Technology | Precision Agriculture, Automation, IoT, GPS |

| End Use Industry | Crops, Livestock, Horticulture, Aquaculture |

| Distribution Channel | Direct Sales, Retail, Online, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Agricultural Production Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at