444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The voluntary carbon offsets for forestry market is witnessing significant growth, driven by increasing awareness of climate change and the need for sustainable environmental practices. Voluntary carbon offsets for forestry involve projects that aim to mitigate carbon emissions by preserving, restoring, or enhancing forests. These projects sequester carbon dioxide from the atmosphere, thereby offsetting greenhouse gas emissions from various activities. The market for voluntary carbon offsets for forestry offers individuals and organizations the opportunity to support forest conservation efforts while reducing their carbon footprint.

Meaning

Voluntary carbon offsets for forestry refer to the practice of investing in projects that protect, restore, or enhance forests to mitigate carbon emissions. These projects involve activities such as afforestation (planting trees on land that was not previously forested), reforestation (replanting trees in areas that were previously forested), and sustainable forest management practices. By investing in voluntary carbon offsets for forestry, individuals and organizations can compensate for their carbon emissions and contribute to global efforts to combat climate change.

Executive Summary

The voluntary carbon offsets for forestry market is experiencing rapid growth, driven by increasing demand from individuals, businesses, and governments to address climate change. Key factors such as growing awareness of environmental issues, corporate sustainability initiatives, and regulatory support for carbon offsetting programs are fueling market expansion. However, challenges such as ensuring the integrity and credibility of offset projects and addressing concerns about additionality and permanence remain significant considerations for market participants. Despite these challenges, the voluntary carbon offsets for forestry market presents lucrative opportunities for stakeholders to support forest conservation efforts and mitigate climate change impacts.

Key Market Insights

Market Drivers

Several factors are driving the growth of the voluntary carbon offsets for forestry market, including:

Market Restraints

Despite the significant growth prospects, the voluntary carbon offsets for forestry market face certain challenges, including:

Market Opportunities

The voluntary carbon offsets for forestry market presents several opportunities for growth, including:

Market Dynamics

The voluntary carbon offsets for forestry market is characterized by dynamic trends and developments, including:

Regional Analysis

The voluntary carbon offsets for forestry market is global in scope, with key markets and opportunities across regions such as:

Competitive Landscape

The voluntary carbon offsets for forestry market is characterized by a diverse range of stakeholders, including:

Segmentation

The voluntary carbon offsets for forestry market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the voluntary carbon offsets for forestry market can benefit in various ways, including:

SWOT Analysis

Market Key Trends

Key trends shaping the voluntary carbon offsets for forestry market include:

Covid-19 Impact

The Covid-19 pandemic has had mixed impacts on the voluntary carbon offsets for forestry market:

Key Industry Developments

Analyst Suggestions

To capitalize on the growing opportunities in the voluntary carbon offsets for forestry market, industry participants should focus on the following strategies:

Future Outlook

The voluntary carbon offsets for forestry market is poised for significant growth in the coming years, driven by increasing demand from individuals, businesses, and governments to address climate change and support forest conservation efforts. Key trends such as nature-based solutions, corporate climate action, and regulatory support are expected to drive market expansion and investment in forestry-based offset projects. However, challenges such as ensuring the integrity and credibility of offset projects, addressing additionality and permanence concerns, and enhancing transparency and accountability will require continued attention and collaboration among stakeholders.

Conclusion

In conclusion, the voluntary carbon offsets for forestry market offers opportunities for individuals, businesses, and governments to mitigate carbon emissions, support forest conservation efforts, and contribute to global climate change mitigation and adaptation efforts. Despite challenges such as integrity and credibility concerns, market fragmentation, and regulatory uncertainties, the market presents significant opportunities for stakeholders to invest in high-quality forestry-based offset projects and achieve environmental, social, and economic co-benefits. By leveraging innovative financing mechanisms, technology and data analytics, and collaborative partnerships, the voluntary carbon offsets for forestry market can play a vital role in advancing climate action and sustainable development goals.

Voluntary Carbon Offsets for Forestry Market

| Segmentation Details | Description |

|---|---|

| Offset Type | Reforestation, Afforestation, Improved Forest Management, Agroforestry |

| Project Scale | Smallholder, Community-Based, Large-Scale, National |

| Verification Standard | VCS, Gold Standard, Climate Action Reserve, American Carbon Registry |

| End User | Corporations, NGOs, Governments, Individuals |

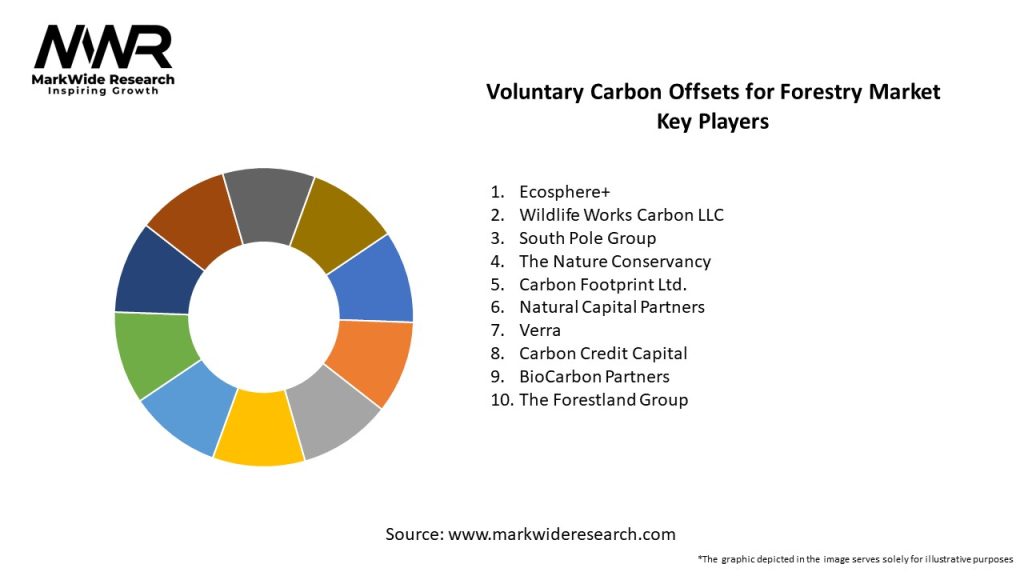

Leading Companies in Voluntary Carbon Offsets for Forestry Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at