444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The PV Encapsulant Material market is a vital segment within the solar energy industry, providing essential materials for the manufacturing of photovoltaic (PV) modules. These encapsulant materials protect solar cells from environmental factors, such as moisture, UV radiation, and mechanical stress, while also ensuring efficient light transmission and electrical insulation. With the increasing adoption of solar energy as a clean and sustainable power source, the PV Encapsulant Material market is experiencing significant growth, driven by the growing demand for high-performance PV modules in residential, commercial, and utility-scale applications worldwide.

Meaning

PV Encapsulant Materials refer to specialized materials used in the production of solar photovoltaic (PV) modules to protect solar cells and electrical components from environmental degradation and mechanical damage. These materials typically consist of ethylene-vinyl acetate (EVA) or polyolefin-based films, which are laminated onto the front and back surfaces of solar cells to form a protective and transparent layer. PV Encapsulant Materials play a crucial role in enhancing the durability, reliability, and performance of PV modules by providing electrical insulation, mechanical support, and weather resistance, ensuring long-term operation and energy production.

Executive Summary

The PV Encapsulant Material market is witnessing robust growth driven by the expanding solar energy market and increasing demand for high-performance PV modules. Key players in the market are innovating to develop advanced encapsulant materials, manufacturing processes, and quality control systems to meet the stringent requirements of solar cell production. Moreover, the transition towards more efficient and cost-effective solar cell technologies, such as PERC (Passivated Emitter Rear Cell) and bifacial modules, is further driving market growth and adoption of PV Encapsulant Materials globally.

Key Market Insights

Several key trends are shaping the PV Encapsulant Material market, including:

Market Drivers

The PV Encapsulant Material market is driven by various factors, including:

Market Restraints

Despite significant growth opportunities, the PV Encapsulant Material market faces several challenges, including:

Market Opportunities

The PV Encapsulant Material market offers numerous opportunities for growth and innovation, including:

Market Dynamics

The PV Encapsulant Material market is characterized by dynamic market dynamics driven by technological innovation, market demand, and regulatory policies. Market players must adapt to these changes by investing in research and development, forging strategic partnerships, and leveraging emerging technologies to remain competitive and meet evolving market demands. Furthermore, collaboration between solar cell manufacturers, material suppliers, and equipment vendors is essential for driving innovation, reducing costs, and accelerating the adoption of PV Encapsulant Materials in solar module production.

Regional Analysis

The PV Encapsulant Material market exhibits varying growth patterns across regions, with key markets including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region presents unique opportunities and challenges shaped by factors such as solar energy policies, industrial infrastructure, and market maturity. For instance, Asia Pacific dominates the global solar PV market, driven by the rapid expansion of solar energy capacity in countries such as China, India, and Japan, creating significant demand for PV Encapsulant Materials in solar module production.

Competitive Landscape

The PV Encapsulant Material market is highly competitive, with numerous global and regional players vying for market share. Key players in the market include DuPont de Nemours, Inc., STR Holdings, Inc., Hangzhou First PV Material Co., Ltd., Bridgestone Corporation, and Covestro AG, among others. These companies offer a wide range of encapsulant materials, films, and coatings tailored to meet the diverse needs of solar cell manufacturers worldwide. Additionally, emerging players and startups are entering the market with innovative technologies and business models, further intensifying competition and driving market innovation.

Segmentation

The PV Encapsulant Material market can be segmented based on various parameters, including encapsulant type, thickness, transparency, and application. Common encapsulant types used in PV module production include ethylene-vinyl acetate (EVA), polyolefin-based films, and thermoplastic materials. Encapsulant thickness and transparency specifications vary depending on the design and performance requirements of PV modules. Applications of PV Encapsulant Materials include front and backsheet encapsulation, edge sealing, and junction box potting in solar cell manufacturing processes.

Category-wise Insights

Within the PV Encapsulant Material market, various categories of encapsulant materials offer unique functionalities and applications. For example:

Key Benefits for Industry Participants and Stakeholders

PV Encapsulant Materials offer several key benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the PV Encapsulant Material market include:

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the PV Encapsulant Material market, with both challenges and opportunities emerging. On one hand, the pandemic has disrupted global supply chains, manufacturing operations, and project timelines, leading to delays and cancellations of solar energy projects and installations. On the other hand, the pandemic has underscored the importance of clean, sustainable, and resilient energy sources such as solar power in mitigating future risks and enhancing energy security. Governments, industries, and utilities are increasingly investing in solar energy infrastructure and technologies to accelerate economic recovery and transition towards a low-carbon future.

Key Industry Developments

Recent developments in the PV Encapsulant Material market include:

Analyst Suggestions

Industry analysts suggest that market players focus on the following strategies to capitalize on emerging opportunities and mitigate potential challenges in the PV Encapsulant Material market:

Future Outlook

The future outlook for the PV Encapsulant Material market remains promising, with sustained growth expected in the coming years. Factors such as increasing solar energy deployment, declining costs of PV modules, evolving regulatory frameworks, and growing demand for high-performance encapsulant materials are driving market expansion and adoption worldwide. Moreover, technological advancements in encapsulant formulations, manufacturing processes, and quality control systems are creating opportunities for innovation and investment in PV Encapsulant Materials. As industries and governments strive to accelerate the transition towards clean, sustainable, and resilient energy systems, the PV Encapsulant Material market is poised for significant growth and development.

Conclusion

In conclusion, the PV Encapsulant Material market plays a crucial role in the production of solar photovoltaic (PV) modules, providing essential materials for protecting solar cells and electrical components from environmental degradation and mechanical damage. Market players are innovating to develop advanced encapsulant formulations, films, and coatings that optimize the performance, reliability, and durability of PV modules in various environmental conditions and applications. Collaboration between industry stakeholders, governments, and technology providers is essential for driving innovation, reducing costs, and accelerating the adoption of PV Encapsulant Materials in solar module production. By embracing these opportunities and challenges, market players can position themselves for success and contribute to building a more sustainable, resilient, and efficient solar energy infrastructure for the future.

| Segmentation Details | Details |

|---|---|

| Type | Ethylene Vinyl Acetate (EVA), Polyolefin Elastomer (POE), Others |

| Application | Crystalline Silicon PV Modules, Thin-Film PV Modules |

| End-User | Solar Panel Manufacturers, PV Module Manufacturers |

| Region | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

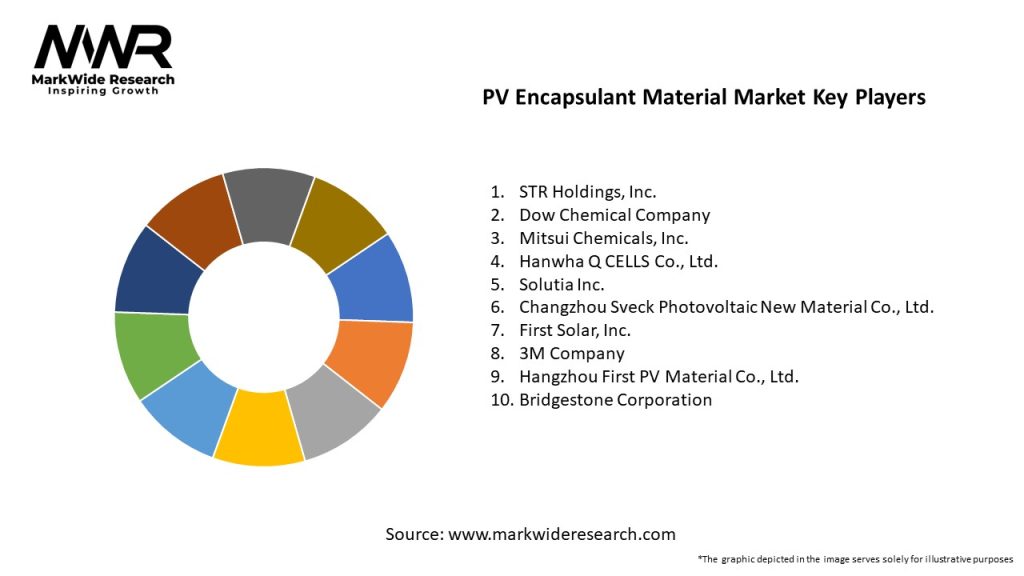

Leading Companies in PV Encapsulant Material Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at