444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The oil & gas data management market is witnessing significant growth globally, driven by increasing exploration and production activities, growing adoption of digital technologies, and regulatory compliance requirements. Effective data management is crucial for oil & gas companies to optimize operations, enhance decision-making, and ensure regulatory compliance. Market dynamics are influenced by factors such as technological advancements, industry consolidation, and market demand for integrated data management solutions.

Meaning

Oil & gas data management involves the collection, storage, processing, and analysis of various types of data generated throughout the exploration, production, and distribution processes in the oil & gas industry. This includes geological data, well logs, production data, seismic data, reservoir simulations, and operational data. Effective data management enables oil & gas companies to improve operational efficiency, reduce costs, mitigate risks, and comply with regulatory requirements.

Executive Summary

The global oil & gas data management market is experiencing robust growth, driven by factors such as increasing data volumes, complexity, and diversity in the oil & gas industry. Market participants are focusing on innovation, collaboration, and market expansion to address evolving customer needs and capitalize on growing opportunities in upstream, midstream, and downstream sectors worldwide.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global oil & gas data management market is characterized by dynamic market dynamics, including technological innovation, regulatory compliance, and industry trends driving market growth and adoption. Key stakeholders in the oil & gas industry are collaborating to address market challenges, drive innovation, and promote best practices in data management and analytics worldwide.

Regional Analysis

North America, Europe, Asia Pacific, and Latin America are key regions driving the growth of the oil & gas data management market. North America leads the market in terms of technological innovation, digital adoption, and market maturity, followed by Europe and Asia Pacific, where growing energy demand, resource development, and market liberalization drive demand for advanced data management solutions in the oil & gas industry.

Competitive Landscape

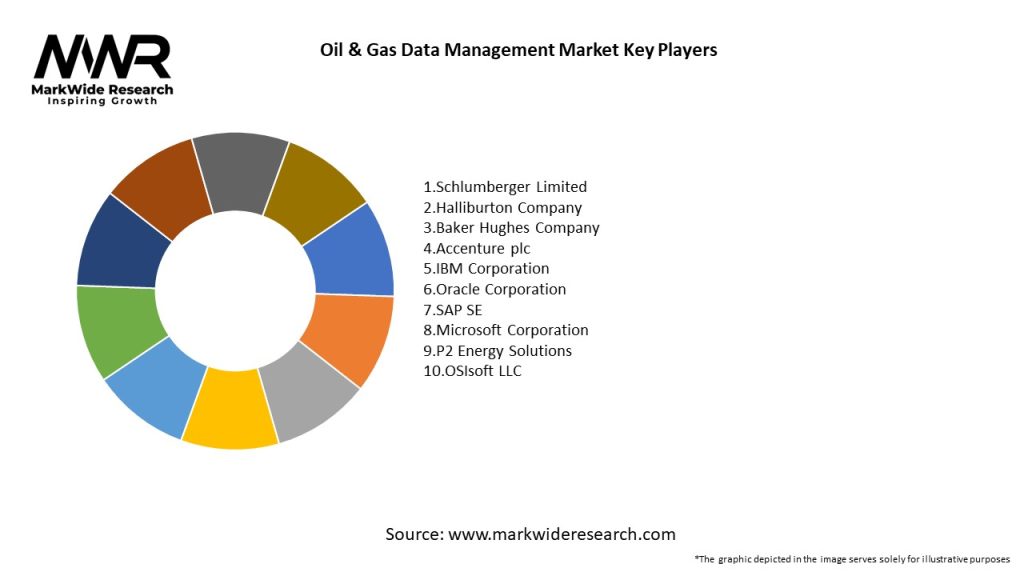

The oil & gas data management market is competitive, with several established players and new entrants competing for market share in data management software, analytics, and consulting services. Key players include Schlumberger Limited, Halliburton Company, IBM Corporation, Oracle Corporation, and SAP SE. Market competition is driven by factors such as product innovation, industry expertise, customer service, and market reach.

Segmentation

The oil & gas data management market can be segmented based on solution type (data integration, data quality, data governance), deployment model (on-premises, cloud), application (exploration & production, reservoir management, asset integrity), and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has affected global markets, including the oil & gas data management market, causing disruptions in supply chains, project timelines, and investment decisions. While the pandemic has temporarily slowed market growth and adoption of digital technologies, it has also accelerated digital transformation efforts in the oil & gas industry, driving demand for data management solutions that enable remote work, virtual collaboration, and operational resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global oil & gas data management market is poised for continued growth, driven by factors such as increasing data volumes, complexity, and regulatory compliance requirements in the oil & gas industry. Key trends such as digital transformation, cloud adoption, and market expansion are expected to shape the future trajectory of the market, offering opportunities for industry stakeholders to drive innovation, efficiency, and sustainability in oil & gas operations worldwide.

Conclusion

In conclusion, the oil & gas data management market presents significant opportunities for industry stakeholders to optimize operations, enhance decision-making, and ensure regulatory compliance in a rapidly evolving market environment. With ongoing investments in technology innovation, regulatory compliance, and industry collaboration, oil & gas companies can leverage data management solutions to address market challenges, drive efficiency, and create long-term value in oil & gas operations worldwide.

Oil & Gas Data Management Market

| Segmentation Details | Description |

|---|---|

| Service Type | Data Analytics, Cloud Storage, Data Integration, Data Visualization |

| Technology | IoT Solutions, Machine Learning, Blockchain, Big Data |

| End User | Exploration Companies, Production Firms, Service Providers, Regulatory Bodies |

| Application | Asset Management, Risk Assessment, Compliance Monitoring, Performance Optimization |

Leading Companies in the Oil and Gas Data Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at