444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The monosultap market has witnessed steady growth in recent years, driven by its widespread application as an insecticide in agriculture. Monosultap, a member of the carbamate family, is known for its effectiveness against a broad spectrum of insect pests, including caterpillars, beetles, and aphids. Its popularity stems from its rapid action, low toxicity to mammals, and relatively low environmental persistence compared to other insecticides. As agriculture continues to expand to meet the growing global demand for food, the demand for monosultap is expected to remain robust.

Meaning

Monosultap is a chemical compound commonly used as an insecticide in agriculture. It belongs to the carbamate class of insecticides and is effective against a wide range of insect pests, including but not limited to, caterpillars, beetles, and aphids. Monosultap acts by inhibiting acetylcholinesterase, an enzyme necessary for proper nerve function in insects. This disruption leads to paralysis and ultimately death in the targeted pests. Due to its efficacy and relatively low toxicity to mammals, monosultap has become a popular choice among farmers for pest control in various crops.

Executive Summary

The monosultap market is experiencing steady growth, driven by the increasing demand for effective insecticides in agriculture. Key factors contributing to this growth include the expansion of agriculture, the rising need to enhance crop yields, and the continuous threat posed by insect pests to crop health and productivity. Monosultap’s attributes such as rapid action, broad spectrum efficacy, and mammalian safety profile position it as a preferred choice for pest management in various crops. However, regulatory scrutiny and environmental concerns regarding pesticide use pose challenges to market expansion.

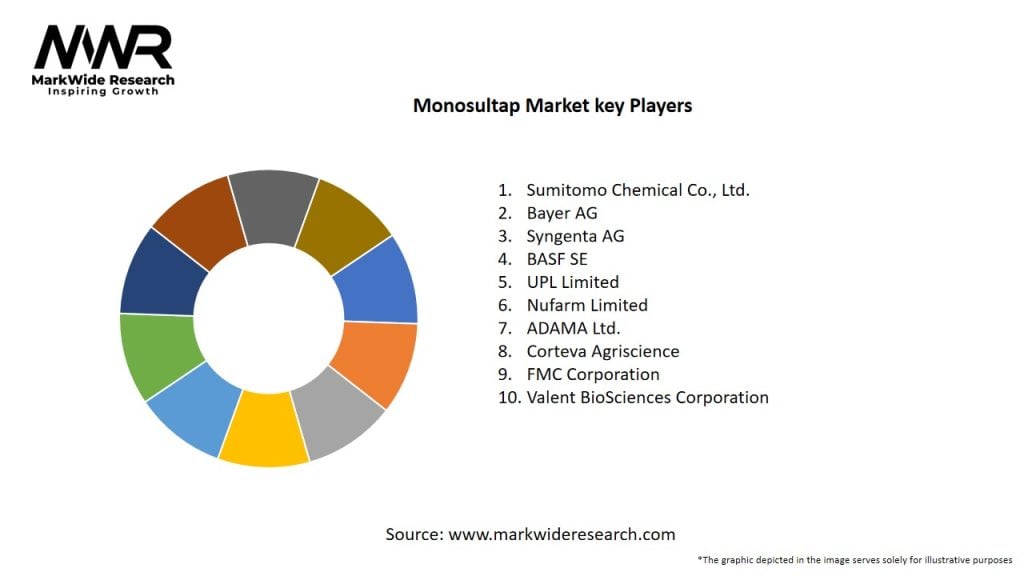

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the monosultap market:

Market Restraints

Despite the favorable market conditions, the monosultap market faces certain challenges:

Market Opportunities

The monosultap market presents several opportunities for growth and innovation:

Market Dynamics

The monosultap market is characterized by dynamic trends and factors influencing growth and competitiveness:

Regional Analysis

The monosultap market is geographically diverse, with key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Each region has its unique market dynamics, regulatory environment, and agricultural practices. Asia-Pacific is the largest and fastest-growing market for monosultap, driven by the extensive agriculture sector in countries such as China, India, and Southeast Asian nations. North America and Europe are mature markets for monosultap, characterized by stringent regulatory standards, technological advancements, and sustainable agriculture initiatives. Latin America and Africa offer growth opportunities for monosultap, supported by expanding agricultural activities, increasing pest pressure, and rising demand for crop protection products.

Competitive Landscape

Leading Companies in Monosultap Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

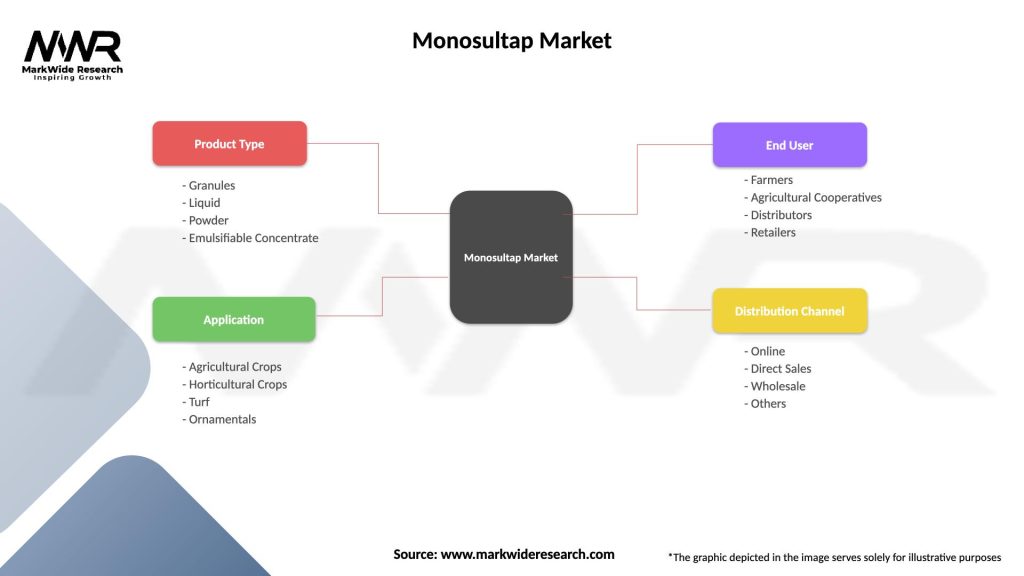

Segmentation

The monosultap market can be segmented based on various factors, including:

Each segment has unique characteristics, requirements, and growth drivers, offering opportunities for manufacturers and suppliers to target specific market segments and address the evolving needs and preferences of farmers and consumers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The monosultap market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Market Key Trends

Several key trends are shaping the monosultap market:

Covid-19 Impact

The Covid-19 pandemic has had mixed impacts on the monosultap market. While certain segments such as agriculture experienced minimal disruptions, others such as public health and travel faced significant challenges. The pandemic underscored the importance of food security, agricultural resilience, and sustainable pest management practices in ensuring a stable and reliable food supply chain. As countries and industries adapt to the new normal, opportunities emerge for innovation, collaboration, and investment in technologies and solutions that enhance agricultural productivity, environmental sustainability, and economic resilience.

Key Industry Developments

Analyst Suggestions

Based on market trends and dynamics, analysts suggest the following strategies for industry participants:

Future Outlook

The monosultap market is poised for continued growth and innovation, driven by the increasing demand for effective and sustainable pest management solutions in agriculture. Key trends such as integrated pest management (IPM), bio-based alternatives, digital farming, and pesticide stewardship will continue to shape the market landscape and opportunities for industry participants and stakeholders. As countries and industries strive to achieve food security, environmental sustainability, and economic resilience, the demand for monosultap-based insecticides and other crop protection products is expected to grow, driving investment and innovation in the global agriculture sector.

Conclusion

In conclusion, the monosultap market offers significant opportunities for industry participants and stakeholders to address emerging pest challenges, regulatory requirements, and sustainability concerns in agriculture. Despite challenges such as regulatory constraints, environmental concerns, and competition from alternative pest control methods and products, monosultap-based insecticides remain essential components of integrated pest management (IPM) programs and sustainable crop protection strategies. By investing in research and development, collaboration, and innovation, industry participants can position themselves for success in the dynamic and evolving monosultap market, driving growth, competitiveness, and sustainability for years to come.

What is Monosultap?

Monosultap is a systemic insecticide used primarily in agriculture to control various pests. It is effective against a range of insects, making it valuable for crop protection in different agricultural sectors.

What are the key companies in the Monosultap Market?

Key companies in the Monosultap Market include BASF, Syngenta, and FMC Corporation, among others. These companies are involved in the production and distribution of Monosultap and similar agricultural chemicals.

What are the growth factors driving the Monosultap Market?

The Monosultap Market is driven by the increasing demand for effective pest control solutions in agriculture and the growing trend towards sustainable farming practices. Additionally, the rise in global food production needs contributes to the market’s expansion.

What challenges does the Monosultap Market face?

The Monosultap Market faces challenges such as regulatory scrutiny regarding pesticide use and potential environmental impacts. Additionally, the emergence of pest resistance to chemical treatments poses a significant challenge for manufacturers.

What opportunities exist in the Monosultap Market?

Opportunities in the Monosultap Market include the development of new formulations that enhance efficacy and reduce environmental impact. There is also potential for growth in emerging markets where agricultural practices are evolving.

What trends are shaping the Monosultap Market?

Trends shaping the Monosultap Market include the increasing adoption of integrated pest management (IPM) strategies and advancements in precision agriculture technologies. These trends are leading to more targeted and efficient use of Monosultap in various crops.

Monosultap Market

| Segmentation Details | Description |

|---|---|

| Product Type | Granules, Liquid, Powder, Emulsifiable Concentrate |

| Application | Agricultural Crops, Horticultural Crops, Turf, Ornamentals |

| End User | Farmers, Agricultural Cooperatives, Distributors, Retailers |

| Distribution Channel | Online, Direct Sales, Wholesale, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Monosultap Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at