444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The embedded graphics processor market revolves around the demand for graphics processing units (GPUs) integrated within electronic devices such as smartphones, tablets, gaming consoles, and automotive infotainment systems. These embedded GPUs provide enhanced graphics rendering capabilities, enabling smoother and more realistic visual experiences for users. With the increasing adoption of high-resolution displays, virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) applications, the demand for powerful embedded graphics processors is on the rise. Key players in the market are focusing on developing GPUs with higher performance, lower power consumption, and advanced features to meet the evolving needs of various industries and applications.

Meaning

Embedded graphics processors, also known as embedded GPUs, refer to specialized semiconductor chips integrated within electronic devices to handle graphics processing tasks. These GPUs are designed to render high-quality graphics, images, and videos on displays, providing users with immersive visual experiences. Embedded GPUs are commonly found in smartphones, tablets, gaming consoles, automotive infotainment systems, digital signage, and industrial equipment. They play a crucial role in enabling applications such as gaming, multimedia playback, virtual reality (VR), augmented reality (AR), and user interface rendering. Embedded graphics processors vary in terms of performance, power consumption, and features, depending on the specific requirements of the target device and application.

Executive Summary

The embedded graphics processor market is experiencing steady growth driven by the increasing demand for high-quality visual experiences across various electronic devices and applications. Key players in the market are introducing innovative GPUs with higher performance, lower power consumption, and advanced features to meet the evolving needs of consumers and industries. Despite challenges such as technological constraints and market competition, the market is poised for continued expansion as the demand for immersive graphics and multimedia content continues to rise.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The embedded graphics processor market is characterized by steady growth and innovation, driven by the increasing demand for high-quality visual experiences across various electronic devices and applications. Key players in the market offer a variety of GPUs with different performance levels, power consumption profiles, and features to cater to diverse customer needs and application requirements. Technological advancements in GPU architecture, manufacturing processes, and software optimization enable manufacturers to develop embedded graphics processors with improved performance, efficiency, and capabilities. Despite challenges such as technological constraints and market competition, the market is poised for continued expansion as the demand for immersive graphics and multimedia content continues to rise.

Regional Analysis

The embedded graphics processor market is distributed globally, with significant demand emanating from regions such as North America, Europe, Asia Pacific, and Latin America. These regions are witnessing increasing adoption of electronic devices and applications requiring high-quality graphics rendering capabilities, driving demand for embedded graphics processors. Emerging economies in Asia Pacific and Latin America are presenting growth opportunities fueled by rising disposable incomes, urbanization, and technological advancements. Regional variations in consumer preferences, regulatory frameworks, and industry ecosystems influence market dynamics and growth prospects in different geographic regions.

Competitive Landscape

Leading Companies in the Embedded Graphics Processor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

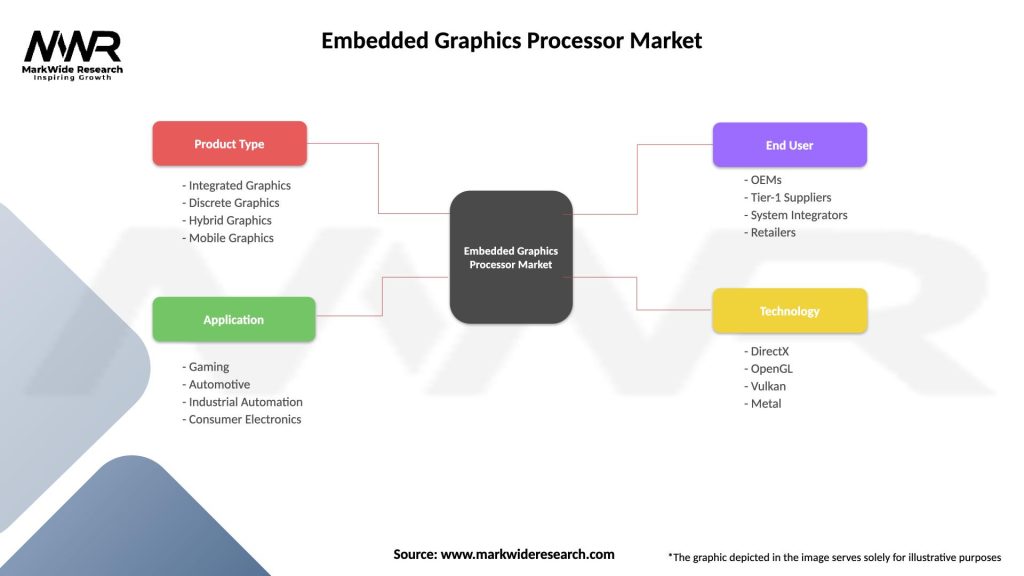

Segmentation

The embedded graphics processor market can be segmented based on various factors, including application, performance level, power consumption profile, and industry vertical. By application, it includes options such as smartphones, tablets, gaming consoles, automotive infotainment systems, digital signage, and industrial equipment. By performance level, it encompasses options such as entry-level, mid-range, and high-end GPUs. By power consumption profile, it includes options such as low-power, mainstream, and high-performance GPUs. By industry vertical, it includes options such as consumer electronics, automotive, gaming, healthcare, aerospace and defense, and industrial automation.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the embedded graphics processor market. While temporary disruptions to supply chains and manufacturing operations have affected production and distribution, the pandemic has also accelerated the adoption of electronic devices and applications requiring high-quality graphics rendering capabilities. As individuals spend more time indoors and seek entertainment, productivity, and connectivity solutions, the demand for smartphones, tablets, gaming consoles, and automotive infotainment systems has increased. This has driven demand for embedded graphics processors and related components. As the pandemic recedes and economic recovery takes hold, the embedded graphics processor market is expected to rebound, with continued growth driven by the increasing adoption of high-resolution displays, VR, AR, and AI applications.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the embedded graphics processor market looks promising, with steady growth expected in the coming years. The increasing demand for high-quality visual experiences across electronic devices and applications, coupled with technological advancements in GPU architecture and manufacturing processes, will continue to drive market expansion. Key players that innovate, collaborate, and invest in research and development will be well-positioned to capitalize on emerging trends and opportunities in the dynamic embedded graphics processor market.

Conclusion

In conclusion, the embedded graphics processor market serves industries and applications requiring high-quality graphics rendering capabilities across various electronic devices, including smartphones, tablets, gaming consoles, automotive infotainment systems, digital signage, and industrial equipment. Despite challenges such as technological constraints and market competition, the market is experiencing steady growth driven by the increasing demand for immersive visual experiences. Key players in the market are introducing innovative GPUs with higher performance, lower power consumption, and advanced features to meet the evolving needs of consumers and industries. As the demand for high-resolution displays, VR, AR, and AI applications continues to rise, the embedded graphics processor market is poised for continued expansion, offering new opportunities for industry participants and stakeholders alike.

What is Embedded Graphics Processor?

Embedded Graphics Processors are specialized hardware components designed to handle graphics rendering tasks within embedded systems, such as smartphones, automotive displays, and gaming consoles. They integrate graphics processing capabilities directly into the device, enhancing performance and efficiency.

What are the key players in the Embedded Graphics Processor Market?

Key players in the Embedded Graphics Processor Market include NVIDIA, AMD, Intel, and ARM Holdings. These companies are known for their innovative technologies and products that cater to various applications, including mobile devices, automotive systems, and consumer electronics, among others.

What are the growth factors driving the Embedded Graphics Processor Market?

The growth of the Embedded Graphics Processor Market is driven by the increasing demand for high-performance graphics in mobile devices, the rise of gaming applications, and the expansion of automotive infotainment systems. Additionally, advancements in AI and machine learning are also contributing to market growth.

What challenges does the Embedded Graphics Processor Market face?

The Embedded Graphics Processor Market faces challenges such as the rapid pace of technological change, which requires continuous innovation, and the high costs associated with research and development. Additionally, competition from integrated graphics solutions can also pose a challenge to market players.

What opportunities exist in the Embedded Graphics Processor Market?

Opportunities in the Embedded Graphics Processor Market include the growing adoption of augmented reality (AR) and virtual reality (VR) applications, which require advanced graphics processing capabilities. Furthermore, the increasing integration of graphics processors in IoT devices presents new avenues for growth.

What trends are shaping the Embedded Graphics Processor Market?

Trends shaping the Embedded Graphics Processor Market include the shift towards energy-efficient designs, the integration of AI capabilities into graphics processing, and the development of heterogeneous computing architectures. These trends are influencing how graphics processors are designed and utilized across various industries.

Embedded Graphics Processor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Integrated Graphics, Discrete Graphics, Hybrid Graphics, Mobile Graphics |

| Application | Gaming, Automotive, Industrial Automation, Consumer Electronics |

| End User | OEMs, Tier-1 Suppliers, System Integrators, Retailers |

| Technology | DirectX, OpenGL, Vulkan, Metal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Embedded Graphics Processor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at