444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Cancer Generics market is experiencing significant growth, fueled by the rising incidence of cancer worldwide, increasing demand for affordable treatment options, and the expiration of patents for several branded cancer drugs. Cancer generics, also known as generic oncology drugs, are cost-effective alternatives to brand-name medications, offering comparable efficacy and safety profiles at lower prices. With the growing burden of cancer and the escalating costs of cancer care, generic oncology drugs play a crucial role in expanding access to essential cancer therapies and improving patient outcomes across diverse healthcare settings.

Meaning

Cancer generics refer to bioequivalent versions of branded cancer drugs that have lost patent protection and are manufactured and marketed by multiple pharmaceutical companies. These generic oncology drugs contain the same active ingredients, dosage forms, and routes of administration as their branded counterparts, but are typically sold at lower prices due to competition among manufacturers. By providing affordable alternatives to expensive cancer medications, cancer generics enable healthcare systems, payers, and patients to reduce treatment costs, improve medication adherence, and allocate resources more efficiently in the fight against cancer.

Executive Summary

The Cancer Generics market is witnessing rapid expansion, driven by the convergence of demographic trends, regulatory reforms, and market dynamics shaping the global healthcare landscape. Key players in the market are leveraging economies of scale, manufacturing efficiencies, and regulatory pathways to accelerate the development, production, and commercialization of generic oncology drugs. With the increasing adoption of value-based healthcare models and the growing emphasis on cost containment in cancer care, cancer generics are poised to play a pivotal role in shaping the future of oncology treatment worldwide.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Cancer Generics market is characterized by dynamic trends driven by scientific advances, regulatory reforms, and market competition. Key players in the market are investing in research and development, manufacturing capabilities, and commercialization strategies to capitalize on emerging opportunities and address evolving challenges in generic oncology drug development. Moreover, strategic partnerships, licensing agreements, and acquisitions are reshaping the competitive landscape and driving consolidation in the generic drug industry.

Regional Analysis

North America dominates the global Cancer Generics market, owing to factors such as the high prevalence of cancer, well-established generic drug industry, and favorable regulatory environment for generic drug approval and market access. Europe and Asia-Pacific are also significant markets for cancer generics, driven by increasing demand for affordable cancer treatments, healthcare cost containment measures, and regulatory initiatives to promote generic drug utilization.

Competitive Landscape

Leading Companies in Cancer Generics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Cancer Generics market can be segmented based on drug class, cancer type, dosage form, and distribution channel. Drug classes may include cytotoxic agents, hormonal therapies, targeted therapies, supportive care medications, and biosimilars. Cancer types may include breast cancer, lung cancer, colorectal cancer, prostate cancer, and hematological malignancies. Dosage forms may include oral tablets, injectable formulations, topical preparations, and oral solutions. Distribution channels may include retail pharmacies, hospital pharmacies, online pharmacies, and specialty clinics.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had mixed effects on the Cancer Generics market, with disruptions to drug manufacturing, supply chains, and clinical trials offset by increased demand for affordable cancer treatments and healthcare cost containment measures. While the pandemic has underscored the importance of generic drugs in ensuring access to essential medications and improving healthcare affordability, it has also highlighted vulnerabilities in global drug supply chains and regulatory frameworks. Moving forward, the Cancer Generics market is expected to rebound as healthcare systems adapt to new challenges, regulatory agencies implement reforms, and industry stakeholders collaborate to address emerging needs and opportunities in cancer care.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Cancer Generics market is poised for sustained growth and innovation in the coming years, driven by factors such as demographic trends, regulatory reforms, and market dynamics shaping the global oncology drug market. With the increasing demand for affordable cancer treatments, rising prevalence of cancer worldwide, and expanding opportunities for generic drug development, cancer generics are expected to play a vital role in improving patient access to essential cancer therapies, reducing treatment costs, and advancing cancer care across diverse healthcare settings.

Conclusion

In conclusion, the Cancer Generics market presents significant opportunities for industry participants and stakeholders to address unmet medical needs, improve patient outcomes, and enhance healthcare affordability in cancer care. By providing cost-effective alternatives to branded cancer drugs, generic oncology drugs and biosimilars enable patients, healthcare providers, and payers to maximize treatment benefits, minimize financial burden, and allocate resources more efficiently in the fight against cancer. With ongoing advancements in drug development, regulatory reforms, and market access initiatives, cancer generics are poised to revolutionize the oncology landscape and contribute to the global effort to combat cancer and improve public health outcomes.

What is Cancer Generics?

Cancer Generics refer to pharmaceutical products that are chemically identical to brand-name drugs used in cancer treatment but are sold under their chemical names. These generics provide cost-effective alternatives for patients and healthcare systems while maintaining the same efficacy and safety standards as their branded counterparts.

What are the key players in the Cancer Generics Market?

Key players in the Cancer Generics Market include companies like Teva Pharmaceutical Industries, Mylan N.V., and Sandoz, which focus on developing and distributing generic oncology medications. These companies play a significant role in increasing access to cancer treatments for patients worldwide, among others.

What are the growth factors driving the Cancer Generics Market?

The Cancer Generics Market is driven by factors such as the rising prevalence of cancer, increasing healthcare costs, and the growing demand for affordable treatment options. Additionally, the expiration of patents for several blockbuster cancer drugs has opened the market for generics.

What challenges does the Cancer Generics Market face?

Challenges in the Cancer Generics Market include stringent regulatory requirements, the complexity of cancer treatments, and competition from branded drugs. These factors can hinder the entry of new generics and affect market growth.

What opportunities exist in the Cancer Generics Market?

The Cancer Generics Market presents opportunities such as the development of biosimilars and the expansion into emerging markets. Additionally, increasing collaborations between generic manufacturers and research institutions can lead to innovative treatment options.

What trends are shaping the Cancer Generics Market?

Trends in the Cancer Generics Market include the rise of personalized medicine, advancements in drug formulation technologies, and the increasing focus on sustainability in drug manufacturing. These trends are influencing how generics are developed and marketed.

Cancer Generics Market

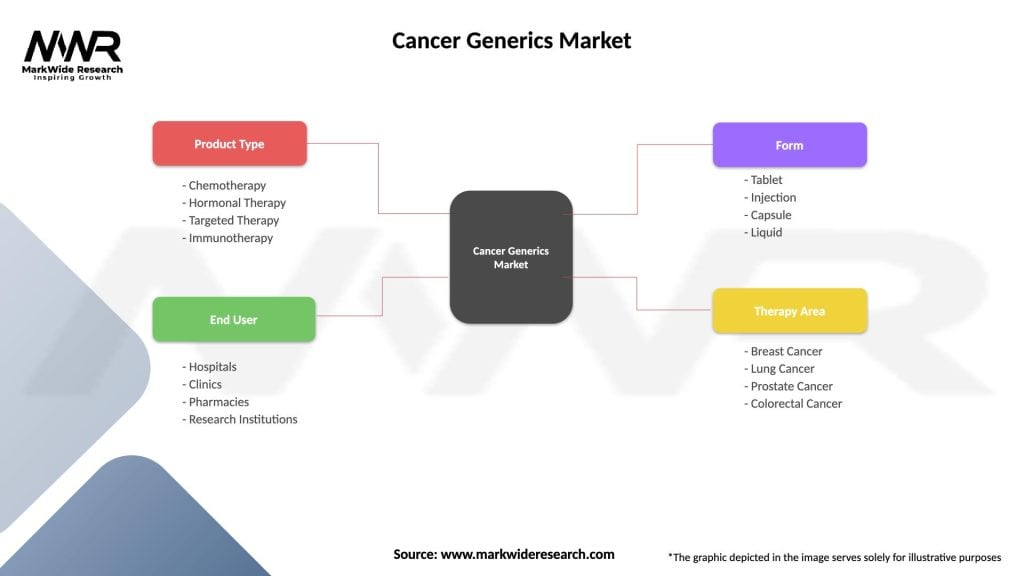

| Segmentation Details | Description |

|---|---|

| Product Type | Chemotherapy, Hormonal Therapy, Targeted Therapy, Immunotherapy |

| End User | Hospitals, Clinics, Pharmacies, Research Institutions |

| Form | Tablet, Injection, Capsule, Liquid |

| Therapy Area | Breast Cancer, Lung Cancer, Prostate Cancer, Colorectal Cancer |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at