444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The ophthalmic lens coating equipment market plays a crucial role in the eyewear industry, providing advanced coating solutions for ophthalmic lenses to enhance their performance, durability, and aesthetic appeal. Ophthalmic lens coating equipment encompasses various technologies and processes designed to apply coatings such as anti-reflective, scratch-resistant, hydrophobic, and photochromic coatings onto ophthalmic lenses. These coatings improve optical clarity, reduce glare, and protect lenses from scratches, water, and UV radiation, contributing to better vision and eye health for consumers.

Meaning

Ophthalmic lens coating equipment refers to specialized machinery and systems used in the optical industry to coat ophthalmic lenses with various functional and decorative coatings. These coatings are applied through processes such as physical vapor deposition (PVD), chemical vapor deposition (CVD), sputtering, and spin coating, depending on the desired properties and specifications of the lenses. Ophthalmic lens coating equipment enables eyewear manufacturers to customize lenses according to consumer preferences and market trends, offering a wide range of coatings for different applications and requirements.

Executive Summary

The ophthalmic lens coating equipment market is experiencing steady growth, driven by the increasing demand for high-quality coated lenses in the eyewear industry. Market growth is fueled by factors such as rising consumer awareness about the importance of lens coatings for vision protection, technological advancements in coating materials and equipment, and growing adoption of specialty coatings for specific eye care needs. Ophthalmic lens coating equipment manufacturers are innovating to meet evolving market demands and deliver efficient, cost-effective coating solutions for eyewear manufacturers worldwide.

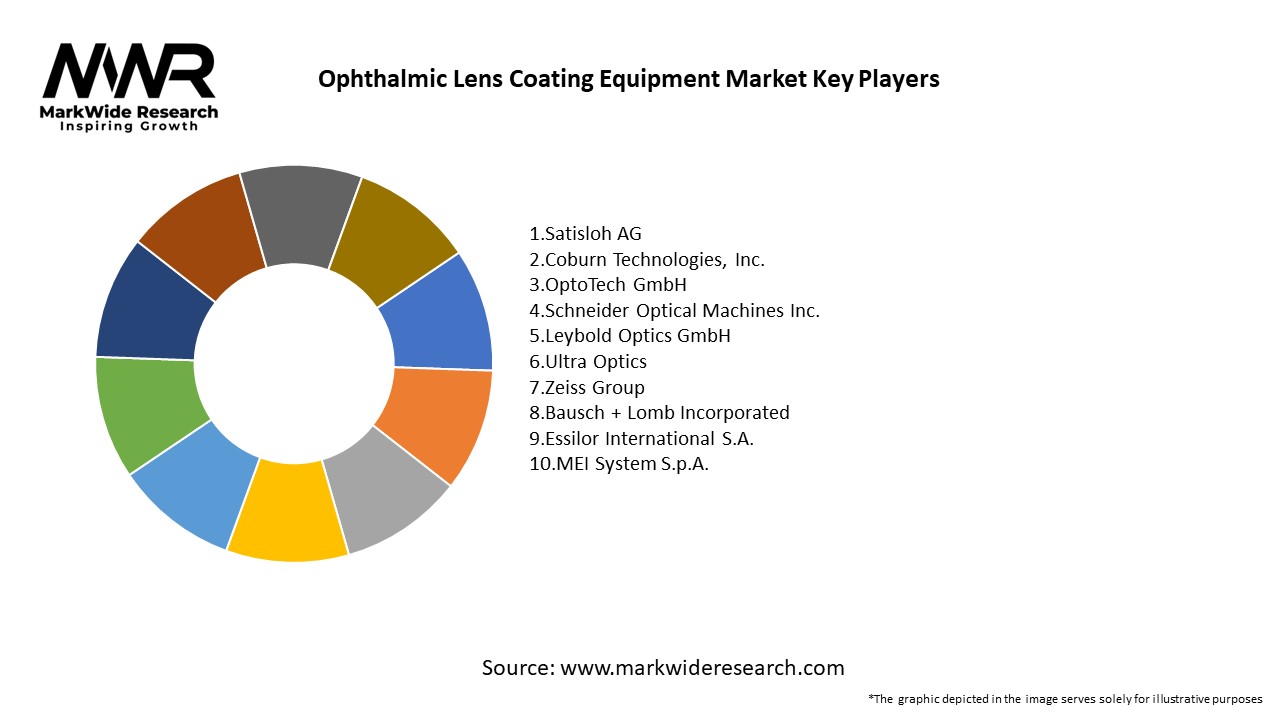

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The ophthalmic lens coating equipment market operates in a dynamic environment influenced by factors such as technological innovation, changing consumer preferences, regulatory requirements, and competitive landscape. Market dynamics drive product development, market segmentation, and strategic partnerships among industry participants to address evolving market needs and gain a competitive edge in the global eyewear industry.

Regional Analysis

The ophthalmic lens coating equipment market exhibits regional variations in demand, adoption of advanced coating technologies, and regulatory frameworks governing the eyewear industry. Developed regions such as North America and Europe lead the market in terms of technological innovation, product quality, and market maturity, driven by established eyewear manufacturers and stringent quality standards. In contrast, emerging economies in Asia-Pacific and Latin America offer significant growth opportunities due to expanding middle-class populations, increasing disposable incomes, and rising awareness of eye health and vision correction.

Competitive Landscape

Leading Companies in the Ophthalmic Lens Coating Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

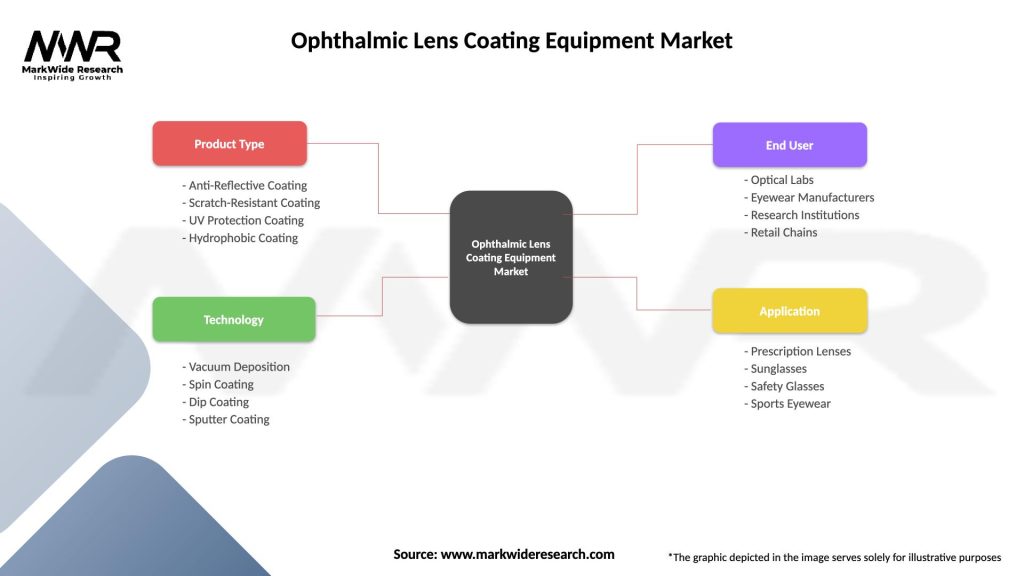

Segmentation

The ophthalmic lens coating equipment market can be segmented based on equipment type, coating technology, end-user industry, and geographic region. Equipment types include vacuum coating systems, dip coating systems, spray coating systems, and spin coating systems. Coating technologies encompass physical vapor deposition (PVD), chemical vapor deposition (CVD), and sol-gel coating methods. End-user industries served by ophthalmic lens coating equipment include eyewear manufacturers, optical laboratories, research institutions, and academic centers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had mixed effects on the ophthalmic lens coating equipment market, with disruptions in supply chains, manufacturing operations, and consumer demand offset by increased awareness of eye health and hygiene practices. While the initial impact of the pandemic led to temporary closures of eyewear manufacturing facilities and reduced consumer spending on non-essential goods, the resurgence of routine eye care services and the growing importance of protective eyewear in healthcare settings have driven market recovery and renewed investment in ophthalmic lens coating equipment for future growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The ophthalmic lens coating equipment market is poised for steady growth in the coming years, driven by increasing demand for coated eyewear products, technological advancements in coating materials and equipment, and growing awareness of eye health and vision correction. Market expansion into emerging economies, adoption of green coating solutions, and integration of digital coating technologies are expected to shape the future landscape of the ophthalmic lens coating equipment industry, offering opportunities for innovation, collaboration, and market differentiation.

Conclusion

The ophthalmic lens coating equipment market plays a critical role in the eyewear industry by enabling the production of high-quality coated lenses with enhanced performance, durability, and aesthetic appeal. Technological innovation, customization capabilities, and sustainability initiatives drive market growth and differentiation, while regulatory compliance, competitive pressures, and supply chain disruptions pose challenges for industry participants. By leveraging advanced coating technologies, expanding market presence, and embracing industry trends, ophthalmic lens coating equipment manufacturers can position themselves for success in the dynamic and evolving global eyewear market.

What is Ophthalmic Lens Coating Equipment?

Ophthalmic Lens Coating Equipment refers to the machinery and technology used to apply various coatings to ophthalmic lenses, enhancing their performance and durability. These coatings can include anti-reflective, scratch-resistant, and UV protection layers, which improve the functionality and longevity of eyewear.

What are the key players in the Ophthalmic Lens Coating Equipment Market?

Key players in the Ophthalmic Lens Coating Equipment Market include companies like Satisloh, Schneider Optical Machines, and OptoTech, which specialize in manufacturing advanced coating systems for ophthalmic lenses. These companies are known for their innovative technologies and extensive product offerings, among others.

What are the growth factors driving the Ophthalmic Lens Coating Equipment Market?

The growth of the Ophthalmic Lens Coating Equipment Market is driven by increasing demand for high-quality eyewear, advancements in coating technologies, and a rise in vision-related health issues. Additionally, the growing trend of personalized eyewear solutions contributes to market expansion.

What challenges does the Ophthalmic Lens Coating Equipment Market face?

The Ophthalmic Lens Coating Equipment Market faces challenges such as high initial investment costs and the need for skilled labor to operate advanced machinery. Furthermore, competition from low-cost alternatives can hinder market growth.

What opportunities exist in the Ophthalmic Lens Coating Equipment Market?

Opportunities in the Ophthalmic Lens Coating Equipment Market include the development of eco-friendly coatings and the integration of smart technologies in lens manufacturing. Additionally, expanding markets in developing regions present new avenues for growth.

What trends are shaping the Ophthalmic Lens Coating Equipment Market?

Trends in the Ophthalmic Lens Coating Equipment Market include the increasing adoption of digital technologies for precision coating and the growing popularity of anti-fog and blue light blocking coatings. These innovations are enhancing user experience and driving demand for advanced coating solutions.

Ophthalmic Lens Coating Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Anti-Reflective Coating, Scratch-Resistant Coating, UV Protection Coating, Hydrophobic Coating |

| Technology | Vacuum Deposition, Spin Coating, Dip Coating, Sputter Coating |

| End User | Optical Labs, Eyewear Manufacturers, Research Institutions, Retail Chains |

| Application | Prescription Lenses, Sunglasses, Safety Glasses, Sports Eyewear |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Ophthalmic Lens Coating Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at