444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Serum Replacement market is experiencing significant growth, driven by the rising demand for cell culture media alternatives, advancements in cell therapy and regenerative medicine, and the expanding applications of serum-free and animal component-free supplements in biopharmaceutical production and research. Serum replacement products serve as alternatives to fetal bovine serum (FBS) and other animal-derived sera traditionally used in cell culture, offering advantages such as improved reproducibility, batch-to-batch consistency, and reduced risk of contamination. With increasing emphasis on biomanufacturing efficiency, product quality, and regulatory compliance, the Serum Replacement market is poised for continued expansion globally.

Meaning

The Serum Replacement market comprises manufacturers, suppliers, and distributors offering serum-free and animal component-free cell culture supplements for use in biopharmaceutical manufacturing, cell therapy, tissue engineering, and stem cell research. These products include recombinant proteins, synthetic growth factors, chemically-defined media formulations, and serum replacement supplements derived from human or plant-based sources. Serum replacement technologies enable the production of high-quality cells and biologics with reduced variability and safety risks compared to traditional serum-containing media, driving their adoption in industrial-scale bioprocessing and academic research laboratories.

Executive Summary

The Serum Replacement market is witnessing rapid growth fueled by the increasing adoption of serum-free and animal component-free cell culture technologies, advancements in cell-based therapies and biomanufacturing, and regulatory initiatives promoting the use of defined media formulations in biopharmaceutical production. Key drivers of market expansion include the demand for xeno-free and chemically-defined culture systems, the emergence of novel serum replacement products with enhanced performance and scalability, and the growing investment in regenerative medicine and personalized therapies. However, challenges such as the high cost of serum replacement supplements, formulation optimization, and batch-to-batch consistency may impact market growth.

Key Market Insights

The Serum Replacement market is characterized by a diverse array of products and technologies catering to different cell types, culture systems, and therapeutic applications. Key trends driving market growth include the development of serum-free and animal component-free formulations for specific cell types and culture conditions, the integration of serum replacement supplements with bioreactor systems and automated cell culture platforms, and the adoption of chemically-defined media for clinical-grade cell therapy manufacturing. Moreover, the shift towards cell-based assays, 3D cell culture models, and organoid systems in drug discovery and toxicity testing is driving demand for serum replacement products with improved performance and reproducibility.

Market Drivers

Several factors are driving the growth of the Serum Replacement market:

Market Restraints

Despite the growth drivers, the Serum Replacement market faces several challenges:

Market Opportunities

Despite challenges, the Serum Replacement market presents significant opportunities for growth and innovation:

Market Dynamics

The Serum Replacement market is influenced by dynamic trends and factors:

Regional Analysis

The Serum Replacement market is global in scope, with North America, Europe, Asia Pacific, and Rest of the World (RoW) emerging as key regions for market growth:

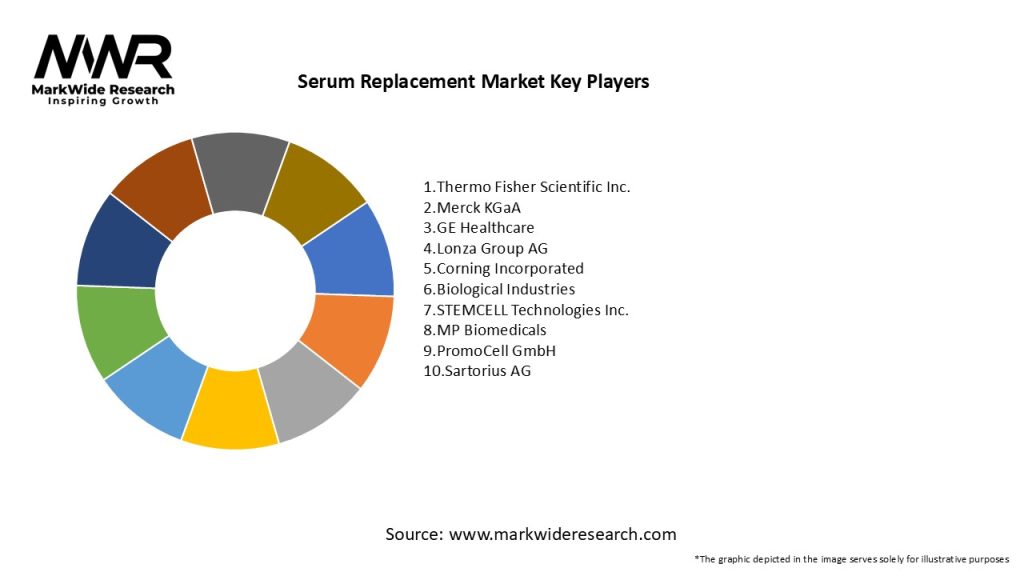

Competitive Landscape

The Serum Replacement market is highly competitive, with a diverse mix of suppliers, manufacturers, and distributors offering a wide range of serum-free and animal component-free cell culture supplements. Key players in the market include Thermo Fisher Scientific Inc., Merck KGaA, Lonza Group Ltd., Sartorius AG, and Irvine Scientific, among others. These companies offer a variety of serum replacement products, including recombinant proteins, growth factors, cytokines, and chemically-defined media formulations, validated for specific cell types and culture applications. Strategic partnerships, collaborations, and acquisitions are common strategies among serum replacement suppliers to expand product portfolios, enhance technical capabilities, and strengthen market presence in the global Serum Replacement market.

Segmentation

The Serum Replacement market can be segmented based on product type, application, end-user, and region. By product type, the market includes recombinant proteins, synthetic growth factors, chemically-defined media formulations, and serum replacement supplements derived from human or plant-based sources. By application, Serum Replacement products are used in biopharmaceutical production, cell therapy manufacturing, tissue engineering, stem cell research, and regenerative medicine. By end-user, Serum Replacement products are utilized by biopharmaceutical companies, contract manufacturing organizations (CMOs), academic research institutions, and clinical laboratories engaged in cell culture and bioprocessing activities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of Serum Replacement products offers several benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the Serum Replacement market:

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Serum Replacement market:

Key Industry Developments

Analyst Suggestions

To capitalize on the opportunities presented by the Serum Replacement market, industry participants and stakeholders should:

Future Outlook

The future outlook for the Serum Replacement market is promising, with continued growth expected in the coming years:

Conclusion

In conclusion, the Serum Replacement market is experiencing rapid growth driven by the increasing adoption of serum-free and animal component-free culture technologies, advancements in cell therapy and regenerative medicine, and regulatory initiatives promoting the use of defined media formulations in biopharmaceutical production. Despite challenges such as formulation complexity, high production costs, and supply chain risks, the market presents significant opportunities for growth and innovation. By investing in research and development, expanding market access, and enhancing regulatory compliance, industry participants and stakeholders can capitalize on the growing demand for Serum Replacement products and contribute to advancements in biopharmaceutical manufacturing, cell therapy, and regenerative medicine.

| Segmentation Details | Information |

|---|---|

| Type | Defined Serum Replacements, Serum-free Media Supplements |

| Application | Cell Culture, Tissue Engineering, Regenerative Medicine, Others |

| End User | Research Laboratories, Pharmaceutical & Biotechnology Companies, Academic Institutes, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Serum Replacement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at