444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The molecular diagnostic products market is experiencing rapid growth driven by advancements in technology, increasing prevalence of infectious diseases, and rising demand for personalized medicine. Molecular diagnostics involve the detection and analysis of nucleic acids, proteins, and other biomarkers to diagnose diseases, monitor treatment responses, and guide therapeutic decisions. These products play a crucial role in healthcare by enabling accurate and timely diagnosis of infectious diseases, genetic disorders, cancer, and other conditions.

Meaning

The molecular diagnostic products market encompasses a wide range of products and technologies used for the detection, quantification, and analysis of nucleic acids, proteins, and other biomarkers in clinical specimens. These products include nucleic acid amplification assays, PCR instruments, next-generation sequencing platforms, microarrays, and other molecular diagnostic tools. Molecular diagnostics provide rapid and sensitive detection of pathogens, genetic mutations, and biomarkers, enabling early diagnosis, targeted therapy, and personalized medicine approaches.

Executive Summary

The molecular diagnostic products market is witnessing significant growth fueled by the increasing adoption of molecular testing in clinical laboratories, the development of novel diagnostic assays, and the expansion of applications in infectious disease testing, oncology, and genetic testing. Key factors driving market expansion include technological advancements, such as the development of multiplexed assays, automation, and point-of-care testing platforms, as well as the growing emphasis on precision medicine and companion diagnostics. However, challenges such as regulatory hurdles, reimbursement issues, and data interpretation complexities may impact market growth.

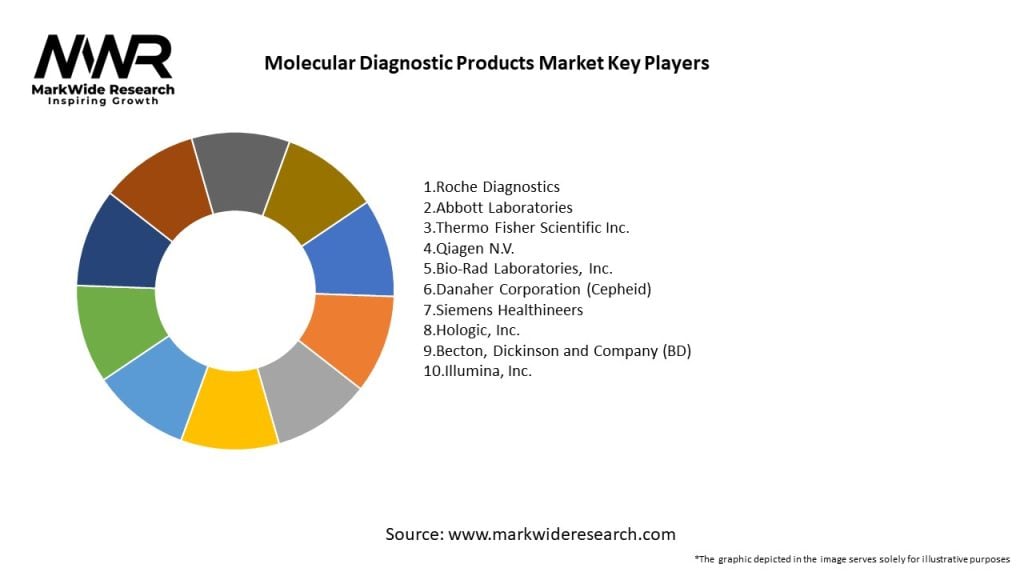

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The molecular diagnostic products market is characterized by a diverse range of products and technologies offered by multinational corporations, mid-sized companies, and start-ups. Key trends driving market growth include the integration of molecular testing with electronic health records (EHRs) and laboratory information systems (LISs), the emergence of digital PCR and single-cell sequencing technologies, and the increasing adoption of decentralized testing platforms for point-of-care and near-patient testing. Additionally, the COVID-19 pandemic has accelerated the adoption of molecular testing for SARS-CoV-2 detection and surveillance, highlighting the importance of molecular diagnostics in public health emergencies.

Market Drivers

Several factors are driving the growth of the molecular diagnostic products market. These include the increasing prevalence of infectious diseases, such as COVID-19, HIV/AIDS, tuberculosis, and hepatitis, which require rapid and accurate diagnostic testing for timely intervention and disease control. Additionally, advancements in molecular biology, genomics, and bioinformatics have led to the development of highly sensitive and specific molecular diagnostic assays for detecting genetic mutations, infectious agents, and cancer biomarkers. Furthermore, the shift towards personalized medicine and targeted therapies is driving demand for molecular diagnostics for patient stratification, treatment monitoring, and drug development.

Market Restraints

Despite the promising growth prospects, the molecular diagnostic products market faces several challenges that may hinder its growth. These include regulatory hurdles, such as FDA approval and CE marking requirements for new diagnostic assays and platforms, which can delay market entry and increase development costs. Additionally, reimbursement issues, including coding and coverage determinations for molecular tests, may impact market access and adoption by healthcare providers and payers. Furthermore, data interpretation complexities, including variant classification and clinical significance, pose challenges for clinicians and laboratories in implementing molecular testing in routine clinical practice.

Market Opportunities

Despite the challenges, the molecular diagnostic products market presents significant opportunities for growth and innovation. Key opportunities include the development of rapid and portable molecular testing platforms for point-of-care and near-patient testing, enabling timely diagnosis and treatment in resource-limited settings. Additionally, the integration of molecular testing with digital health technologies, such as mobile health apps and wearable devices, offers new avenues for remote monitoring, disease management, and patient engagement. Furthermore, the expansion of molecular testing beyond infectious diseases to include oncology, pharmacogenomics, and reproductive health creates new market opportunities for molecular diagnostic companies.

Market Dynamics

The molecular diagnostic products market is characterized by dynamic trends and factors that influence its growth trajectory. Key market dynamics include advancements in technology, changing regulatory landscapes, evolving reimbursement policies, and competitive dynamics among market players. Additionally, the globalization of healthcare delivery, increasing healthcare expenditure, and rising awareness of molecular testing among healthcare providers and patients are driving demand for molecular diagnostic products across geographies and therapeutic areas. Furthermore, the COVID-19 pandemic has reshaped the molecular diagnostic landscape, accelerating digital transformation, innovation, and collaboration in response to public health challenges.

Regional Analysis

The molecular diagnostic products market is global in scope, with North America, Europe, Asia Pacific, Latin America, and Middle East & Africa emerging as key regions for market growth. North America dominates the market, driven by the presence of leading molecular diagnostic companies, well-established healthcare infrastructure, and favorable reimbursement policies for molecular testing. Europe is also a significant market, fueled by increasing adoption of molecular testing in clinical laboratories, growing prevalence of chronic diseases, and supportive regulatory frameworks for diagnostic innovation. Asia Pacific is expected to witness rapid growth, driven by rising healthcare expenditure, increasing awareness of molecular diagnostics, and expanding access to healthcare services in emerging markets.

Competitive Landscape

Leading Companies in the Molecular Diagnostic Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The molecular diagnostic products market can be segmented based on product type, technology, application, end-user, and region. By product type, the market includes nucleic acid amplification assays, PCR instruments, next-generation sequencing platforms, microarrays, and other molecular diagnostic tools. By technology, molecular diagnostic products are categorized into polymerase chain reaction (PCR), nucleic acid sequencing, microarray analysis, isothermal amplification, and other molecular techniques. By application, molecular diagnostics are used for infectious disease testing, oncology, genetic testing, pharmacogenomics, and other clinical applications. By end-user, molecular diagnostic products are utilized by hospitals, clinical laboratories, academic research institutions, pharmaceutical companies, and contract research organizations (CROs) engaged in clinical research and drug development.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of molecular diagnostic products offers several benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the molecular diagnostic products market:

Covid-19 Impact

The Covid-19 pandemic has had a profound impact on the molecular diagnostic products market, driving unprecedented demand for SARS-CoV-2 testing and surveillance worldwide. Molecular testing platforms, including PCR, NGS, and rapid antigen tests, have played a critical role in pandemic response efforts, enabling mass testing, contact tracing, and surveillance of virus variants. Additionally, the pandemic has accelerated digital transformation and innovation in molecular diagnostics, leading to the development of novel testing platforms, digital health solutions, and data analytics tools for pandemic preparedness and response.

Key Industry Developments

Analyst Suggestions

To capitalize on the opportunities presented by the molecular diagnostic products market, industry participants and stakeholders should:

Future Outlook

The future outlook for the molecular diagnostic products market is promising, with continued growth expected in the coming years. Key drivers of market growth include advancements in technology, increasing prevalence of infectious diseases and chronic conditions, and rising demand for personalized medicine and precision diagnostics. Additionally, the Covid-19 pandemic has accelerated digital transformation, innovation, and collaboration in molecular diagnostics, reshaping the landscape of testing platforms, applications, and market dynamics. However, challenges such as regulatory hurdles, reimbursement issues, and competitive pressures may impact market growth. Overall, the molecular diagnostic products market presents significant opportunities for industry participants and stakeholders to innovate, collaborate, and contribute to advancements in healthcare delivery, disease management, and public health preparedness.

Conclusion

In conclusion, the molecular diagnostic products market is experiencing rapid growth driven by advancements in technology, increasing prevalence of infectious diseases, and rising demand for personalized medicine. Molecular diagnostics play a crucial role in healthcare by enabling accurate and timely diagnosis of diseases, monitoring treatment responses, and guiding therapeutic decisions. Despite challenges such as regulatory hurdles and reimbursement issues, the market presents significant opportunities for growth and innovation. By investing in innovation, expanding market access, and enhancing collaboration, molecular diagnostic companies can capitalize on the growing demand for molecular testing and contribute to advancements in healthcare delivery, disease management, and public health preparedness.

What is Molecular Diagnostic Products?

Molecular Diagnostic Products refer to a range of medical devices and technologies used to analyze biological markers in the genome and proteome. These products are essential for diagnosing diseases, monitoring health conditions, and guiding treatment decisions.

What are the key players in the Molecular Diagnostic Products Market?

Key players in the Molecular Diagnostic Products Market include Roche Diagnostics, Abbott Laboratories, and Thermo Fisher Scientific. These companies are known for their innovative diagnostic solutions and extensive product portfolios, among others.

What are the main drivers of growth in the Molecular Diagnostic Products Market?

The growth of the Molecular Diagnostic Products Market is driven by the increasing prevalence of infectious diseases, advancements in genomic technologies, and the rising demand for personalized medicine. Additionally, the growing focus on early disease detection contributes to market expansion.

What challenges does the Molecular Diagnostic Products Market face?

The Molecular Diagnostic Products Market faces challenges such as high development costs, regulatory hurdles, and the need for skilled personnel to operate complex diagnostic equipment. These factors can hinder market entry for new players and slow down innovation.

What opportunities exist in the Molecular Diagnostic Products Market?

Opportunities in the Molecular Diagnostic Products Market include the development of point-of-care testing solutions, integration of artificial intelligence in diagnostics, and expansion into emerging markets. These trends can enhance accessibility and improve patient outcomes.

What are the current trends in the Molecular Diagnostic Products Market?

Current trends in the Molecular Diagnostic Products Market include the increasing adoption of next-generation sequencing technologies, the rise of liquid biopsy methods, and the growing emphasis on companion diagnostics. These innovations are shaping the future of molecular diagnostics.

Molecular Diagnostic Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Reagents, Instruments, Software, Assays |

| Application | Infectious Diseases, Oncology, Genetic Testing, Blood Screening |

| End User | Hospitals, Laboratories, Research Institutions, Clinics |

| Technology | PCR, NGS, Microarrays, Sequencing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Molecular Diagnostic Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at