444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The native starch market has witnessed significant growth in recent years, driven by the increasing demand for natural and clean-label ingredients in various industries. Native starch refers to starch extracted from its natural source, such as corn, wheat, potato, tapioca, and others, without undergoing any chemical modifications or treatments. It is widely used in food and beverage, pharmaceuticals, paper and packaging, and other industries for its functional properties and versatility.

Meaning

Native starch is the unmodified form of starch obtained from plants. It is derived from various sources like corn, wheat, potato, tapioca, and more. Unlike modified starches, native starches are not subjected to any chemical alterations or treatments. Native starches find applications across industries due to their functional properties and natural origin.

Executive Summary

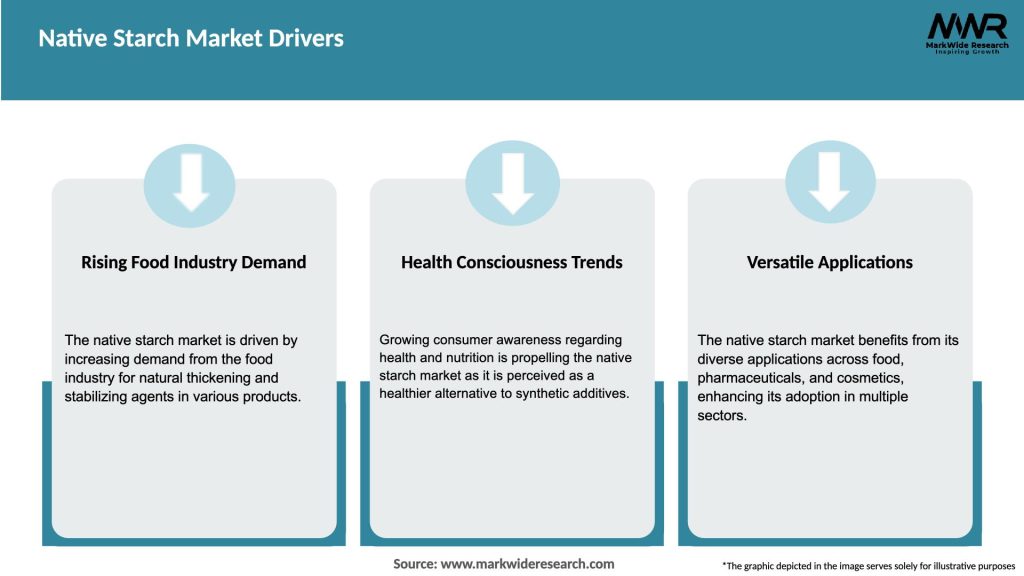

The global native starch market has experienced significant growth in recent years and is expected to continue its upward trajectory. The increasing consumer demand for clean-label and natural ingredients in food and beverages has been a major driver for this market. Native starches offer a wide range of functional properties and are widely used as thickeners, stabilizers, binders, and texturizers in various applications.

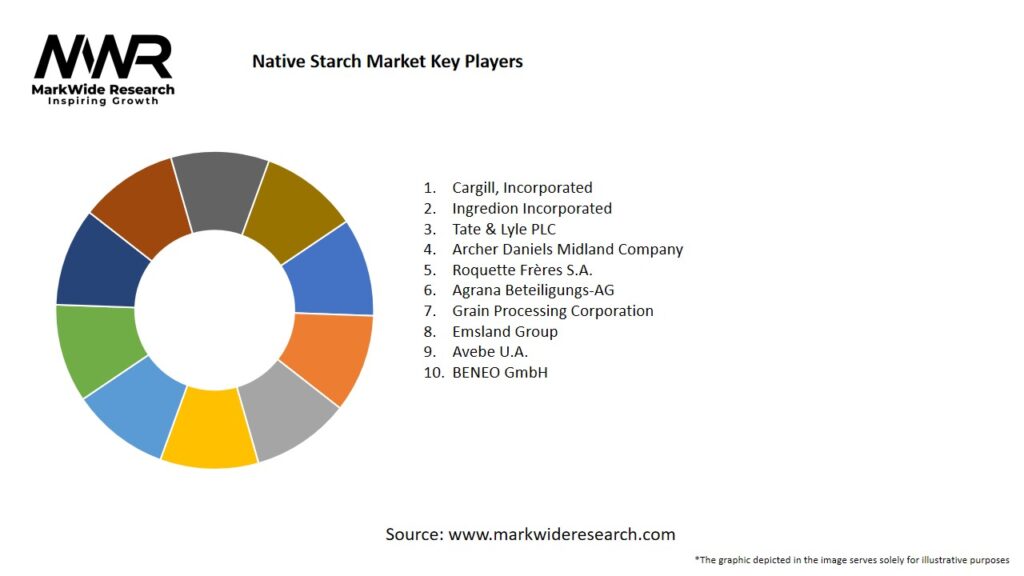

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The native starch market is characterized by a dynamic landscape driven by evolving consumer preferences, technological advancements, and regulatory changes. The demand for clean-label and natural ingredients has been a significant driver, pushing manufacturers to develop innovative solutions using native starches. The market is highly competitive, with key players focusing on product development, expansion of production capacities, and strategic partnerships to gain a competitive edge.

Regional Analysis

The native starch market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these, the Asia Pacific region dominates the market, driven by the high consumption of native starches in countries like China, India, and Thailand. North America and Europe also hold substantial market shares, with a growing demand for clean-label and natural ingredients in the food and beverage industry.

Competitive Landscape

Leading Companies in the Native Starch Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

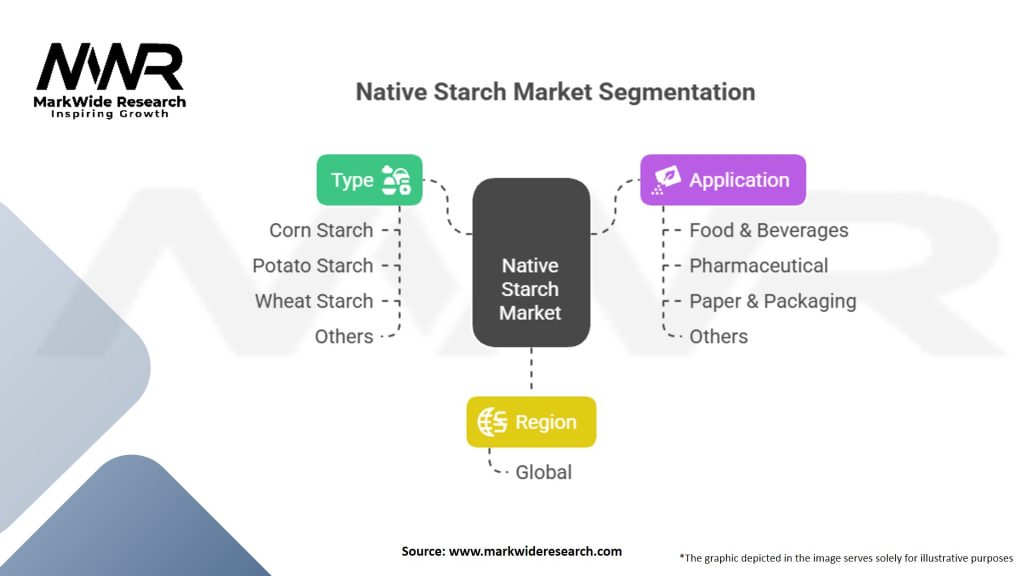

Segmentation

The native starch market can be segmented based on source, application, and region. By source, it can be categorized into corn, wheat, potato, tapioca, and others. By application, it can be divided into food and beverage, pharmaceuticals, paper and packaging, textiles, adhesives, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The native starch market witnessed both positive and negative impacts due to the COVID-19 pandemic. The demand for native starches in the food and beverage industry remained stable as consumers continued to purchase essential food items. However, the closure of restaurants, cafes, and other foodservice establishments resulted in a temporary decline in the demand for native starches in this sector. The pharmaceutical industry, on the other hand, witnessed increased demand for certain drug formulations, driving the consumption of native starches.

Key Industry Developments

Analyst Suggestions

Future Outlook

The native starch market is expected to witness steady growth in the coming years. The demand for natural and clean-label ingredients, along with the expanding applications of native starches in various industries, will be key drivers for market growth. Technological advancements in extraction methods and the development of native starches from unconventional sources will further fuel market expansion. However, manufacturers need to address challenges related to raw material prices and limited availability to sustain growth in the competitive market.

Conclusion

The native starch market has experienced significant growth driven by the increasing consumer demand for natural and clean-label ingredients. Native starches find applications in various industries, including food and beverage, pharmaceuticals, paper and packaging, textiles, and adhesives, due to their functional properties and versatility. While the market presents opportunities for expansion, manufacturers need to address challenges such as raw material prices and limited availability. Overall, the native starch market is poised for steady growth in the future, driven by evolving consumer preferences and technological advancements.

What is native starch?

Native starch refers to starch that is extracted from plants without any modification or chemical treatment. It is commonly used in food products, pharmaceuticals, and various industrial applications due to its thickening and gelling properties.

Who are the key players in the Native Starch Market?

Key players in the Native Starch Market include companies like Cargill, Archer Daniels Midland Company, and Ingredion Incorporated, among others.

What are the main drivers of growth in the Native Starch Market?

The growth of the Native Starch Market is driven by increasing demand for clean-label products, the rise in the food and beverage industry, and the expanding applications in the pharmaceutical sector.

What challenges does the Native Starch Market face?

Challenges in the Native Starch Market include fluctuations in raw material prices, competition from modified starches, and regulatory hurdles related to food safety and labeling.

What opportunities exist in the Native Starch Market?

Opportunities in the Native Starch Market include the growing trend towards natural and organic food products, innovations in starch processing technologies, and the increasing use of native starch in non-food applications such as bioplastics.

What trends are shaping the Native Starch Market?

Trends in the Native Starch Market include a shift towards sustainable sourcing practices, the development of new starch varieties with enhanced functionalities, and the rising popularity of plant-based diets influencing starch applications.

Native Starch Market

| Segmentation Details | Description |

|---|---|

| Type | Corn Starch, Potato Starch, Wheat Starch, Others |

| Application | Food & Beverages, Pharmaceutical, Paper & Packaging, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Native Starch Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at