444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The passive dosimetry equipment and service market encompasses a vital segment within the radiation monitoring industry. Passive dosimeters are instrumental in measuring an individual’s cumulative exposure to ionizing radiation over a specified period without the need for external power sources. These dosimeters find widespread application across various sectors, including healthcare, nuclear power plants, industrial settings, and research facilities. The market for passive dosimetry equipment and services is propelled by stringent regulatory mandates, increasing awareness regarding radiation safety, and the growing emphasis on occupational health monitoring.

Meaning

Passive dosimetry equipment refers to devices utilized for the measurement and monitoring of ionizing radiation exposure levels without necessitating active user intervention. These dosimeters passively accumulate radiation doses over time and are subsequently analyzed to assess an individual’s radiation exposure. Passive dosimetry services encompass the calibration, distribution, and analysis of dosimeters, as well as the provision of comprehensive radiation monitoring solutions tailored to specific industry requirements.

Executive Summary

The passive dosimetry equipment and service market is witnessing robust growth, driven by the imperative need for radiation safety measures across diverse sectors. Regulatory compliance mandates, coupled with increasing awareness regarding the detrimental effects of radiation exposure, are fueling market expansion. Key players in the market offer a spectrum of passive dosimetry solutions, ranging from thermoluminescent dosimeters (TLDs) to optically stimulated luminescence dosimeters (OSLDs), alongside value-added services such as dose analysis, reporting, and consultancy.

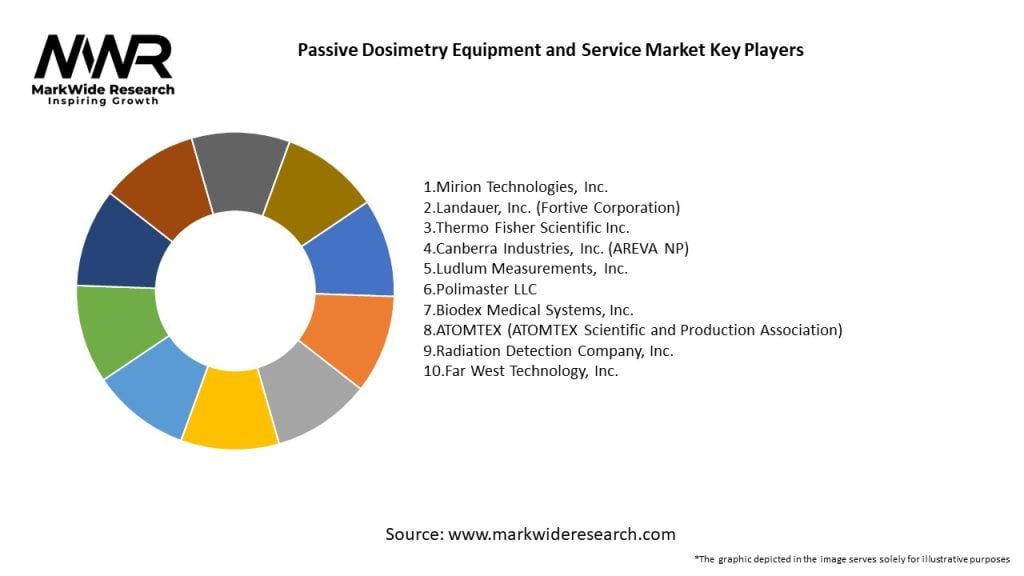

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The passive dosimetry equipment and service market operate within a dynamic landscape shaped by regulatory frameworks, technological advancements, industry dynamics, and evolving end-user preferences. Continuous innovation, strategic collaborations, and market diversification are essential strategies for market players to navigate the ever-evolving market dynamics and capitalize on emerging opportunities.

Regional Analysis

The passive dosimetry equipment and service market exhibit regional variations influenced by factors such as regulatory regimes, industrialization levels, healthcare infrastructure, and radiation safety awareness. Key regions driving market growth include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. While developed regions boast mature markets with stringent regulatory frameworks and high adoption rates, emerging economies offer untapped growth opportunities driven by industrial expansion and healthcare infrastructure development.

Competitive Landscape

Leading Companies in Passive Dosimetry Equipment and Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The passive dosimetry equipment and service market can be segmented based on various parameters, including product type, end-user industry, application, and geography. Segmentation facilitates a comprehensive understanding of market dynamics, enabling market players to tailor their strategies to specific customer segments and geographical regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis offers a holistic assessment of the passive dosimetry equipment and service market’s strengths, weaknesses, opportunities, and threats:

Understanding these factors through a SWOT analysis enables market players to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate threats, thus enhancing their competitive positioning and market resilience.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the passive dosimetry equipment and service market. While disruptions in supply chains and project delays initially hampered market growth, increased awareness regarding health and safety measures has led to greater emphasis on radiation monitoring and occupational health compliance. Key impacts of COVID-19 on the market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The passive dosimetry equipment and service market is poised for substantial growth in the foreseeable future, propelled by factors such as increasing regulatory mandates, technological advancements, and growing awareness regarding radiation safety. Market players leveraging innovative dosimetry solutions, strategic partnerships, and geographic expansion strategies are poised to capitalize on emerging opportunities and consolidate their market positions amidst evolving industry dynamics and competitive pressures.

Conclusion

The passive dosimetry equipment and service market occupy a pivotal position within the broader radiation monitoring landscape, providing indispensable solutions for assessing and mitigating radiation exposure risks across diverse industries and applications. With increasing regulatory scrutiny, technological advancements, and evolving end-user expectations, market players are compelled to innovate, collaborate, and adapt to thrive in the dynamic dosimetry market. By embracing next-generation dosimeter technologies, fostering customer education and awareness, and forging strategic partnerships, dosimetry solution providers can navigate through challenges, capitalize on opportunities, and emerge as key enablers of radiation safety and occupational health worldwide.

What is Passive Dosimetry Equipment and Service?

Passive dosimetry equipment and service refers to tools and methodologies used to measure and assess radiation exposure without the need for active monitoring. This includes devices like thermoluminescent dosimeters and optically stimulated luminescence dosimeters, which are widely used in medical, industrial, and research applications.

What are the key players in the Passive Dosimetry Equipment and Service Market?

Key players in the Passive Dosimetry Equipment and Service Market include Landauer, Inc., Mirion Technologies, and Radiation Detection Company, among others. These companies provide a range of dosimetry solutions for healthcare, nuclear power, and research sectors.

What are the growth factors driving the Passive Dosimetry Equipment and Service Market?

The growth of the Passive Dosimetry Equipment and Service Market is driven by increasing awareness of radiation safety, advancements in dosimetry technology, and the rising demand for radiation monitoring in healthcare and industrial applications.

What challenges does the Passive Dosimetry Equipment and Service Market face?

Challenges in the Passive Dosimetry Equipment and Service Market include the high cost of advanced dosimetry systems and the need for regular calibration and maintenance. Additionally, regulatory compliance can be complex and varies by region.

What opportunities exist in the Passive Dosimetry Equipment and Service Market?

Opportunities in the Passive Dosimetry Equipment and Service Market include the development of innovative dosimetry technologies and the expansion of services in emerging markets. There is also potential for growth in sectors such as environmental monitoring and personal dosimetry.

What trends are shaping the Passive Dosimetry Equipment and Service Market?

Trends in the Passive Dosimetry Equipment and Service Market include the integration of digital technologies for data analysis and reporting, as well as the increasing use of wearable dosimeters. These innovations aim to enhance accuracy and user convenience in radiation monitoring.

Passive Dosimetry Equipment and Service Market

| Segmentation Details | Description |

|---|---|

| Product Type | Thermoluminescent Dosimeters, Optically Stimulated Luminescence Dosimeters, Film Dosimeters, Chemical Dosimeters |

| Service Type | Calibration Services, Measurement Services, Consulting Services, Training Services |

| End User | Hospitals, Research Laboratories, Nuclear Power Plants, Industrial Facilities |

| Application | Radiation Protection, Environmental Monitoring, Medical Applications, Occupational Safety |

Leading Companies in Passive Dosimetry Equipment and Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at