444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The tumor localization system market is a vital segment within the broader medical imaging industry. These systems play a critical role in the precise detection and localization of tumors within the human body. With the rising incidence of cancer worldwide and the increasing demand for minimally invasive surgical procedures, the tumor localization system market is experiencing significant growth and innovation.

Meaning

Tumor localization systems are medical devices designed to accurately identify the location of tumors within the body. These systems utilize various imaging modalities such as magnetic resonance imaging (MRI), computed tomography (CT), ultrasound, and positron emission tomography (PET) to visualize tumors and guide surgeons during procedures such as biopsy, tumor resection, and radiation therapy. By providing real-time, high-resolution imaging, tumor localization systems help improve the precision, safety, and effectiveness of cancer treatment.

Executive Summary

The tumor localization system market is witnessing rapid growth driven by factors such as the increasing prevalence of cancer, technological advancements in imaging modalities, growing demand for minimally invasive surgical techniques, and rising investments in healthcare infrastructure. Key players in the market are focusing on developing innovative solutions with enhanced imaging capabilities, improved accuracy, and greater compatibility with existing surgical procedures. Collaboration between healthcare providers, medical device manufacturers, and research institutions is driving advancements in tumor localization technology and expanding market opportunities.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The tumor localization system market is influenced by a variety of factors, including technological advancements, regulatory changes, and shifts in consumer preferences. Key dynamics include the increasing focus on precision medicine, the development of novel imaging technologies, and the impact of global health trends on cancer care. The competitive landscape is characterized by the presence of established players, emerging startups, and ongoing collaborations between technology companies and healthcare providers to drive innovation and enhance system performance.

Regional Analysis

The tumor localization system market exhibits varied growth across different regions, influenced by healthcare infrastructure, cancer incidence rates, and regulatory environments:

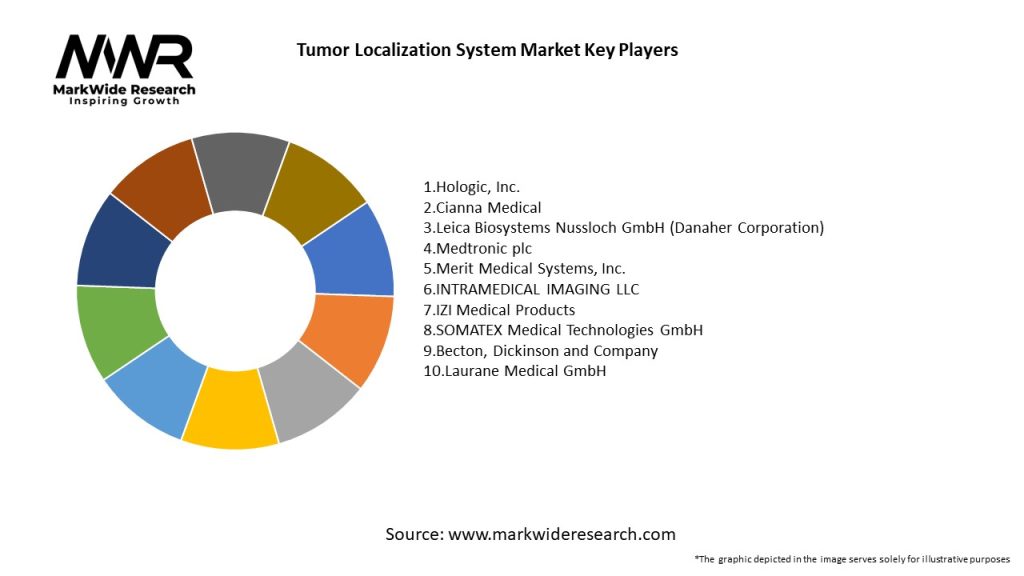

Competitive Landscape

Leading Companies: Tumor Localization System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

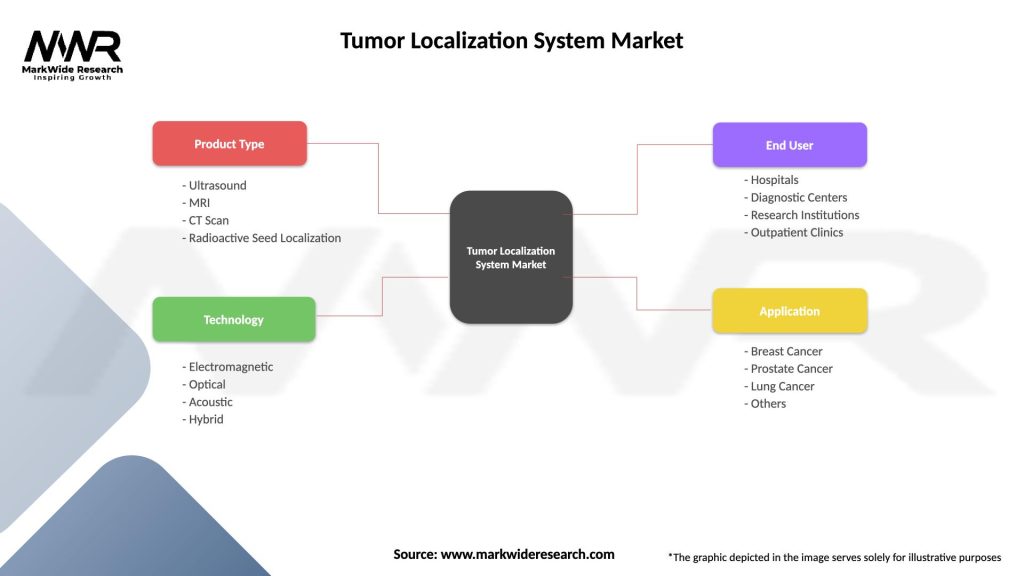

Segmentation

The tumor localization system market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the tumor localization system market, disrupting healthcare delivery, delaying elective procedures, and reshaping clinical priorities. While the immediate focus has been on managing the pandemic and ensuring patient safety, the long-term implications for cancer diagnosis, treatment, and surveillance are becoming increasingly apparent. Key impacts of Covid-19 on the tumor localization system market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The tumor localization system market is poised for continued growth and innovation, driven by factors such as the increasing incidence of cancer, technological advancements in imaging technology, rising demand for minimally invasive surgical techniques, and growing investments in healthcare infrastructure. Key trends shaping the future of the market include the integration of AI and machine learning algorithms, the adoption of hybrid imaging techniques, the shift towards image-guided therapies, and the emphasis on patient-centered care. By leveraging these trends and addressing emerging challenges such as data security, regulatory compliance, and reimbursement constraints, tumor localization system manufacturers can capitalize on market opportunities, drive innovation, and contribute to the advancement of cancer diagnosis and treatment worldwide.

In conclusion, the tumor localization system market presents a dynamic landscape characterized by significant growth opportunities, technological advancements, and evolving clinical needs. These systems play a pivotal role in the accurate detection and localization of tumors, guiding clinicians in treatment planning, surgical interventions, and therapeutic monitoring. Despite challenges such as high costs, regulatory hurdles, and data security concerns, the market is poised for sustained growth driven by increasing cancer incidence, technological innovations, and the shift towards value-based care models.

The Covid-19 pandemic has underscored the importance of tumor localization systems in maintaining continuity of cancer care, facilitating remote consultations, and ensuring patient safety in challenging environments. Manufacturers have responded with rapid innovation, developing AI-powered imaging solutions, remote monitoring platforms, and patient-centric design features to address emerging clinical needs and market trends.

Looking ahead, collaboration, training, regulatory compliance, and value-based care will be critical success factors for tumor localization system manufacturers. By fostering interdisciplinary communication, investing in user training, prioritizing data security, and demonstrating value to healthcare stakeholders, manufacturers can capitalize on market opportunities, drive adoption, and improve patient outcomes in the fight against cancer. As the global healthcare landscape continues to evolve, tumor localization systems will remain essential tools in the diagnosis, treatment, and management of cancer, contributing to improved survival rates and enhanced quality of life for patients worldwide.

What is Tumor Localization System?

Tumor Localization System refers to advanced technologies and methodologies used to accurately identify and locate tumors within the body. These systems are crucial in guiding surgical procedures and improving treatment outcomes in oncology.

What are the key companies in the Tumor Localization System Market?

Key companies in the Tumor Localization System Market include Medtronic, Siemens Healthineers, and GE Healthcare, among others.

What are the drivers of growth in the Tumor Localization System Market?

The growth of the Tumor Localization System Market is driven by the increasing prevalence of cancer, advancements in imaging technologies, and the rising demand for minimally invasive surgical procedures.

What challenges does the Tumor Localization System Market face?

Challenges in the Tumor Localization System Market include high costs of advanced localization technologies, the need for skilled professionals, and regulatory hurdles that can delay product approvals.

What opportunities exist in the Tumor Localization System Market?

Opportunities in the Tumor Localization System Market include the development of innovative localization techniques, expansion into emerging markets, and collaborations between technology companies and healthcare providers.

What trends are shaping the Tumor Localization System Market?

Trends in the Tumor Localization System Market include the integration of artificial intelligence for enhanced accuracy, the use of real-time imaging during surgeries, and the growing focus on personalized medicine.

Tumor Localization System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ultrasound, MRI, CT Scan, Radioactive Seed Localization |

| Technology | Electromagnetic, Optical, Acoustic, Hybrid |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Application | Breast Cancer, Prostate Cancer, Lung Cancer, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies: Tumor Localization System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at