444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The fintech industry in Australia has experienced significant growth over the past decade, fueled by advancements in technology and changing consumer preferences. Fintech, short for financial technology, refers to the innovative use of technology to provide financial services and solutions. It encompasses a wide range of activities such as online banking, digital payments, lending platforms, cryptocurrency, and robo-advisors, among others.

Meaning

Fintech is reshaping the financial services landscape by introducing new business models, improving operational efficiency, and enhancing customer experiences. It leverages cutting-edge technologies like artificial intelligence, blockchain, and cloud computing to deliver faster, more accessible, and cost-effective financial solutions.

Executive Summary

The Australian fintech market has experienced robust growth in recent years, driven by factors such as increasing smartphone penetration, a tech-savvy population, supportive government regulations, and a strong startup ecosystem. The industry has attracted significant investments and has become a hotbed for innovation and entrepreneurship.

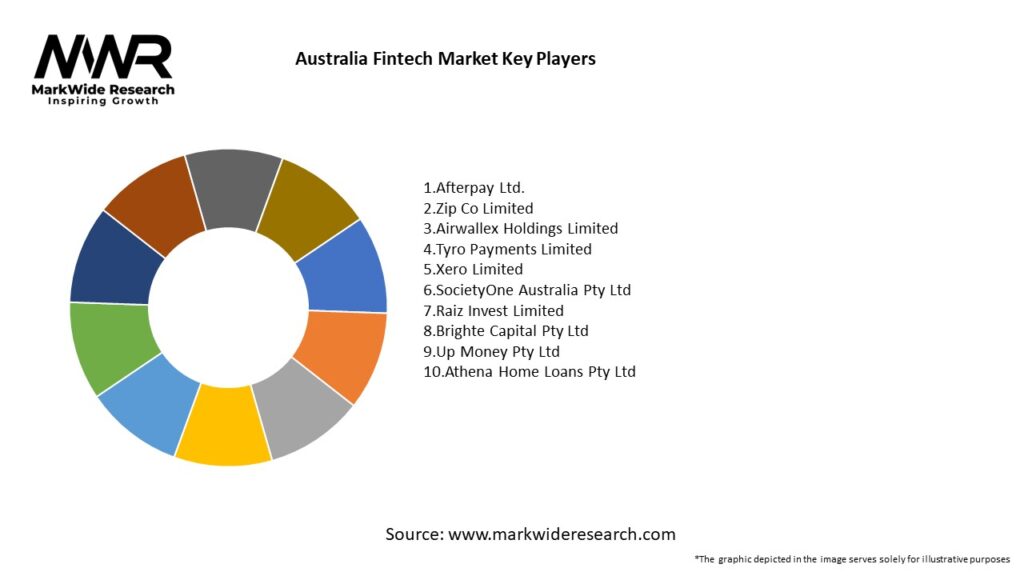

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australian fintech market is characterized by intense competition, rapid technological advancements, and evolving customer expectations. Startups, incumbent financial institutions, and technology giants are vying for market share and striving to deliver superior financial products and services. Continuous innovation, strategic partnerships, and a focus on customer-centric solutions will be key to success in this dynamic landscape.

Regional Analysis

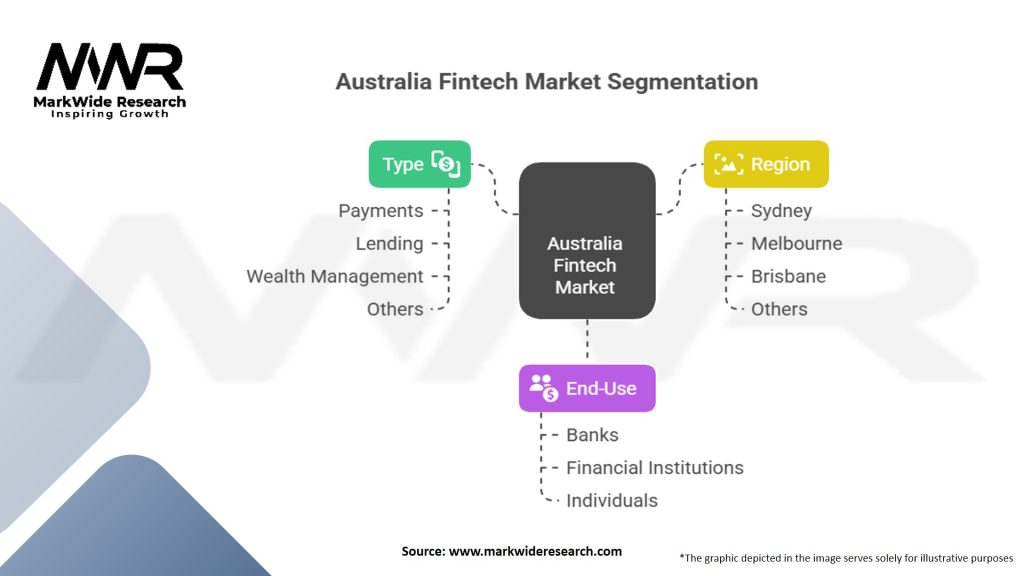

The fintech market in Australia is spread across various regions, with major hubs in Sydney, Melbourne, and Brisbane. These cities have a vibrant startup ecosystem, access to venture capital funding, and a pool of skilled professionals. However, fintech adoption is not limited to urban areas, as digital banking and payment services are gaining popularity nationwide.

Competitive Landscape

Leading Companies in the Australia Fintech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The fintech market in Australia can be segmented based on the type of services offered:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of digital financial services in Australia. Lockdowns and social distancing measures have limited in-person interactions, leading to an increased reliance on online banking, digital payments, and contactless transactions. Fintech companies have played a crucial role in providing essential financial services during these challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Australian fintech market is expected to continue its growth trajectory in the coming years. Increasing consumer adoption of digital financial services, supportive government regulations, and ongoing technological advancements will drive the industry forward. Fintech companies that can innovate, collaborate, and address customer needs will be well-positioned to thrive in this evolving landscape.

Conclusion

The Australian fintech market is a vibrant and rapidly evolving industry. It offers innovative solutions, improved customer experiences, and greater financial inclusion. Fintech companies have the opportunity to disrupt traditional financial services and shape the future of finance in Australia. With a supportive regulatory environment, a culture of innovation, and a tech-savvy population, the Australian fintech market is poised for continued growth and success.

What is the Australia Fintech?

Australia Fintech refers to the financial technology sector in Australia, which encompasses a range of innovative services and solutions that leverage technology to enhance financial services. This includes areas such as digital payments, online lending, and blockchain applications.

Who are the key players in the Australia Fintech Market?

Key players in the Australia Fintech Market include Afterpay, Zip Co, and Prospa, which are known for their contributions to payment solutions and lending services. Other notable companies include Airwallex and Xero, among others.

What are the growth factors driving the Australia Fintech Market?

The Australia Fintech Market is driven by factors such as increasing smartphone penetration, a growing preference for digital banking solutions, and the rise of e-commerce. Additionally, regulatory support for innovation in financial services plays a significant role.

What challenges does the Australia Fintech Market face?

Challenges in the Australia Fintech Market include regulatory compliance complexities, competition from traditional banks, and cybersecurity threats. These factors can hinder the growth and adoption of fintech solutions.

What opportunities exist in the Australia Fintech Market?

Opportunities in the Australia Fintech Market include the expansion of open banking, the potential for blockchain technology in various applications, and the increasing demand for personalized financial services. These trends present avenues for innovation and growth.

What trends are shaping the Australia Fintech Market?

Trends shaping the Australia Fintech Market include the rise of neobanks, the integration of artificial intelligence in financial services, and the growing focus on sustainability in fintech solutions. These trends are influencing how consumers interact with financial products.

Australia Fintech Market

| Segmentation Details | Description |

|---|---|

| Type | Payments, Lending, Wealth Management, Others |

| End-Use | Banks, Financial Institutions, Individuals |

| Region | Sydney, Melbourne, Brisbane, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia Fintech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at