444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UAE certified pre-owned car market has witnessed significant growth in recent years. Certified pre-owned (CPO) cars are vehicles that have gone through a thorough inspection and reconditioning process, ensuring their quality and reliability. These cars offer a great value proposition to buyers, as they come with warranty coverage and other benefits similar to new cars, but at a lower price point.

Meaning

Certified pre-owned cars refer to used vehicles that have been inspected, reconditioned, and certified by authorized dealers or manufacturers. These vehicles undergo a comprehensive inspection process, ensuring that they meet specific quality standards set by the manufacturer. CPO cars are typically late-model vehicles with low mileage, making them attractive options for buyers looking for a reliable and affordable vehicle.

Executive Summary

The UAE certified pre-owned car market has experienced robust growth in recent years, driven by factors such as increasing consumer demand for affordable and reliable vehicles, the availability of a wide range of CPO car options, and the convenience offered by authorized dealerships. The market has also been influenced by the rising popularity of online platforms, which provide easy access to information and facilitate the buying process for consumers.

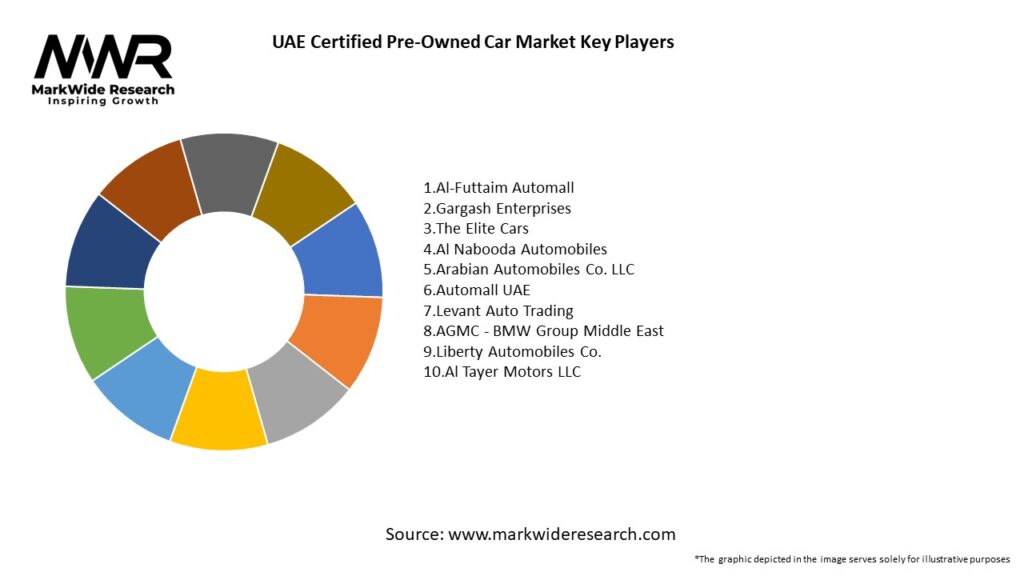

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE certified pre-owned car market is characterized by dynamic factors that influence its growth and development. These dynamics include changing consumer preferences, technological advancements, market competition, and economic conditions. Understanding and adapting to these dynamics is crucial for market players to capitalize on opportunities and overcome challenges.

Regional Analysis

The UAE certified pre-owned car market exhibits regional variations, with certain emirates and cities experiencing higher demand compared to others. Dubai and Abu Dhabi, being major economic and commercial hubs, have a significant market share due to higher consumer purchasing power and a larger population base. However, other regions, such as Sharjah, Ajman, and Ras Al Khaimah, also contribute to the market’s growth, driven by increasing awareness and a growing middle-class population.

Competitive Landscape

Leading companies in the UAE Certified Pre-Owned Car Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

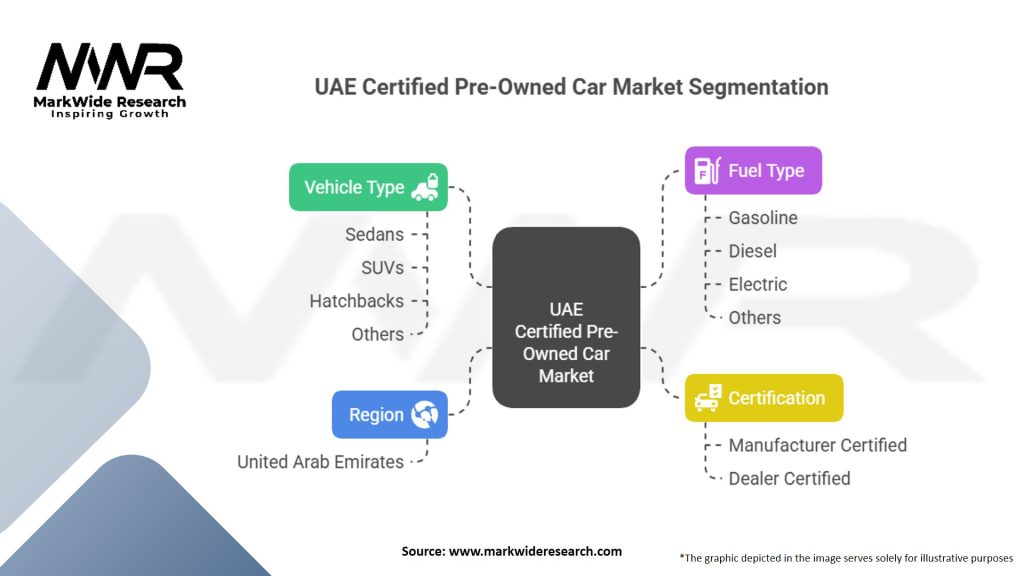

Segmentation

The UAE certified pre-owned car market can be segmented based on various factors, including vehicle type, price range, brand, and dealership type. Segmentation allows market players to target specific customer segments and tailor their offerings accordingly. Buyers can choose from a range of options, such as sedans, SUVs, luxury cars, economy vehicles, and more, based on their preferences and budget.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the UAE certified pre-owned car market. During the initial stages of the pandemic, the market experienced a decline in sales and demand due to economic uncertainties, restrictions on movement, and reduced consumer spending. However, as the situation gradually improved, the market witnessed a rebound, with buyers seeking cost-effective transportation options and a shift towards individual mobility. The market’s recovery was also supported by the increasing acceptance of online purchasing and contactless transactions, allowing buyers to complete the buying process while adhering to safety measures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the UAE certified pre-owned car market is promising. The market is expected to continue its growth trajectory, driven by factors such as increasing consumer awareness, technological advancements, and the convenience offered by online platforms. Market players who adapt to changing consumer preferences, embrace digitalization, and offer personalized experiences will likely thrive in the competitive landscape. The integration of sustainable transportation options and strategic collaborations will further contribute to the market’s expansion.

Conclusion

The UAE certified pre-owned car market has witnessed substantial growth, fueled by consumer demand for affordable and reliable vehicles. Certified pre-owned cars provide buyers with warranty coverage, quality assurance, and a wide range of options to choose from. While the market faces challenges such as limited supply and pricing barriers, opportunities lie in increasing awareness, online platforms, and integration with leasing and rental markets. The market’s future outlook remains positive, with sustained growth expected through technological advancements, enhanced customer experiences, and the incorporation of sustainable transportation options.

What is the UAE Certified Pre-Owned Car?

The UAE Certified Pre-Owned Car refers to used vehicles that have undergone a thorough inspection and refurbishment process, ensuring they meet specific quality standards. These cars typically come with warranties and are sold through authorized dealerships, providing buyers with peace of mind.

Who are the key players in the UAE Certified Pre-Owned Car Market?

Key players in the UAE Certified Pre-Owned Car Market include Al-Futtaim Automotive, Emirates Motor Company, and Al Nabooda Automobiles, among others. These companies offer a range of certified pre-owned vehicles and have established trust with consumers through quality assurance programs.

What are the growth factors driving the UAE Certified Pre-Owned Car Market?

The growth of the UAE Certified Pre-Owned Car Market is driven by increasing consumer demand for affordable vehicles, the rising cost of new cars, and a growing awareness of the benefits of certified pre-owned options. Additionally, improved financing options and warranty offerings are attracting more buyers.

What challenges does the UAE Certified Pre-Owned Car Market face?

Challenges in the UAE Certified Pre-Owned Car Market include competition from new car sales, consumer skepticism regarding vehicle history, and the need for stringent quality assurance processes. These factors can impact consumer confidence and market growth.

What opportunities exist in the UAE Certified Pre-Owned Car Market?

Opportunities in the UAE Certified Pre-Owned Car Market include the potential for online sales platforms, expanding into electric and hybrid vehicle segments, and enhancing customer service experiences. These avenues can help attract a broader customer base and increase market penetration.

What trends are shaping the UAE Certified Pre-Owned Car Market?

Trends in the UAE Certified Pre-Owned Car Market include the growing popularity of digital platforms for vehicle purchases, increased focus on sustainability with eco-friendly vehicle options, and the integration of advanced technology features in pre-owned cars. These trends are influencing consumer preferences and purchasing behaviors.

UAE Certified Pre-Owned Car Market

| Segmentation | Details |

|---|---|

| Vehicle Type | Sedans, SUVs, Hatchbacks, Others |

| Fuel Type | Gasoline, Diesel, Electric, Others |

| Certification | Manufacturer Certified, Dealer Certified |

| Region | United Arab Emirates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Certified Pre-Owned Car Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at