444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The civil aerospace simulation and training market is a crucial component of the aviation industry. It plays a pivotal role in training pilots, crew members, and ground personnel, ensuring safe and efficient operations in the civil aerospace sector. Simulation and training programs simulate real-life scenarios, enabling trainees to acquire the necessary skills and knowledge to handle various aircraft systems, emergency situations, and operational procedures. This market is witnessing significant growth due to the increasing demand for trained aviation professionals, advancements in simulation technologies, and the need for cost-effective training solutions.

Meaning

Civil aerospace simulation and training refer to the process of providing realistic training experiences to individuals involved in the civil aviation industry. It involves the use of flight simulators, virtual reality (VR) technology, computer-based training modules, and other simulation tools to recreate the operational environment of an aircraft. By simulating various scenarios, trainees can practice their skills, learn to respond to emergencies, and gain a better understanding of aviation procedures without the risks associated with real flights. This training method ensures that aviation professionals are adequately prepared to handle different situations they may encounter during their careers.

Executive Summary

The civil aerospace simulation and training market is witnessing substantial growth, driven by the rising demand for skilled aviation professionals and the need for effective training methods. Flight simulators, VR technology, and computer-based training modules are increasingly being adopted to provide realistic and immersive training experiences. These solutions offer significant cost savings compared to traditional training methods and allow trainees to develop their skills in a safe and controlled environment. The market is characterized by the presence of several key players, each offering a wide range of simulation and training solutions to meet the diverse needs of the civil aerospace industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

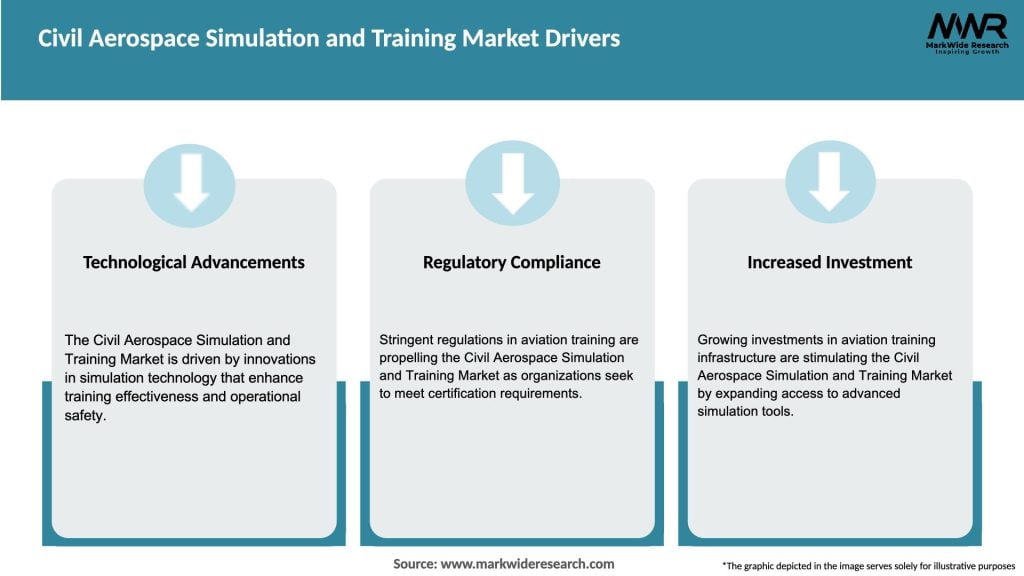

Market Drivers

The civil aerospace simulation and training market is driven by several factors that contribute to its growth and expansion. These market drivers include:

Market Restraints

While the civil aerospace simulation and training market exhibit significant growth potential, it faces certain restraints that could impede its progress. These market restraints include:

Market Opportunities

The civil aerospace simulation and training market presents several opportunities for growth and expansion. These market opportunities include:

Market Dynamics

The civil aerospace simulation and training market is driven by various dynamics that shape its growth and development. These market dynamics include technological advancements, industry regulations, market competition, and customer demands.

Technological advancements play a crucial role in driving the market forward. Continued innovations in simulation technologies, such as the development of high-fidelity flight simulators, VR integration, and AI-enabled training modules, enhance the quality and effectiveness of training programs. These advancements enable trainees to acquire practical skills and knowledge in a realistic and immersive environment.

Industry regulations and certification requirements significantly influence the market dynamics. Regulatory bodies, such as the FAA and EASA, mandate specific training standards and certifications for aviation professionals. Training providers must adhere to these regulations to ensure that their programs meet the necessary safety and operational standards. Compliance with industry regulations drives the demand for simulation and training solutions.

Market competition also shapes the dynamics of the civil aerospace simulation and training market. Key players in the market continually innovate and develop new training solutions to gain a competitive edge. This competition drives technological advancements, cost optimization, and the expansion of service offerings. Additionally, market competition leads to the customization of training programs to cater to the diverse needs of aviation organizations.

Customer demands and preferences play a vital role in shaping the market dynamics. Aviation organizations seek simulation and training programs that align with their operational requirements, fleet characteristics, and safety standards. Training providers that can offer tailored and flexible solutions are well-positioned to capitalize on customer demands and gain a competitive advantage.

Regional Analysis

The civil aerospace simulation and training market exhibit regional variations influenced by factors such as economic growth, air travel demand, and government initiatives. The market can be segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

North America is a prominent market for civil aerospace simulation and training. The region is home to several key players in the aviation industry, and the United States is one of the largest aviation markets globally. The presence of major airlines, training providers, and advanced simulation facilities contribute to the growth of the market in this region.

Europe is another significant market for civil aerospace simulation and training. The region is characterized by a well-established aviation industry and stringent regulatory standards. European training providers focus on delivering high-quality training programs that comply with the EASA regulations. The presence of leading aircraft manufacturers and aviation organizations further boosts the demand for simulation and training services.

Asia-Pacific is witnessing substantial growth in the civil aerospace industry, driven by economic development and increasing air travel. The region’s emerging markets, such as China and India, are experiencing a surge in demand for aviation professionals. This growing demand presents opportunities for simulation and training providers to cater to the training needs of the expanding aviation industry in Asia-Pacific.

Latin America and the Middle East and Africa also offer potential for market growth. These regions are witnessing significant investments in aviation infrastructure, including airports and fleet expansion. The demand for trained aviation professionals in these regions creates opportunities for simulation and training providers to establish their presence and cater to the growing market.

Competitive Landscape

Leading companies in the Civil Aerospace Simulation and Training Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

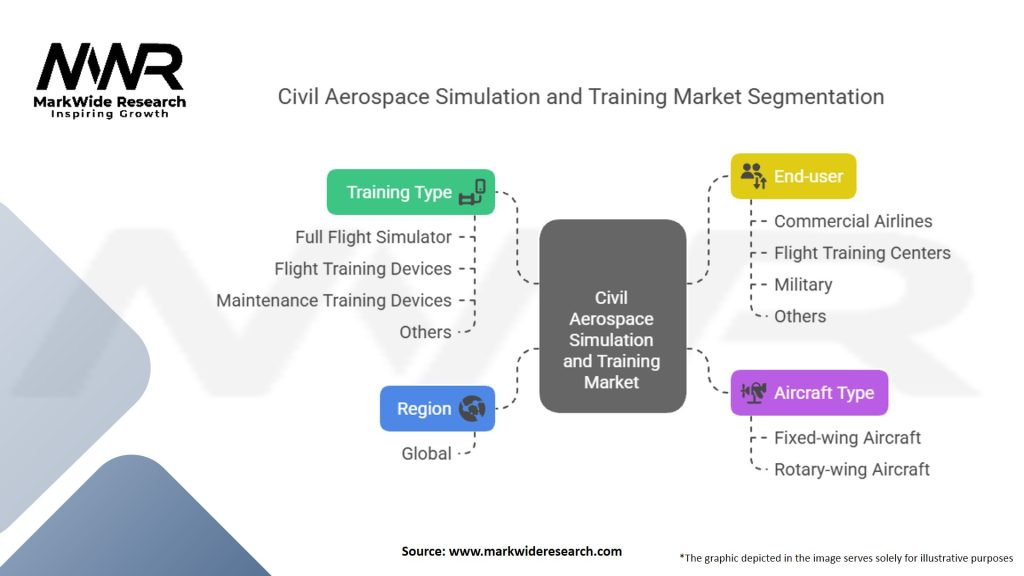

Segmentation

The civil aerospace simulation and training market can be segmented based on various factors, including training method, aircraft type, and end-user. Segmentation provides a comprehensive understanding of the market landscape and allows training providers to target specific customer segments effectively.

1. Training Method

a. Full Flight Simulators: Full flight simulators provide a realistic replica of an aircraft cockpit and replicate flight conditions, including motion, visuals, and sound. These simulators offer the highest level of fidelity and are primarily used for pilot training.

b. Virtual Reality (VR) Training: Virtual reality training involves the use of VR headsets and interactive virtual environments to simulate flight operations and emergency procedures. VR technology provides an immersive training experience and is gaining popularity in the market.

c. Computer-Based Training: Computer-based training modules involve interactive computer programs that provide theoretical knowledge and procedural training. These modules are cost-effective and can be accessed remotely.

d. Part-Task Trainers: Part-task trainers focus on specific aircraft systems or operational procedures. These trainers provide targeted training for individual components or tasks, such as engine operation or emergency evacuation procedures.

2. Aircraft Type

a. Fixed-Wing Aircraft: Training programs for fixed-wing aircraft, such as commercial airliners, business jets, and military aircraft, are in high demand. Simulation and training solutions for fixed-wing aircraft cover a wide range of aircraft models and operational scenarios.

b. Rotary-Wing Aircraft: Rotary-wing aircraft, including helicopters, require specialized training programs due to their unique flight characteristics and operational procedures. Simulation and training solutions for rotary-wing aircraft cater to the specific needs of helicopter pilots and crew members.

3. End-User

a. Airlines: Airlines are one of the major end-users of civil aerospace simulation and training services. They require training programs for pilots, cabin crew members, and ground personnel to ensure operational efficiency and safety.

b. Aviation Training Centers: Dedicated aviation training centers provide comprehensive simulation and training services to multiple aviation organizations. These training centers offer a wide range of training programs, from pilot training to cabin crew and maintenance staff training.

c. Defense Organizations: Defense organizations utilize simulation and training services for military aircraft training. These organizations require specialized training programs to prepare pilots and crew members for combat operations and emergency situations.

d. Others: Other end-users include aircraft manufacturers, maintenance, repair, and overhaul (MRO) companies, and aviation regulatory bodies. These stakeholders require simulation and training services to meet their specific training and certification requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The civil aerospace simulation and training market offers several key benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis provides an assessment of the strengths, weaknesses, opportunities, and threats in the civil aerospace simulation and training market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The civil aerospace simulation and training market is influenced by several key trends that shape its development and growth. These trends include:

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the civil aerospace simulation and training market. The aviation industry faced travel restrictions, reduced air traffic, and operational challenges, resulting in a temporary decline in the demand for simulation and training services.

The pandemic disrupted the training schedules and operations of aviation organizations. Flight restrictions and social distancing measures limited the availability of training facilities and reduced the number of training sessions conducted. In-person training programs were postponed or canceled, leading to a decrease in revenue for training providers.

However, the pandemic also accelerated the adoption of remote training solutions. Aviation organizations embraced e-learning platforms, virtual classrooms, and online modules to ensure the continuity of training during travel restrictions and lockdowns. Remote training solutions allowed trainees to access training materials, participate in interactive sessions, and practice simulations from their homes.

As the aviation industry gradually recovers from the impact of the pandemic, the demand for simulation and training services is expected to rebound. Training providers are adapting to the new normal by offering a hybrid approach, combining in-person training with remote and virtual training solutions. The focus on safety and risk mitigation has intensified, with increased emphasis on emergency procedures, health protocols, and pandemic-related scenarios in training programs.

Key Industry Developments

The civil aerospace simulation and training market have witnessed several key industry developments that have shaped its landscape. These developments include:

Analyst Suggestions

Based on market trends and developments, analysts provide the following suggestions for stakeholders in the civil aerospace simulation and training market:

Future Outlook

The future of the civil aerospace simulation and training market looks promising, driven by the increasing demand for skilled aviation professionals, technological advancements, and the need for cost-effective and efficient training solutions.

Technological innovations, such as VR training, AI integration, and mobile-based learning, will continue to transform the training landscape. These advancements will enhance the realism, interactivity, and accessibility of training programs, improving the skills and competency of aviation professionals.

The market will witness a growing emphasis on sustainability and environmental impact reduction. Training programs will incorporate fuel-efficient operations, carbon footprint reduction, and eco-friendly practices to align with global sustainability initiatives.

The recovery from the COVID-19 pandemic will further drive the market’s growth. As air travel gradually resumes and travel restrictions ease, the demand for simulation and training services will rebound, creating opportunities for training providers to expand their operations and cater to the increasing training needs of aviation organizations.

Conclusion

In conclusion, the civil aerospace simulation and training market is poised for significant growth. Technological advancements, the increasing demand for skilled aviation professionals, and the focus on safety and cost-effectiveness are driving market expansion. Stakeholders in the market should embrace innovation, customization, and collaboration to capitalize on emerging opportunities and navigate the evolving landscape successfully.

What is Civil Aerospace Simulation and Training?

Civil Aerospace Simulation and Training refers to the use of simulators and training programs designed to prepare pilots and crew for operating aircraft in a safe and efficient manner. This includes flight simulators, virtual reality training, and other educational tools that enhance the skills and knowledge of aviation professionals.

Who are the key players in the Civil Aerospace Simulation and Training Market?

Key players in the Civil Aerospace Simulation and Training Market include companies like CAE Inc., FlightSafety International, and L3Harris Technologies, which provide advanced simulation technologies and training solutions for the aviation industry, among others.

What are the main drivers of growth in the Civil Aerospace Simulation and Training Market?

The growth of the Civil Aerospace Simulation and Training Market is driven by increasing air traffic, the need for enhanced pilot training due to safety regulations, and advancements in simulation technology that improve training effectiveness and reduce costs.

What challenges does the Civil Aerospace Simulation and Training Market face?

Challenges in the Civil Aerospace Simulation and Training Market include the high costs associated with developing and maintaining advanced simulation systems, the need for continuous updates to keep pace with evolving aircraft technologies, and regulatory compliance requirements that can complicate training programs.

What opportunities exist in the Civil Aerospace Simulation and Training Market?

Opportunities in the Civil Aerospace Simulation and Training Market include the growing demand for remote and virtual training solutions, the integration of artificial intelligence in training programs, and the expansion of training services to emerging markets with increasing aviation activity.

What trends are shaping the Civil Aerospace Simulation and Training Market?

Trends in the Civil Aerospace Simulation and Training Market include the rise of immersive training technologies such as virtual and augmented reality, the shift towards more personalized training experiences, and the increasing focus on sustainability in training practices to reduce environmental impact.

Civil Aerospace Simulation and Training Market

| Segmentation | Details |

|---|---|

| Training Type | Full Flight Simulator, Flight Training Devices, Maintenance Training Devices, Others |

| Aircraft Type | Fixed-wing Aircraft, Rotary-wing Aircraft |

| End-user | Commercial Airlines, Flight Training Centers, Military, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Civil Aerospace Simulation and Training Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at