444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The military explosives market serves as a critical component of defense and security operations, encompassing the production, procurement, and utilization of explosive materials and munitions for military applications. Military explosives play a pivotal role in various defense activities, including combat operations, counter-terrorism efforts, and training exercises, contributing to national security and defense preparedness.

Meaning

Military explosives denote a broad spectrum of explosive materials and munitions specifically designed and utilized for military purposes. These explosives encompass a diverse range of ordnance, including grenades, bombs, artillery shells, and rocket-propelled grenades (RPGs), employed across land, sea, and air domains for offensive, defensive, and strategic purposes by armed forces worldwide.

Executive Summary

The military explosives market is characterized by robust demand stemming from ongoing global security threats, geopolitical tensions, and modernization initiatives undertaken by defense agencies. Despite stringent regulatory frameworks governing the production and use of military explosives, the market presents lucrative opportunities for manufacturers, suppliers, and defense contractors, albeit tempered by challenges such as safety concerns, environmental regulations, and geopolitical instability.

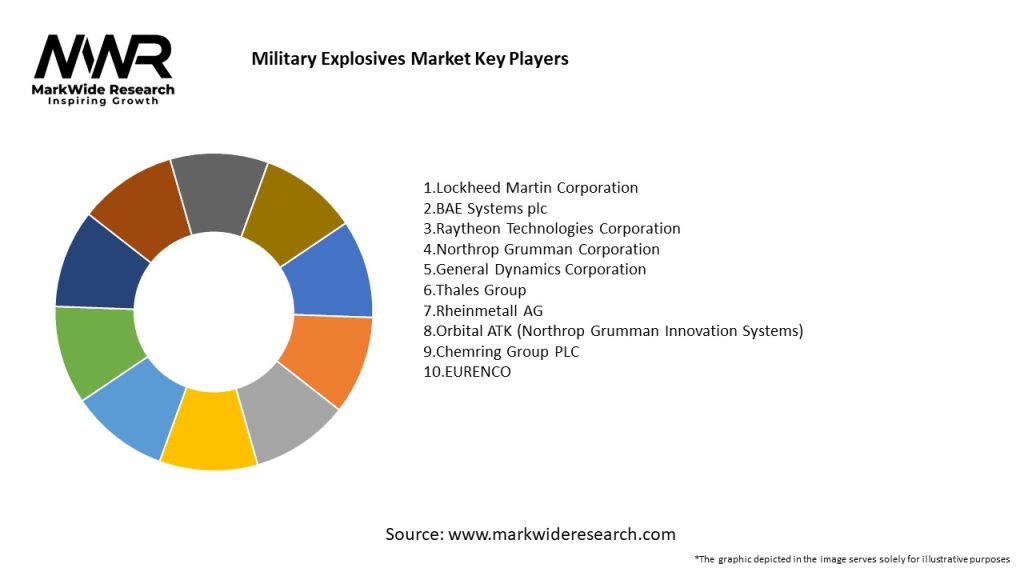

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The military explosives market operates within a dynamic landscape shaped by geopolitical, technological, regulatory, and operational factors. Market dynamics such as evolving threat landscapes, defense modernization initiatives, and technological innovation influence procurement strategies, product development cycles, and operational doctrines within the defense sector, driving market evolution and shaping industry trends.

Regional Analysis

The military explosives market exhibits regional variations influenced by geopolitical tensions, defense budgets, and strategic priorities. Notable regional dynamics include:

Competitive Landscape

Leading Companies in the Military Explosives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

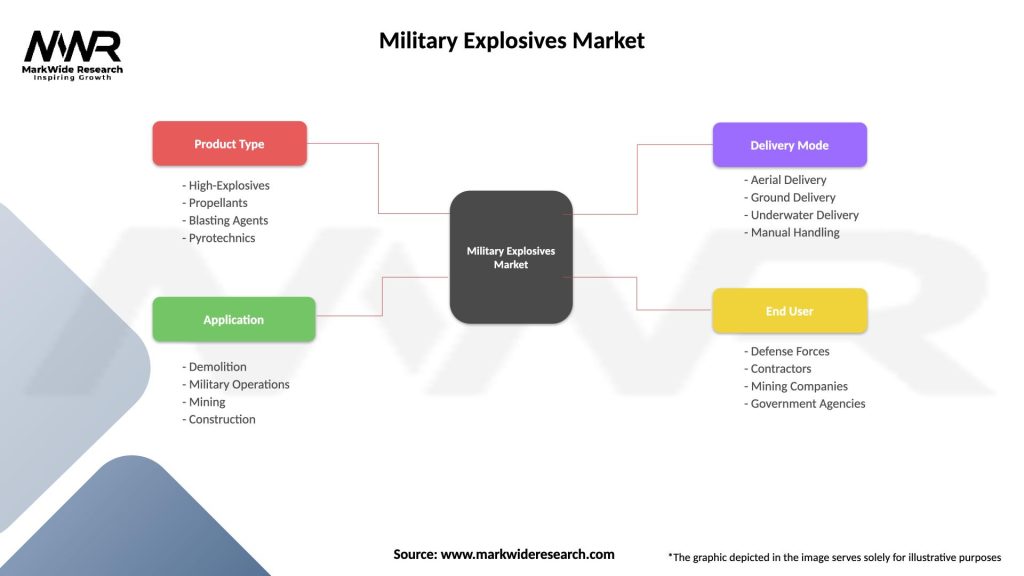

Segmentation

The military explosives market can be segmented based on various criteria, including:

Segmentation facilitates targeted marketing strategies, product development initiatives, and customer engagement efforts tailored to specific market segments and end-user requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the military explosives market derive several benefits, including:

SWOT Analysis

A SWOT analysis offers insights into the military explosives market’s:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has influenced the military explosives market in various ways:

Key Industry Developments

Analyst Suggestions

Future Outlook

The military explosives market is poised for sustained growth and innovation, driven by escalating security threats, defense modernization initiatives, and technological advancements. However, challenges such as safety concerns, environmental regulations, and budgetary constraints necessitate adaptive strategies and proactive risk management approaches. The industry’s future will be shaped by advancements in precision-guided munitions, counter-terrorism technologies, and green explosives, as well as evolving geopolitical dynamics and strategic imperatives.

Conclusion

In conclusion, the military explosives market serves as a linchpin within the global defense ecosystem, underpinning national security, deterrence, and operational effectiveness. Despite regulatory constraints and ethical considerations, the market presents lucrative opportunities for industry participants and stakeholders, fueled by technological innovation, defense modernization initiatives, and evolving threat landscapes. By embracing innovation, prioritizing safety and sustainability, and forging strategic partnerships, companies can navigate challenges and capitalize on emerging trends to achieve sustainable growth and relevance in the dynamic landscape of military explosives. Through collaborative efforts and forward-thinking strategies, the military explosives industry is poised to shape the future of defense capabilities, operational doctrines, and security paradigms on a global scale.

What is Military Explosives?

Military explosives refer to a category of materials designed for use in military applications, including munitions, demolition, and ordnance. These explosives are engineered for specific performance characteristics, such as stability, sensitivity, and detonation velocity.

What are the key players in the Military Explosives Market?

Key players in the Military Explosives Market include companies like BAE Systems, Rheinmetall AG, and Northrop Grumman. These companies are involved in the development and production of various explosive materials and systems for defense applications, among others.

What are the growth factors driving the Military Explosives Market?

The Military Explosives Market is driven by factors such as increasing defense budgets, rising geopolitical tensions, and advancements in explosive technology. Additionally, the demand for more effective and safer military munitions contributes to market growth.

What challenges does the Military Explosives Market face?

The Military Explosives Market faces challenges such as stringent regulations regarding the production and use of explosives, safety concerns, and the high costs associated with research and development. These factors can hinder market expansion and innovation.

What opportunities exist in the Military Explosives Market?

Opportunities in the Military Explosives Market include the development of environmentally friendly explosives and the integration of advanced technologies like smart munitions. Additionally, emerging markets are increasing their defense capabilities, creating new avenues for growth.

What trends are shaping the Military Explosives Market?

Trends in the Military Explosives Market include the shift towards precision-guided munitions and the use of nanotechnology in explosive formulations. Furthermore, there is a growing emphasis on sustainability and reducing the environmental impact of military operations.

Military Explosives Market

| Segmentation Details | Description |

|---|---|

| Product Type | High-Explosives, Propellants, Blasting Agents, Pyrotechnics |

| Application | Demolition, Military Operations, Mining, Construction |

| Delivery Mode | Aerial Delivery, Ground Delivery, Underwater Delivery, Manual Handling |

| End User | Defense Forces, Contractors, Mining Companies, Government Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Military Explosives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at