444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The ATM Machine Market represents a cornerstone of the global banking and financial services industry, providing convenient access to cash and banking services for consumers across the world. Automated Teller Machines (ATMs) serve as vital touchpoints for individuals to perform a variety of financial transactions, including cash withdrawals, balance inquiries, fund transfers, and bill payments. With the proliferation of digital banking channels and the increasing adoption of cashless payment methods, ATMs continue to evolve, offering enhanced functionalities, security features, and omnichannel integration. As financial institutions and independent deployers expand their ATM networks and embrace technological innovations, the ATM Machine Market remains a fundamental component of the modern banking landscape.

Meaning

ATM Machines, or Automated Teller Machines, are self-service banking terminals that enable consumers to perform various financial transactions without the need for human intervention. These machines are typically installed in banks, retail locations, airports, and other public spaces, providing convenient access to cash and banking services 24/7. ATM Machines allow users to withdraw cash, check their account balances, transfer funds between accounts, deposit checks and cash, and pay bills. They play a crucial role in facilitating banking transactions, enhancing financial inclusion, and providing convenience to consumers worldwide.

Executive Summary

The ATM Machine Market has experienced significant growth and transformation in recent years, driven by factors such as technological advancements, changing consumer preferences, and regulatory developments. This growth presents opportunities for financial institutions, ATM manufacturers, and independent deployers to expand their ATM networks, enhance service offerings, and improve customer experience. However, the market also faces challenges such as security risks, regulatory compliance, and competition from digital banking channels. Understanding the key market insights, trends, and dynamics is essential for stakeholders to navigate these challenges and capitalize on emerging opportunities effectively.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Several key insights shape the ATM Machine Market:

Market Drivers

Key drivers fueling the growth of the ATM Machine Market include:

Market Restraints

However, the market faces challenges such as:

Market Opportunities

Despite challenges, there are significant opportunities in areas like:

Market Dynamics

The ATM Machine Market operates in a dynamic environment influenced by factors such as technological advancements, regulatory changes, consumer behavior, and competitive dynamics. Adapting to these dynamics and staying abreast of emerging trends is crucial for stakeholders to remain competitive and meet the evolving needs of consumers.

Regional Analysis

Regional variations exist in the ATM Machine Market, influenced by factors such as economic conditions, banking infrastructure, regulatory environment, and consumer preferences. Key regions include:

Competitive Landscape

Leading Companies in the ATM Machine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

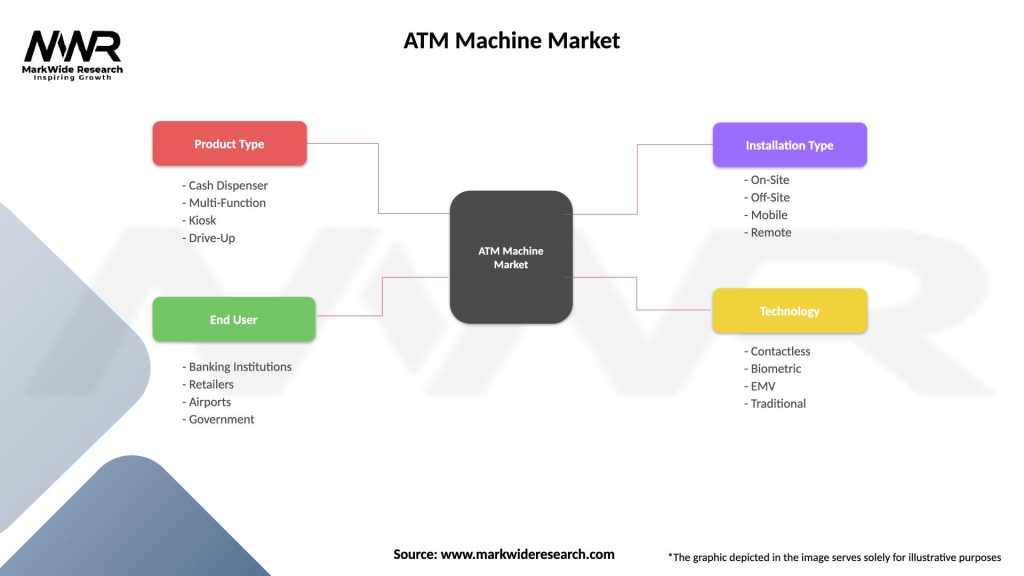

Segmentation

Segmentation based on factors such as location, ATM type, and functionality provides insights into market dynamics and consumer preferences, enabling stakeholders to tailor their offerings and services accordingly.

Category-wise Insights

Insights into different types of ATM services, functionalities, and value-added offerings highlight the diverse needs and preferences of consumers, guiding stakeholders in designing targeted solutions and service enhancements.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders benefit from:

SWOT Analysis

A SWOT analysis reveals the market’s strengths, weaknesses, opportunities, and threats, guiding stakeholders in strategic decision-making and risk management.

Market Key Trends

Trends such as the adoption of contactless payments, biometric authentication, cash recycling, and personalized banking experiences are driving innovation and shaping the future of the ATM Machine Market, enabling stakeholders to offer differentiated and value-added services to consumers.

Covid-19 Impact

The COVID-19 pandemic has underscored the importance of ATMs as essential banking infrastructure, providing access to cash and banking services during times of crisis and uncertainty. Financial institutions and ATM deployers have responded by implementing hygiene and safety measures, enhancing digital capabilities, and expanding ATM networks to meet changing consumer preferences.

Key Industry Developments

Developments such as the integration of AI and machine learning for predictive maintenance, the deployment of solar-powered ATMs in remote areas, and the emergence of blockchain-based ATM networks are reshaping the ATM Machine Market, paving the way for enhanced efficiency, accessibility, and security.

Analyst Suggestions

Suggestions for industry participants include:

Future Outlook

The ATM Machine Market is poised for continued growth driven by factors such as increasing consumer demand for convenient banking services, technological advancements in ATM technology, and the expansion of ATM networks. However, stakeholders must address challenges such as security concerns, regulatory compliance, and competition from digital banking channels to capitalize on market opportunities and sustain long-term growth.

Conclusion

In conclusion, the ATM Machine Market plays a crucial role in providing convenient access to cash and banking services for consumers worldwide. With the increasing adoption of digital banking and cashless payment methods, ATMs continue to evolve, offering enhanced functionalities, security features, and omnichannel integration. By understanding market dynamics, embracing technological innovations, and delivering exceptional value to consumers, stakeholders can navigate challenges effectively and capitalize on emerging opportunities, driving efficiency, convenience, and financial inclusion in the global banking and financial services industry.

What is ATM Machine?

An ATM Machine, or Automated Teller Machine, is a specialized computer that allows individuals to perform financial transactions, such as cash withdrawals, deposits, and balance inquiries, without the need for human assistance.

What are the key players in the ATM Machine Market?

Key players in the ATM Machine Market include NCR Corporation, Diebold Nixdorf, and GRG Banking, which are known for their innovative solutions and extensive product offerings in the ATM sector, among others.

What are the main drivers of growth in the ATM Machine Market?

The main drivers of growth in the ATM Machine Market include the increasing demand for cashless transactions, the expansion of banking services in remote areas, and advancements in ATM technology, such as contactless transactions and enhanced security features.

What challenges does the ATM Machine Market face?

The ATM Machine Market faces challenges such as the rising threat of cyberattacks, the high costs associated with maintenance and upgrades, and the growing preference for digital banking solutions over traditional cash transactions.

What opportunities exist in the ATM Machine Market?

Opportunities in the ATM Machine Market include the integration of advanced technologies like artificial intelligence for fraud detection, the potential for expanding services such as bill payments and mobile banking, and the increasing adoption of ATMs in developing regions.

What trends are shaping the ATM Machine Market?

Trends shaping the ATM Machine Market include the rise of multi-functional ATMs that offer a variety of services beyond cash withdrawal, the shift towards environmentally friendly machines, and the growing use of biometric authentication for enhanced security.

ATM Machine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cash Dispenser, Multi-Function, Kiosk, Drive-Up |

| End User | Banking Institutions, Retailers, Airports, Government |

| Installation Type | On-Site, Off-Site, Mobile, Remote |

| Technology | Contactless, Biometric, EMV, Traditional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the ATM Machine Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at