444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Asset Recovery Services Market encompasses a range of services aimed at recovering assets, both tangible and intangible, for businesses, financial institutions, governments, and individuals. Asset recovery involves the identification, location, and retrieval of assets that have been lost, stolen, misappropriated, or fraudulently obtained. These assets can include financial assets such as funds, securities, and investments, as well as physical assets such as equipment, vehicles, and real estate properties. Asset recovery services play a crucial role in mitigating financial losses, recovering stolen property, resolving disputes, and enforcing legal judgments.

Meaning

Asset recovery services refer to the professional services provided by specialized firms or agencies to locate, recover, and repatriate assets that have been lost, stolen, or unlawfully obtained. These services encompass a wide range of activities, including asset tracing, investigation, litigation support, negotiation, and recovery strategies. Asset recovery professionals utilize various techniques and tools, including forensic accounting, digital forensics, surveillance, and legal proceedings, to identify hidden assets, track their movements, and recover them on behalf of their clients. Asset recovery services are sought by individuals, businesses, financial institutions, law enforcement agencies, and governments to recover assets in cases of fraud, theft, embezzlement, bankruptcy, and financial crimes.

Executive Summary

The Asset Recovery Services Market is witnessing significant demand driven by increasing incidents of fraud, financial crimes, and asset misappropriation globally. Businesses, financial institutions, and individuals are turning to specialized asset recovery firms to recover lost assets, recover stolen property, and enforce legal judgments. Key players in the asset recovery services market are leveraging advanced technologies, data analytics, and global networks to deliver effective asset recovery solutions and drive value for their clients.

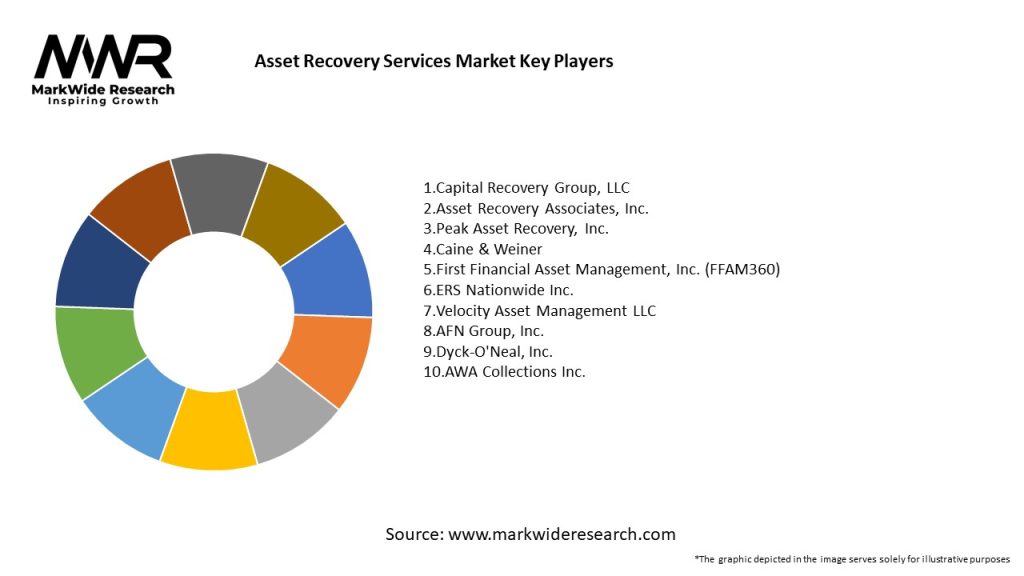

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asset Recovery Services Market operates within a dynamic and evolving landscape shaped by factors such as technological advancements, regulatory changes, market trends, and competitive dynamics. Understanding these dynamics is essential for asset recovery firms, financial institutions, and legal professionals to navigate challenges, capitalize on opportunities, and drive innovation in asset recovery efforts.

Regional Analysis

The demand for asset recovery services varies across regions, influenced by factors such as economic conditions, regulatory environment, legal framework, and prevalence of financial crimes. Developed economies such as North America and Europe witness high demand for asset recovery services due to the sophistication of financial markets and prevalence of white-collar crimes. Emerging economies in Asia Pacific, Latin America, and Middle East & Africa present growth opportunities driven by increasing incidents of fraud, corruption, and asset misappropriation.

Competitive Landscape

Leading Companies in the Asset Recovery Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

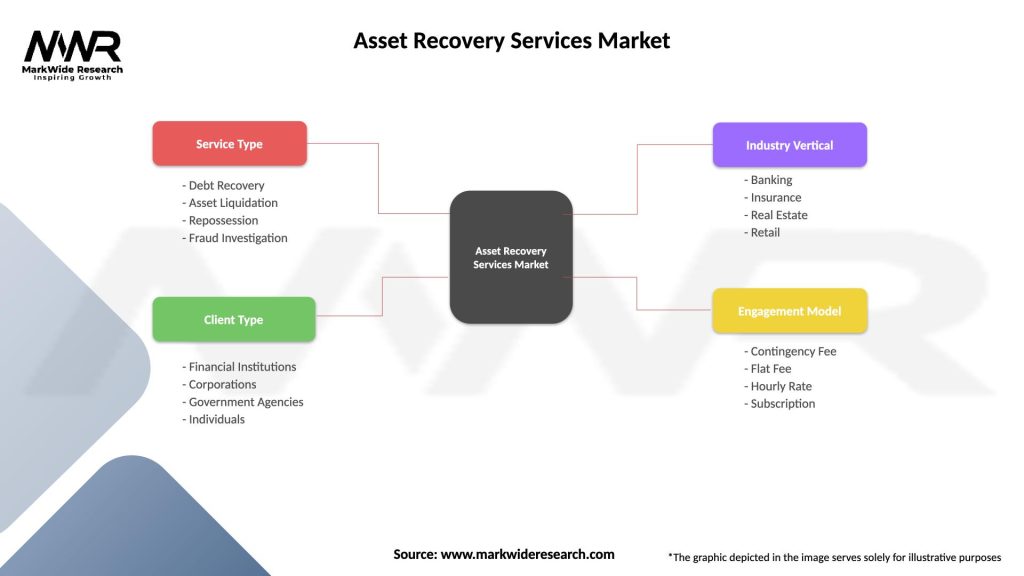

Segmentation

The Asset Recovery Services Market can be segmented based on various factors such as service type, end-user industry, and geographic region. Common segments include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Asset Recovery Services Market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the Asset Recovery Services Market reveals:

Market Key Trends

Key trends shaping the Asset Recovery Services Market include:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Asset Recovery Services Market, leading to an increase in financial crimes, fraud schemes, and asset misappropriation globally. The pandemic has created new vulnerabilities, challenges, and opportunities for asset recovery firms, as businesses, financial institutions, and individuals grapple with the economic fallout, remote work arrangements, and heightened cybersecurity risks. Asset recovery firms have adapted to the changing landscape by leveraging technology, remote investigation techniques, and global networks to continue their asset recovery efforts and support clients in recovering lost assets.

Key Industry Developments

Recent developments in the Asset Recovery Services Market include:

Analyst Suggestions

Industry analysts recommend several strategies for asset recovery firms to navigate the dynamic market landscape and drive growth:

Future Outlook

The future outlook for the Asset Recovery Services Market is positive, driven by factors such as increasing incidents of financial crimes, fraud schemes, and asset misappropriation globally. Asset recovery firms are expected to continue investing in advanced technologies, global networks, and specialized expertise to enhance asset tracing, investigation, and recovery capabilities. The market is likely to witness continued regulatory scrutiny, compliance requirements, and demand for ethical conduct in asset recovery engagements. As businesses, financial institutions, and individuals face evolving threats and challenges, the demand for professional asset recovery services is expected to remain strong, driving growth and innovation in the dynamic and rapidly evolving Asset Recovery Services Market.

Conclusion

In conclusion, the Asset Recovery Services Market plays a critical role in mitigating financial losses, recovering stolen assets, and enforcing legal judgments for businesses, financial institutions, governments, and individuals. Asset recovery firms provide a range of specialized services, including asset tracing, investigation, litigation support, and enforcement actions, leveraging advanced technologies, global networks, and specialized expertise. Despite challenges such as legal and regulatory hurdles, resource constraints, and evolving fraud schemes, the market offers significant opportunities for asset recovery firms to drive growth, innovation, and value for their clients. By staying abreast of market trends, technological advancements, and regulatory developments, asset recovery firms can navigate the dynamic market landscape, capitalize on emerging opportunities, and position themselves for success in the future.

What is Asset Recovery Services?

Asset Recovery Services refer to the processes and strategies employed to reclaim lost or misappropriated assets. These services are often utilized in sectors such as finance, real estate, and legal to recover funds or property that have been lost due to fraud, bankruptcy, or other financial discrepancies.

What are the key players in the Asset Recovery Services Market?

Key players in the Asset Recovery Services Market include companies like Kroll, Control Risks, and BAE Systems, which provide comprehensive asset recovery solutions. These firms specialize in investigations, risk management, and financial consulting, among others.

What are the main drivers of growth in the Asset Recovery Services Market?

The growth of the Asset Recovery Services Market is driven by increasing instances of financial fraud, the rising complexity of financial transactions, and the need for businesses to safeguard their assets. Additionally, regulatory pressures and the demand for transparency in financial dealings contribute to market expansion.

What challenges does the Asset Recovery Services Market face?

The Asset Recovery Services Market faces challenges such as jurisdictional issues, the complexity of international laws, and the difficulty in tracing assets across borders. These factors can hinder the recovery process and complicate legal proceedings.

What opportunities exist in the Asset Recovery Services Market?

Opportunities in the Asset Recovery Services Market include the growing demand for digital asset recovery services and the increasing need for compliance with anti-money laundering regulations. As technology evolves, firms can leverage advanced analytics and blockchain for more effective asset recovery.

What trends are shaping the Asset Recovery Services Market?

Trends in the Asset Recovery Services Market include the integration of technology such as artificial intelligence and machine learning to enhance recovery processes. Additionally, there is a growing focus on proactive asset management and risk assessment strategies to prevent asset loss.

Asset Recovery Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Debt Recovery, Asset Liquidation, Repossession, Fraud Investigation |

| Client Type | Financial Institutions, Corporations, Government Agencies, Individuals |

| Industry Vertical | Banking, Insurance, Real Estate, Retail |

| Engagement Model | Contingency Fee, Flat Fee, Hourly Rate, Subscription |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asset Recovery Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at