444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The whole of life assurance market represents a significant segment within the broader insurance industry, offering individuals comprehensive coverage for their entire lifetime. Unlike term life insurance, which provides coverage for a specific period, whole of life assurance policies guarantee a payout upon the policyholder’s death, regardless of when it occurs. These policies often include investment components, allowing policyholders to build cash value over time. The whole of life assurance market caters to individuals seeking long-term financial protection and estate planning solutions, making it a vital component of the insurance landscape.

Meaning

Whole of life assurance is a type of life insurance policy that provides coverage for the policyholder’s entire life. These policies offer guaranteed payouts to beneficiaries upon the policyholder’s death, along with a cash value component that accumulates over time. Policyholders pay premiums throughout their lifetime, with a portion of the premiums allocated to the insurance coverage and the remaining portion invested to build cash value. Whole of life assurance policies offer financial security and peace of mind to policyholders and their loved ones, serving as a valuable tool for estate planning and wealth preservation.

Executive Summary

The whole of life assurance market plays a crucial role in the insurance industry, offering individuals lifelong financial protection and estate planning solutions. These policies provide guaranteed payouts to beneficiaries, along with the opportunity to build cash value through investments. Despite the availability of alternative insurance products, such as term life insurance and universal life insurance, whole of life assurance policies remain popular among individuals seeking long-term security and stability. However, the market faces challenges such as low interest rates, regulatory changes, and evolving consumer preferences. Understanding key market trends, drivers, and challenges is essential for insurers to adapt and innovate in the whole of life assurance market.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The whole of life assurance market operates in a dynamic environment influenced by economic conditions, regulatory developments, technological advancements, and demographic trends. Insurers must adapt to changing market dynamics, consumer behaviors, and competitive pressures to remain relevant and competitive in the insurance landscape.

Regional Analysis

The whole of life assurance market exhibits regional variations in market size, growth prospects, regulatory frameworks, and consumer preferences. Developed regions such as North America, Europe, and Asia Pacific have mature insurance markets with high penetration rates and diverse product offerings. Emerging markets in Latin America, Africa, and the Middle East offer growth opportunities due to rising income levels, urbanization, and increasing awareness of insurance products.

Competitive Landscape

The whole of life assurance market is characterized by intense competition among insurers, financial institutions, and wealth management firms. Key players in the market include insurance companies such as MetLife, Prudential Financial, New York Life, and Northwestern Mutual, as well as global banks and asset managers. Competition in the market is driven by factors such as product differentiation, brand reputation, distribution channels, and customer service.

Segmentation

The whole of life assurance market can be segmented based on various factors, including policy features, coverage options, premium structures, and geographic regions. Common types of whole of life assurance policies include traditional whole life, variable life, indexed universal life, and survivorship life insurance. Policyholders can choose from a range of coverage options, riders, and investment strategies to customize their policies to meet their specific needs and objectives.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has influenced consumer behavior, economic conditions, and market dynamics in the whole of life assurance market. While the pandemic initially led to uncertainty and volatility, insurers adapted by enhancing digital capabilities, introducing flexible coverage options, and addressing customer needs remotely. The pandemic underscored the importance of financial security and protection, driving awareness and demand for whole of life assurance products.

Key Industry Developments

Analyst Suggestions

Future Outlook

The whole of life assurance market is poised for continued growth and innovation, driven by demographic trends, regulatory developments, technological advancements, and evolving consumer preferences. Insurers must adapt to changing market dynamics, customer needs, and competitive pressures to remain relevant and competitive in the insurance landscape. By embracing digital transformation, sustainable strategies, and customer-centric approaches, insurers can capitalize on emerging opportunities and drive sustainable growth in the whole of life assurance market.

Conclusion

The whole of life assurance market plays a vital role in the insurance industry, offering individuals lifelong financial protection, estate planning solutions, and investment opportunities. Despite challenges such as low interest rates, regulatory changes, and competitive pressures, whole of life assurance policies remain popular among individuals seeking long-term security and stability. Insurers must adapt to changing market dynamics, customer preferences, and regulatory requirements to remain competitive and innovative in the whole of life assurance market. By focusing on product innovation, digital transformation, sustainable strategies, and customer-centric approaches, insurers can drive growth and profitability while fulfilling their commitment to protecting and preserving financial security for policyholders and their beneficiaries.

Whole of Life Assurance Market

| Segment | Details |

|---|---|

| Type | Whole of Life Assurance |

| Coverage | Death Benefit, Cash Value, Premium Flexibility |

| Policy Options | Guaranteed Premiums, Non-Guaranteed Premiums |

| End User | Individuals, Families, High Net Worth Individuals |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

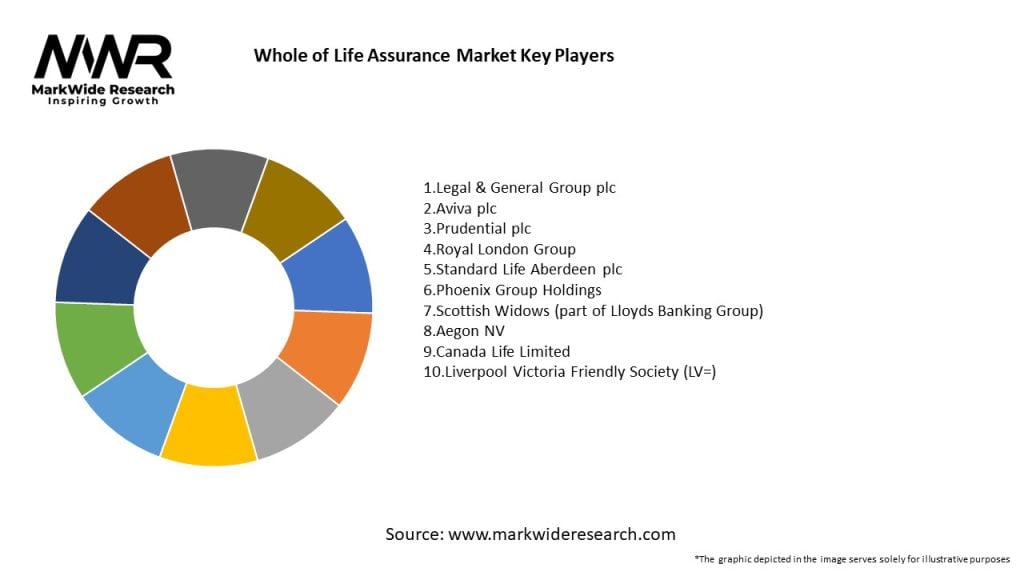

Leading Companies in the Whole of Life Assurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at