444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The banknote recycler sales market plays a pivotal role in the banking and financial services industry, offering efficient and secure solutions for cash handling and management. Banknote recyclers are sophisticated machines designed to accept, validate, store, and dispense banknotes, enabling banks, retailers, and businesses to automate cash transactions while minimizing the risks associated with manual cash handling. This market encompasses a wide range of products and services, including standalone banknote recyclers, integrated cash handling systems, maintenance and support services, and software solutions tailored to meet the diverse needs of customers.

Meaning

Banknote recyclers are advanced cash handling devices that automate the process of accepting, validating, and dispensing banknotes in various denominations. These machines are equipped with sophisticated sensors, counterfeit detection mechanisms, and storage modules to ensure accuracy, security, and efficiency in cash transactions. Banknote recyclers streamline cash handling operations for businesses, reducing labor costs, improving transaction speed, and enhancing overall operational efficiency. With the increasing digitization of payments, banknote recyclers remain indispensable for businesses and financial institutions that deal with cash-intensive operations.

Executive Summary

The banknote recycler sales market is experiencing steady growth driven by factors such as the increasing adoption of cash automation solutions, the need for improved operational efficiency, and the growing emphasis on security and compliance. This market presents lucrative opportunities for industry players, but it also faces challenges such as technological complexities, regulatory requirements, and market saturation. Understanding key market insights, drivers, and trends is crucial for businesses operating in this space to capitalize on emerging opportunities and stay competitive in a rapidly evolving landscape.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The banknote recycler sales market operates within a dynamic ecosystem influenced by factors such as technological advancements, regulatory developments, market trends, and competitive forces. Understanding these dynamics is essential for industry participants to navigate challenges, capitalize on emerging opportunities, and drive sustainable growth in the market.

Regional Analysis

The banknote recycler sales market exhibits regional variations influenced by factors such as economic conditions, regulatory environment, technological infrastructure, and cultural preferences. Key regions include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, each offering unique opportunities and challenges for market players.

Competitive Landscape

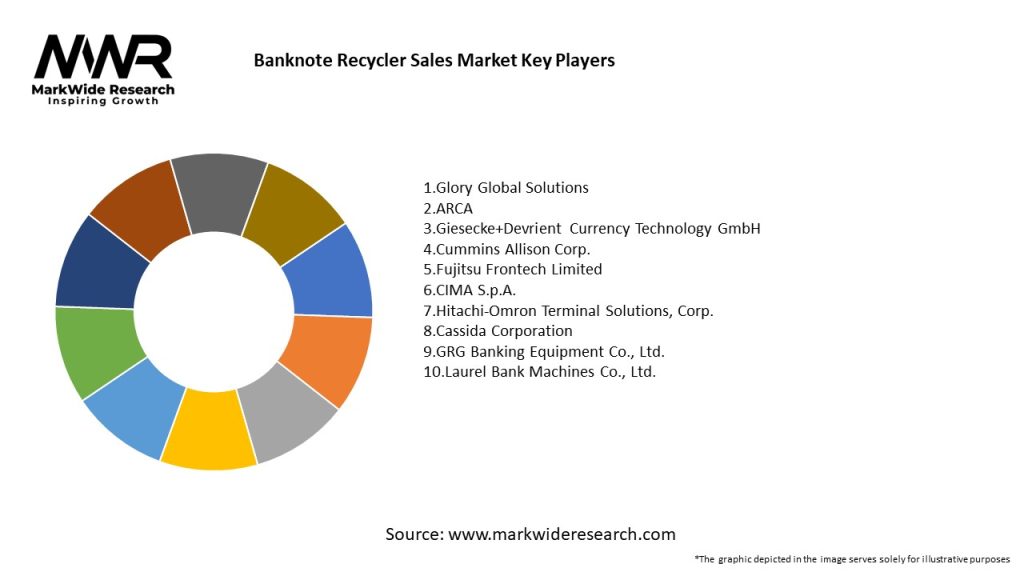

The banknote recycler sales market is characterized by intense competition among players such as manufacturers, distributors, system integrators, and service providers. Key players include Glory Global Solutions, ARCA, Cashmaster International, Giesecke+Devrient Currency Technology GmbH, and Cummins Allison Corporation, competing based on factors such as product innovation, quality, reliability, customer service, and price competitiveness.

Segmentation

The banknote recycler sales market can be segmented based on various factors such as product type, end-user industry, application, and geography, providing insights into specific market segments and customer needs. Common segments include standalone banknote recyclers, integrated cash handling systems, retail banking, commercial banking, and self-service kiosks.

Category-wise Insight

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of banknote recyclers as businesses and financial institutions prioritize hygiene, safety, and efficiency in cash handling operations. Banknote recyclers offer touch-free and automated solutions for cash transactions, reducing the risk of viral transmission and ensuring compliance with health and safety guidelines.

Key Industry Developments

Analyst Suggestions

Future Outlook

The banknote recycler sales market is poised for continued growth and innovation, driven by factors such as the increasing adoption of cash automation solutions, the expansion of digital banking services, and the growing demand for secure and efficient cash handling solutions. Industry players must adapt to changing market dynamics, capitalize on emerging opportunities, and address challenges to sustain growth and competitiveness in the future.

Conclusion

The banknote recycler sales market plays a crucial role in the banking and financial services industry, offering efficient, secure, and automated solutions for cash handling and management. Despite challenges such as technological complexity, regulatory compliance, and market saturation, the market presents significant growth opportunities driven by the increasing adoption of cash automation solutions, expansion in emerging markets, and innovation in product design and functionality. By understanding key market insights, drivers, and trends, industry players can capitalize on emerging opportunities, address challenges, and drive sustainable growth in the banknote recycler sales market.

Banknote Recycler Sales Market

| Segmentation | Details |

|---|---|

| Type | Full-Service Banknote Recyclers, Cash Recycling Modules, Cash Dispensing Modules, Others |

| End User | Banks, Retailers, Casinos, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Banknote Recycler Sales Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at