444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Medical Liability Insurance Market plays a crucial role in the healthcare industry by providing financial protection to healthcare professionals and institutions against claims of medical negligence, malpractice, errors, and omissions. This insurance coverage is essential for healthcare providers to mitigate the financial risks associated with potential lawsuits and legal liabilities arising from patient care-related incidents. The market for medical liability insurance is influenced by various factors, including regulatory changes, legal trends, healthcare practices, patient expectations, and advancements in medical technology.

Meaning

Medical liability insurance, also known as medical malpractice insurance or professional liability insurance, offers financial protection to healthcare professionals, including physicians, surgeons, nurses, dentists, and other allied healthcare professionals, as well as healthcare facilities, such as hospitals, clinics, nursing homes, and medical practices. This insurance coverage indemnifies healthcare providers against legal claims and damages arising from alleged acts of negligence, errors, or omissions in the provision of medical services, including diagnosis, treatment, surgery, and patient care.

Executive Summary

The Medical Liability Insurance Market is characterized by a complex and evolving regulatory environment, shifting legal landscapes, and increasing litigation risks for healthcare providers. While medical liability insurance is a critical component of risk management and patient safety in the healthcare industry, the market faces challenges such as rising insurance premiums, claim frequency and severity, legal reforms, and the availability and affordability of coverage for healthcare professionals and institutions. Understanding the key market dynamics, trends, and challenges is essential for stakeholders in the medical liability insurance market to navigate the complexities and make informed decisions.

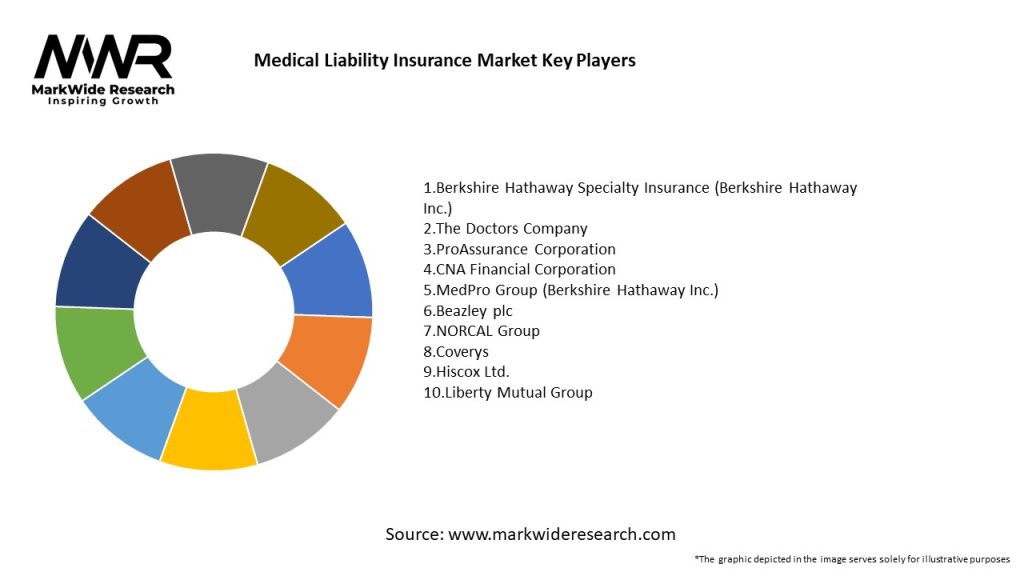

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Medical Liability Insurance Market operates in a dynamic environment shaped by various factors, including healthcare delivery models, reimbursement trends, patient demographics, medical malpractice litigation, regulatory changes, and public policy initiatives. These dynamics influence insurance pricing, underwriting standards, claims management practices, and risk mitigation strategies employed by insurers and healthcare providers.

Regional Analysis

The Medical Liability Insurance Market exhibits regional variations in insurance regulation, legal frameworks, healthcare practices, and litigation environments. While some regions may have tort reform laws, liability caps, or patient compensation funds aimed at mitigating medical malpractice risks, others may have more plaintiff-friendly legal systems, higher claims frequency, and severity, impacting insurance market dynamics and pricing.

Competitive Landscape

Leading Companies in the Medical Liability Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Medical Liability Insurance Market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Medical Liability Insurance Market, with implications for healthcare delivery, patient care, legal liability, and insurance coverage. The pandemic has highlighted the importance of medical liability insurance for healthcare providers responding to public health emergencies, delivering telemedicine services, treating COVID-19 patients, and navigating regulatory changes and liability risks associated with the pandemic response.

Key Industry Developments

Analyst Suggestions

To navigate the evolving landscape of the Medical Liability Insurance Market, healthcare providers and insurance carriers should consider the following strategic recommendations:

Future Outlook

The Medical Liability Insurance Market is expected to evolve in response to changing healthcare dynamics, legal landscapes, regulatory environments, and societal expectations for patient safety, quality of care, and access to justice. While the market faces challenges such as rising insurance costs, litigation risks, and regulatory uncertainties, it also presents opportunities for innovation, collaboration, and risk management solutions that support healthcare providers in delivering safe, effective, and patient-centered care.

Conclusion

The Medical Liability Insurance Market plays a critical role in the healthcare ecosystem by providing essential financial protection, risk management, and legal defense support to healthcare providers facing medical malpractice claims and liability risks. Despite challenges such as rising insurance premiums, legal reforms, and pandemic-related uncertainties, the market offers opportunities for insurers, healthcare providers, and industry stakeholders to innovate, collaborate, and adapt to the evolving needs of healthcare delivery, patient care, and risk management in today’s complex and dynamic healthcare environment. By leveraging technology, data analytics, risk management strategies, and legal expertise, stakeholders can navigate the complexities of medical liability insurance, enhance patient safety, mitigate liability risks, and ensure access to quality healthcare for patients worldwide.

What is Medical Liability Insurance?

Medical Liability Insurance is a type of insurance that protects healthcare professionals and organizations against claims of negligence or malpractice. It covers legal costs and damages that may arise from lawsuits related to medical services provided.

What are the key players in the Medical Liability Insurance Market?

Key players in the Medical Liability Insurance Market include companies such as The Doctors Company, MedPro Group, and CNA Financial. These companies provide various liability insurance products tailored for healthcare providers, among others.

What are the main drivers of the Medical Liability Insurance Market?

The main drivers of the Medical Liability Insurance Market include the increasing number of malpractice claims, the rising awareness of patient rights, and the growing complexity of healthcare services. These factors contribute to a higher demand for comprehensive liability coverage.

What challenges does the Medical Liability Insurance Market face?

The Medical Liability Insurance Market faces challenges such as rising premiums, regulatory changes, and the difficulty in assessing risk for new medical technologies. These challenges can impact the affordability and availability of insurance for healthcare providers.

What opportunities exist in the Medical Liability Insurance Market?

Opportunities in the Medical Liability Insurance Market include the development of tailored insurance products for telemedicine and emerging healthcare practices. Additionally, advancements in risk management and patient safety initiatives can enhance the market’s growth potential.

What trends are shaping the Medical Liability Insurance Market?

Trends shaping the Medical Liability Insurance Market include the increasing use of technology in healthcare, such as electronic health records and telehealth services, which require updated liability coverage. Furthermore, there is a growing emphasis on preventive measures and risk management strategies among healthcare providers.

Medical Liability Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | General Liability, Professional Liability, Product Liability, Cyber Liability |

| Policyholder Type | Physicians, Hospitals, Clinics, Long-term Care Facilities |

| Premium Structure | Fixed Premium, Variable Premium, Pay-as-you-go, Retrospective Rating |

| Claims Handling | Direct Settlement, Mediation, Arbitration, Litigation |

Leading Companies in the Medical Liability Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at