444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview The financial wellness program market is gaining prominence as organizations recognize the importance of employee financial health. These programs aim to educate and support individuals in managing their finances effectively, reducing financial stress, and improving overall well-being. With growing awareness of the impact of financial wellness on productivity, retention, and employee satisfaction, businesses are increasingly investing in these programs to create a more engaged and resilient workforce.

Meaning Financial wellness programs encompass a range of initiatives and resources designed to help individuals achieve financial stability and security. These programs may include financial education workshops, one-on-one coaching sessions, budgeting tools, retirement planning assistance, and access to financial benefits such as employer-sponsored retirement plans and health savings accounts. By addressing various aspects of personal finance, financial wellness programs empower individuals to make informed decisions, reduce debt, save for the future, and achieve their financial goals.

Executive Summary The financial wellness program market is experiencing rapid growth, driven by factors such as increasing employee demand for financial support, rising awareness of the impact of financial stress on productivity, and regulatory initiatives promoting financial well-being. As businesses strive to create a more inclusive and supportive work environment, financial wellness programs offer a strategic solution to address the diverse financial needs of employees and drive organizational success. Understanding the key market trends, drivers, challenges, and opportunities is essential for businesses to develop and implement effective financial wellness strategies.

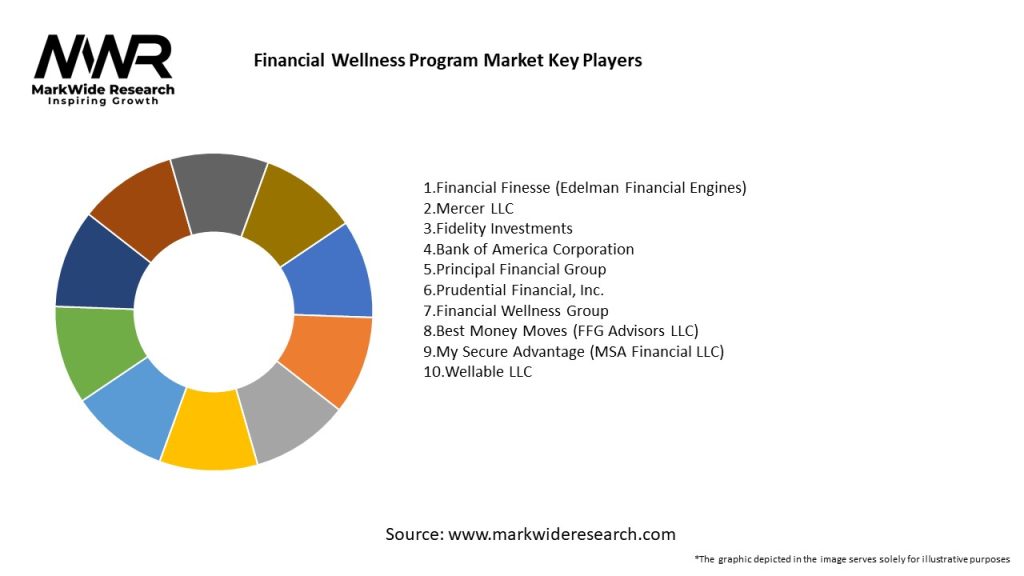

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics The financial wellness program market operates in a dynamic and evolving landscape shaped by factors such as regulatory changes, technological advancements, demographic shifts, and macroeconomic trends. Employers must adapt to these market dynamics by continuously assessing employee needs, monitoring industry developments, and evolving their financial wellness strategies to remain competitive and effective.

Regional Analysis

Competitive Landscape

Leading Companies in the Financial Wellness Program Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation The financial wellness program market can be segmented based on various factors, including:

Segmentation provides insights into the diverse needs and preferences of employees and employers and enables providers to customize and target their offerings to specific market segments effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact The COVID-19 pandemic has underscored the importance of financial wellness as individuals face unprecedented economic challenges, job insecurity, and financial uncertainty. Employers are increasingly recognizing the need to support employee financial well-being through financial wellness programs that provide resources, guidance, and support to navigate financial hardships and plan for the future effectively.

Key Industry Developments

Analyst Suggestions

Future Outlook The financial wellness program market is poised for continued growth and innovation as employers recognize the strategic importance of supporting employee financial well-being. As businesses adapt to evolving workforce dynamics, technological advancements, and regulatory changes, financial wellness programs will play an increasingly critical role in driving employee engagement, productivity, and organizational success. By investing in comprehensive, personalized, and technology-enabled financial wellness solutions, employers can create a more resilient, engaged, and productive workforce equipped to navigate the financial challenges of today and prepare for the opportunities of tomorrow.

Conclusion The financial wellness program market is witnessing significant growth and transformation as employers prioritize employee financial well-being as a strategic imperative. By offering comprehensive, personalized, and technology-enabled financial wellness programs, employers can enhance employee engagement, productivity, and satisfaction while achieving cost savings and competitive advantage. As the market continues to evolve, employers must adapt their financial wellness strategies to meet the diverse needs and preferences of their workforce and position themselves as leaders in promoting employee well-being and organizational success. By embracing innovation, collaboration, and continuous improvement, employers can build a more resilient, engaged, and financially healthy workforce capable of thriving in an increasingly complex and dynamic economic landscape.

What is Financial Wellness Program?

Financial Wellness Programs are initiatives designed to improve individuals’ financial literacy, budgeting skills, and overall financial health. These programs often include workshops, resources, and tools to help participants manage their finances effectively.

What are the key players in the Financial Wellness Program Market?

Key players in the Financial Wellness Program Market include companies like SmartDollar, Enrich, and Financial Fitness Group, which offer various financial education and wellness solutions. These companies focus on enhancing employee financial well-being through tailored programs and resources, among others.

What are the growth factors driving the Financial Wellness Program Market?

The Financial Wellness Program Market is driven by increasing employee demand for financial education, rising levels of personal debt, and a growing recognition of the importance of financial well-being in overall health. Organizations are increasingly adopting these programs to enhance employee satisfaction and productivity.

What challenges does the Financial Wellness Program Market face?

Challenges in the Financial Wellness Program Market include varying levels of employee engagement, the complexity of financial topics, and the need for personalized solutions. Additionally, measuring the effectiveness of these programs can be difficult for organizations.

What opportunities exist in the Financial Wellness Program Market?

Opportunities in the Financial Wellness Program Market include the integration of technology for personalized financial advice, the expansion of programs to underserved populations, and partnerships with financial institutions to enhance service offerings. These trends can lead to more comprehensive and accessible financial wellness solutions.

What trends are shaping the Financial Wellness Program Market?

Trends in the Financial Wellness Program Market include the increasing use of digital platforms for financial education, a focus on mental health and financial stress, and the rise of gamification in financial learning. These innovations aim to engage participants more effectively and improve financial literacy.

Financial Wellness Program Market

| Segmentation Details | Description |

|---|---|

| Service Type | Coaching, Workshops, Online Courses, Mobile Apps |

| Target Audience | Employees, Students, Retirees, Freelancers |

| Delivery Method | In-Person, Virtual, Hybrid, Self-Paced |

| Content Focus | Budgeting, Debt Management, Investment Strategies, Savings Plans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Financial Wellness Program Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at