444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Credit Scores, Credit Reports, and Credit Check Services Market serve as vital components of the financial industry, providing essential insights into individuals’ creditworthiness and financial health. These services encompass the evaluation of credit scores, generation of credit reports, and facilitation of credit checks, enabling lenders, financial institutions, and businesses to assess borrowers’ credit risk and make informed lending decisions. With the growing importance of creditworthiness in financial transactions, the market for these services has witnessed significant growth and evolution.

Meaning

Credit Scores, Credit Reports, and Credit Check Services entail the evaluation and analysis of individuals’ credit histories and financial behaviors to ascertain their creditworthiness. Credit scores, typically ranging from 300 to 850, reflect individuals’ credit risk based on factors such as payment history, credit utilization, length of credit history, and credit mix. Credit reports provide detailed summaries of individuals’ credit histories, including accounts, balances, payment history, and inquiries. Credit check services facilitate the retrieval and assessment of credit information to aid in lending decisions, rental applications, employment screenings, and other financial transactions.

Executive Summary

The Credit Scores, Credit Reports, and Credit Check Services Market have experienced substantial growth, fueled by the increasing reliance on credit assessments in financial transactions and the proliferation of digital lending platforms. This market offers a plethora of opportunities for industry participants, ranging from credit bureaus and financial institutions to fintech startups and credit monitoring services. However, challenges such as data privacy concerns, regulatory compliance, and the need for advanced analytics pose significant hurdles. Navigating these challenges and leveraging emerging trends is crucial for stakeholders to capitalize on the market’s growth potential.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The dynamics of the Credit Scores, Credit Reports, and Credit Check Services Market are influenced by various factors:

Regional Analysis

The Credit Scores, Credit Reports, and Credit Check Services Market can be segmented regionally to highlight specific trends and growth potential:

Competitive Landscape

Leading Companies in the Credit Scores, Credit Reports and Credit Check Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

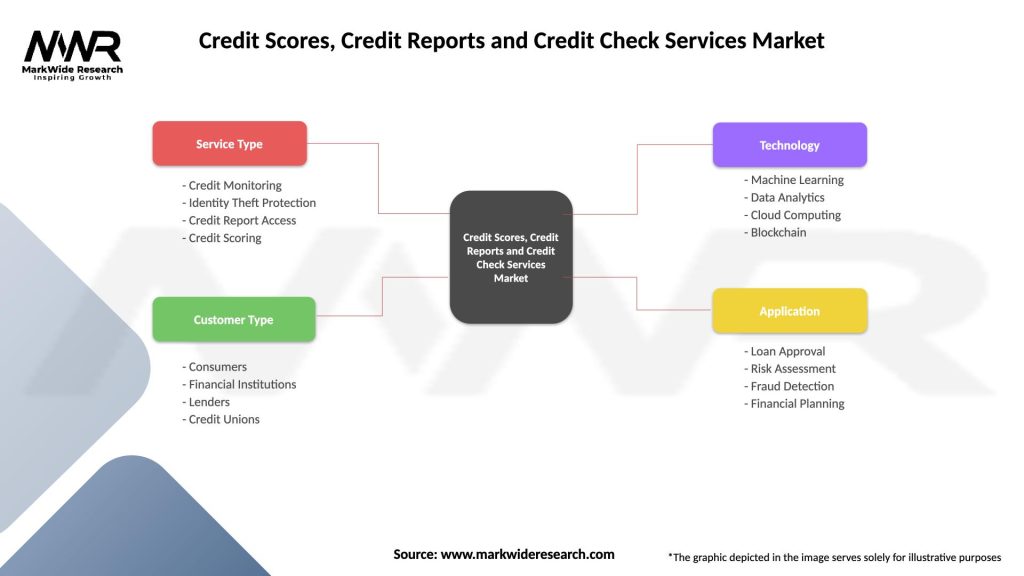

Segmentation

The Credit Scores, Credit Reports, and Credit Check Services Market can be segmented based on type, service, and end-user:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a notable impact on the Credit Scores, Credit Reports, and Credit Check Services Market. Key observations include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Credit Scores, Credit Reports, and Credit Check Services Market is poised for continued growth in the coming years. With increasing consumer awareness of credit health and ongoing technological advancements, the demand for credit-related services is expected to rise. Companies that prioritize innovation, consumer education, and data security will be well-positioned to thrive in this dynamic market. As the landscape evolves, stakeholders should remain adaptable and responsive to emerging trends and consumer needs.

Conclusion

In conclusion, the Credit Scores, Credit Reports, and Credit Check Services Market play a pivotal role in the global financial ecosystem, facilitating credit assessments, risk management, and financial inclusion. Success in this dynamic market requires a nuanced understanding of market dynamics, regulatory compliance, and technological innovation. By leveraging emerging trends, fostering consumer trust, and embracing digital transformation, industry stakeholders can navigate challenges and capitalize on the market’s growth potential, ensuring a resilient and prosperous future for the Credit Scores, Credit Reports, and Credit Check Services Market.

What is Credit Scores, Credit Reports and Credit Check Services?

Credit Scores, Credit Reports and Credit Check Services refer to the systems and processes used to assess an individual’s creditworthiness. These services provide insights into a person’s financial behavior, including their borrowing history and repayment patterns, which are crucial for lenders in making informed decisions.

What are the key players in the Credit Scores, Credit Reports and Credit Check Services Market?

Key players in the Credit Scores, Credit Reports and Credit Check Services Market include Experian, TransUnion, and Equifax, which are major credit reporting agencies. Additionally, fintech companies like Credit Karma and Mint are also significant contributors to this market, providing innovative solutions for credit monitoring and reporting, among others.

What are the main drivers of growth in the Credit Scores, Credit Reports and Credit Check Services Market?

The growth of the Credit Scores, Credit Reports and Credit Check Services Market is driven by increasing consumer awareness about credit health, the rise in digital lending platforms, and the growing need for identity verification in financial transactions. Additionally, the expansion of e-commerce and online services has heightened the demand for credit checks.

What challenges does the Credit Scores, Credit Reports and Credit Check Services Market face?

Challenges in the Credit Scores, Credit Reports and Credit Check Services Market include data privacy concerns, regulatory compliance issues, and the potential for inaccuracies in credit reporting. These factors can undermine consumer trust and complicate the credit assessment process.

What opportunities exist in the Credit Scores, Credit Reports and Credit Check Services Market?

Opportunities in the Credit Scores, Credit Reports and Credit Check Services Market include the development of advanced analytics and AI-driven solutions for more accurate credit assessments. Additionally, the growing trend of financial literacy programs presents a chance to educate consumers about credit management and improve their credit scores.

What trends are shaping the Credit Scores, Credit Reports and Credit Check Services Market?

Trends in the Credit Scores, Credit Reports and Credit Check Services Market include the increasing integration of technology in credit scoring models, the rise of alternative data sources for credit assessments, and a shift towards more consumer-centric credit reporting practices. These trends aim to enhance transparency and accessibility in credit information.

Credit Scores, Credit Reports and Credit Check Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Credit Monitoring, Identity Theft Protection, Credit Report Access, Credit Scoring |

| Customer Type | Consumers, Financial Institutions, Lenders, Credit Unions |

| Technology | Machine Learning, Data Analytics, Cloud Computing, Blockchain |

| Application | Loan Approval, Risk Assessment, Fraud Detection, Financial Planning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at