444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The actuarial service market plays a critical role in the insurance and financial sectors by providing expert analysis and risk assessment services. Actuaries use mathematical and statistical methods to evaluate financial risks, determine insurance premiums, and ensure the long-term financial stability of insurance companies, pension funds, and other financial institutions. The actuarial service market encompasses a wide range of services, including pricing and product development, reserving and financial reporting, risk management, and regulatory compliance. With the increasing complexity of financial markets and regulatory requirements, the demand for actuarial services continues to grow, driving innovation and expansion in the market.

Meaning

Actuarial services refer to the expertise and analysis provided by actuaries to assess and manage financial risks in insurance, pensions, and other financial domains. Actuaries use mathematical models, statistical techniques, and financial theory to analyze data, evaluate risks, and make informed decisions to ensure the financial stability and sustainability of insurance companies, pension funds, and other entities. These services are essential for pricing insurance products, valuing liabilities, managing investment portfolios, and complying with regulatory requirements.

Executive Summary

The actuarial service market is witnessing significant growth driven by factors such as increasing regulatory scrutiny, rising demand for risk management solutions, and growing complexity in financial markets. Actuarial services play a crucial role in helping insurance companies, pension funds, and other financial institutions navigate these challenges by providing expertise in risk assessment, financial modeling, and regulatory compliance. Key market players are innovating and expanding their service offerings to meet the evolving needs of clients and capitalize on emerging opportunities in the market.

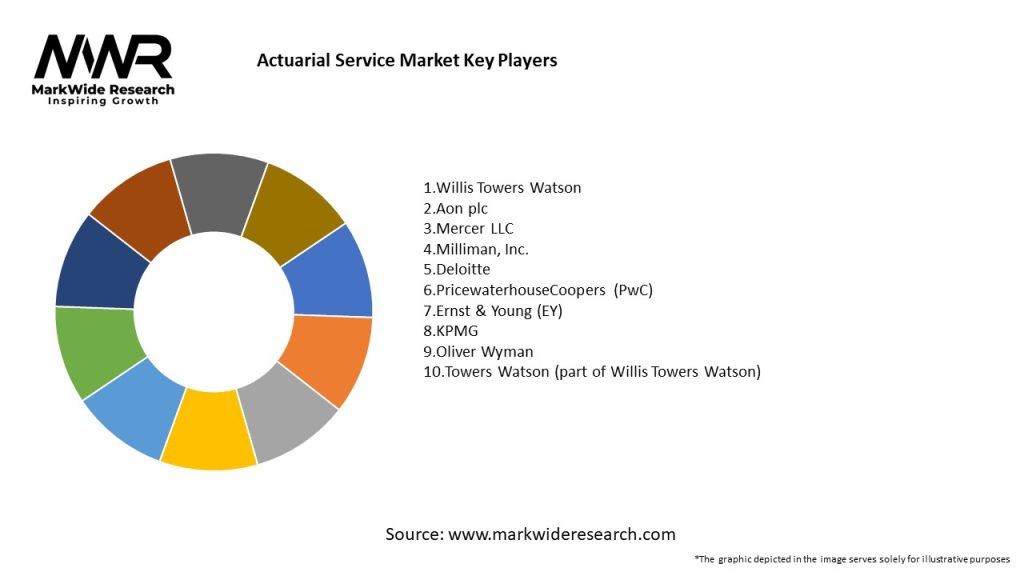

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The actuarial service market operates in a dynamic environment shaped by factors such as regulatory changes, technological advancements, economic conditions, and competitive pressures. Understanding these dynamics is essential for actuarial firms to identify opportunities, mitigate risks, and adapt their strategies to meet the evolving needs of clients and the market.

Regional Analysis

The actuarial service market exhibits regional variations in terms of market size, growth potential, regulatory frameworks, and competitive dynamics. Let’s take a closer look at some key regions:

North America: North America is a leading market for actuarial services, driven by factors such as the presence of a large insurance industry, stringent regulatory requirements, and a strong demand for risk management solutions. The United States and Canada are key markets within the region, characterized by a competitive landscape and a focus on innovation and technology adoption.

Europe: Europe is a mature market for actuarial services, with established regulatory frameworks and a strong emphasis on compliance and risk management. The European Union’s Solvency II directive and IFRS 17 standards drive demand for actuarial expertise in financial reporting, risk assessment, and regulatory compliance. Countries such as the United Kingdom, Germany, and France are key markets within the region, characterized by a high level of actuarial expertise and a competitive landscape.

Asia Pacific: The Asia Pacific region presents significant growth opportunities for actuarial services, driven by factors such as rapid economic growth, increasing insurance penetration, and evolving regulatory environments. Countries such as China, India, and Japan are key markets within the region, characterized by a growing demand for actuarial expertise in areas such as risk management, product development, and regulatory compliance.

Latin America: Latin America is an emerging market for actuarial services, with increasing demand for risk management solutions and regulatory compliance expertise. Countries such as Brazil, Mexico, and Argentina are key markets within the region, characterized by a growing insurance industry and a focus on regulatory reforms and market development.

Middle East and Africa: The Middle East and Africa present opportunities for actuarial services, driven by factors such as population growth, urbanization, and infrastructure development. Countries such as South Africa, Nigeria, and the United Arab Emirates are key markets within the region, characterized by a nascent insurance industry and a growing demand for actuarial expertise in risk management, product development, and regulatory compliance.

Competitive Landscape

Leading Companies in the Actuarial Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The actuarial service market can be segmented based on various factors such as:

Segmentation provides a more detailed understanding of market dynamics and allows actuarial firms to tailor their services to specific client needs and geographic regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the actuarial service market, highlighting the importance of risk management, regulatory compliance, and data analytics in navigating unprecedented challenges. Key impacts of COVID-19 on the market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The actuarial service market is expected to witness steady growth in the coming years, driven by factors such as increasing regulatory scrutiny, growing demand for risk management solutions, and accelerating digital transformation. Key trends such as regulatory compliance, risk management, data analytics, and product innovation will shape the future of the market. Actuarial firms that embrace digital transformation, focus on talent development, invest in regulatory compliance, and leverage partnerships and collaborations will be well-positioned to capitalize on emerging opportunities and drive industry-wide innovation.

Conclusion

In conclusion, the actuarial service market plays a crucial role in the insurance and financial sectors by providing expertise in risk assessment, regulatory compliance, and financial modeling. Actuarial services help companies navigate complex regulatory requirements, manage financial risks, and drive innovation in product development and pricing. The market is characterized by increasing demand for risk management solutions, growing regulatory scrutiny, and accelerating digital transformation. Actuarial firms that embrace digital transformation, focus on talent development, invest in regulatory compliance, and leverage partnerships and collaborations will be well-positioned to capitalize on emerging opportunities and drive industry-wide innovation in the evolving landscape of the actuarial service market.

What is Actuarial Service?

Actuarial Service refers to the application of mathematical and statistical methods to assess risk in insurance, finance, and other industries. Actuaries use these services to evaluate the likelihood of future events and their financial implications.

What are the key players in the Actuarial Service Market?

Key players in the Actuarial Service Market include companies like Milliman, Aon, and Willis Towers Watson, which provide a range of actuarial consulting services. These firms specialize in areas such as risk management, insurance, and pension planning, among others.

What are the main drivers of growth in the Actuarial Service Market?

The Actuarial Service Market is driven by increasing demand for risk assessment in insurance and finance sectors, regulatory changes requiring more robust risk management practices, and the growing complexity of financial products. Additionally, advancements in data analytics are enhancing actuarial capabilities.

What challenges does the Actuarial Service Market face?

Challenges in the Actuarial Service Market include the shortage of skilled actuaries, the need for continuous education to keep up with evolving regulations, and the pressure to adopt new technologies. These factors can impact the quality and availability of actuarial services.

What opportunities exist in the Actuarial Service Market?

Opportunities in the Actuarial Service Market include the expansion of services into emerging markets, the integration of artificial intelligence and machine learning for better predictive analytics, and the increasing focus on sustainability and ESG factors in risk assessment.

What trends are shaping the Actuarial Service Market?

Trends in the Actuarial Service Market include the growing use of big data analytics, the shift towards more personalized insurance products, and the increasing importance of climate risk modeling. These trends are influencing how actuaries approach risk assessment and service delivery.

Actuarial Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Life Insurance, Health Insurance, Pension Funds, Property & Casualty |

| Client Type | Insurance Companies, Government Agencies, Corporations, Non-Profits |

| Engagement Type | Consulting, Outsourcing, Project-Based, Retainer |

| Industry Vertical | Financial Services, Healthcare, Telecommunications, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Actuarial Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at