444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The asset tokenization platforms market represents a significant evolution in the way traditional assets are bought, sold, and managed. Asset tokenization involves the process of converting real-world assets, such as real estate, stocks, bonds, and commodities, into digital tokens that can be traded on blockchain-based platforms. These platforms leverage blockchain technology to create digital representations of assets, allowing investors to fractionalize ownership, trade assets seamlessly, and access previously illiquid markets. The asset tokenization platforms market is witnessing rapid growth, driven by the increasing demand for alternative investment opportunities, the growing adoption of blockchain technology, and the desire for greater liquidity, transparency, and efficiency in asset markets.

Meaning:

Asset tokenization platforms enable the digitization of real-world assets by representing them as digital tokens on a blockchain network. These platforms use blockchain technology to create, issue, and manage digital tokens that represent ownership rights to physical assets. Asset tokenization unlocks value by enabling fractional ownership, enhancing liquidity, and expanding access to asset markets. Investors can buy, sell, and trade digital tokens representing assets, allowing for greater flexibility, transparency, and efficiency in asset transactions.

Executive Summary:

The asset tokenization platforms market is experiencing rapid growth, driven by factors such as the increasing demand for alternative investments, the adoption of blockchain technology, and the need for greater liquidity and efficiency in asset markets. Asset tokenization platforms enable the digitization of real-world assets, allowing investors to fractionalize ownership, trade assets seamlessly, and access previously illiquid markets. These platforms offer numerous benefits, including enhanced liquidity, increased transparency, reduced transaction costs, and greater accessibility to a wider range of investors. However, challenges such as regulatory uncertainty, security concerns, and technological barriers remain significant hurdles for the market. Despite these challenges, the asset tokenization platforms market is poised for continued growth and innovation, as companies leverage blockchain technology to unlock new opportunities in the digitization of assets.

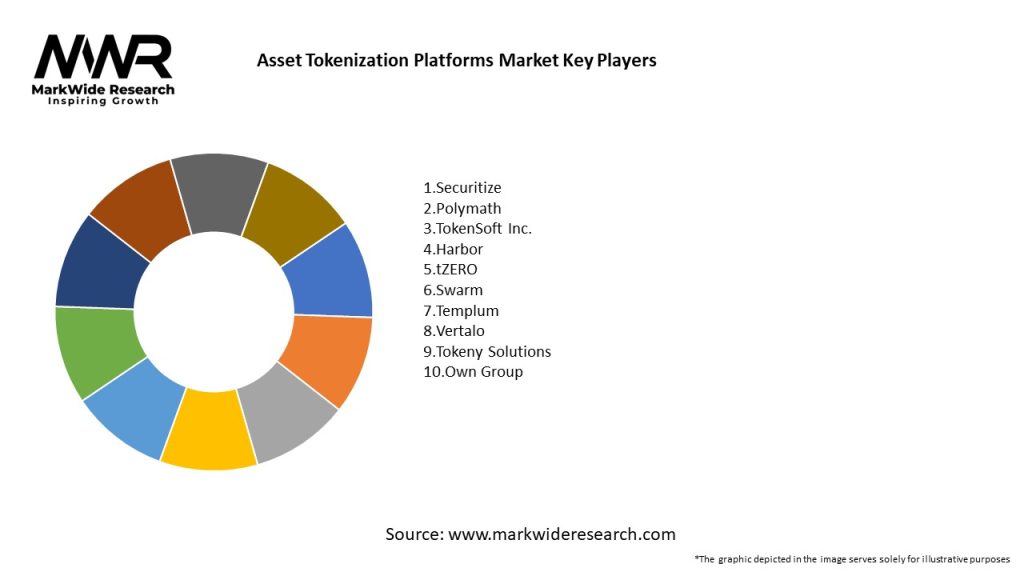

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The asset tokenization platforms market operates in a dynamic environment shaped by technological advancements, regulatory developments, market demand, and investor sentiment. These dynamics influence market participants’ behavior, investment decisions, and strategic initiatives, driving innovation, competition, and market evolution. Understanding the market dynamics is essential for asset tokenization platforms to navigate challenges, capitalize on opportunities, and maintain a competitive edge in the market.

Regional Analysis:

The asset tokenization platforms market exhibits regional variations due to differences in regulatory frameworks, market maturity, investor preferences, and technological infrastructure. Key regions in the market include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region presents unique opportunities and challenges for asset tokenization platforms, depending on factors such as market size, regulatory clarity, investor sophistication, and economic conditions.

Competitive Landscape:

Leading Companies in the Asset Tokenization Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The asset tokenization platforms market can be segmented based on various factors, including:

Segmentation provides a more granular understanding of the asset tokenization platforms market, allowing market participants to tailor their strategies and offerings to specific customer segments and market segments.

Category-wise Insight:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has accelerated the adoption of digital technologies and alternative investment opportunities, including asset tokenization platforms. The pandemic highlighted the importance of digitalization, remote access, and decentralized finance (DeFi) solutions, as investors sought alternative investment opportunities and diversified their portfolios amid market volatility and economic uncertainty. Asset tokenization platforms benefited from increased investor interest in digital assets, blockchain technology, and decentralized finance (DeFi) protocols, as market participants looked for ways to hedge against inflation, diversify risk, and preserve wealth in a rapidly changing economic landscape.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The asset tokenization platforms market is poised for significant growth and innovation in the coming years, driven by factors such as increasing demand for alternative investments, adoption of blockchain technology, and regulatory clarity. Asset tokenization platforms have the opportunity to revolutionize traditional asset markets by digitizing assets, enhancing liquidity, and democratizing access to investment opportunities. However, challenges such as regulatory uncertainty, security concerns, and technological barriers remain significant hurdles for the market. Despite these challenges, the asset tokenization platforms market is expected to continue expanding as companies leverage blockchain technology to unlock new opportunities in the digitization of assets and the evolution of decentralized finance (DeFi) ecosystems.

Conclusion:

The asset tokenization platforms market represents a significant opportunity for innovation, growth, and disruption in traditional finance. Asset tokenization platforms enable the digitization of real-world assets, allowing investors to fractionalize ownership, trade assets seamlessly, and access previously illiquid markets. These platforms offer numerous benefits, including enhanced liquidity, increased transparency, reduced transaction costs, and greater accessibility to a wider range of investors. However, challenges such as regulatory uncertainty, security concerns, and technological barriers remain significant hurdles for the market. Despite these challenges, the asset tokenization platforms market is poised for continued growth and innovation as companies leverage blockchain technology to unlock new opportunities in the digitization of assets and the evolution of decentralized finance (DeFi) ecosystems. By staying agile, adapting to market dynamics, and embracing innovation, asset tokenization platforms can thrive in the future and reshape the future of finance.

What is Asset Tokenization Platforms?

Asset tokenization platforms are digital frameworks that enable the conversion of physical and digital assets into blockchain-based tokens. These platforms facilitate the buying, selling, and trading of tokenized assets, enhancing liquidity and accessibility for investors.

What are the key players in the Asset Tokenization Platforms Market?

Key players in the Asset Tokenization Platforms Market include companies like Polymath, Securitize, and Tokeny Solutions, which provide various services for asset tokenization. These companies focus on compliance, security, and user-friendly interfaces to attract clients, among others.

What are the growth factors driving the Asset Tokenization Platforms Market?

The growth of the Asset Tokenization Platforms Market is driven by increasing demand for liquidity in traditionally illiquid assets, advancements in blockchain technology, and a growing interest in digital assets among investors. Additionally, regulatory clarity is enhancing market confidence.

What challenges does the Asset Tokenization Platforms Market face?

The Asset Tokenization Platforms Market faces challenges such as regulatory uncertainty, technological integration issues, and concerns regarding security and fraud. These factors can hinder widespread adoption and trust in tokenized assets.

What opportunities exist in the Asset Tokenization Platforms Market?

Opportunities in the Asset Tokenization Platforms Market include the potential for fractional ownership of high-value assets, expansion into emerging markets, and the development of new financial products. These factors can attract a broader range of investors and enhance market growth.

What trends are shaping the Asset Tokenization Platforms Market?

Trends shaping the Asset Tokenization Platforms Market include the rise of decentralized finance (DeFi), increased institutional interest in digital assets, and the integration of artificial intelligence for enhanced security and user experience. These trends are likely to influence the future landscape of asset tokenization.

Asset Tokenization Platforms Market

| Segmentation Details | Description |

|---|---|

| Technology | Blockchain, Smart Contracts, Distributed Ledger, Token Standards |

| Asset Type | Real Estate, Art, Commodities, Financial Instruments |

| Deployment Model | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| End User | Investors, Asset Managers, Financial Institutions, Startups |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asset Tokenization Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at