444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Litecoin Trading Market is a dynamic and evolving sector within the broader cryptocurrency ecosystem, centered around the buying, selling, and exchange of Litecoin (LTC), one of the pioneering cryptocurrencies. Litecoin, often referred to as the silver to Bitcoin’s gold, was created in 2011 by Charlie Lee and has since gained traction as a digital currency with fast transaction times and low fees. The Litecoin Trading Market encompasses various platforms, exchanges, and trading services that facilitate the buying, selling, and investment in Litecoin, catering to traders, investors, and enthusiasts worldwide.

Meaning

The Litecoin Trading Market refers to the ecosystem of platforms, exchanges, and services that enable the buying, selling, and exchange of Litecoin, a decentralized digital currency based on blockchain technology. Litecoin trading involves the exchange of Litecoin for fiat currencies (such as USD, EUR, or GBP) or other cryptocurrencies (such as Bitcoin or Ethereum) through online trading platforms or cryptocurrency exchanges. Traders and investors engage in Litecoin trading for various purposes, including investment, speculation, hedging, and remittances.

Executive Summary

The Litecoin Trading Market has experienced significant growth and evolution since the launch of Litecoin in 2011, driven by factors such as increasing adoption, technological advancements, market liquidity, and investor interest. The market offers opportunities for traders and investors to participate in the growing cryptocurrency ecosystem, diversify their investment portfolios, and capitalize on price movements in Litecoin and other digital assets. However, challenges such as regulatory uncertainty, market volatility, cybersecurity risks, and competition among trading platforms exist, requiring market participants to navigate carefully and stay informed to make informed trading decisions.

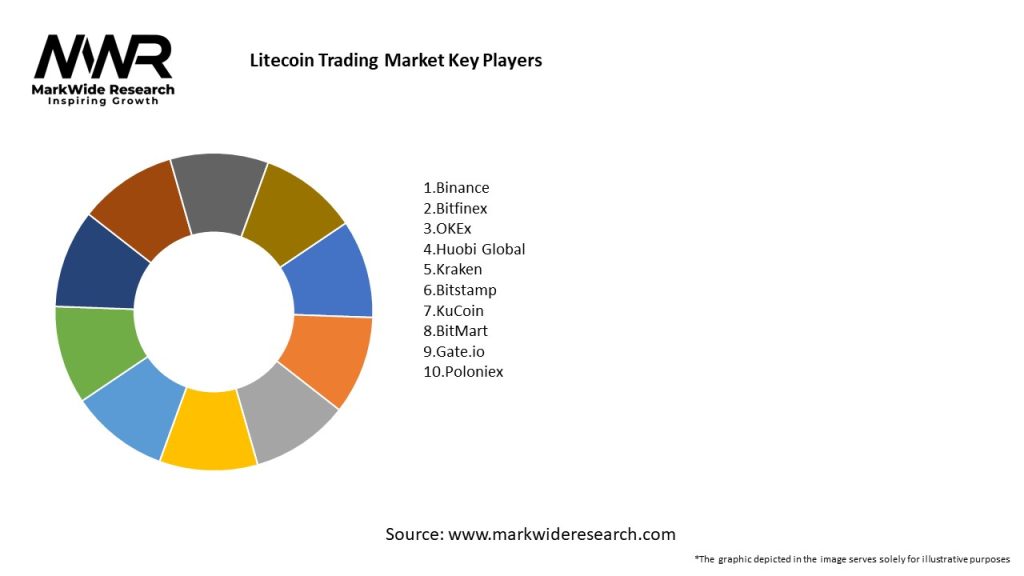

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Litecoin Trading Market operates in a dynamic and evolving environment influenced by various factors, including market sentiment, technological innovation, regulatory developments, macroeconomic trends, and investor behavior. These dynamics shape the market landscape, driving trends, opportunities, and challenges for traders, investors, and service providers in the Litecoin ecosystem.

Regional Analysis

The Litecoin Trading Market exhibits regional variations in terms of trading volumes, market infrastructure, regulatory frameworks, and investor sentiment. Major cryptocurrency trading hubs, such as the United States, Europe, Asia, and Latin America, contribute to global liquidity and trading activity in the Litecoin Trading Market, each with its unique market dynamics and characteristics.

Competitive Landscape

Leading Companies in the Litecoin Trading Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Litecoin Trading Market can be segmented based on various factors, including trading volume, geographic location, user demographics, trading pairs, and trading instruments. Segmentation provides insights into market trends, user preferences, and trading patterns, enabling market participants to tailor their strategies and services to specific market segments.

Category-wise Insights

Key Benefits for Market Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the Litecoin Trading Market provides insights into its strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had a mixed impact on the Litecoin Trading Market, with initial market volatility and uncertainty followed by increased adoption, trading activity, and institutional interest in cryptocurrencies as a hedge against economic uncertainty and inflationary pressures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Litecoin Trading Market is positive, driven by factors such as increasing adoption, technological innovation, institutional interest, and regulatory clarity. While challenges such as regulatory uncertainty, market volatility, and competition persist, opportunities for growth, innovation, and value creation abound in the dynamic and evolving cryptocurrency ecosystem.

Conclusion

The Litecoin Trading Market is a vibrant and dynamic sector within the broader cryptocurrency ecosystem, offering opportunities for traders, investors, and enthusiasts to participate in the growing digital asset economy. Despite challenges such as regulatory uncertainty, market volatility, and cybersecurity risks, the market continues to evolve and expand, driven by factors such as increasing adoption, technological innovation, and institutional interest. By staying informed, adopting risk management strategies, and taking a long-term perspective, market participants can navigate the complexities of the Litecoin Trading Market and capitalize on opportunities for growth and value creation in the digital age.

What is Litecoin Trading?

Litecoin Trading refers to the buying and selling of Litecoin, a peer-to-peer cryptocurrency that enables instant, low-cost payments to anyone in the world. It is often considered a silver to Bitcoin’s gold due to its faster transaction times and lower fees.

What are the key players in the Litecoin Trading Market?

Key players in the Litecoin Trading Market include cryptocurrency exchanges like Binance, Coinbase, and Kraken, which facilitate the trading of Litecoin. Additionally, various wallet providers and payment processors also play significant roles in the ecosystem, among others.

What factors are driving the growth of the Litecoin Trading Market?

The growth of the Litecoin Trading Market is driven by increasing adoption of cryptocurrencies for transactions, the rise of decentralized finance (DeFi) applications, and growing interest from institutional investors. Additionally, the demand for faster and cheaper transaction solutions contributes to its expansion.

What challenges does the Litecoin Trading Market face?

The Litecoin Trading Market faces challenges such as regulatory scrutiny, market volatility, and security concerns related to exchanges and wallets. These factors can impact investor confidence and the overall stability of trading activities.

What opportunities exist in the Litecoin Trading Market?

Opportunities in the Litecoin Trading Market include the potential for increased mainstream adoption, the development of new trading platforms, and innovations in blockchain technology that enhance transaction efficiency. Additionally, partnerships with traditional financial institutions could broaden its user base.

What trends are shaping the Litecoin Trading Market?

Trends shaping the Litecoin Trading Market include the rise of automated trading bots, the integration of Litecoin into payment systems, and the growing popularity of decentralized exchanges. Furthermore, the increasing focus on regulatory compliance is influencing how trading platforms operate.

Litecoin Trading Market

| Segmentation Details | Description |

|---|---|

| Trading Platform | Centralized Exchange, Decentralized Exchange, Peer-to-Peer, Over-the-Counter |

| Transaction Type | Spot Trading, Margin Trading, Futures Trading, Options Trading |

| User Type | Retail Investors, Institutional Investors, Traders, Miners |

| Payment Method | Bank Transfer, Credit Card, Cryptocurrency, E-Wallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Litecoin Trading Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at