444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Bitcoin loan market represents a niche segment within the broader cryptocurrency and lending industries, where borrowers and lenders engage in transactions using Bitcoin as collateral or payment. This market has gained traction due to the growing popularity of cryptocurrencies and the demand for alternative financial services. Bitcoin loans offer unique opportunities and challenges, making it essential to understand its dynamics, trends, and key players.

Meaning

A Bitcoin loan refers to a financial arrangement where borrowers receive funds in the form of Bitcoin from lenders, with Bitcoin used as collateral or repayment. Unlike traditional loans, which are typically issued in fiat currencies, Bitcoin loans operate within the cryptocurrency ecosystem. Borrowers pledge their Bitcoin holdings as collateral to secure the loan, providing lenders with assurance against default.

Executive Summary

The Bitcoin loan market has witnessed significant growth driven by the increasing adoption of cryptocurrencies, the need for liquidity, and the emergence of lending platforms. This market offers benefits such as decentralized lending, global accessibility, and potential returns for lenders. However, it also faces challenges related to volatility, regulatory uncertainty, and risk management.

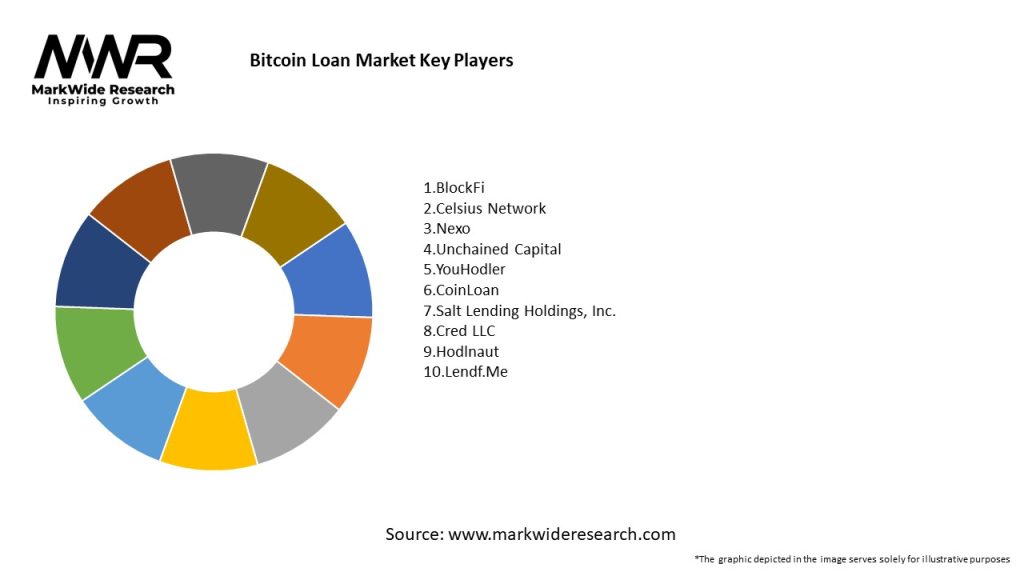

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

itating risk management strategies.

Market Opportunities

Market Dynamics

The Bitcoin loan market operates in a dynamic environment shaped by market trends, technological advancements, regulatory developments, and investor sentiment. These dynamics influence market liquidity, interest rates, loan demand, and risk factors, requiring participants to adapt and innovate continuously.

Regional Analysis

The Bitcoin loan market is global in nature, with participants from various regions engaging in lending and borrowing activities. Key regions include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each with unique market dynamics, regulatory frameworks, and adoption levels.

Competitive Landscape

Leading Companies in the Bitcoin Loan Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Bitcoin loan market can be segmented based on loan types, collateral requirements, interest rates, loan durations, and borrower profiles. Segmentation allows lenders to tailor loan offerings to specific customer segments, enhance risk management, and optimize loan portfolio diversification.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has influenced the Bitcoin loan market by increasing demand for liquidity, driving interest in alternative investments, and highlighting the importance of digital assets as financial instruments amid economic uncertainties.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Bitcoin loan market remains positive, driven by growing cryptocurrency adoption, institutional participation, technological innovations, and market maturation. Key trends such as DeFi integration, regulatory clarity, product diversification, and global expansion will shape the market’s evolution and potential for continued growth.

Conclusion

In conclusion, the Bitcoin loan market represents a dynamic and evolving sector within the cryptocurrency and financial industries, offering borrowers access to liquidity and lenders opportunities for investment returns. Despite challenges such as volatility, regulatory uncertainty, and security risks, the market continues to innovate, attract new participants, and expand its global footprint. Strategic risk management, regulatory compliance, customer-centric approaches, and technological advancements will be crucial for unlocking the full potential of the Bitcoin loan market and driving sustainable growth in the years ahead.

What is Bitcoin Loan?

Bitcoin loans are financial products that allow individuals to borrow funds using Bitcoin as collateral. This type of loan enables borrowers to access liquidity without selling their Bitcoin holdings, which can be beneficial in a volatile market.

What are the key players in the Bitcoin Loan Market?

Key players in the Bitcoin Loan Market include companies like BlockFi, Celsius Network, and Nexo, which offer various lending services and interest-earning accounts for Bitcoin holders, among others.

What are the growth factors driving the Bitcoin Loan Market?

The Bitcoin Loan Market is driven by increasing adoption of cryptocurrencies, the need for liquidity among Bitcoin holders, and the growing acceptance of digital assets by traditional financial institutions.

What challenges does the Bitcoin Loan Market face?

Challenges in the Bitcoin Loan Market include regulatory uncertainties, the volatility of Bitcoin prices, and the risk of default by borrowers, which can impact lenders’ operations.

What opportunities exist in the Bitcoin Loan Market?

Opportunities in the Bitcoin Loan Market include the potential for innovative lending products, partnerships with traditional banks, and the expansion of services to new markets and demographics.

What trends are shaping the Bitcoin Loan Market?

Trends in the Bitcoin Loan Market include the rise of decentralized finance (DeFi) platforms, increased interest in crypto-backed loans, and the integration of blockchain technology to enhance transparency and security.

Bitcoin Loan Market

| Segmentation Details | Description |

|---|---|

| Loan Type | Secured Loans, Unsecured Loans, Margin Loans, Peer-to-Peer Loans |

| Borrower Type | Retail Investors, Institutional Investors, Crypto Traders, Miners |

| Collateral Type | Bitcoin, Altcoins, Stablecoins, NFTs |

| Interest Rate Model | Fixed Rate, Variable Rate, Hybrid Rate, Dynamic Rate |

Leading Companies in the Bitcoin Loan Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at