444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Duty Drawback Service Market plays a vital role in global trade, offering businesses opportunities to recover import duties and taxes paid on imported goods that are subsequently exported or used in manufacturing for export. Duty drawback services enable companies to improve cash flow, enhance competitiveness, and maximize cost savings by leveraging duty drawback programs offered by governments worldwide.

Meaning

Duty drawback refers to the refund or exemption of customs duties, taxes, and fees paid on imported goods when those goods are exported or used in the production of exported goods. This process helps businesses remain competitive in international markets by reducing the financial burden of import tariffs and promoting export-oriented manufacturing activities.

Executive Summary

The Duty Drawback Service Market has experienced significant growth due to globalization, trade liberalization, supply chain complexities, and the increasing demand for cost-saving measures by businesses engaged in international trade. Key market players, including customs brokers, logistics providers, trade consultants, and technology firms, offer comprehensive duty drawback services to help companies navigate complex customs regulations, maximize duty refunds, and ensure compliance with trade laws.

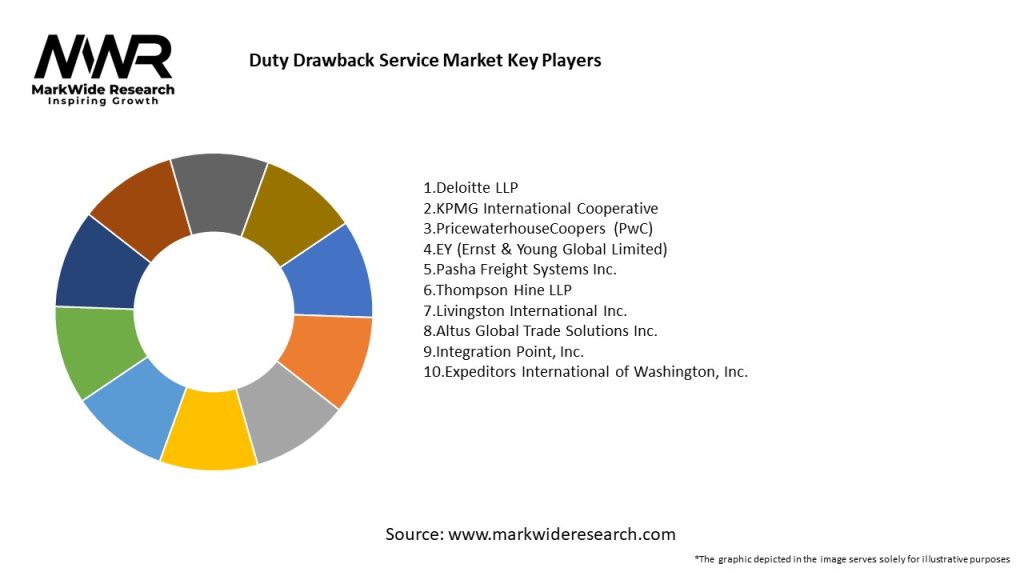

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Duty Drawback Service Market operates in a dynamic environment influenced by factors such as trade policy changes, economic trends, technological advancements, regulatory updates, geopolitical events, and industry disruptions. These dynamics shape market trends, competitive strategies, client requirements, service offerings, and market positioning for duty drawback service providers.

Regional Analysis

The Duty Drawback Service Market exhibits regional variations influenced by factors such as customs regulations, trade volumes, industry sectors, economic conditions, geopolitical factors, technological adoption, and government policies. Key regions driving market growth and opportunities include:

Market Opportunities

Market Dynamics

The Duty Drawback Service Market operates in a dynamic environment shaped by factors such as trade policies, regulatory changes, technological advancements, geopolitical developments, economic trends, and industry dynamics. Continuous innovation, agility, adaptability, and customer-centricity are essential for service providers to navigate market dynamics, seize opportunities, overcome challenges, and sustain growth.

Regional Analysis

The Duty Drawback Service Market exhibits regional variations influenced by factors such as trade volumes, industry concentrations, customs regulations, economic conditions, and geopolitical factors. Key regions driving market growth and opportunities include:

Competitive Landscape

Leading Companies in the Duty Drawback Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Duty Drawback Service Market can be segmented based on various factors, including:

Category-wise Insight

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has disrupted global trade, supply chains, and economic activities, impacting the Duty Drawback Service Market in several ways:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Duty Drawback Service Market is poised for growth and innovation, driven by factors such as digital transformation, regulatory reforms, global trade dynamics, industry collaboration, and sustainability initiatives. Key trends shaping the market’s future include:

Conclusion

The Duty Drawback Service Market is a critical enabler of global trade, helping businesses recover import duties and taxes, reduce supply chain costs, enhance competitiveness, and comply with customs regulations. Digital transformation, customized solutions, global integration, risk management, and sustainability focus are key drivers shaping the market’s future. Service providers need to embrace innovation, enhance compliance, offer value-added services, and foster industry collaboration to succeed in this dynamic and evolving market landscape. By staying agile, customer-centric, and forward-thinking, duty drawback service providers can navigate challenges, capitalize on opportunities, and drive sustainable growth in the years ahead.

What is Duty Drawback Service?

Duty Drawback Service refers to a refund of customs duties paid on imported goods that are subsequently exported or destroyed. This service is designed to encourage international trade by reducing the cost burden on exporters.

What are the key players in the Duty Drawback Service Market?

Key players in the Duty Drawback Service Market include companies like FedEx, UPS, and DHL, which provide logistics and customs brokerage services. Additionally, specialized firms such as A.N. Deringer and Livingston International also play significant roles in this sector, among others.

What are the growth factors driving the Duty Drawback Service Market?

The growth of the Duty Drawback Service Market is driven by increasing globalization of trade, the rise in e-commerce, and the need for cost-effective solutions for exporters. Additionally, favorable government policies promoting exports contribute to market expansion.

What challenges does the Duty Drawback Service Market face?

Challenges in the Duty Drawback Service Market include complex regulatory requirements, potential delays in processing refunds, and the need for accurate documentation. These factors can hinder the efficiency and attractiveness of the service for exporters.

What opportunities exist in the Duty Drawback Service Market?

Opportunities in the Duty Drawback Service Market include the development of technology-driven solutions for better tracking and management of duty drawback claims. Additionally, expanding into emerging markets presents new avenues for growth.

What trends are shaping the Duty Drawback Service Market?

Trends in the Duty Drawback Service Market include the increasing use of automation and digital platforms to streamline processes. Moreover, there is a growing emphasis on sustainability, with companies seeking to minimize their environmental impact while engaging in international trade.

Duty Drawback Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Customs Brokerage, Refund Processing, Compliance Consulting, Claims Management |

| Client Type | Manufacturers, Exporters, Importers, Logistics Providers |

| Industry Vertical | Textiles, Electronics, Pharmaceuticals, Automotive |

| Engagement Model | Project-Based, Retainer, Subscription, Ad-Hoc |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Duty Drawback Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at