444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The credit-free lease market is a segment within the leasing industry that focuses on providing accessible leasing options to individuals and businesses without requiring traditional credit checks or stringent financial qualifications. This market segment aims to bridge the gap for those who may not have a strong credit history but still need access to vehicles, equipment, or other assets through leasing arrangements.

Meaning

A credit-free lease, also known as a no-credit-check lease or non-traditional lease, allows individuals or businesses to lease assets without undergoing a rigorous credit evaluation process. Instead of relying solely on credit scores, these leases consider alternative factors such as income stability, employment history, and asset affordability to determine eligibility.

Executive Summary

The credit-free lease market has gained traction as a viable alternative for individuals and businesses facing challenges in obtaining traditional leases due to credit constraints. By offering flexible terms, simplified application processes, and customized solutions, this market segment addresses the needs of a diverse customer base and opens up opportunities for mobility and asset utilization.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The credit-free lease market operates in a dynamic environment shaped by economic trends, technological advancements, regulatory changes, and customer preferences. Adapting to market dynamics, innovating lease products, and maintaining risk management practices are critical for sustained growth and competitiveness.

Regional Analysis

Competitive Landscape

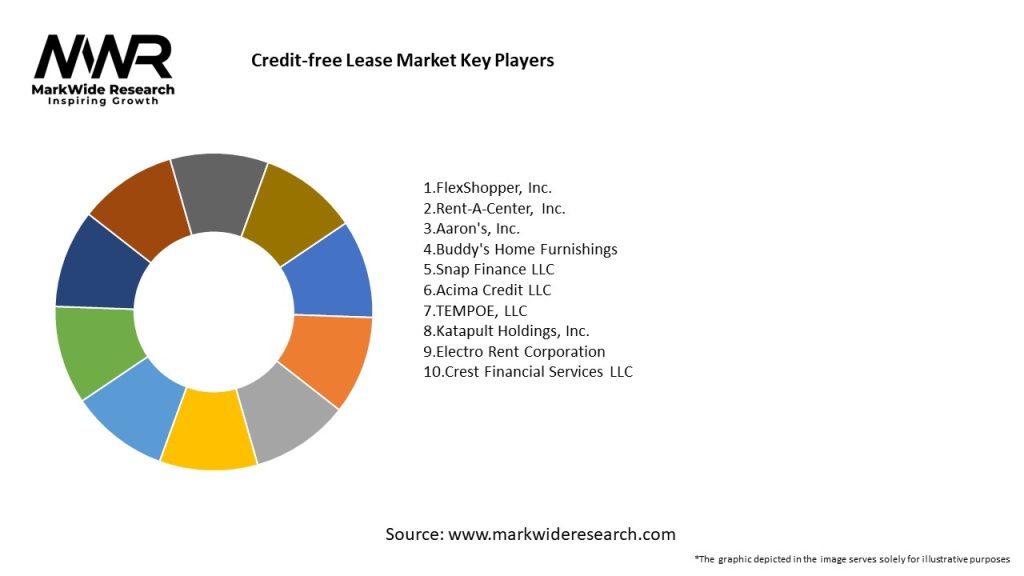

The credit-free lease market features a mix of traditional lessors, fintech startups, leasing platforms, and niche providers. Key players include:

Competitive strategies focus on offering competitive rates, enhancing customer experiences, leveraging technology for process efficiency, and expanding market reach through strategic partnerships.

Segmentation

The credit-free lease market can be segmented based on:

Segmentation enables providers to target specific markets, tailor lease offerings, and optimize portfolio management strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Customer Satisfaction: Simplified processes, transparent terms, flexible options, and responsive customer support enhance satisfaction levels and foster long-term relationships.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic influenced the credit-free lease market by:

Key Industry Developments

Analyst Suggestions

Future Outlook

The credit-free lease market is poised for continued growth, innovation, and evolution, driven by changing consumer behaviors, technological disruptions, regulatory reforms, and market dynamics. Key focus areas for the future include:

Conclusion

The credit-free lease market presents opportunities for accessible mobility, asset utilization, and financial inclusion, catering to diverse customer needs and market demands. By embracing innovation, risk management practices, customer-centricity, and strategic partnerships, industry participants can navigate challenges, capitalize on opportunities, and drive sustainable growth in a dynamic and competitive leasing landscape.

Credit-free Lease Market

| Segmentation | Details |

|---|---|

| Asset Type | Equipment Lease, Vehicle Lease, Property Lease, Others |

| End User | Businesses, Individuals |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Credit-free Lease Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at