444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The equity crowdfunding platforms market has emerged as a disruptive force in the finance industry, revolutionizing the way startups and small businesses raise capital. Equity crowdfunding platforms provide online marketplaces where entrepreneurs can pitch their business ideas to a large pool of investors, offering equity stakes in exchange for funding. This market has experienced significant growth in recent years, driven by the democratization of investment opportunities, the rise of entrepreneurial culture, and the increasing popularity of alternative finance solutions.

Meaning

Equity crowdfunding platforms enable entrepreneurs to raise capital by selling equity stakes in their businesses to a large number of investors through online platforms. Unlike traditional fundraising methods such as venture capital or bank loans, equity crowdfunding allows businesses to access capital from a diverse range of individual investors, including retail investors, accredited investors, and institutional investors. This democratization of investment opportunities has opened up new avenues for entrepreneurs to fund their ventures and for investors to diversify their investment portfolios.

Executive Summary

The equity crowdfunding platforms market is experiencing rapid growth, driven by the increasing demand for alternative finance solutions, the proliferation of startups and small businesses, and the changing regulatory landscape. These platforms offer a convenient and accessible way for entrepreneurs to raise capital and for investors to access investment opportunities in high-growth startups and early-stage companies. With the continued expansion of the market and the development of new technologies and regulatory frameworks, the future outlook for equity crowdfunding platforms remains promising.

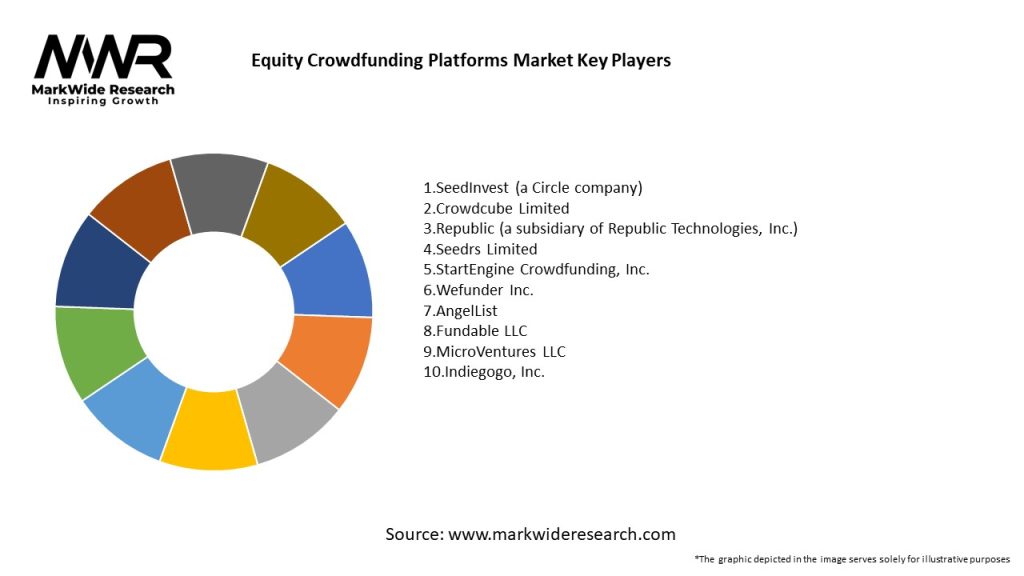

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The equity crowdfunding platforms market operates in a dynamic environment shaped by various factors, including technological advancements, regulatory developments, market trends, and investor sentiment. These dynamics influence platform adoption, fundraising activities, investor participation, and market competitiveness, driving continuous evolution and innovation in the market.

Regional Analysis

The equity crowdfunding platforms market exhibits regional variations in terms of market size, regulatory frameworks, investor behavior, and industry dynamics. While some regions have well-established crowdfunding ecosystems with supportive regulatory environments and active investor communities, others are still emerging markets with regulatory challenges and nascent crowdfunding industries.

Competitive Landscape

Leading Companies in the Equity Crowdfunding Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The equity crowdfunding platforms market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the equity crowdfunding platforms market. While the initial phase of the pandemic led to disruptions in fundraising activities, investor uncertainty, and market volatility, the equity crowdfunding market quickly rebounded as entrepreneurs and investors adapted to the new normal. The pandemic has accelerated trends such as digital transformation, remote work, and virtual fundraising, presenting new opportunities and challenges for platform operators and participants.

Key Industry Developments

Analyst Suggestions

Future Outlook

The equity crowdfunding platforms market is poised for continued growth and innovation, driven by increasing demand for alternative finance solutions, technological advancements, regulatory support, and changing investor preferences. As the market evolves, platforms will continue to play a pivotal role in facilitating capital formation, supporting entrepreneurship and innovation, and democratizing investment opportunities for a diverse range of entrepreneurs and investors.

Conclusion

The equity crowdfunding platforms market has emerged as a disruptive force in the finance industry, providing entrepreneurs with a convenient and accessible way to raise capital and investors with access to high-potential investment opportunities in startups and early-stage companies. Despite challenges such as regulatory complexity, investor education, and market volatility, the market is experiencing rapid growth and innovation, fueled by technological advancements, regulatory support, and changing market dynamics. With the continued evolution of the market and the development of new technologies and regulatory frameworks, the future outlook for equity crowdfunding platforms remains promising, offering opportunities for platform operators, entrepreneurs, investors, and regulators to participate in and shape the future of finance.

What is Equity Crowdfunding Platforms?

Equity Crowdfunding Platforms are online platforms that allow startups and small businesses to raise capital by offering equity shares to a large number of investors. This model democratizes investment opportunities, enabling individuals to invest in companies they believe in, often in exchange for ownership stakes.

What are the key players in the Equity Crowdfunding Platforms Market?

Key players in the Equity Crowdfunding Platforms Market include platforms like SeedInvest, Crowdcube, and Wefunder, which facilitate investments in various sectors such as technology, real estate, and consumer goods. These companies provide a space for entrepreneurs to connect with potential investors, among others.

What are the growth factors driving the Equity Crowdfunding Platforms Market?

The growth of the Equity Crowdfunding Platforms Market is driven by increasing entrepreneurial activity, the rise of digital finance, and a growing acceptance of alternative investment methods. Additionally, the demand for diverse funding sources among startups is contributing to market expansion.

What challenges does the Equity Crowdfunding Platforms Market face?

The Equity Crowdfunding Platforms Market faces challenges such as regulatory hurdles, investor skepticism, and the need for robust due diligence processes. These factors can hinder the growth and acceptance of crowdfunding as a viable funding option for businesses.

What opportunities exist in the Equity Crowdfunding Platforms Market?

Opportunities in the Equity Crowdfunding Platforms Market include the potential for expanding into new industries, enhancing platform technology for better user experience, and increasing awareness among investors about the benefits of equity crowdfunding. This could lead to greater participation and investment volumes.

What trends are shaping the Equity Crowdfunding Platforms Market?

Trends shaping the Equity Crowdfunding Platforms Market include the integration of blockchain technology for transparency, the rise of niche crowdfunding platforms targeting specific industries, and an increasing focus on sustainability and social impact investments. These trends are influencing how platforms operate and attract investors.

Equity Crowdfunding Platforms Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Investment-Based, Reward-Based, Donation-Based, Hybrid |

| Investor Type | Retail Investors, Accredited Investors, Institutional Investors, Angel Investors |

| Industry Vertical | Technology, Real Estate, Healthcare, Consumer Goods |

| Funding Stage | Seed Stage, Early Stage, Growth Stage, Late Stage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Equity Crowdfunding Platforms Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at