444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Letter of Credit (LC) service market plays a pivotal role in international trade finance, facilitating secure transactions between buyers and sellers across borders. A Letter of Credit is a financial instrument issued by a bank on behalf of a buyer, guaranteeing payment to the seller upon fulfillment of specified terms and conditions. This market serves as a crucial intermediary, providing risk mitigation, payment security, and financing solutions to businesses engaged in cross-border trade transactions. With globalization driving the expansion of international trade, the demand for Letter of Credit services continues to grow, making it a vital component of the global trade finance ecosystem.

Meaning

The Letter of Credit (LC) service market encompasses a range of financial services and products designed to facilitate international trade transactions by providing payment security and risk mitigation for buyers and sellers. A Letter of Credit is a written commitment from a bank to pay the seller (beneficiary) a specified amount of money upon presentation of certain documents, such as shipping documents, proving that the goods have been shipped or delivered as per the terms of the LC. LC services are used to mitigate risks associated with cross-border trade, including non-payment, delivery delays, and political or economic instability, by providing a secure mechanism for payment and ensuring compliance with agreed-upon terms and conditions.

Executive Summary

The Letter of Credit (LC) service market is a critical component of the global trade finance landscape, providing essential financial services and products to facilitate secure and efficient cross-border trade transactions. As businesses increasingly engage in international trade, the demand for LC services continues to grow, driven by factors such as globalization, expansion into new markets, and the need for payment security and risk mitigation. LC service providers play a crucial role in facilitating trade by offering a range of services, including LC issuance, confirmation, negotiation, and advisory, to help businesses navigate the complexities of international trade and ensure smooth and seamless transactions.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Letter of Credit service market operates in a dynamic and evolving landscape shaped by various factors, including economic trends, technological advancements, regulatory changes, and geopolitical developments. Understanding the market dynamics is essential for LC service providers to identify opportunities, address challenges, and adapt their strategies to drive sustainable growth and success in a competitive marketplace.

Regional Analysis

The Letter of Credit service market exhibits regional variations in terms of market size, growth rate, industry composition, and regulatory environment. While developed economies such as the United States, Europe, and Japan have mature and well-established LC markets, emerging economies in Asia-Pacific, Latin America, and Africa offer significant growth opportunities driven by rapid economic growth, increasing trade volumes, and demand for trade finance solutions.

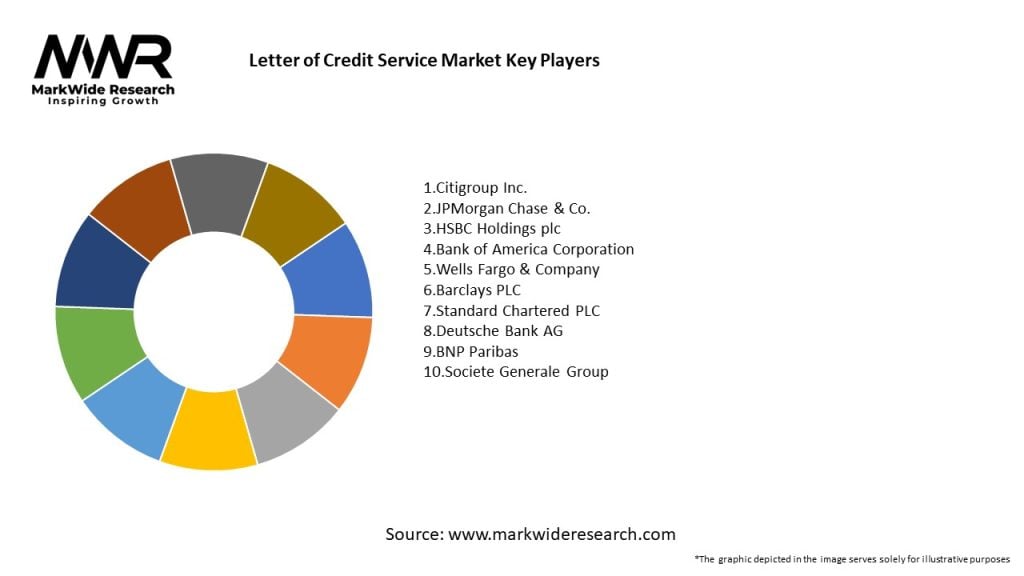

Competitive Landscape

The Letter of Credit service market is highly competitive, with a diverse array of global, regional, and local players competing for market share. Key players in the market include global banks, financial institutions, and specialized trade finance providers offering a range of LC services, including LC issuance, confirmation, negotiation, and advisory, to businesses engaged in cross-border trade transactions. The competitive landscape is characterized by factors such as service offerings, geographic coverage, industry expertise, and technological innovation.

Segmentation

The Letter of Credit service market can be segmented based on various factors, including:

Category-wise Insights

Letter of Credit services offer several key benefits for buyers and sellers engaged in cross-border trade transactions, including:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the Letter of Credit service market:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Letter of Credit service market, disrupting global trade flows, supply chains, and business operations. While the initial phase of the pandemic led to disruptions in trade activity and LC transactions, the market has rebounded, driven by pent-up demand, economic recovery efforts, and adaptation to new trade patterns and business models. The pandemic has also accelerated digital transformation initiatives, remote work solutions, and the adoption of digital LC platforms, reshaping the trade finance landscape and driving demand for innovative solutions that address evolving client needs and market dynamics.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Letter of Credit service market is positive, driven by factors such as increasing globalization, expansion of international trade, digital transformation, and sustainability initiatives. While challenges such as compliance and regulatory complexity, technological adoption barriers, and economic uncertainty remain, LC service providers that embrace digital innovation, enhance regulatory compliance, expand trade finance offerings, and integrate ESG considerations into trade transactions are well-positioned to capitalize on opportunities for growth and success in an evolving market landscape.

Conclusion

The Letter of Credit service market is a vital component of the global trade finance ecosystem, providing essential financial services and products to facilitate secure and efficient cross-border trade transactions. As businesses increasingly engage in international trade, the demand for LC services continues to grow, driven by factors such as globalization, expansion into new markets, and the need for payment security and risk mitigation. LC service providers play a crucial role in facilitating trade by offering a range of services, including LC issuance, confirmation, negotiation, and advisory, to help businesses navigate the complexities of international trade and ensure smooth and seamless transactions. By embracing digital innovation, enhancing regulatory compliance, expanding trade finance offerings, and integrating ESG considerations, LC service providers can drive sustainable growth, deliver value-added solutions, and contribute to the success and resilience of their clients in an ever-changing global trade landscape.

Letter of Credit Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Documentary Credit, Standby Credit, Transferable Credit, Revolving Credit |

| Client Type | Importers, Exporters, Banks, Financial Institutions |

| Transaction Size | Small, Medium, Large, High-Value |

| Industry Vertical | Manufacturing, Retail, Agriculture, Construction |

Leading Companies in the Letter of Credit Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at