444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The international money transfer service market is a key component of the global financial ecosystem, facilitating the seamless transfer of funds across borders. This market caters to individuals, businesses, and financial institutions seeking to send and receive money internationally for various purposes, including remittances, payments, and investments. With the increasing globalization of economies and the rise of international trade and migration, the demand for efficient, secure, and cost-effective money transfer services continues to grow, driving innovation and competition in the market.

Meaning

International money transfer services encompass a range of financial products and solutions designed to facilitate cross-border fund transfers. These services enable individuals and businesses to send money abroad or receive funds from overseas quickly and securely. International money transfer providers offer various channels for sending and receiving funds, including bank transfers, online platforms, mobile apps, and remittance networks. The market encompasses traditional financial institutions, fintech startups, money transfer operators, and digital payment platforms, offering customers a wide array of options to meet their international money transfer needs.

Executive Summary

The international money transfer service market is experiencing rapid growth, fueled by factors such as globalization, increasing cross-border transactions, and technological advancements. This market offers diverse services tailored to meet the needs of different customer segments, including expatriates, immigrants, businesses, and travelers. As demand for international money transfers continues to rise, market players are investing in innovative technologies, expanding their global networks, and enhancing customer experiences to gain a competitive edge. Despite regulatory challenges and evolving market dynamics, the international money transfer service market presents lucrative opportunities for growth and expansion.

Key Market Insights

Several key insights define the international money transfer service market:

Market Drivers

The international money transfer service market is propelled by various drivers:

Market Restraints

Several factors restrain the international money transfer service market’s growth:

Market Opportunities

Despite challenges, the international money transfer service market presents several opportunities:

Market Dynamics

The international money transfer service market operates within a dynamic environment influenced by economic conditions, regulatory changes, technological advancements, and customer preferences. These dynamics shape market trends, competitive strategies, product innovations, and customer experiences, requiring service providers to adapt and evolve to stay competitive and meet evolving customer needs.

Regional Analysis

The international money transfer service market exhibits regional variations influenced by factors such as regulatory frameworks, economic development, migrant populations, and technological infrastructure. Regional markets may have unique characteristics, opportunities, and challenges that impact service providers’ strategies and operations.

Competitive Landscape

The international money transfer service market is highly competitive, with a diverse range of players competing for market share and customer loyalty. Competitive factors include service quality, pricing, network coverage, product offerings, and customer experience. Service providers invest in branding, marketing, and customer acquisition efforts to differentiate themselves and gain a competitive edge in the market.

Segmentation

The international money transfer service market can be segmented based on various factors, including:

Segmentation enables service providers to tailor their offerings, pricing, and marketing strategies to specific customer segments and market segments, maximizing relevance and appeal to target audiences.

Category-wise Insights

Insights into different categories of international money transfer services, such as remittances, business payments, travel money, and investment transfers, provide a deeper understanding of market dynamics, customer preferences, and growth opportunities within each segment.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders benefit from international money transfer services in several ways:

SWOT Analysis

A SWOT analysis provides an overview of the international money transfer service market’s strengths, weaknesses, opportunities, and threats, guiding service providers in strategic decision-making, risk management, and market positioning.

Market Key Trends

Key trends shaping the international money transfer service market include:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the international money transfer service market, leading to changes in consumer behavior, migration patterns, and economic conditions. The pandemic highlighted the importance of digital channels for money transfers, accelerated the adoption of contactless payments, and underscored the resilience of formal remittance channels in times of crisis.

Key Industry Developments

Industry developments, such as strategic partnerships, product innovations, regulatory reforms, and market expansions, shape the international money transfer service market’s evolution and future direction. Service providers adapt to changing market dynamics and customer needs by leveraging technology, expanding their global networks, and enhancing customer experiences to drive growth and profitability.

Analyst Suggestions

Industry analysts suggest several strategies for international money transfer service providers to navigate market challenges and capitalize on growth opportunities:

Future Outlook

The future outlook for the international money transfer service market is positive, driven by globalization, digitalization, regulatory reforms, and changing consumer preferences. Service providers that embrace innovation, adapt to market trends, and prioritize customer-centric strategies are well-positioned to capitalize on growth opportunities and succeed in a dynamic and competitive market landscape.

Conclusion

In conclusion, the international money transfer service market plays a critical role in facilitating cross-border transactions, supporting economic development, and promoting financial inclusion. As globalization, digitalization, and regulatory reforms reshape the financial landscape, international money transfer service providers must innovate, adapt, and collaborate to meet evolving customer needs and market demands. By embracing digital innovation, ensuring regulatory compliance, enhancing customer experiences, and expanding market reach, service providers can drive growth, profitability, and positive social impact in a rapidly evolving global economy.

International Money Transfer Service Market

| Segmentation | Details |

|---|---|

| Type of Transfer | Bank Transfer, Online Money Transfer, Cash Transfer, Others |

| Channel | Banks, Money Transfer Operators (MTOs), Online Platforms, Others |

| End User | Individuals, Businesses |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

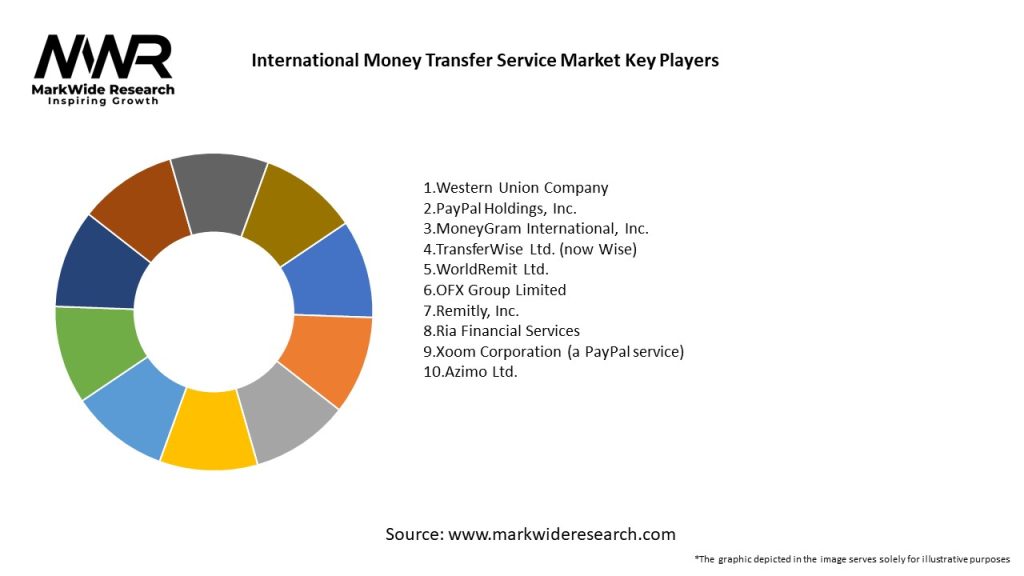

Leading Companies in the International Money Transfer Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at