444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The senior life insurance market is a vital sector of the insurance industry that provides financial protection and peace of mind for seniors and their families. This market offers a range of life insurance products tailored to the needs of older adults, providing coverage for final expenses, outstanding debts, and estate planning.

Meaning

Senior life insurance, also known as final expense insurance or burial insurance, is a type of life insurance designed specifically for seniors. It provides coverage for end-of-life expenses, such as funeral costs, medical bills, and outstanding debts, ensuring that seniors can leave behind a financial legacy for their loved ones.

Executive Summary

The senior life insurance market is experiencing significant growth due to several factors, including the aging population, increasing life expectancy, and rising funeral costs. As seniors seek to protect their families from financial burden, the demand for senior life insurance products is expected to continue growing.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The senior life insurance market is influenced by various factors, including demographic trends, economic conditions, and regulatory changes. These dynamics create opportunities and challenges for insurers, requiring them to adapt their products and strategies to meet the changing needs of seniors.

Regional Analysis

The senior life insurance market varies by region, with factors such as population demographics, cultural attitudes toward death and insurance, and regulatory environments influencing market dynamics. Developed regions with aging populations, such as North America and Europe, are key markets for senior life insurance products.

Competitive Landscape

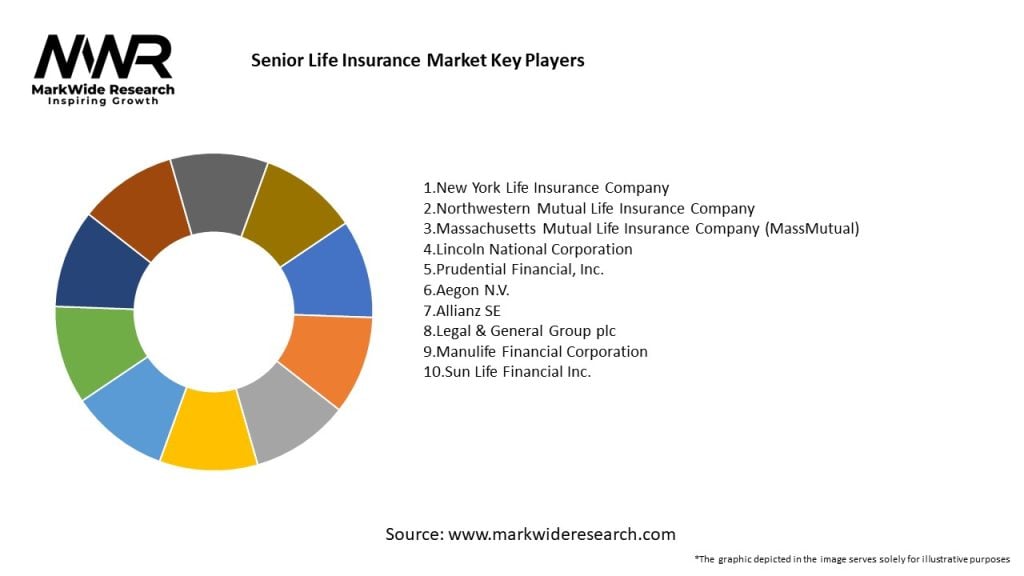

The senior life insurance market is highly competitive, with a wide range of insurers offering products tailored to the needs of seniors. Key players in the market include insurance companies specializing in senior life insurance, as well as traditional insurers that offer senior-specific products.

Segmentation

The senior life insurance market can be segmented based on various factors, including the type of policy (e.g., term life, whole life, universal life), coverage amount, and age of the insured. Insurers may also offer specialized products for specific senior demographics, such as seniors with pre-existing health conditions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has highlighted the importance of senior life insurance, as seniors seek to protect themselves and their families from the financial impact of the virus. The pandemic has also accelerated the digitalization of the insurance industry, making it easier for seniors to access and purchase life insurance online.

Key Industry Developments

Analyst Suggestions

Future Outlook

The senior life insurance market is expected to continue growing, driven by demographic trends, economic conditions, and the increasing need for financial protection among seniors. Insurers that innovate, educate, and digitalize will be well-positioned to capitalize on this growth and meet the evolving needs of seniors.

Conclusion

The senior life insurance market plays a crucial role in providing financial security and peace of mind for seniors and their families. As the population ages and the need for financial protection grows, the market is expected to continue expanding, offering new opportunities for insurers to innovate and meet the evolving needs of seniors.

Senior Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Life, Term Life, Universal Life, Final Expense |

| Customer Type | Individuals, Couples, Families, Seniors |

| Distribution Channel | Direct Sales, Agents, Brokers, Online Platforms |

| Policy Features | Guaranteed Acceptance, Cash Value, Flexible Premiums, Accelerated Benefits |

Leading Companies in the Senior Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at