444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Pet Health Insurance Market is a rapidly growing sector within the broader insurance industry, driven by increasing pet ownership rates, rising healthcare costs for pets, and growing awareness of the benefits of pet insurance. This market offers coverage for veterinary expenses, including medical treatments, surgeries, preventive care, and emergency services, providing pet owners with financial protection and peace of mind. With the humanization of pets and the growing importance of pet health and wellness, the demand for pet health insurance is expected to continue rising in the coming years.

Meaning

Pet health insurance refers to a type of insurance coverage designed to help pet owners manage the costs of veterinary care for their pets. Similar to health insurance for humans, pet health insurance policies typically cover a portion of the costs associated with medical treatments, surgeries, medications, and preventive care for pets. These policies provide financial protection against unexpected veterinary expenses, allowing pet owners to provide necessary healthcare for their furry companions without facing significant financial burdens.

Executive Summary

The Pet Health Insurance Market is witnessing robust growth driven by factors such as increasing pet ownership rates, rising healthcare costs for pets, and growing awareness of the importance of pet health and wellness. This executive summary provides an overview of the market, highlighting its significance, key drivers, challenges, and future outlook. As pet ownership continues to rise and pets increasingly become valued members of the family, the demand for pet health insurance is expected to soar, presenting significant opportunities for insurers and other stakeholders in the pet care ecosystem.

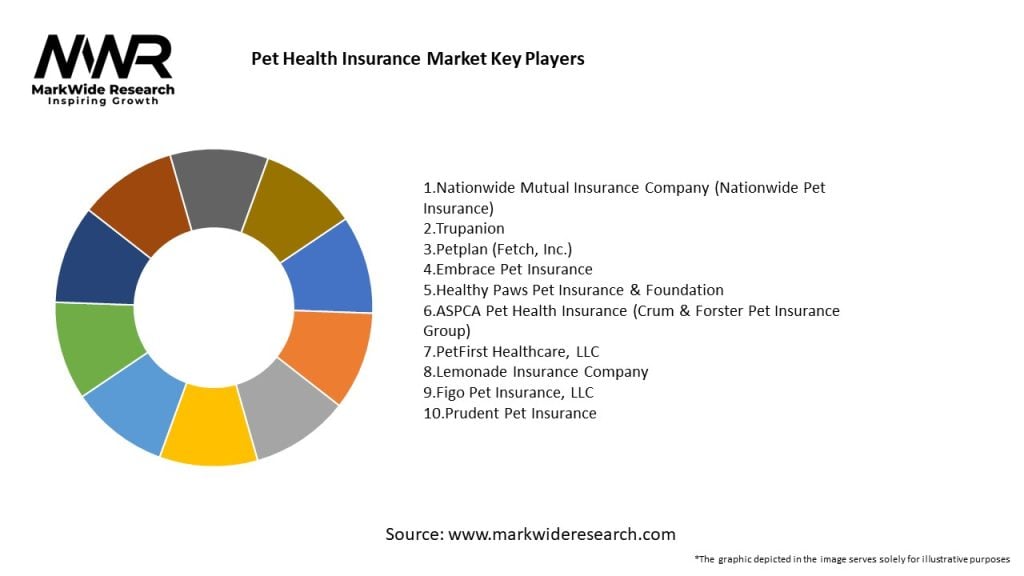

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The dynamics of the pet health insurance market are influenced by several factors, including:

Regional Analysis

The pet health insurance market can be analyzed by region, highlighting specific characteristics and growth potential:

Competitive Landscape

Leading companies Pet Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The pet health insurance market can be segmented based on coverage type, distribution channel, and region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the pet health insurance market. Initially, there were disruptions in veterinary services and a decline in non-essential visits. However, as pet ownership surged during lockdowns, many new pet owners became aware of the potential healthcare costs, leading to increased interest in pet health insurance. The pandemic highlighted the importance of financial preparedness for pet care, resulting in more consumers seeking insurance solutions. Furthermore, the growth of e-commerce and digital platforms has made it easier for pet owners to research and purchase insurance policies online.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the pet health insurance market looks promising, with continued growth anticipated in the coming years. As pet ownership rises and pet care costs increase, the demand for pet health insurance will likely grow. Insurers that prioritize innovation, consumer education, and digital engagement are well-positioned to capitalize on emerging opportunities. The market is expected to evolve, with more tailored and comprehensive insurance solutions becoming available, ultimately benefiting both pet owners and their beloved animals.

Conclusion

In conclusion, the Pet Health Insurance Market represents a rapidly growing sector within the insurance industry, driven by increasing pet ownership rates, rising healthcare costs for pets, and growing awareness of the importance of pet health and wellness. As pet ownership continues to rise and pets increasingly become valued members of the family, the demand for pet health insurance is expected to soar, presenting significant opportunities for insurers and other stakeholders in the pet care ecosystem. By offering comprehensive coverage options, leveraging technology to enhance customer service and engagement, and fostering partnerships with veterinary clinics and pet care professionals, insurers can capitalize on the growing demand for pet health insurance and drive sustainable growth and success in the market.

What is Pet Health Insurance?

Pet health insurance is a type of insurance policy that helps cover the medical expenses of pets, including veterinary visits, surgeries, and medications. It provides financial protection for pet owners against unexpected health issues and accidents involving their pets.

What are the key players in the Pet Health Insurance Market?

Key players in the Pet Health Insurance Market include companies like Nationwide, Trupanion, and Petplan, which offer various insurance plans tailored to pet owners’ needs. These companies compete on coverage options, pricing, and customer service, among others.

What are the main drivers of growth in the Pet Health Insurance Market?

The main drivers of growth in the Pet Health Insurance Market include the increasing pet ownership rates, rising veterinary costs, and growing awareness of pet health among owners. Additionally, the trend towards preventive care and wellness plans is contributing to market expansion.

What challenges does the Pet Health Insurance Market face?

The Pet Health Insurance Market faces challenges such as limited awareness among pet owners about the benefits of insurance and the complexity of policy terms. Additionally, competition among providers can lead to pricing pressures and reduced profit margins.

What opportunities exist in the Pet Health Insurance Market?

Opportunities in the Pet Health Insurance Market include the potential for innovative insurance products that cater to specific pet needs, such as chronic conditions or alternative therapies. There is also room for growth in digital platforms that simplify the claims process for pet owners.

What trends are shaping the Pet Health Insurance Market?

Trends shaping the Pet Health Insurance Market include the rise of telemedicine for pets, increased customization of insurance plans, and a focus on preventive care. These trends reflect a shift towards more comprehensive and accessible pet health solutions.

Pet Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Policy Type | Accident Only, Accident & Illness, Wellness, Comprehensive |

| Animal Type | Dogs, Cats, Birds, Exotic Pets |

| Coverage Level | Basic, Standard, Premium, Custom |

| Distribution Channel | Online, Agents, Brokers, Veterinary Clinics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies Pet Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at