444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The check writer market plays a pivotal role in financial transactions, providing businesses and individuals with efficient tools for creating and processing checks. This market encompasses a range of check writing solutions, including software-based platforms, standalone devices, and integrated systems. With the continued reliance on checks for payments and transactions, the check writer market remains a crucial segment within the broader financial services industry.

Meaning

The check writer market refers to the sector focused on check writing and processing solutions. Check writers enable users to create checks electronically, print them securely, and manage payment transactions effectively. These solutions streamline the check issuance process, reduce errors, and enhance financial record-keeping for businesses and organizations.

Executive Summary

The check writer market has experienced notable growth driven by factors such as digitization, regulatory compliance, and the need for secure payment methods. This market offers diverse solutions catering to varying business needs, from small enterprises to large corporations. Key players in the market provide software applications, hardware devices, and cloud-based platforms to meet the demands of modern check processing.

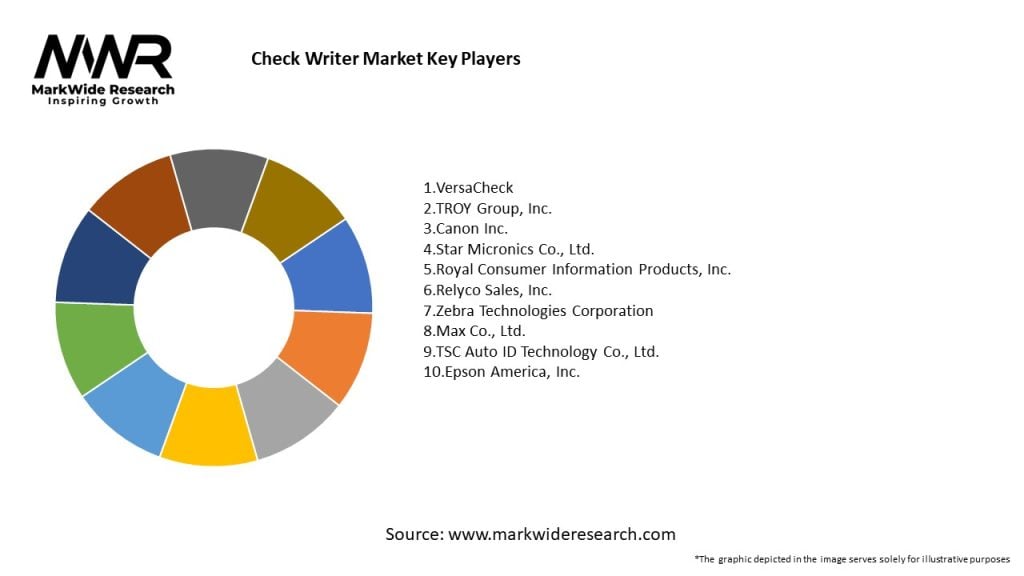

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Several key market insights shape the check writer industry:

Market Drivers

The check writer market is driven by several key factors:

Market Restraints

Despite its growth, the check writer market faces certain challenges:

Market Opportunities

The check writer market presents several opportunities for growth and innovation:

Market Dynamics

Market dynamics in the check writer industry are influenced by technological advancements, regulatory changes, market trends, and consumer preferences. Understanding these dynamics is crucial for check writer providers to innovate, adapt, and meet evolving market demands effectively.

Regional Analysis

The check writer market exhibits regional variations in adoption rates, regulatory environments, and market trends. While developed regions like North America and Europe have mature markets with established players, emerging economies in Asia Pacific and Latin America present growth opportunities fueled by digital transformation and financial inclusion initiatives.

Competitive Landscape

Leading Companies in the Check Writer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

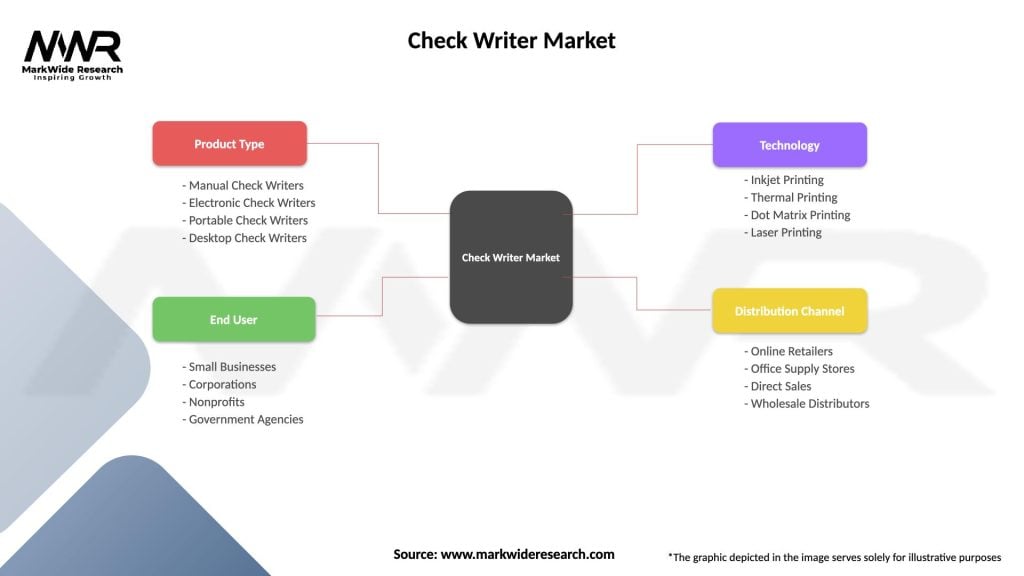

Segmentation

Segmentation in the check writer market can be based on factors such as:

Category-wise Insights

Insights into different categories within the check writer market, such as:

Key Benefits for Industry Participants

Industry participants in the check writer market can benefit from:

SWOT Analysis

A SWOT analysis of the check writer market reveals:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the check writer market include:

Covid-19 Impact

The COVID-19 pandemic accelerated digital transformation in the check writer market, with increased demand for remote check processing, touchless payments, and secure financial transactions. Businesses prioritized digital solutions to maintain operations amid lockdowns and social distancing measures.

Key Industry Developments

Recent developments in the check writer market include:

Analyst Suggestions

Suggestions for check writer market participants include:

Future Outlook

The check writer market is poised for growth with ongoing digital transformation, security advancements, and market innovations. Mobile check writing, cloud-based solutions, enhanced security features, and integration with financial systems will drive market evolution and customer adoption.

Conclusion

The check writer market continues to evolve with technological advancements, regulatory changes, and shifting consumer preferences. Industry participants must navigate challenges such as digital transformation, cybersecurity risks, and adoption barriers while capitalizing on opportunities like mobile check writing, cloud-based solutions, and enhanced security features. By embracing innovation, focusing on compliance, and meeting customer demands, the check writer market can thrive in an increasingly digital and competitive landscape, providing efficient and secure payment solutions for businesses and individuals alike.

What is Check Writer?

A Check Writer is a tool or software that facilitates the creation and printing of checks, allowing users to manage payments efficiently. It is commonly used by businesses and individuals to streamline their financial transactions.

What are the key players in the Check Writer Market?

Key players in the Check Writer Market include companies like Checkeeper, ezCheckPrinting, and QuickBooks, which offer various solutions for check writing and management. These companies provide features such as customizable templates and integration with accounting software, among others.

What are the growth factors driving the Check Writer Market?

The Check Writer Market is driven by the increasing need for efficient payment processing and the rise of small businesses requiring check management solutions. Additionally, the growing trend of digital payments is influencing the adoption of check writing software.

What challenges does the Check Writer Market face?

Challenges in the Check Writer Market include the decline in check usage due to the rise of electronic payment methods and concerns over security and fraud. These factors may hinder the growth of traditional check writing solutions.

What opportunities exist in the Check Writer Market?

Opportunities in the Check Writer Market include the development of advanced software features such as mobile check writing and enhanced security measures. Additionally, targeting niche markets like non-profits and freelancers can provide new avenues for growth.

What trends are shaping the Check Writer Market?

Trends in the Check Writer Market include the integration of cloud-based solutions and the increasing use of mobile applications for check writing. Furthermore, there is a growing emphasis on user-friendly interfaces and automation in check management.

Check Writer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Manual Check Writers, Electronic Check Writers, Portable Check Writers, Desktop Check Writers |

| End User | Small Businesses, Corporations, Nonprofits, Government Agencies |

| Technology | Inkjet Printing, Thermal Printing, Dot Matrix Printing, Laser Printing |

| Distribution Channel | Online Retailers, Office Supply Stores, Direct Sales, Wholesale Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Check Writer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at